Basic Information

Société Tunisienne de Banque (STB) is a state-owned commercial bank with a deep history and an important role in the Tunisian financial system. As one of the three largest state-owned banks in Tunisia, STB serves the domestic economy with a robust posture and occupies a place in the regional financial market. It is not only an option for ordinary people to save money and take out loans, but also an important partner for corporate financing. Despite the challenges, the bank is trying to reinvigorate itself with government support and reform efforts.

Name and Background

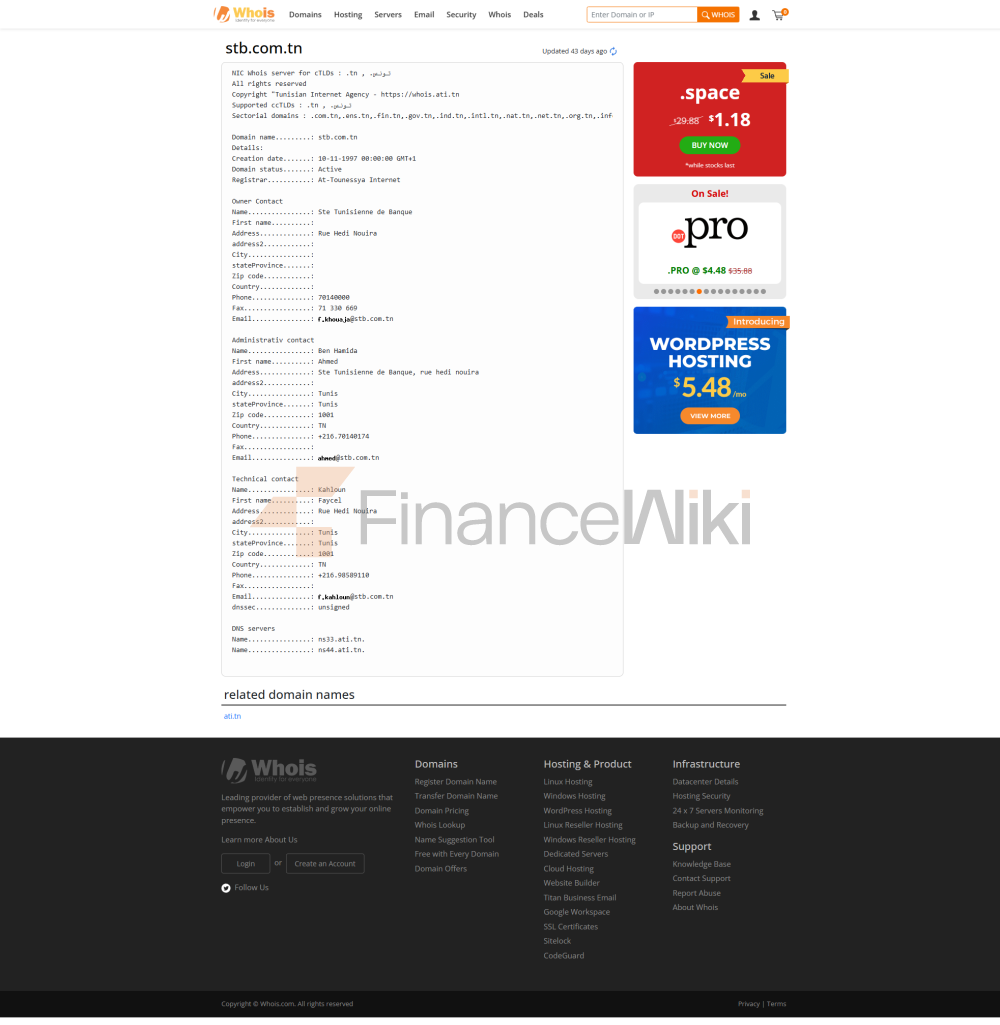

Full name: Société Tunisienne de Banque (Bank of Tunisia).

Founded: 1958 in the wake of Tunisia's post-independence financial system to support the country's economic development.

Headquarters in Tunis, the capital of Tunisia, in the heart of the economy and politics, in coordination with government and regulatory agencies.

Shareholder Background: STB is a state-owned bank with a major stake held by the government, symbolizing the country's commitment to financial stability. The bank is not listed on the Tunis Stock Exchange (Bourse de Tunis), remains state-owned, and is not open to the public. In 2015, the government injected about 440 million dinars (US$220 million) into STB to tackle non-performing loans and undercapitalization, demonstrating state support for STB as "too important to fail".

