National Bank of Vanuatu (NBV) is Vanuatu's largest commercial bank, established in 1989 and committed to providing comprehensive financial services to individuals, businesses and rural communities. As a largely government-owned institution, NBV is known for its extensive network of outlets, rural financial services, and contribution to economic development. This article will provide an in-depth analysis of the characteristics and advantages of NBV from the aspects of institutional overview, financial health, products and services, fee structure, digital experience, customer service, safety and security, special services and market position, etc., to provide a comprehensive reference for potential customers and researchers.

Institutional Overview and BackgroundNational

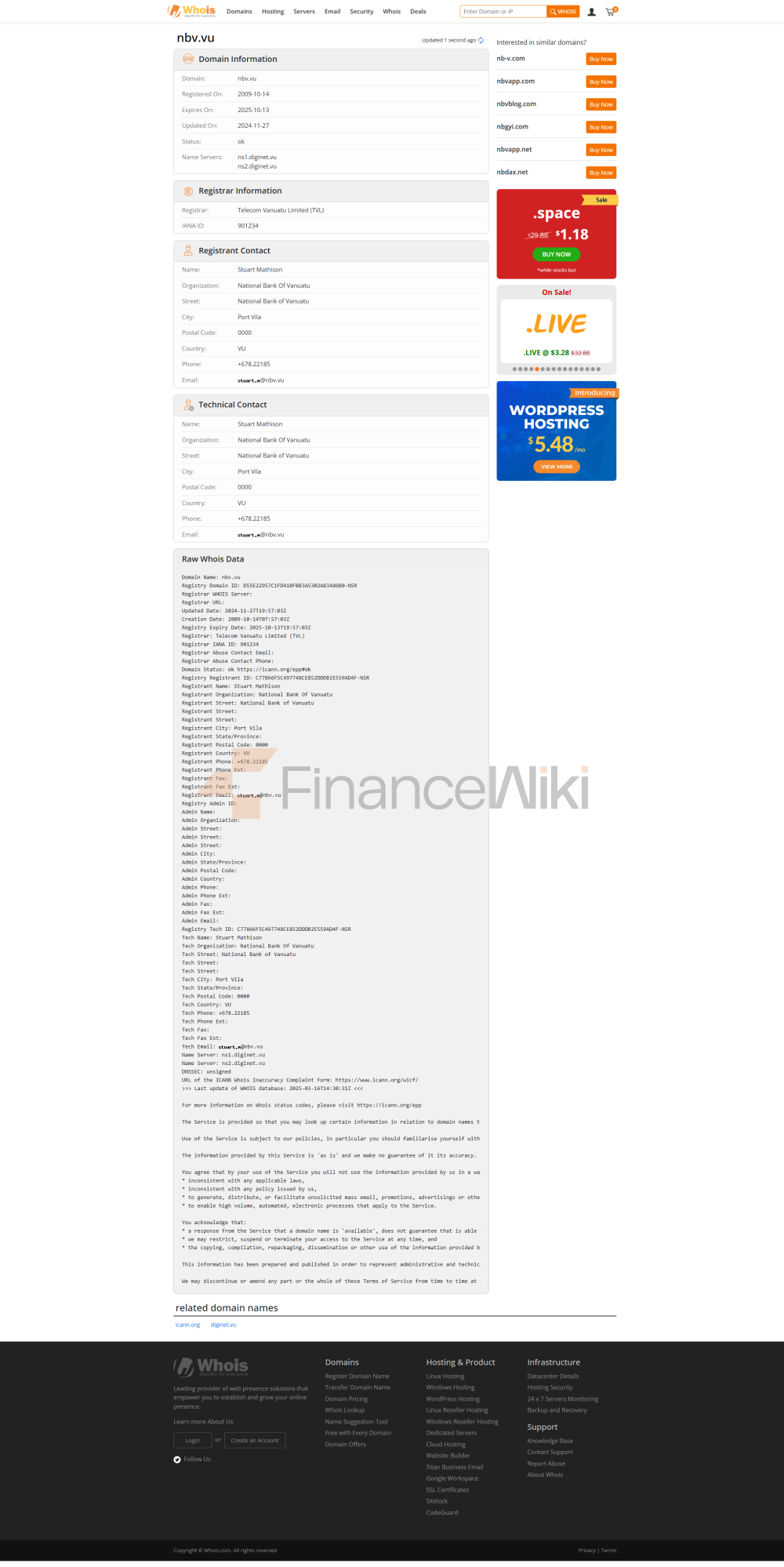

Bank of Vanuatu was founded in 1989 and is headquartered in Port Vila, Vanuatu. Box 249, Port Vila)。 As a commercial bank, NBV is jointly owned by three shareholders: the Vanuatu Government holds 70% of the shares, the Vanuatu National Provident Fund holds 15% of the shares, and the International Finance Corporation (IFC) holds 15% of the shares. This shareholding structure allows it to remain stable with government support while integrating into international financial resources. NBV is not a public company, but operates as a private entity focused on serving local and international clients in Vanuatu.

