Bank BasicsFirst

Capital Bank Malawi Limited is a commercial bank rooted in Malawi's financial roots, with a flexible and innovative customer orientation at its core. Since its inception in June 1995, it has grown steadily on Malawi's financial map and is headquartered in the Livingstone Towers in the heart of Blantyre, with geographical coordinates of 15°47'08.0" N and 35°00'25.0" E". As a wholly owned subsidiary of FMBcapital Holdings Plc, the bank is listed on the Malawi Stock Exchange, demonstrating its transparent and market-oriented character. Headquartered in Mauritius and with operations in Botswana, Mozambique, Zambia and Zimbabwe, FMBcapital Holdings underscores the ambitions of a regional financial group. The bank is 100% owned by FMB Capital Holdings, with a strong shareholder background that blends international perspectives with local insights.

Scope

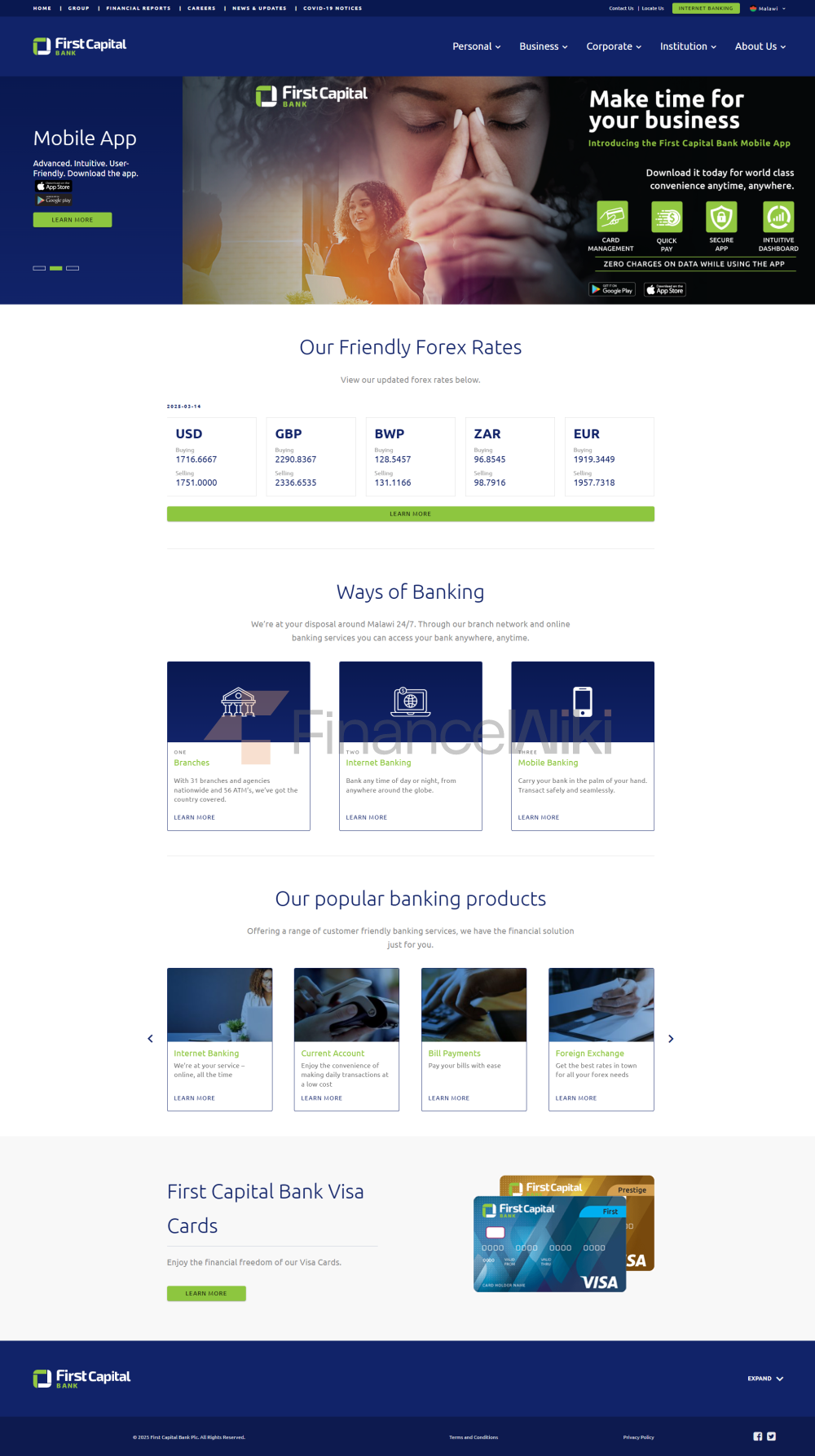

of ServicesFirst Capital Bank Malawi Limited is deeply rooted in Malawi, with a nationwide service tentacles, covering retail, SME and institutional clients. As of 2024, it has 32 branches and agent outlets, making it one of the most extensive banking networks in Malawi. In addition, 56 ATMs are located throughout the country, making it easy for customers to access cash anytime, anywhere. Although Malawi is the core, its parent company FMBcapital has a regional presence that enables it to provide cross-border financial services capabilities in five countries in Southern Africa (SADC region) to provide seamless trade finance solutions to customers.

