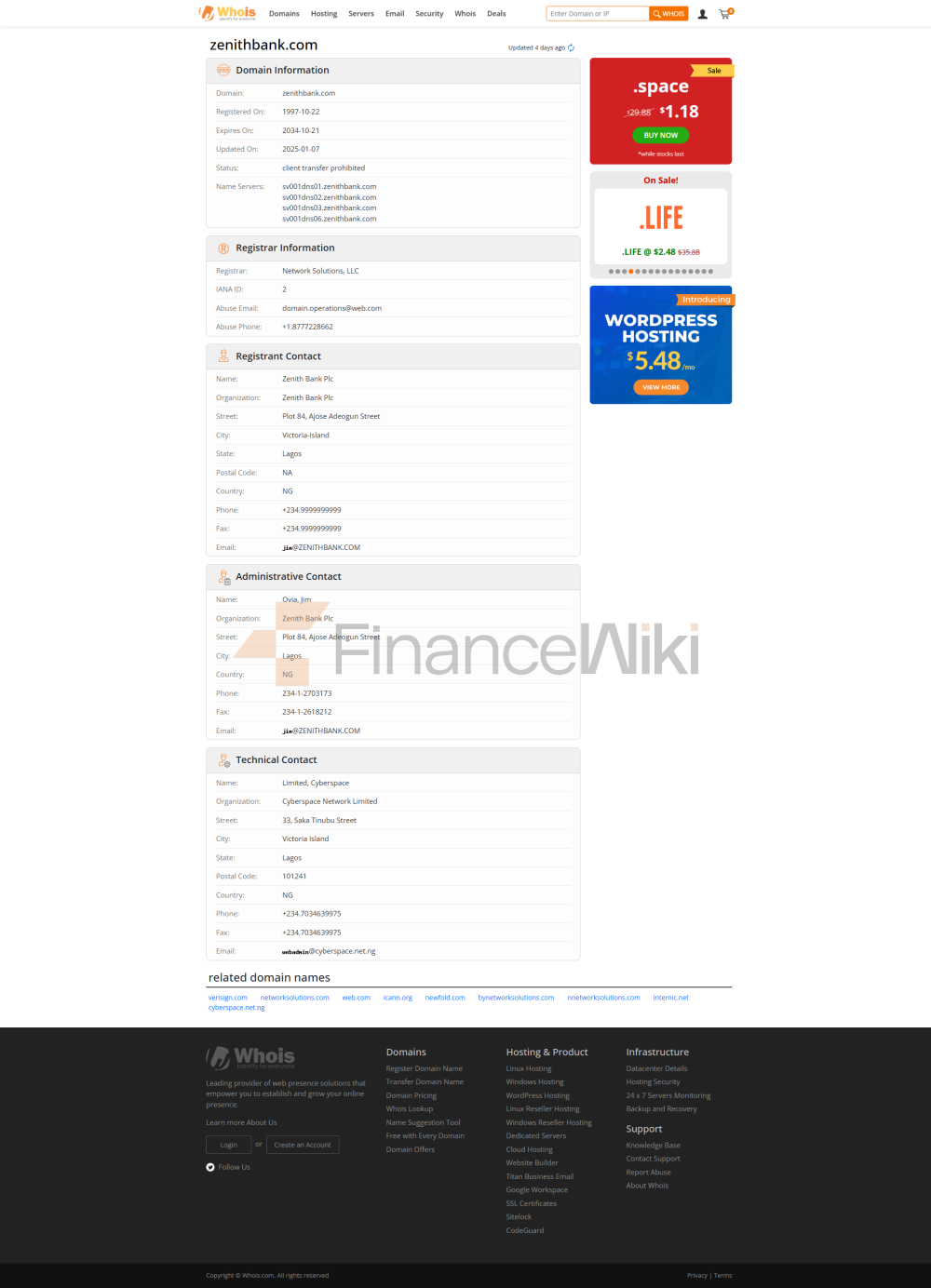

Bank Basic

InformationZenith Bank Plc is a leading commercial bank in Nigeria that was established in 1990. As an innovative and modern commercial bank, it operates in Nigeria and beyond, providing a wide range of banking services.

