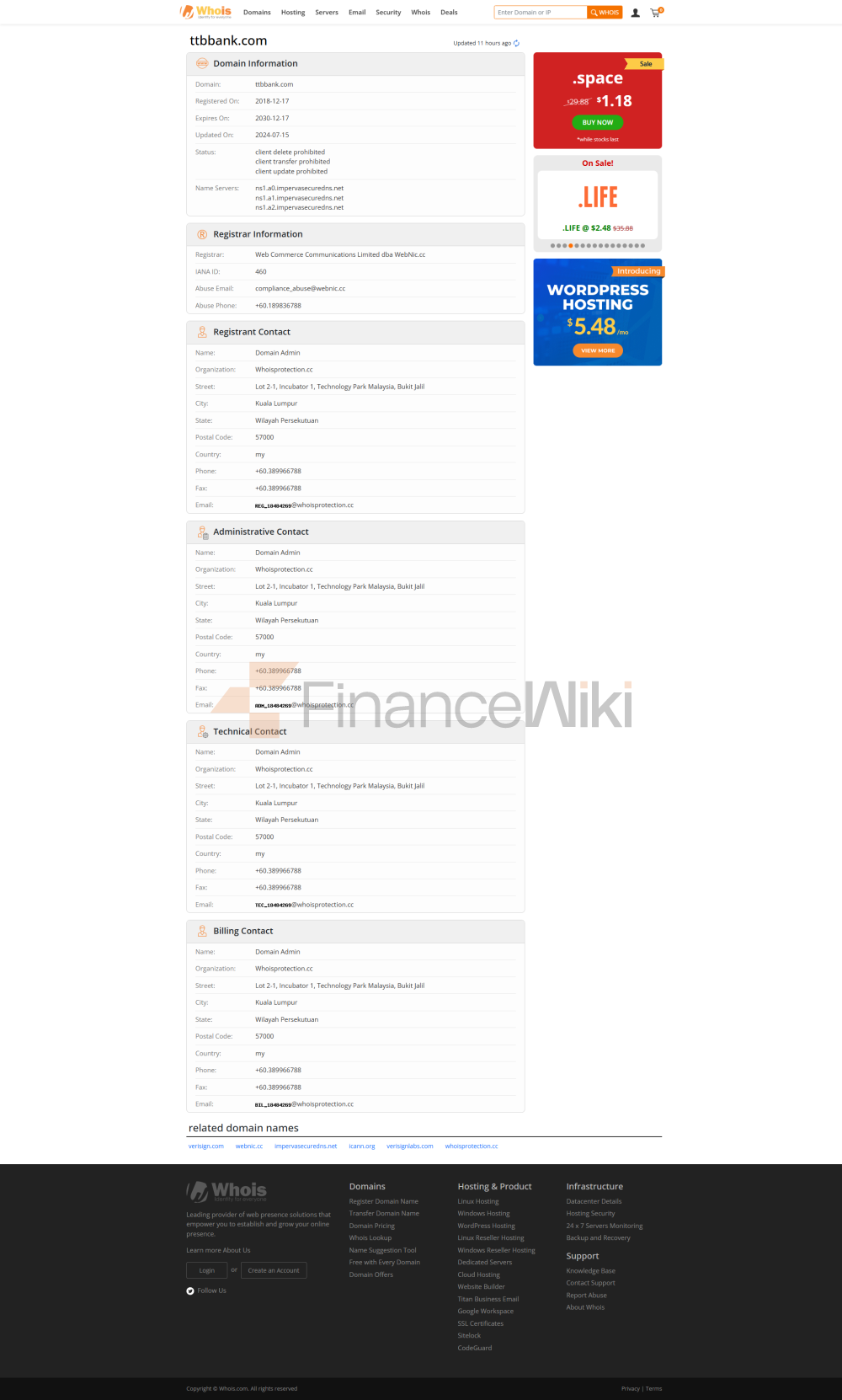

the name and background of the basic information of the bank

TMB Bank, full name TMB Thanachart Bank, is a commercial bank in Thailand, established in 1957 and headquartered in Bangkok, Thailand. TMB was originally created by a group of Thai businessmen to provide financial services to local Thai businesses and individuals. In recent years, TMB Bank has further expanded its market share through a merger with Thanachart Bank, becoming a significant force in Thailand's financial industry. The bank is privately held and is listed on the Stock Exchange of Thailand under the ticker symbol "TMB".

