basic information

of banksSNS Bank is a Dutch commercial bank that occupies a place in the Dutch retail banking industry with its accessible service and simple banking model. It is not a state-owned or joint venture bank, but rather a business entity backed by private shareholders that focuses on providing financial services to individuals and small businesses.

name and background

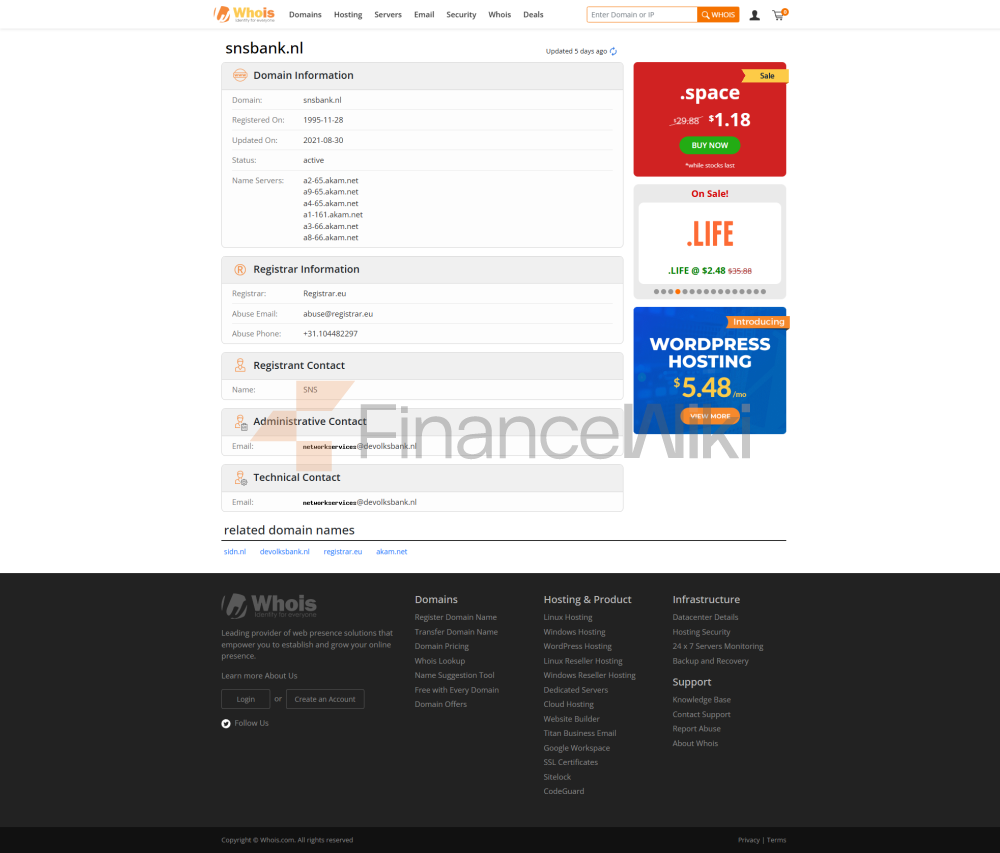

full name: SNS Bank N.V

Founded: 1817

Headquartered in Utrecht, Netherlands

Shareholder background: SNS Bank is part of de Volksbank, a banking group that the Dutch government took over through nationalisation after the 2008 financial crisis, but has now been gradually privatized. SNS Bank itself is not independently listed, and its parent company, de Volksbank, is jointly owned by the Dutch government and private investors, with a certain state-owned background, but its operation is more market-oriented. With the brand concept of "Simple, Sustainable and Accessible to the People", SNS Bank emphasizes serving ordinary families and local communities.

service scope

coverage area: mainly serving the local market of the Netherlands, covering major cities and towns across the country.

Offline outlets: Around 200 branches, mainly in the central and northern regions of the Netherlands, with a relatively streamlined number of outlets to encourage customers to use online services.

ATM distribution: Approximately 7,000 ATMs are available through the Geldmaat network, which is shared with other banks in the Netherlands, covering the entire Netherlands, making it easy for customers to withdraw and make deposits.

regulatory and compliance

regulator: Regulated by the Dutch Central Bank (De Nederlandsche Bank, DNB) and the European Central Bank (ECB) are jointly supervised in line with the EU's strict financial regulations.

