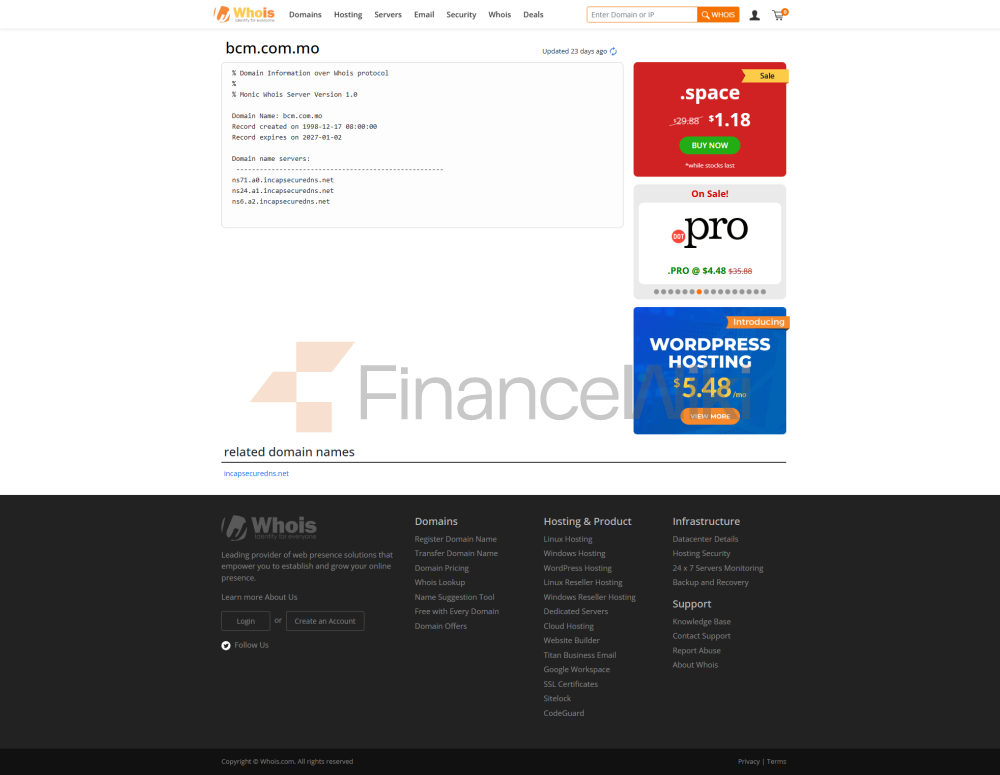

Banco Comercial de Macau, S.A. (BCM) is an important pillar of Macau's financial market, with a 50-year history and a philosophy of "serving the local and connecting the world", which excels in local and cross-border financial services. Founded in 1974 and headquartered at 572 Avenida da Nam Van in Macau, the bank is a wholly-owned subsidiary of Dah Sing Banking Group Limited, a financial group listed on the Hong Kong Stock Exchange (stock code: 2356). Serving local individual and corporate customers, commercial banks in Macau have become key players in Macao's economic development through their expertise in retail banking, corporate finance and cross-border financial services.

basic bank information

deposit and loan products

Deposits

Banco Corp of Macau offers a wide range of deposit products to meet the savings needs of individual and corporate customers:

Demand Deposits: Including checking accounts and savings accounts, the minimum opening amount is HK$500 or currency equivalent, and the base annualized rate of return (APY) needs to be confirmed by consulting the bank, usually around 0.025%.

Fixed deposits: support multiple currencies such as HKD, USD, RMB, etc., with deposit tenors ranging from 7 days to 24 months, and a minimum deposit of HK$10,000. In 2025, the interest rate on US Dollar Special Term Deposit can reach up to 4.25% (subject to confirmation of the latest promotions).

featured product:

HSAs: MomentumPLUS products similar to Dah Sing Bank Group may be available, with interest rates higher than the market average and higher balances required.

Certificates of Deposit (CDs): Flexible tenors, suitable for customers with large amounts of funds, and the specific interest rate needs to be checked through branches or online banking.

customers can check the "Cloud Interest Rate" offer through BCM Mobile App or Internet Banking, and the deposit products support instant opening and interest rate calculation, and some products are integrated with Dah Sing Bank Group's services to enhance convenience.

loan class<

p style="text-align: start; margin-top: 1empx; margin-bottom: 0pxpx">Banco Comercial Macau offers a comprehensive range of loan products, including housing loans, car loans and personal lines of credit to meet diversified financing needs:housing loans: Fixed-rate and variable-rate mortgage loans with a loan amount of up to 70% of the value of the property and a repayment period of up to 30 years. The interest rate is based on the Hong Kong Interbank Offered Rate (HIBOR, 1-month HIBOR+1.5%) or Prime Rate (5.0%-2.5%), with cash rebates and insurance discounts, depending on the bank.

