Basic Bank Information

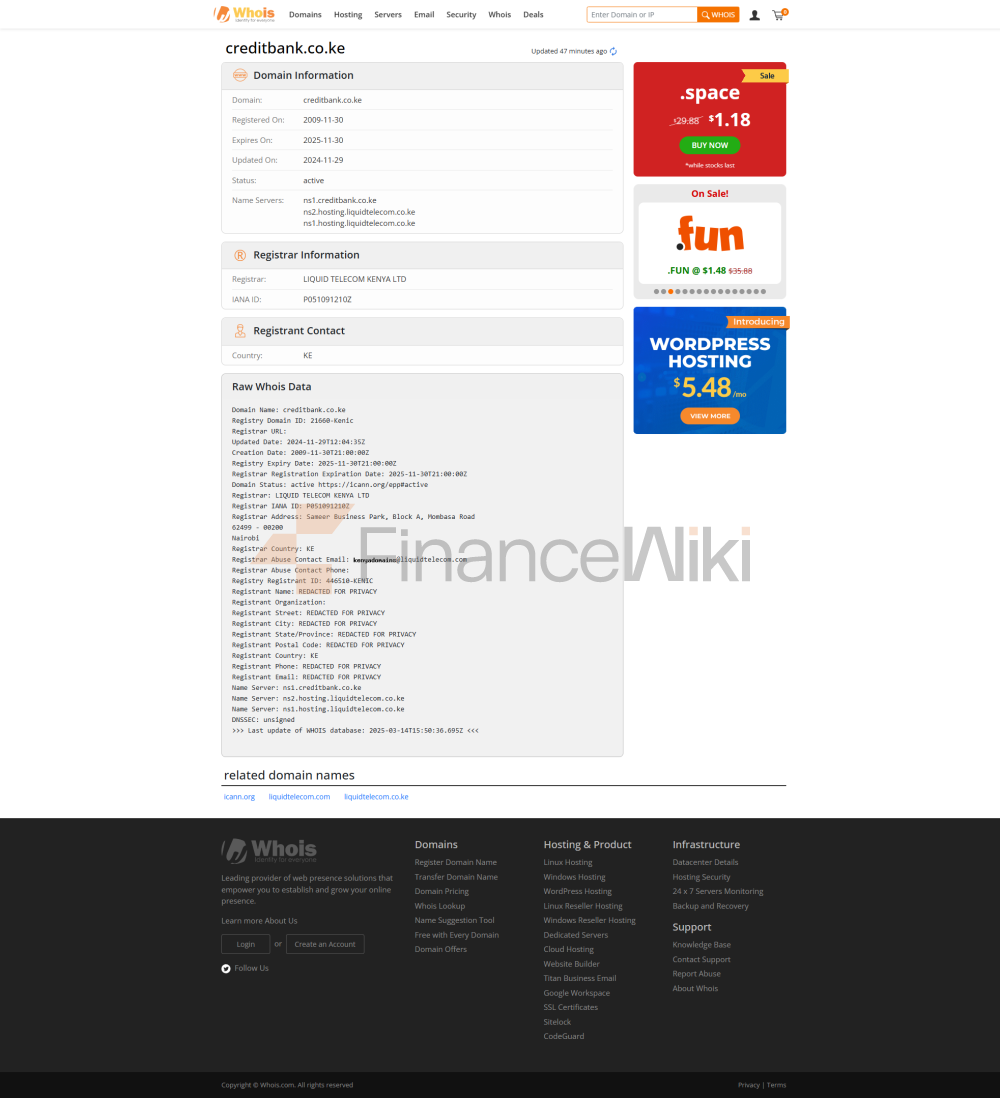

Credit Bank Limited (hereinafter referred to as Credit Bank) is a commercial bank registered in Kenya and positioned as a medium-sized retail bank dedicated to providing innovative financial solutions to individuals, businesses and communities.

Founded in 1986 and initially operating as Credit Kenya Limited, a non-bank financial institution (NBFI), it was granted a commercial banking license and renamed Credit Bank in 1995.

The headquarters is located in Nairobi, the capital of Kenya, at Mercantile House, Koinange Street.

Credit Bank's shareholding structure is privately owned, with shareholders including corporate and individual investors.

As of 2019, major shareholders include Ketan Morjaria (21.43%), Jayesh Kumar Dave (12.50%), etc., and the specific shareholder information has not been publicly updated.

In 2016, the Fountain Enterprises Programme Group (FEP) had planned to acquire a 75% controlling stake for 4 billion Kenyan shillings (about $40 million), but whether the deal was completed was not clearly disclosed. Credit Bank is not listed on the stock exchange and is a private company.

Scope of Services

Credit Bank primarily serves the Kenyan market and is positioned as a national retail bank, covering individuals, SMEs and large corporate customers. Offline outlets are located in Nairobi, Kisumu and Kitengera, including:

Nairobi main branch (Koinange Street) and

Westlands branch (Westlands

). Industrial Area,

Lavington,

Kisumu,

Kitengela

As of the latest data, Credit Bank has about 6 major outlets, with a limited number of ATMs, and the exact distribution data is not disclosed, but its branches and ATMs are mainly concentrated in economically active areas of Kenya, such as Nairobi and surrounding cities. Compared with large banks such as KCB or Equity Bank, it has a smaller physical branch coverage and relies more on digital services to expand its customer base.

Regulation & Compliance

Credit Bank is regulated by the Central Bank of Kenya (CBK) and is subject to the Banking Act, the Microfinance Act and relevant prudential guidelines. CBK adopts a Risk-Based Supervision (RBS) framework to ensure compliance with capital adequacy, liquidity and risk management.