Backgroundstory: The founding of STB is closely linked to Tunisia's dream of economic self-sufficiency after it emerged from colonial rule. It was once a corporate financing vehicle for former President Ben Ali's cronies, which has led to some of its legacies, but it is now being reformed to become a model for modern banking.

Scope of Services

Coverage: STB mainly serves the whole country of Tunisia, with outlets in urban areas and some rural areas. Although it does not have a significant global presence, it supports cross-border payments and trade finance through partnerships with international banks such as Citibank's counterpart in the United States.

Offline outlets: As of the latest data, STB has about 120 branches, covering major cities in Tunisia, such as Tunis City, Sfax and Souss, with a moderate density of outlets, serving individual and SME customers.

ATM distribution: STB operates about 200 ATMs, mainly in urban areas, with limited coverage in rural areas. ATMs support basic withdrawal, deposit and balance inquiry functions, and some support multi-currency operations, which is convenient for tourists and foreign customers. User perspective: STB's branches and ATMs are convenient enough for city dwellers, but customers in remote areas may need to rely on other banks or post office services.

Regulatory & Compliance

Regulators: STB is under the direct supervision of the Banque Centrale de Tunisie (CBT) and is subject to capital and liquidity requirements under the Banking Act and Basel III. The Conseil du Marché Financier (Financial Market Commission) in Tunisia also monitors its financial transparency.

Deposit Insurance: STB participates in the Fonds de Garantie des Dépôts Bancaires (Tunisian Deposit Insurance Program), which provides deposit protection of up to 60,000 dinars (about US$20,000) per depositor, boosting depositors' confidence.

Compliance Record: STB has been in the spotlight in recent years due to its historical non-performing loan issues. Following the 2015 government capital injection and the 2016 central bank regulations, banks have strengthened risk management and transparency, but continuous improvement is still needed to fully comply with international standards. There is no record of major violations and penalties in the near future, and the compliance performance has gradually improved.

Financial health

Capital adequacy ratio: According to 2021 data, STB's capital adequacy ratio (CAR) is 13.4%, higher than the 10% required by Tunisian regulators, showing some resilience, but there is still room for improvement compared to the world's leading banks (such as more than 15%).

Non-Performing Loan Ratio (NPL): The non-performing loan ratio was 13.1% in 2021, a slight decrease from 13.9% in 2017, but still higher than the regional average of about 10%. This reflects the impact of historical loan management issues, with banks being gradually liquidated through asset restructuring and recovery procedures.

Liquidity Coverage Ratio (LCR): The specific LCR data is not disclosed, but the overall LCR of the Tunisian banking sector is above 100%, which is in line with Basel III requirements. STB's reliance on central bank refinancing to support liquidity suggests that its deposit growth has been slower.

Users' judgment: STB's financial health is at the upper middle level, and the state-owned background provides a safety net, but the high non-performing loan ratio indicates potential risks, which is suitable for customers who seek stability but do not pursue high yields.

Deposit & Loan Products

Deposits:

demand deposits: about 2.5%-3% per annum, suitable for daily cash flow, free of monthly fees but subject to maintaining a minimum balance (about 100 dinars).

Fixed deposits: The interest rate for 1-year is about 4.5%, and the interest rate for 3-year can reach 5.5%, which is higher than the regional average and is suitable for stable savers.

High Yield Savings Account: STB offers an "Épargne Plus" account with an interest rate of up to 6%, a minimum deposit of 5,000 dinars, locked for 6 months.

Certificates of Deposit: 1-5 years certificates of deposit, interest rates of 5%-6.5%, and a minimum deposit amount of 10,000 dinars, suitable for large amounts of idle funds.

Loans:

Mortgage: 15-20 years fixed interest rate of about 7%-8%, down payment requirements of 20%-30%, approval requires proof of stable income, suitable for middle-class families.

Car loan: The 5-year interest rate is about 6.5%-7.5%, the loan amount covers up to 80% of the car price, and the approval is fast (3-5 working days).

Personal Line of Credit: 8%-10% interest rate for unsecured loans, up to 50,000 dinars, good credit history.

Flexible repayment: STB provides a penalty waiver option for early repayment of some loans, and the mortgage supports monthly payment adjustment (application required).