Deposit Insurance: Join the Dutch Deposit Guarantee Scheme (Depositogarantiestelsel) to protect deposits of up to €100,000 per customer.

Compliance Record: In recent years, there have been no major violations, maintaining a good compliance record, and regularly undergoing stress tests and audits from DNB.

financial health

capital adequacy ratio: about 18% (higher than the EU minimum requirements, showing strong resilience).

Non-performing loan ratio: about 1.2% (lower than the industry average, with better asset quality).

Liquidity Coverage Ratio: Approximately 140% (well above the regulatory requirement of 100%, with abundant liquidity).

Overall Evaluation: Financially sound, suitable for customers with low risk appetite.

deposit and loan products

deposit class

Fixed deposits: 0.5% for 1 year, 1.2% for 3 years, 1.8% for 5 years (medium market competitiveness).

Featured products: "Green Savings Account" is available, where deposits are used to fund sustainable projects at a slightly higher interest rate than ordinary time deposits; Large Certificates of Deposit (CDs) have flexible tenors and are suitable for medium to long-term savers.

Demand deposit rate: 0.01% (industry norm in a low interest rate environment).

loans

mortgages: fixed interest rate (about 2.5%-3.5% for 10 years, depending on credit rating), preferential policies for first-time home buyers; Flexible repayment options include early repayment without penalty.

Car loan: The interest rate is about 4%-6%, the approval is fast, and it is suitable for new or used car purchases.

Personal credit loan: interest rate 5%-8%, maximum loan amount of 50,000 euros, low threshold, suitable for emergency funding needs.

list of common expenses

account management fee: no monthly fee for basic current accounts, a minimum balance of €100 is maintained, otherwise €2/month will be charged.

Transfer fee: Free of charge for SEPA transfers within the Eurozone, 0.1% per cross-border transfer (non-Eurozone) (minimum €5, maximum €50).

ATM fees: Withdrawals within the Geldmaat network are free of charge, and interbank or international ATM withdrawals are 2 euros per withdrawal.

Hidden Fee Warning: Please be aware of the management fee (0.5%-1%/year) that may be involved in the investment account, as well as the small handling fee that may be incurred for early repayment of the loan.

digital service experience

APP & Online Banking: SNS Bank's mobile app and online banking have a good reputation among Dutch users, with a Google Play rating of 4.5/ 5, App Store rating 4.7/5.

Core functions: support face recognition login, real-time transfer, automatic bill classification, budget management tools; The investment feature allows for the direct purchase of funds and ETFs.

Technological innovation: Provide AI-driven budget recommendation tools, and some accounts support open banking APIs, allowing third-party financial application integration; The robo-advisory service is in beta and is expected to be fully launched in 2026.

customer service quality

service channels: 24/7 phone support, live chat (8:00-20:00 on weekdays), Responding to customer inquiries through Platform X and WhatsApp has an average response time of about 5 minutes.

Complaint handling: The complaint rate is lower than the industry average, the average resolution time is 3-5 working days, and the user satisfaction rate is about 85%.

Multi-language support: Mainly Dutch and English, some services are available in German and French, suitable for international customers in the Netherlands.

security measures

funds security: deposits are protected by 100,000 euros insurance, real-time transaction monitoring system can quickly detect fraud, abnormal transactions will trigger automatic freezing.

Data security: ISO 27001 certified with end-to-end encryption to protect customer data. There are no known major data breaches, and external security audits are conducted regularly.

featured services and differentiation

market segments

Student account: free of fees, with a small overdraft limit (up to €500) and suitable for students aged 18-25.

Exclusive wealth management for the elderly: low-risk bond fund, regular health check-up vouchers (in cooperation with local medical institutions in the Netherlands).

Green Finance: ESG investment products, such as green bonds and sustainable savings accounts, attract environmentally conscious customers.

high-net-worth services

through de Volksbank's private banking brand, BLG Wonen, offer customized wealth management with a threshold of €500,000 in assets, including tax planning and estate administration.

market position and accolades

industry ranking: ranked among the top 10 retail banks in the Netherlands, with assets of about 60 billion euros (2024 data), ranking in the middle of the global bank rankings.

Awards: Nominated for "Best Sustainable Bank in the Netherlands" in 2024 and "Most Accessible Bank Brand" by Banking Holland in 2023.