Scope of

ServicesTMB Bank mainly provides comprehensive banking services in Thailand, and its coverage includes branches in several provinces across the country. In addition, TMB Bank also provides online banking services to increase the adoption of digital financial services. The bank's ATM network can provide 24-hour self-service to facilitate customers to make deposits, withdrawals, transfers, and other operations, especially in metropolitan areas and areas with high foot traffic.

Regulation &

ComplianceTMB Bank is regulated by Thai banks and financial institutions, which is regulated and approved by the Bank of Thailand. The bank follows Thai financial laws and regulations, ensuring that its operations meet the country's compliance requirements. In addition, TMB Bank has joined Thailand's deposit insurance scheme to protect the safety of customers' deposits. Recently, TMB Bank has maintained a good compliance record with no major breaches.

Key indicators of financial health

:

Capital adequacy ratio: 15% in line with Bank of Thailand The above (2023 data) shows a strong ability to resist risks.

Non-Performing Loan Ratio (NPL): In recent years, it has remained in the range of 2%-3%, which is better than the average level of the Thai banking industry.

Liquidity Coverage Ratio (LCR): Over 100%, Basel III compliant, ensuring short-term solvency.

deposit and loan

productsDeposit class:

- demand

deposits: interest rate about 0.25%-0.5%, Ideal for day-to-day money management.

Time deposits: 1-year interest rate is about 1.5%-2%, 3-year interest rate can reach 2.5%-3%.

High-yield savings accounts, such as "TTB Save & Win", offer additional lucky draw opportunities to attract savers.

Large Certificate of Deposit (CD): The threshold usually starts from 100,000 baht, and the interest rate is higher than that of ordinary fixed deposits.

Loans:

Mortgages: 4.5%-6% variable rate, minimum 10% down payment, maximum 30-year repayment period.

Car Loan: 5%-8% p.a., flexible instalment options (12-84 months).

Personal Line of Credit: The interest rate of unsecured loans is 8%-15%, which fluctuates according to credit score.

Flexible repayment: Early repayment (no penalty for some products), repayment holidays (short-term suspension of repayment), etc.

list of common expenses

account management fee: no monthly fee for ordinary savings accounts, 500-1,000 baht annual fee for some premium accounts.

Transfer fee: 10-15 baht per domestic inter-bank transfer, 0.1%-0.3% of the amount for international wire transfer.

ATM inter-bank withdrawal fee: 10-20 baht per transaction in Thailand, 150 baht overseas + 1%-2% exchange rate difference.

Hidden Fee Reminder: Some accounts require a minimum balance (e.g. 5,000 THB), otherwise a monthly fee will be charged.

Digital Service Experience

APP & Online Banking:

User rating: ttb touch The app has a Google Play rating of 4.2/5 in Thailand, and its core functions are stable.

Core functions: face recognition login, real-time inter-bank transfer, automatic bill deduction, fund/insurance investment integration.

Technological innovation: AI customer service "ttb Buddy" provides 24×7 support, and open banking API supports third-party fintech cooperation.

service channels: 24/7 telephone customer service, live chat (response time<3 minutes), Social media (Facebook/Line Quick Response).

Complaint handling: The complaint rate in 2023 is lower than the industry average, and 90% of complaints are resolved within 5 working days.

Multi-language support: Provide Thai and English services, and some outlets support Chinese (for Chinese customers).

security measures

fund security: deposit insurance coverage (5 million baht/account), real-time transaction monitoring system to intercept suspicious transactions.

Data security: ISO 27001 certified, no public data breaches after 2020.

Featured Services & Differentiation

market segments:

student account: no account management fee, education loan offer.

Exclusive financial management for the elderly: high-interest fixed deposit + free health examination value-added services.

Green Finance: Launched ESG-themed deposits to support renewable energy projects.

High-net-worth services: Private banking threshold of 10 million baht (about 290,000 US dollars), providing customized investment portfolios.

market position and accolades

industry ranking: one of the top five commercial banks in Thailand, ranking among the top 200 banks in the world in terms of total assets.

Awards: "Best Digital Bank in Thailand" (2023) and "The Asian Banker – Best SME Service" (2022) in recent years.