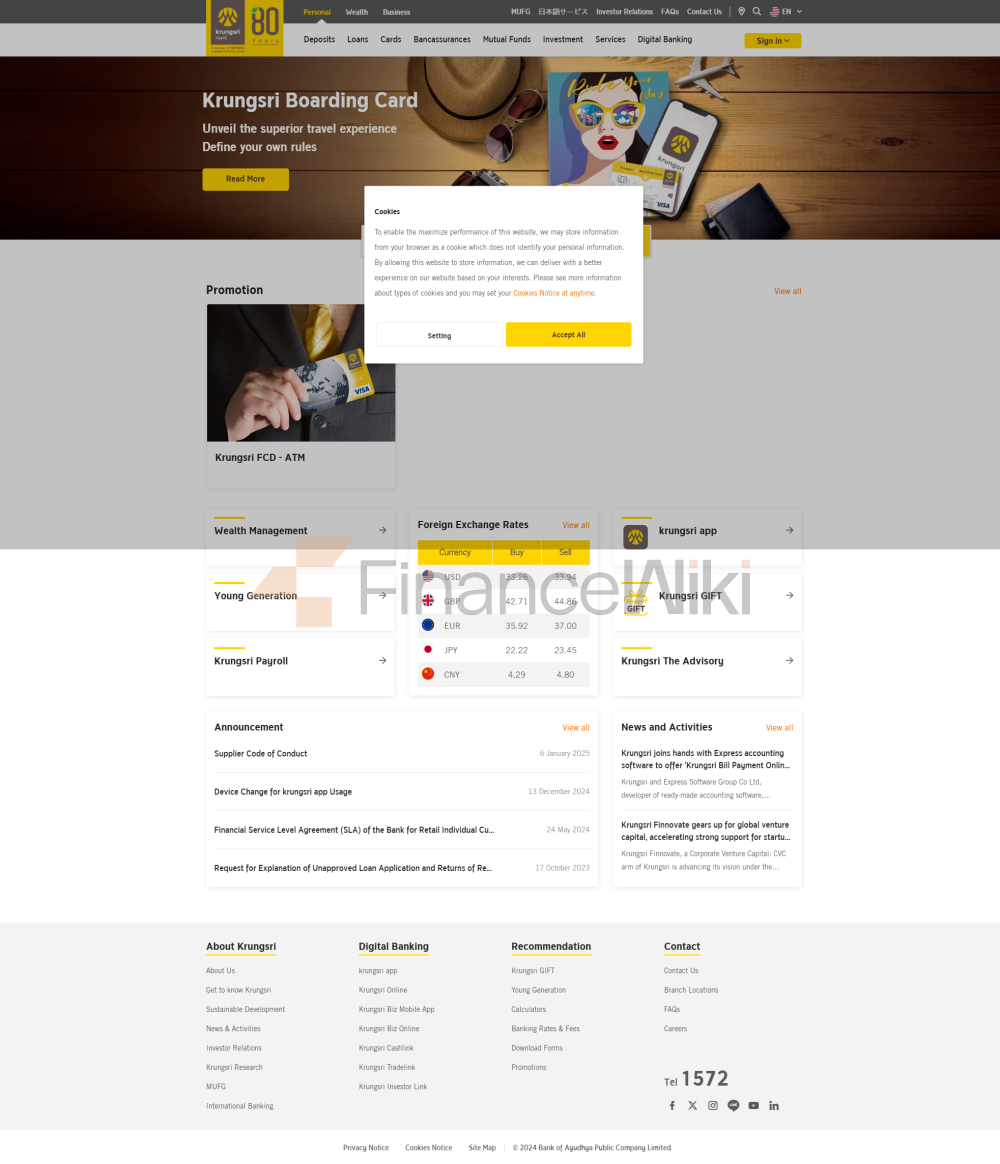

The full name and background

of the bank's basic information is "Krungsri Bank", which was established in 1945 and is headquartered in Bangkok, Thailand. The bank is backed by three major shareholders: Sumitomo Mitsui Financial Group, the Thai government and other private shareholders. It is one of Thailand's state-owned banks and is the main subsidiary of Sumitomo Mitsui Financial Group in Thailand. Krungsri has a presence in financial services in Thailand and Southeast Asia and is listed on the Stock Exchange of Thailand.