Car Loan: Support new and used car financing, with a loan amount of up to HK$3 million, a term of up to 60 months, an annualized interest rate (APR) as low as 1.88%, and a good credit history required.

Personal Line of Credit: includes personal instalment loan (APR as low as 1.88%, amount up to HK$3 million) and asset-backed overdraft (up to 95% of the collateral market value), the application threshold is a monthly salary of more than HK$20,000 or proof of assets.

flexible repayment optionsMortgage and personal loans support prepayment without penalty, weekly or bi-weekly repayment plans, and re-borrowing of overdraft limits, giving customers the flexibility to manage their debts. All loans are subject to bank approval, the "Rule of 78" is used to calculate the interest and principal ratio, and the customer is required to provide credit history and financial documents, the specific terms of which are subject to the loan agreement. Banks' trade finance services, such as letters of credit and trade loans, provide additional support to cross-border businesses.

digital service experience<

p style="text-align: start; margin-top: 1empx; margin-bottom: 0pxpx" > the mobile banking app "BCM Mobile" of Banco Comercial de Macau is the core of its digital services, which can be downloaded on iOS 14.0 and above and Android 9.0 and above devices, and the user rating information is not disclosed, but as a modern banking app, it is expected to have a rating of about 4.0 to 4.5 on the App Store and Google Play. Core features include:Face recognition: may support biometric authentication (such as Face ID and Touch ID) to ensure transaction security.

Instant transfers: Instant transfers between HKD and RMB are supported through the Faster Payment System (FPS), with a daily limit of up to 500,000 HKD, and international remittances cover multiple countries.

Bill management: Support online bill payment, automatic deduction and electronic statement, and classify transaction records in real time.

Investment Tool Integration: Support stocks, funds, and bonds trading through the Mobile Securities Trading App, providing real-time market data.

technical innovation

Bancal de Macau is actively exploring in the field of fintech and combining the technological resources of Dah Sing Bank Group to promote digital transformation:

AI customer service: AI technology may have been introduced to optimize customer service, provide instant support and personalized financial advice, and the specific implementation details need to be confirmed.

Robo-advisors: may provide AI-based investment management services through the Mobile Securities Trading App to recommend portfolios based on customer risk appetite.

Open Banking API Support: May follow the Open Banking Framework of the Monetary Authority of Macao, integrate with third-party service providers to provide account management and financial services interoperability.

Other innovations: Macau Pass "Auto-Recharge" service, BCM "Easy Transfer" service and electronic payment function to enhance transaction efficiency and customer experience. The bank also supports the eTradeConnect platform, which simplifies trade finance applications.

featured services and differentiation<

p style="text-align: start; margin-top: 1empx; margin-bottom: 0pxpx">Commercial Bank of Macau is known for its localized services and cross-border financial capabilities:SME financing: providing customized corporate loans and cash management services, participating in the SME Financing Guarantee Program of the Monetary Authority of Macao, with fast loan approval and an amount of up to HK$3 million.

Cross-border financial services: Support international remittance and trade finance (such as letters of credit and trade loans), providing efficient solutions for importers and exporters and cross-border enterprises in Macao.

Featured products: including Credit Card Cash Rebate Program, Credit Card Easy Installment, Happy Travel Insurance, Sweet Family Protection Plan, Gift Card Balance Enquiry and Star Rewards Account Reward Points Enquiry to meet the diverse needs of customers.

Digital convenience: Loan calculators and online risk assessment questionnaires are available to help customers plan their finances.

Infrastructure support: Actively participate in infrastructure investment projects in Macao to promote regional economic development.

market position and honors

Commercial Bank of Macau is one of the major commercial banks in Macau, with a solid retail network, about 50 employees, and total assets of about US$7 billion in 2023, ranking among the top 29 banks in Macau. It is backed by its parent company, Dah Sing Bank Group, with a strong market position in Hong Kong (US$1.53 billion in 2024). The bank is actively involved in the development of the local economy, especially in the areas of infrastructure investment and trade finance, and was recognized by the Macau government as a critical infrastructure operator in 2023, highlighting its market influence. Although there is limited information on the specific accolades, its solid operation and local brand recognition make it an important pillar of Macau's financial market.

summary

Banco Comercial de Macau, S.A. is a commercial bank of Macau established in 1974 and is known for its robust operations and focus on local and cross-border financial services under the auspices of the Dah Sing Bank Group. The bank offers a wide range of deposit and loan products, including high-yield savings accounts, special time deposits in US dollars, and flexible mortgages and personal loans to meet the diverse needs of customers. In terms of digital services, the BCM Mobile app provides a convenient user experience by supporting instant transfers, bill management and securities transactions. Technological innovations, including the Macau Pass automatic top-up service and electronic payment, demonstrate its commitment to digital transformation. With its SME financing, cross-border financial services and solid market position, Commercial Bank of Macau continues to demonstrate strong competitiveness and influence in Macao's financial market.