NBV's services cover the whole of Vanuatu with 29 branches and agencies across the main islands of Port Vila, Luganville, Tanna, Santo and remote rural areas. As the only commercial bank with extensive operations in rural areas, NBV has played a key role in financial inclusion. Through the CO-OP network, NBV offers a wide range of ATM services that facilitate customers to deposit and withdraw money nationwide. In addition, NBV supports multi-currency accounts, which are suitable for international trading and wealth management.

NBV is regulated by the Reserve Bank of Vanuatu (RBV) and is subject to regulations such as the Financial Institutions Act Cap. 254 to ensure transparency and stability in its operations. Vanuatu does not currently have a deposit insurance program, so customer deposits are not protected by additional insurance. As of 2025, NBV has reported no material compliance issues, indicating that it is performing well in terms of regulatory compliance.

Deposits &

LoansDeposit Products

NBV offers the following deposit products:

- Current Account (IsiAkaon): Ideal for day-to-day money management, it offers unlimited free transactions and is easily accessible via ATMs, online banking and mobile banking.

- Term Deposit: Used for long-term savings to support goals such as buying a car, buying a house, or starting a business. The exact interest rate is not disclosed, and customers are advised to contact NBV for the latest information.

- Mekem Gro Savings Account: Designed for projects or future savings, with competitive interest rates, but specific data needs to be consulted.

Loan Products

NBV offers a wide range of loan products to meet personal and business needs:

- Personal Loans: Unsecured loans for urgent needs or debt consolidation, with flexible repayment options and competitive interest rates.

- Mortgages: Support for the construction of new homes, the renovation of existing homes, the purchase of new homes, or the on-lending of loans from other banks.

- Car loans: Used to buy a private car, public transport, or to repair an existing vehicle.

- Land loans: support for the purchase of vacant registered land or on-lending.

- Microfinance Loans (IsiHaos): Designed for rural small businesses to purchase equipment, agricultural machinery, or inventory, recommended by local chiefs.

Flexible repayment options

NBV supports both early repayment and partial early repayment, allowing customers to adjust their repayment plans according to their financial situation and reduce interest expenses.

Digital Service Experience

APP & Online Banking

NBV provides IsiNet online banking services, which support the following functions:

- Account Management: View balances, transaction history, and bills.

- Real-time transfers: Domestic and international transfers are supported, using the SWIFT code NBOVVUVU.

- Bill management: Pay bills online to facilitate daily financial management.

Mobile banking services are available through the IsiNet platform and are compatible with iOS and Android devices, but are not publicly available on the App Store or Google Play ratings. As the largest bank in Vanuatu, NBV's digital services should be highly reliable and user-friendly.

Technological innovation

NBV uses industry-standard encryption technology and multi-factor authentication (MFA) to ensure data security. Its online banking platform supports 24/7 access to meet modern financial needs.

Customer Service Quality

Service Channels

- Telephone Support: Support is available on weekdays (Tel: +678 22201).

- Branches: 29 branches provide face-to-face services, covering both urban and rural areas.

- Online support: Support via the IsiNet platform or by email (litiana.a@nbv.vu).

- Social Media: Engage with customers via [Facebook page](https://www.facebook.com/nbv.vu/) Interact with customers, and the response speed is not disclosed.

Safety and Security

MeasuresFunds Security

- Deposit Insurance: NBV is regulated by the Reserve Bank to ensure the safety of funds.

- Anti-fraud technology: Prevent unauthorized transactions with real-time transaction monitoring and industry-standard security measures.

Data Security

- Authentication: Online banking employs encryption and MFA.

- Data breaches: As of 2025, no major data breaches have been identified in NBV.

Featured Services & Differentiated

Segments

- Student Accounts: Student accounts that are not explicitly offered with no fees, but the low fees of a current account may be appropriate for students.

- Exclusive wealth management for the elderly: Fixed deposits are suitable for the savings needs of the elderly, but there are no exclusive products.

- Green finance: Microfinance supports agriculture and rural development, and may involve green projects, but does not specify ESG investment products.

- High Net Worth Services: Multi-currency accounts and investment advisory are available for high-net-worth clients to manage their international assets.

Rural Banking & Microfinance

- IsiHaos Program: Supporting rural communities to build disaster-resilient houses (e.g. Category 5 hurricanes and earthquakes) as a social responsibility.

- Microfinance Loans: Funding for small businesses, recommended by local chiefs, to enhance financial inclusion.

Market Position &

HonorsIndustry Rankings

NBV is the largest commercial bank in Vanuatu, with total assets of VT 25.431 billion and shareholders' equity of VT 1.483 billion in 2017. Its 29 branches cover the whole country, ahead of other banks such as Bred Bank Vanuatu and ANZ Bank (Vanuatu) Limited.

SummaryThe

National Bank of Vanuatu is the backbone of Vanuatu's financial system and is known for its extensive network of outlets, rural financial services and strong financial position. As a commercial bank that is mainly owned by the government, NBV provides convenient financial solutions to customers through IsiNet online banking and a wide range of loan products. Its commitment to social responsibility is reflected in its rural banking and microfinance programs, especially in supporting economic development in remote areas. While some of the information, such as interest rates and fees, is not publicly available, NBV's market leadership and government support make it a trusted financial partner. Customers should contact the bank directly for the most up-to-date information when choosing.