Credit Bank participates in the Kenya Deposit Insurance Act 2012 to provide depositors with a certain level of deposit protection set by the CBK (usually up to Ksh 500,000, or about US$3,800 per depositor).

There have been no recent public reports showing that Credit Bank has significant compliance issues or regulatory penalties, indicating that its operations are relatively sound.

Financial health

As of December 2018, Credit Bank had total assets of approximately Ksh178.28 million (Ksh17.8 billion) and shareholders' equity of K$28.67 million (Ksh2.86 billion). The specific financial indicators are as follows:

capital adequacy ratio: no specific data is disclosed, but CBK requires commercial banks to maintain a core capital adequacy ratio of at least 8%, and Credit Bank, as a compliant bank, should meet this standard.

Non-Performing Loan Ratio (NPL): The overall NPL ratio of the Kenyan banking sector was around 13.6% in 2020, and the specific NPL data for Credit Bank was not disclosed, but its retail banking transformation may expose it to some credit risk.

Liquidity Coverage Ratio (LCR): Under the Basel III framework, CBK requires banks to maintain sufficient liquid assets to cover 30-day cash outflows, and Credit Bank should meet this requirement, but the specific LCR data is not disclosed.

Overall, Credit Bank has a medium financial health, with small assets but stable operations, making it suitable for clients with a lower risk appetite.

Deposit & Loan Products

Deposits:

current account: A basic current account is available with a lower interest rate (usually less than 1%), suitable for daily trading.

Fixed deposits: Fixed deposits are available with tenors ranging from 3 months to 5 years, and the interest rate fluctuates according to the market (usually between 4% and 7%, depending on the bank).

High-Yield Savings Account: The "elev8HER" account is launched to provide high-yield savings options for female entrepreneurs, with an undisclosed interest rate, but with fringe benefits such as insurance discounts.

Large Certificates of Deposit (CDs): Similar products are not explicitly mentioned and may be replaced by fixed deposits.

Loans:

Mortgages: Housing loans are available, and interest rates and thresholds vary depending on the customer's credit rating (usually based on the CBR benchmark rate + floating points, which is around 9%-12%).

Car loan: Support car purchase loan, the specific interest rate is not disclosed, and proof of income and guarantee are required.

Personal Line of Credit: Offers unsecured personal loans up to a credit score-based interest rate (which can be as high as 15%-20%).

Flexible repayment options: Some loan products (elev8HER business loan) offer flexible repayment plans, such as interest waiver for the last two months for early repayment.

List of common fees

Account management fee: A monthly fee may apply for current accounts (approximately Ksh 100-500, depending on the account type), and premium accounts may be waived.

Transfer fees: Fees are lower for domestic transfers (about Ksh 20-100) and higher for cross-border transfers (up to Ksh 500-2,000, depending on the amount and channel).

Overdraft fees: Not explicitly disclosed, but Kenyan banks typically charge high interest (around 20%-30% annualized) on overdraft accounts.

ATM inter-bank withdrawal fee: Inter-bank ATM withdrawals may be charged 50-200 Kenyan shillings per time, and Credit Bank's own ATM is free of charge.

Hidden Fee Reminder: Please pay attention to the minimum balance requirement (fees may be deducted if the target is not met) and foreign exchange conversion fees for cross-border transactions.

Digital Service Experience

Credit Bank launched its mobile banking app "CB Konnect" to integrate lending, transfer and account management functions.

User ratings: App Store and Google Play ratings are not publicly available, but users report that the interface is friendly and the features are gradually improved.

Core functions: support real-time transfers, bill payments, loan application tracking, and some accounts integrate face recognition login (specific coverage is unknown).

Technological innovation: Provide AI-powered customer service chatbots to optimize query response speed. Robo-advisors or open banking APIs are not explicitly supported, but its "elev8HER" platform provides non-financial services (e.g., business training) through a digital eHub.

Customer Service Quality

Service channels: 24/7 telephone support (hotline: +254 709 081 000), live chat via CB Konnect app, social media (Twitter, Facebook) is more responsive (usually within a few hours).

Complaint handling: There is no public data to disclose the complaint rate or average resolution time, but CBK requires banks to establish a complaint handling mechanism, and Credit Bank should have a corresponding process.

User satisfaction: No specific satisfaction score was found, and customer feedback was mostly focused on its support for SMEs and female customers.

Multi-language support: Mainly in English and Swahili, no other non-local languages are supported, suitable for local and fluent English customers.

Security measures

security of funds: Depositors' funds (up to Ksh 500,000) are protected through the Kenya Deposit Insurance Scheme. Prevent fraud with real-time transaction monitoring technology.

Data security: It is not clear whether it is ISO 27001 certified, but CBK requires banks to comply with the Data Protection Act (2019) and Credit Bank should have basic data encryption and privacy protection measures in place. There have been no public reports of a major data breach.

Featured Services & Differentiation

market segments:

Student accounts: Fee-free student accounts are not explicitly available, but retail banking positioning may include low-threshold accounts.

Exclusive financial management for the elderly: There are no special products for the elderly, which needs to be further confirmed.

Green financial products: There are no ESG investment-related products, and green financial services are not prominent for the time being.

High-net-worth services: No private banking or customized wealth management services are provided, and more focus is on small and medium-sized enterprises and retail customers.

elev8HER Program: Designed for women entrepreneurs, it provides loans, insurance discounts, and business training to enhance community impact.

Market Position & Accolades

Industry ranking: Credit Bank is a mid-sized bank among the 39 commercial banks in Kenya, with assets much lower than KCB (over US$7 billion) or Equity Bank. The global ranking did not enter the Top 1000.

Awards: There is no public record of winning awards such as "Best Digital Bank" or "Most Innovative", but its "elev8HER" program has received some recognition in the field of women's empowerment.