The

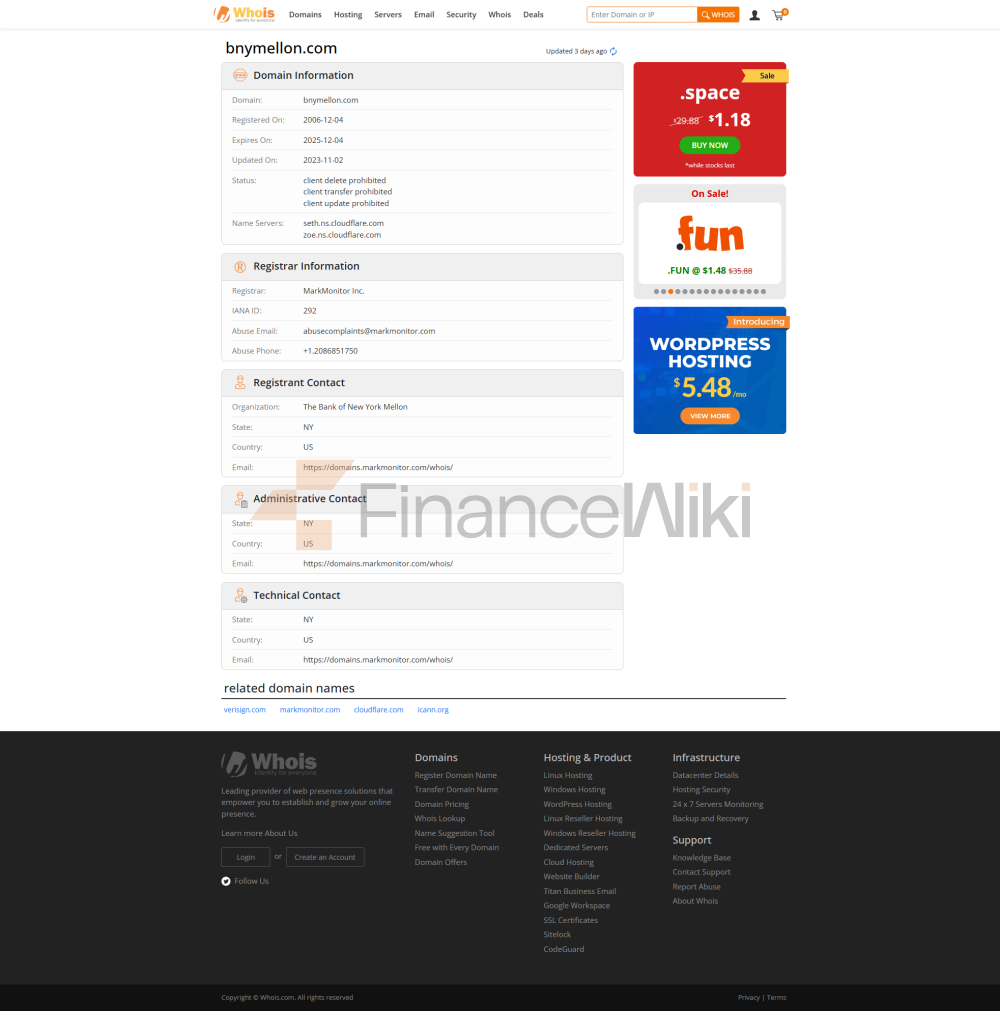

Bank of New York Mellon is a commercial bank, non-state-owned or joint venture, founded on June 9, 1784, headquartered in New York City, USA, with operations centers in London, Hong Kong and Toronto. The bank is listed on the New York Stock Exchange (ticker symbol: BK) and its major shareholders include institutional investors and public shareholders. In 2007, Bank of New York merged with Mellon Financial in a $16.5 billion deal, creating the world's largest securities services firm and top asset manager. BNY is regulated by the Federal Reserve, the New York State Department of Financial Services, and the Federal Deposit Insurance Corporation (FDIC), and deposits are protected by the FDIC with a maximum coverage of $250,000 per depositor. In the international market, BNY is regulated by the UK Prudential Regulation Authority (PRA) and other institutions to ensure global compliance.

Deposit & Loan Products

deposits BNY's deposit products are mainly aimed at high-net-worth customers, institutional and corporate customers, focusing on customized and high-end services. Savings accounts include checking accounts and savings accounts, with a minimum opening amount of $1,000 and a base annualized rate of return (APY) that can be checked through branches or online banking. Term deposits (CDs) are available in a variety of maturities (1 month to 5 years), with a minimum deposit of $5,000, interest rates in 2025 subject to bank consultation, and some products may offer competitive yields. Featured products include:

High Yield Savings Account: For BNY Wealth customers, the yield is higher than that of traditional savings accounts, and needs to meet higher balance requirements.