Scope of

ServicesZenith Bank has a presence in Nigeria and multiple branches in Africa and other global markets. The bank has offline outlets all over the country to provide customers with comprehensive financial services. Its ATMs are widely distributed, ensuring that users can enjoy convenient cash withdrawal services in multiple locations. In terms of digital transformation, Zenith Bank has also made significant achievements in providing convenient online and mobile banking services.

Regulation &

ComplianceZenith Bank is a commercial bank regulated by the Central Bank of Nigeria (CBN). It has joined the deposit insurance scheme to ensure the safety of customers' deposits. In recent years, the bank has maintained a relatively stable compliance record, continued to meet regulatory requirements, and has established a good reputation.

Financial HealthZenith

Bank's capital adequacy ratio remains high in the industry, indicating that it has sufficient capital to withstand potential market risks. Banks' low non-performing loan ratios indicate that their risk management mechanisms are relatively efficient and their loan quality is good. In addition, the liquidity coverage ratio meets regulatory requirements to ensure that it has sufficient liquidity in the face of sudden market changes.

Deposits &

LoansDeposits: Zenith Bank offers a variety of deposit products, including demand and term deposits. Demand deposits have moderate interest rates, while time deposits offer higher interest rates to attract depositors for long-term deposits. In addition, the bank also offers special products such as high-yield savings accounts and large certificates of deposit (CDs) to meet the needs of different depositors.

Loans: As a competitive commercial bank, Zenith Bank offers a wide range of loan products, including home loans, car loans, and personal lines of credit. The interest rate is reasonable, and the loan threshold is relatively low. For customers in need, banks also offer flexible repayment options to help customers better manage their finances.

List of Common FeesZenith

Bank's account management fees are transparent, and the monthly and annual fees are relatively reasonable, so users can clearly understand the fees. Fees for cross-border and domestic transfers are among the highest in the industry. It is important to note that banks charge overdraft fees and ATM interbank withdrawal fees. For some accounts, banks have minimum balance limits that can lead to hidden fees, so users need to be aware of these details.

Digital Service Experience

APP & Online Banking: Zenith Bank offers powerful mobile apps and online banking services. According to user ratings, the app has a higher rating on Google Play and the App Store, indicating that its user experience is better. The core functions include face recognition, real-time transfer, bill management, etc., which improves the convenience and security of user operations.

Technological innovation: Banks have also shown an innovative side when it comes to technology. For example, the introduction of functions such as AI customer service and robo-advisors has enabled customers to obtain more efficient services in their daily banking operations. In addition, Zenith Bank supports open banking APIs, allowing developers and other third-party businesses to build new financial applications on its platform.

Customer Service Quality

Service Channels: Zenith Bank offers 24/7 phone support, and its live chat service is also very responsive. For social media users, banks are also able to respond within a short period of time, demonstrating a good customer service attitude.

Complaint Handling: Zenith Bank has a low complaint rate and an industry-leading average resolution time, allowing it to quickly address customer queries and issues. Users are generally satisfied with the bank's services, which reflects its efficient customer support system.

Multi-language support: The bank not only supports local languages, but also provides multi-language services to cross-border customers, especially in international business, providing English, French and other language support, enhancing its service capabilities in the global market.

Security MeasuresFunds

Safety: Zenith Bank takes the safety of funds very seriously, and customer deposits are protected by a deposit insurance scheme. The bank also ensures that customer funds are protected from the risk of online fraud through a variety of anti-fraud technologies, including real-time transaction monitoring.

Data Security: Zenith Bank is ISO 27001 certified, indicating that it has met international standards in terms of information security. In recent years, the bank has not had any major data breaches, ensuring the security of customers' personal and transaction data.

Featured Services & Differentiated

Market Segments: Zenith Bank offers a wide range of featured services, including fee-free accounts designed for students, tailored financial services for seniors, and ESG investment products that align with the concept of green finance. Through the products of these market segments, banks are able to reach more customer groups with different needs.

High Net Worth Services: For high net worth clients, Zenith Bank offers private banking services, including customized financial solutions. Through personalized financial planning, banks help customers achieve wealth growth and inheritance.

Market Position & AccoladesIndustry

Rankings: Zenith Bank is one of the largest banks in Nigeria and Africa by assets, and has been ranked among the top global banks for many years. Its position among the world's top 50 banks reflects its strong financial strength and market influence.

Awards: Zenith Bank has won multiple accolades such as "Best Digital Bank" and "Most Innovative Bank", reflecting its outstanding performance in digital transformation and innovation.