Scope of

ServicesKrungsri's services are extensive, covering the whole of Thailand and some Southeast Asian markets. The bank has hundreds of branch outlets as well as ATMs across the country, facilitating traditional banking for customers. The bank has a very dense layout of offline branches and is one of the major retail banks in Thailand.

Regulatory &

ComplianceKrungsri is supervised by relevant regulators such as the Bank of Thailand (BoT). As a regulated financial institution, it joins Thailand's deposit insurance program, which ensures the safety of customer deposits. The bank has a good compliance record and has not had any major compliance issues in the near future.

Krungsri's capital adequacy ratio, a key indicator of financial health, remained at a high level, in line with the regulatory standards of the international banking industry, and its non-performing loan ratio remained below the industry average, demonstrating good risk management capabilities. In terms of liquidity coverage ratio, banks have also demonstrated strong liquidity support to ensure the safety and flexibility of customer funds.

Deposits &

LoansDepositsKrungsri offers a variety of deposit products, including demand deposits, term deposits, and a number of high-yield savings accounts. For specialty deposit products such as CDs, banks offer higher interest rates to help attract customers who want higher returns on longer-term investments.

LoansKrungsri's loan products cover home loans, car loans and personal lines of credit. Mortgage and car loan interest rates are comparable to those of other competing banks, while offering flexible repayment options for customers of all income levels. Personal lines of credit have a relatively low threshold and are suitable for all types of customers, especially young consumers and low- and middle-income groups.

List of common

feesKrungsri's account management fees are transparent, and there are no monthly or annual fees for regular accounts, and some high-end accounts may have certain annual fees. The fees for cross-border and domestic transfers are relatively standard and may vary from region to region. Overdraft fees are reasonable, and ATM interbank withdrawal fees vary depending on the bank network. Banks have clear tips on some hidden fees such as minimum balance limits to help customers avoid unnecessary spending.

Digital Service Experience

APP & Online

BankingKrungsri provides a full-featured APP and online banking services. Its user ratings are excellent on both Google Play and the App Store, with many users commenting that the interface is user-friendly and easy to use. Core features include facial recognition login, real-time transfers, bill management, and integrated investment tools.

In addition, Krungsri is committed to technological innovation and has introduced AI customer service and robo-advisory services to help users better plan their finances. The support of open banking APIs also enables Krungsri to seamlessly connect with other financial platforms and services to provide more personalized and flexible financial services.

customer service

quality service channel

, offers 24/7 phone support and live chat services, and its social media response is fast, allowing customers to interact with the bank through Facebook, LINE, and other platforms. For cross-border customers, Krungsri also provides multilingual support to ensure smooth communication between customers with different language backgrounds.

Complaint

HandlingKrungsri has a lower complaint rate and is more quickly processed. Customer satisfaction is high, especially in terms of problem solving efficiency and service quality, and there is a lot of positive feedback.

Security MeasuresFunds

SecurityKrungsri provides deposit insurance and employs multiple anti-fraud technologies, such as real-time transaction monitoring, to ensure the safety of client funds. In addition, the bank's trading platform is also encrypted to prevent external attacks and data breaches.

Data Security

Krungsri has achieved ISO 27001 certification, marking that its data security management system meets international standards. In the past few years, there have been no major data breaches at the bank, and customer privacy is well protected.

Featured Services & Differentiated

Market

SegmentsKrungsri has launched student accounts, senior wealth management, and green financial products such as ESG investments that help banks stand out in a highly competitive market. Student accounts are free of fees, providing convenience for younger customers; Exclusive financial services for the elderly are tailored investment plans; Green financial products, on the other hand, cater to the demand for sustainable investment.

High Net Worth

ServicesKrungsri provides customized private banking services to design personalized wealth management solutions for high net worth clients. Its private banking threshold is moderate, ensuring that it can provide high-quality financial advice and wealth growth opportunities to more customers.