Large Certificates of Deposit (CD): Suitable for customers with large amounts of funds, it supports flexible tenors, and the early withdrawal penalty is from 7 days to 180 days of interest. Customers can check the latest interest rates through BNY's online banking or mobile app, and some deposit products are integrated with BNY's wealth management services to provide personalized income solutions.

loansBNY's loan products mainly serve high-net-worth customers and institutions, focusing on customized financing solutions:

housing loansFixed-rate and variable-rate residential mortgage loans up to 80% of the value of the property with tenors of 15, 20 and 30 years. For 2025, interest rates are based on the SOFR index (floating rate) or fixed rate, subject to bank confirmation. Non-traditional mortgage loans are designed for BNY Wealth and Pershing customers and are subject to strict credit criteria.

Car Loans: Car financing is available through BNY Wealth with a term of 48 to 72 months, competitive interest rates, and a high credit score.

Personal Line of Credit: Securities-Based Lending is available, the amount is based on the value of the client's portfolio, and the annual interest rate (APR) needs to be consulted with the bank. Loan applications are required through BNY Wealth or Pershing platforms, and the thresholds include high net worth assets and a good credit history.

Flexible repayment options: Mortgages and securities-pledged loans offer prepayment without penalty and repayment schedule adjustments, giving customers the flexibility to manage their debt according to their financial situation. All loans are subject to bank approval and the provision of portfolio details or financial documents, the terms of which are subject to the loan agreement. BNY's loan services focus on high-end customers and emphasize personalized financing.

Digital Service

ExperienceBNY's mobile banking app "BNY Mobile" is the core of its digital services, aimed at BNY Wealth and Pershing customers, available for download on iOS 14.0 and above and Android 9.0 and above devices, with a Google Play rating of 4.5 and an App Store rating of 4.6, with users praising its intuitive interface and quick response. Core functions include:

Face recognition: support Touch ID and Face ID to ensure transaction security.

Real-time transfers: Instant transfers through Zelle and global payment systems, with support for USD and other major currencies.

Bill Management: Simplify financial management by providing online bill payment and e-statements.

Investment Tool Integration: Support stocks, ETFs, mutual funds, and bond trading through BNY Investments and Mellon Investments, providing real-time market data and investment advisory services. The online banking platform supports multiple browsers and provides similar features to ensure that customers can manage their accounts at any time. Some users reported occasional technical issues, but BNY continued to optimize the app experience.

Technological

InnovationBNY is leading the way in the fintech sector:

AI customer service: Erica is BNY's AI virtual assistant, launched in 2018, supporting transaction queries, bill payments, and investment advice, 90% Employees use the in-house version of Erica to improve operational efficiency.

Robo-advisory: Provide automated investment management through BNY Investments and Mellon Investments, combined with AI technology to provide customers with personalized financial management solutions and lower the threshold for wealth management.

Open Banking APIs: BNY supports open banking APIs, integrates with third-party service providers, and provides account management and financial services interoperability, particularly in the area of securities services.

Other innovations: AI for fraud detection (to reduce false positives) and contact center optimization (to improve agent efficiency). By 2025, BNY plans to invest $4 billion in AI and new technologies, accounting for one-third of the technology budget.

Featured Services & DifferentiationBNY

is known for its world-leading asset management and securities services:

asset management: Nearly $2 trillion in assets under management through BNY Investments, covering ARX Investimentos, Dreyfus, Insight Investment, etc., serving institutional and individual investors.

Securities Services: Global custody, fund accounting, ETF services, securities lending and foreign exchange trading, including Fortune 500 companies and top-tier institutions.

Sustainability: CDP A rating in 2023, LEED certification for several buildings, and a commitment to achieve net-zero emissions by 2050.

Diversity & Inclusion: Promote the career development of women and diverse groups through employee resource groups such as the Women's Initiative Network (WIN) and PRISM.

Private Banking: Customised wealth management for high-net-worth clients, including art and aircraft financing.

Market Position &

HonorBNY is the world's largest securities service company and top asset management company, with total assets of $335.955 billion in 2024, ranking 13th largest bank in the United States and 83rd in the world. The bank serves 90% of the Fortune 100 and the world's top institutions, with nearly $50 trillion in assets under management. In 2024, BNY was named "World's Best Asset Servicing Bank" by The Banker and "Best Digital Banking Experience in North America" by Forrester for the fifth year in a row. Awarded the 2023 Greenwich Associates' SME & Midsize Corporate Banking Customer Experience Award and the 2025 "Best Employer" certification for its performance in employee development and community support.

SummaryThe

Bank of New York Mellon (BNY) is one of the world's oldest commercial banks, with its excellent asset management and securities services at the heart of the financial markets. It offers high-end deposit and loan products designed for high-net-worth clients and institutions, with flexible repayment options to meet diverse needs. BNY Mobile is a critically acclaimed mobile banking app that supports real-time money transfers, investment management, and AI assistant Erica. In terms of technological innovation, BNY is leading in the fields of AI customer service, robo-advisory, and open banking APIs, and its Erica virtual assistant has become an industry benchmark. With its commitment to sustainability, diversity initiatives, and industry accolades received in 2024, BNY has demonstrated unparalleled trust and influence in the global financial sector.