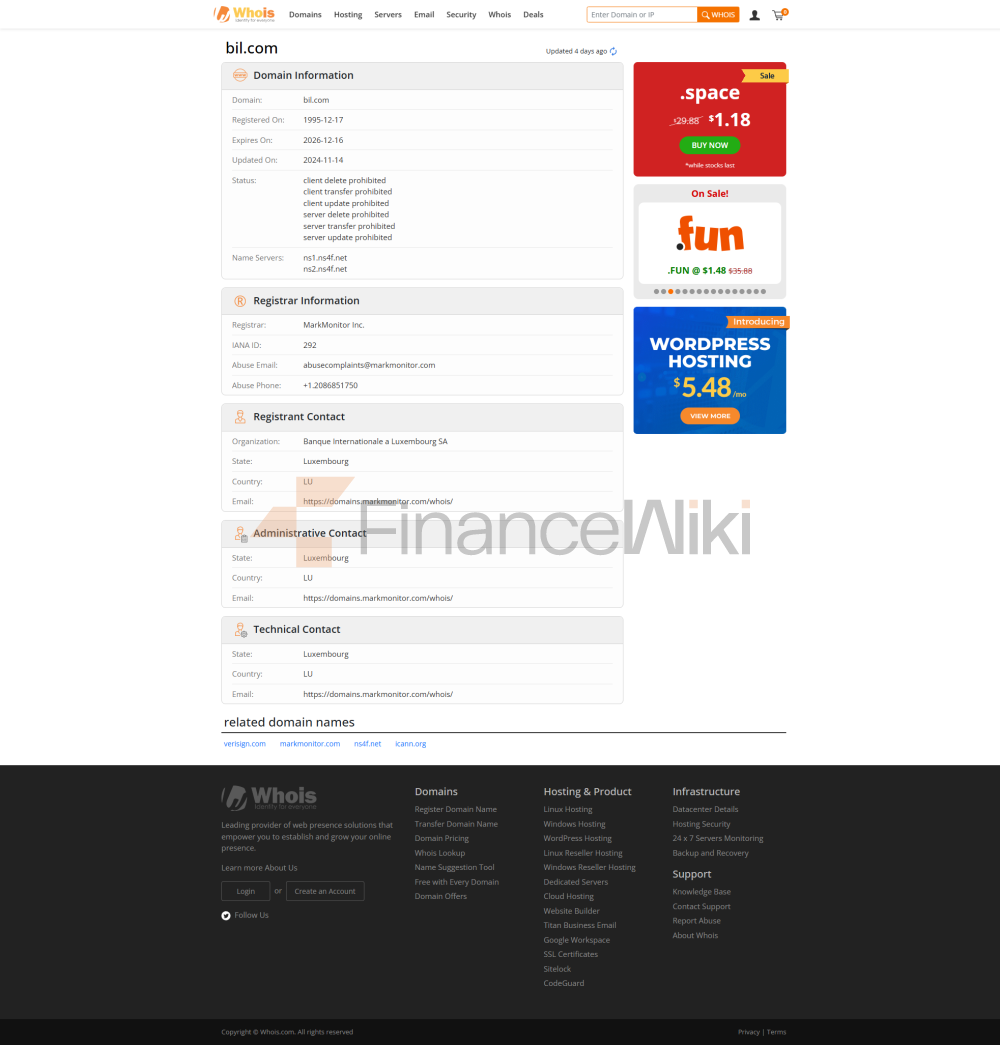

Name &

BackgroundBanque Internationale à Luxembourg (BIL) was founded in 1856 and headquartered in Luxembourg City, and is a commercial bank with a long history. The bank is privately owned by private shareholders in Luxembourg and is not publicly listed. BIL has always been committed to providing comprehensive banking services to individuals, businesses and institutional customers. As an important part of Luxembourg's financial market, BIL not only has a deep presence in the local market, but also provides cross-border financial services to global clients through a number of overseas offices.

Scope of

ServicesBIL has a global presence and a network of presence in Europe, Asia and the Americas. It has an extensive presence in Luxembourg and surrounding areas, as well as partners and branches in other financial centers around the world. The distribution of ATMs is very important, and BIL has ATMs in many important locations in Luxembourg and abroad to support customers with convenient cash withdrawal and account inquiry services, ensuring the popularity and convenience of banking services.