User's perspective: The interest rate of deposit products is highly competitive, which is suitable for conservative depositors; The loan approval process is standardized, but the interest rate is slightly higher and the flexibility is moderate.

List of common fees

Account Management Fee: Current accounts are exempt from annual fees, with a minimum balance of 100 dinars, otherwise 5 dinars per month will be deducted. The annual fee for a savings account is about 10 dinars.

Transfer fee: 1-2 dinars for domestic transfers, 0.5% of the amount for cross-border transfers, minimum 10 dinars.

Overdraft Fee: Overdraft is calculated at a daily interest rate of 0.05% with a maximum limit of 1,000 dinars.

ATM inter-bank withdrawal fee: Free for STB ATMs, 2 dinars per inter-bank withdrawal, 5 dinars for international ATM withdrawals. Hidden Fee Reminder: The minimum balance requirement is strict, and a penalty may be triggered if it is less than 100 dinars; Early withdrawal of time deposits will result in a loss of interest.

User suggestion: Choose a current account with no minimum balance to reduce fees, and ATMs try to use STB's own network.

Digital Service Experience

App & Online Banking: STB's "STB Mobile" app has a Google Play rating of about 3.8/5 (based on 5,000+ reviews) and an App Store rating of 4.0/5. User feedback is that the interface is friendly but occasionally stuttering, and the update frequency is high. The online banking platform supports PC operation and has complete functions but a slightly old design.

Core functions: support face recognition login, real-time transfer (1 minute in China), bill management, deposit/loan application inquiry. The investment vehicle has not yet been integrated and needs to be processed over the counter.

Technological innovation: STB has introduced AI customer service (based on a simple chatbot) that can handle balance inquiries and common problems, but complex problems need to be transferred to manual work. Without robo-advisory or open banking API support, digital transformation is lagging behind.

User experience: APP is suitable for basic operations, and online banking is more friendly to corporate customers, but compared with international banks, technological innovation is slightly inferior.

Quality of customer service

Service channels: 24/7 telephone hotline (+216 71 112 000) available, live chat available on weekdays 9:00-17:00, social media (Facebook/Twitter) response time of about 2 hours.

Complaint handling: The complaint rate data is not disclosed, and user feedback shows that simple problems (such as failed transfers) take an average of 3 days to resolve, and complex problems (such as loan disputes) take 1-2 weeks. Satisfaction is moderate, with about 70% of users saying that the problem has been resolved.

Multi-language support: Arabic, French and English are available for local and foreign customers, and Italian is available in some locations.

User feelings: The customer service attitude is professional, but the response speed and resolution efficiency need to be improved, especially during peak periods.

Safety and security measures

Security of funds: Deposit insurance covers up to 60,000 dinars. STB uses real-time transaction monitoring and SMS verification codes to prevent fraudulent transactions, and there have been no major capital loss incidents in recent years.

Data security: STB does not disclose whether it is ISO 27001 certified, but claims to comply with international data protection standards (such as GDPR-related requirements). There are no known data breaches, and the system security is relatively reliable.

User tip: Enable two-factor authentication and update your password regularly to further enhance account security.

Featured Services & Differentiation

Market Segments:

student accounts: no management fee, 50 dinars sign-up bonus, suitable for students aged 18-25.

Exclusive banking for seniors: "Senior Épargne" accounts are available, with an interest rate increase of 0.5% and no ATM withdrawal fees.

Green Finance: Launched the "Eco-Prêt" loan to support energy-efficient home appliances and solar energy projects, with a preferential interest rate of 0.5%.

High-net-worth services: STB's private banking services are aimed at clients with assets of more than 500,000 dinars, providing customized investment portfolios and exclusive financial advisors, with a high threshold but personalized services.

Differentiation Highlights: Green finance and student accounts reflect a sense of social responsibility, but the coverage of high-net-worth services is limited.

Market Position & Accolades

Industry ranking: STB is one of the top three banks in Tunisia by assets, accounting for about 15% of domestic bank assets. The global ranking did not enter the Top 1000 due to its focus on the local market.

Awards: In 2023, it was awarded the "Best SME Financing Bank" by the Tunisian Banking Association for its efforts to support local businesses.

Market Assessment: STB has a strong position in the Tunisian banking sector, with a state-owned background that gives it a trust advantage, but it needs to accelerate digitalization and non-performing loan cleanup to improve its competitiveness.