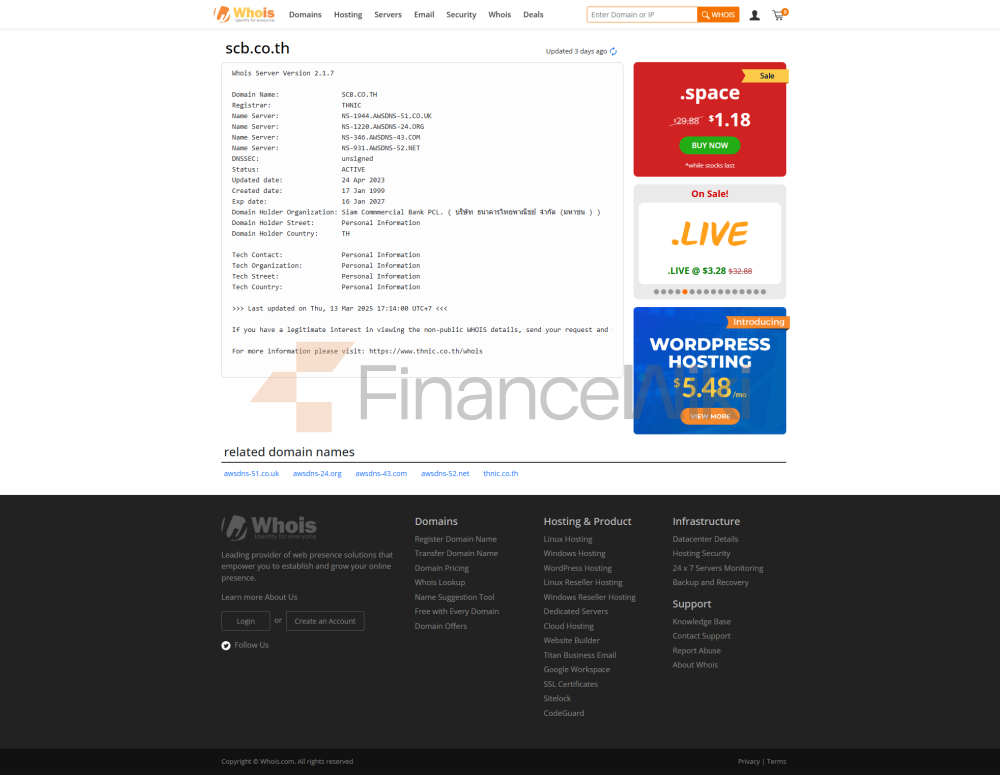

Name and

BackgroundSiam Commercial Bank (SCB) was founded in 1907 and is headquartered in Bangkok, Thailand. As one of the oldest commercial banks in Thailand, SCB was originally initiated by the Thai government, and has become a private bank after several developments and transformations. SCB is currently one of the largest and most influential financial institutions in Thailand and is listed on the Stock Exchange of Thailand. As an important financial service provider, SCB not only serves the local Thai market, but also has branches in many countries and regions around the world.

Scope of

ServicesSiam Commercial Bank's service coverage covers the world, especially in Southeast Asia. The bank has a wide range of offline outlets in Thailand, and its ATMs are distributed throughout the country, making it convenient for customers to conduct all kinds of banking services. As a traditional bank, SCB values the coverage of its physical branches and ATMs, but at the same time, it is also vigorously developing digital services to improve the customer experience.

Regulation &

ComplianceSCB is strictly supervised by Thai banking and financial regulators such as the Bank of Thailand to ensure that banking operations comply with international and local laws and regulations. The bank has joined Thailand's deposit insurance scheme to provide customers with some deposit protection. In addition, in recent years, SCB has also been committed to improving compliance, ensuring transparency and customer legitimate rights and interests, regularly publishing compliance reports and strengthening internal risk control.

Financial HealthSiam

Commercial Bank's financial health performance is excellent, with a capital adequacy ratio that is at a high level in the industry and a non-performing loan ratio that is lower than the industry average. According to the latest financial data, SCB's liquidity coverage ratio is also performing well, which is sufficient to cope with market volatility and potential financial crises, and maintains a strong resilience to risks. These key financial indicators show that SCB has a very high level of management in ensuring the safety of funds and liquidity.

Deposit & Loan

ProductsDeposits: SCB provides customers with a variety of deposit options, including demand deposits, time deposits, and some high-yield savings accounts, with competitive interest rates relative to market levels. In addition, SCB has also launched special deposit products such as Large Certificates of Deposit (CDs) to meet the diversified capital management needs of customers.

Loans: In terms of loans, SCB provides personal housing loans, car loans and credit loans, with moderate and flexible interest rates. Especially in terms of mortgages, SCB has launched a variety of repayment options, including equal principal and equal principal and interest, and can also flexibly adjust the repayment cycle according to the needs of customers.

List of common fees

SCB's account management fees are relatively transparent, and there is usually an annual or monthly fee. In addition, cross-border transfers and domestic transfers may incur handling fees, while overdraft fees and ATM inter-bank withdrawal fees are also common expense items. It is important to note that the SCB also has certain restrictions on the minimum balance requirement, and there may be corresponding fees if the minimum balance is not reached.

Digital Service

ExperienceSiam Commercial Bank has been at the forefront of digital services with the launch of a feature-rich banking app and online banking platform. Users can securely log in to their accounts through facial recognition technology for real-time transfers, bill management and other operations, improving the convenience and customer experience of banks. SCB also combines AI technology to launch intelligent customer service and investment advisory functions to provide customers with more accurate and personalized services.

Customer Service Quality

SCB offers 24/7 phone support and live chat services to ensure that customers can receive effective assistance at all times. The response time on social media is also very fast, especially when it comes to handling complaints, and the bank has a dedicated team in place to ensure that issues are resolved in a timely manner. In order to better serve international customers, SCB also provides multi-language support, especially in cross-border business.

Security MeasuresIn

order to ensure the safety of customer funds, SCB actively adopts advanced anti-fraud technologies, such as real-time transaction monitoring, to ensure the safety of users' transaction processes. The bank is also ISO 27001 certified, ensuring that its data management system meets international standards, minimizing the risk of data breaches. Customer deposits are also covered by Thailand's deposit insurance scheme, which provides some insurance protection.

Featured Services & DifferentiationSiam

Commercial Bank has unique advantages in the market segment. For students and the elderly, the bank offers a number of exclusive products, such as fee-free student accounts and wealth management products designed for the elderly. In addition, SCB has launched green financial products to meet the needs of customers for environmental, social and governance (ESG) investments. For high-net-worth clients, SCB provides customized private banking services and wealth management solutions to help clients achieve wealth growth.

Market Position & AccoladesAs

Thailand's number one commercial bank, Siam Commercial Bank ranks among the top in the global banking industry in terms of asset size. With its excellence in digital transformation and innovation, SCB has won multiple awards such as "Best Digital Bank" and "Most Innovative Bank", which further solidify its leadership position in the industry.