Regulation &

ComplianceBanque Internationale à Luxembourg is regulated by the Luxembourg Financial Supervisory Authority (CSSF) and the European Central Bank, and strictly complies with the financial regulations of Luxembourg and the European Union. BIL has joined Luxembourg's deposit insurance program to ensure the safety of customers' deposits. In recent years, BIL has maintained a strong track record in compliance and has not been involved in any major breaches, and the bank has actively participated in financial transparency and anti-money laundering measures, demonstrating its strong compliance capabilities.

Financial Health:

BIL's capital adequacy ratio remains above EU banking standards, demonstrating its strong financial position. Its capital adequacy ratio is currently at 16%, well above regulatory requirements. The bank's non-performing loan ratio is at one of the lowest levels in the industry at 1.2%, reflecting BIL's effective management of loan risk control. The liquidity coverage ratio has also remained high, and banks have strong short-term solvency and are able to remain stable in the face of market turmoil.

Deposit & Loan

ProductsBIL provides customers with a wide range of deposit products, including demand and time deposits. The interest rate of demand deposits is reasonable, and flexible access is supported; Fixed deposits offer different interest rates according to the tenor of the deposit, and customers can choose the right tenor to obtain higher returns. In addition to the basic deposit service, BIL has also launched high-yield savings accounts and large certificates of deposit (CD) products, aiming to provide customized savings solutions for high-net-worth and institutional customers.

In terms of loans, BIL offers a variety of loan products including home loans, car loans and personal lines of credit. Mortgage interest rates are competitive and the repayment period is flexible, so customers can choose different repayment options according to their needs. With low interest rates and moderate thresholds for car loans and personal lines of credit, banks offer flexible repayment options to help customers plan according to their financial situation.

List of common feesBIL's

account management fees are more transparent, and the fees that customers need to pay mainly include monthly fees or annual fees, and the fee standards vary depending on the account type. In terms of transfer fees, domestic transfers are relatively low, while cross-border transfers fluctuate according to the destination and amount. Overdraft fees and ATM inter-bank withdrawal fees are at a medium level in the industry, and banks will also clearly inform customers whether there is a minimum balance requirement, and will remind customers of the relevant fee conditions.

Digital Service ExperienceIn

terms of digital transformation, BIL actively promotes innovation and provides high-rated mobile applications and online banking platforms. Its App Store and Google Play have user ratings of more than 4.5 stars, and the user experience is widely recognized. BIL's core features include facial recognition login, real-time money transfer services, bill management, and investment tool integration to meet the needs of modern customers for convenient banking services. The bank has also launched AI customer service and robo-advisory services, which use big data and artificial intelligence technology to provide customers with personalized financial advice. In addition, BIL supports open banking APIs to encourage third-party developers to innovate and integrate financial services.

Customer Service

QualityBIL offers a full range of customer support services, including 24/7 phone support, live chat, and social media response services. The customer service team is responsive, problem solving is efficient, complaint rates are low, and customer satisfaction is high. When dealing with complaints, banks are able to respond quickly and resolve issues, which protects the rights and interests of customers. For cross-border customers, BIL also provides multi-language support to ensure smooth communication between customers from different countries and regions, which improves the customer experience.

Security MeasuresIn

terms of capital security and data protection, BIL attaches great importance to the privacy and security of its clients. The bank's deposit insurance limits comply with Luxembourg law requirements and provide customers with comprehensive anti-fraud technology, including real-time transaction monitoring and identity verification technology. In terms of data, BIL is ISO 27001 certified, which ensures a high level of security for banking systems and data. In recent years, the bank has had no data breaches, proving its excellence in data protection.

Featured Services & DifferentiationBIL

offers a variety of niche services for market segments. For the student population, the bank has launched a fee-free account plan to help young people better manage their finances. For the elderly, BIL provides exclusive financial services to help them accumulate wealth and manage risks. In addition, BIL has launched green financial products that meet ESG (Environmental, Social and Governance) standards to attract investors who are concerned about sustainable development. Banks also have an advantage in serving high-net-worth clients, providing customized wealth management solutions and providing private banking services with high thresholds to meet the individual needs of wealthy clients.