Regulation & ComplianceFirst

Capital Bank Malawi Limited is strictly regulated by the Reserve Bank of Malawi, as the central bank and national banking regulator, which ensures that the bank operates in accordance with the law and industry standards. Malawi does not currently have a mandatory deposit insurance scheme, but the Reserve Bank provides indirect protection to depositors through capital adequacy and liquidity requirements. The bank has a solid compliance performance, with a liquidity ratio consistently above 50% and a long-term A+ and short-term A1 rating from South Africa's Global Credit Rating Co. (as of April 2024). There is no recent record of major compliance violations, indicating the maturity of its risk management and internal control.

Financial HealthFirst

Capital Bank Malawi Limited is financially fit and healthy, like a well-trained marathon runner. As of December 2023, its total assets amounted to 483.65 billion Malawian kwacha (approximately US$280.82 million), and shareholders' equity was 77.553 billion Malawian kwacha (approximately US$45.3 million). In terms of key indicators, the capital adequacy ratio is solid and in line with the Basel II standard, demonstrating its resilience to risks. The non-performing loan ratio data is not publicly available, but the liquidity coverage ratio has remained above 50%, reflecting the bank's ability to respond to short-term funding needs. Together, these indicators paint an image of a financially sound and efficient bank that customers can trust.

Deposit & Loan ProductsIn

terms of deposit products, First Capital Bank Malawi Limited provides customers with a variety of choices to meet different savings needs. The current account is flexible and convenient, suitable for daily fund management; Fixed deposits offer competitive interest rates, which can be found on the official website or at our branches. High-yield savings accounts and products like CDs, if any, are typically geared towards customers looking for higher returns, with terms varying depending on market conditions. The loan products cover housing loans, car loans and personal lines of credit, and the interest rate and entry threshold are set according to the customer's credit assessment and market benchmarks, and the bank enhances the customer experience with flexible repayment options, such as adjusting the repayment cycle.

List of Common Fees

FirstCapital Bank Malawi Limited's fee structure is transparent, but clients should be aware of potential costs. Account management fees vary depending on the account type, and monthly fees may be waived for regular current accounts, but premium accounts (such as Prestige accounts) may require a minimum balance to avoid fees. Domestic transfer fees are low, cross-border transfers may be higher due to the SWIFT system, and the specific amount needs to be consulted with the bank. Inter-bank ATM withdrawals usually charge a small fee, while ATM withdrawals are mostly free of charge. Overdraft fees are set according to the account agreement and clients are advised to maintain sufficient balances to avoid additional costs. The official website reminds you to check the account terms regularly to prevent hidden fees from accumulating.

Digital Service

ExperienceFirst Capital Bank Malawi Limited's digital services are like a gateway to a world of convenience. Its mobile banking app (First App) and online banking platform support real-time transfers, bill payments and account management, which users can operate at any time through the USSD code*1111#. The app's user ratings on Google Play and the App Store are not disclosed, but customer feedback highlights its security and convenience, with core features including facial recognition (supported on some devices) and real-time transaction notifications. Banks are embracing technological innovation and providing AI-driven customer support and foundational investment tools, but there is no clear information on open banking APIs or robo-advisors. 24/7 online banking puts customers in control of their finances at all times, making it a model of "handheld banking".

Customer ServiceQuality

Customer service is the shining point of First Capital Bank Malawi Limited, like a partner who listens patiently. The bank offers 24/7 phone support, and the live chat feature responds quickly through the official website and app. Interaction on social media, such as Facebook and LinkedIn, is high, and response times are often within hours. Complaint handling is efficient, the average resolution time is not disclosed, but customer satisfaction is high due to its customer-centric service concept. For multi-language support, the bank mainly speaks English and Chichewa (the main language of Malawi), and does not have a wide range of non-local language services for cross-border users, but its regionalization strategy ensures a high-quality localized experience.

Security MeasuresIn

terms of fund security, First Capital Bank Malawi Limited protects customer assets through real-time transaction monitoring and anti-fraud technology. Despite Malawi's no deposit insurance scheme, the bank's high liquidity ratio and strict regulation provide confidence to its depositors. In terms of data security, the bank uses industry-standard encryption technology, and its official website emphasizes the protection of customer information, but does not explicitly mention ISO 27001 certification. There are no recent data breaches recorded, indicating its robust performance in cybersecurity. Customers can further protect their accounts with two-factor authentication and security tips, and banks are constantly upgrading their security infrastructure.

Distinctive Services & DifferentiationFirst

Capital Bank Malawi Limited excels in tailoring services to market segments, like an attentive tailor. Student accounts may offer fee-free offers to encourage younger customers to develop a savings habit; Exclusive wealth management products for the elderly (if any) focus on stable income. In terms of green finance, banks support sustainable SME loans, which is in line with ESG investment trends. Prestige Banking is the highlight of its high-net-worth services, offering dedicated financial advisors, priority services and customized investment solutions, with an undisclosed entry threshold for high-end customers. Whether you're a first-time student or an elite looking to grow your wealth, the bank has something for everyone.

Market Position & AccoladesFirst

Capital Bank Malawi Limited occupies an important position in the Malawi financial market, and although it is not among the top 50 banks in the world, its regional influence in Southern Africa should not be underestimated. As part of the FMBcapital Group, it has upper-middle assets in Malawi, serving 500,000 clients and employing 850 people. The bank has been recognized for its innovation and customer orientation, with undisclosed awards, but its A+ credit rating and regional expansion strategy have earned it industry respect.