Union Bank of Colombo PLC (hereinafter referred to as "Union Bank") is a shining star in Sri Lanka's financial system, becoming one of the leading commercial banks in Sri Lanka with its innovative financial products, extensive service network and solid financial performance. Since its inception in 1995, Union Bank has earned high recognition in the market through its dedication to retail, SME and corporate customers, as well as its continuous investment in technological innovation. This article will comprehensively analyze the characteristics and advantages of Union Bank from various aspects such as basic bank information, financial health, deposit and loan products, common fees, digital service experience, customer service quality, security measures, special services and market position, etc., to provide in-depth insights for potential customers and researchers.

Union

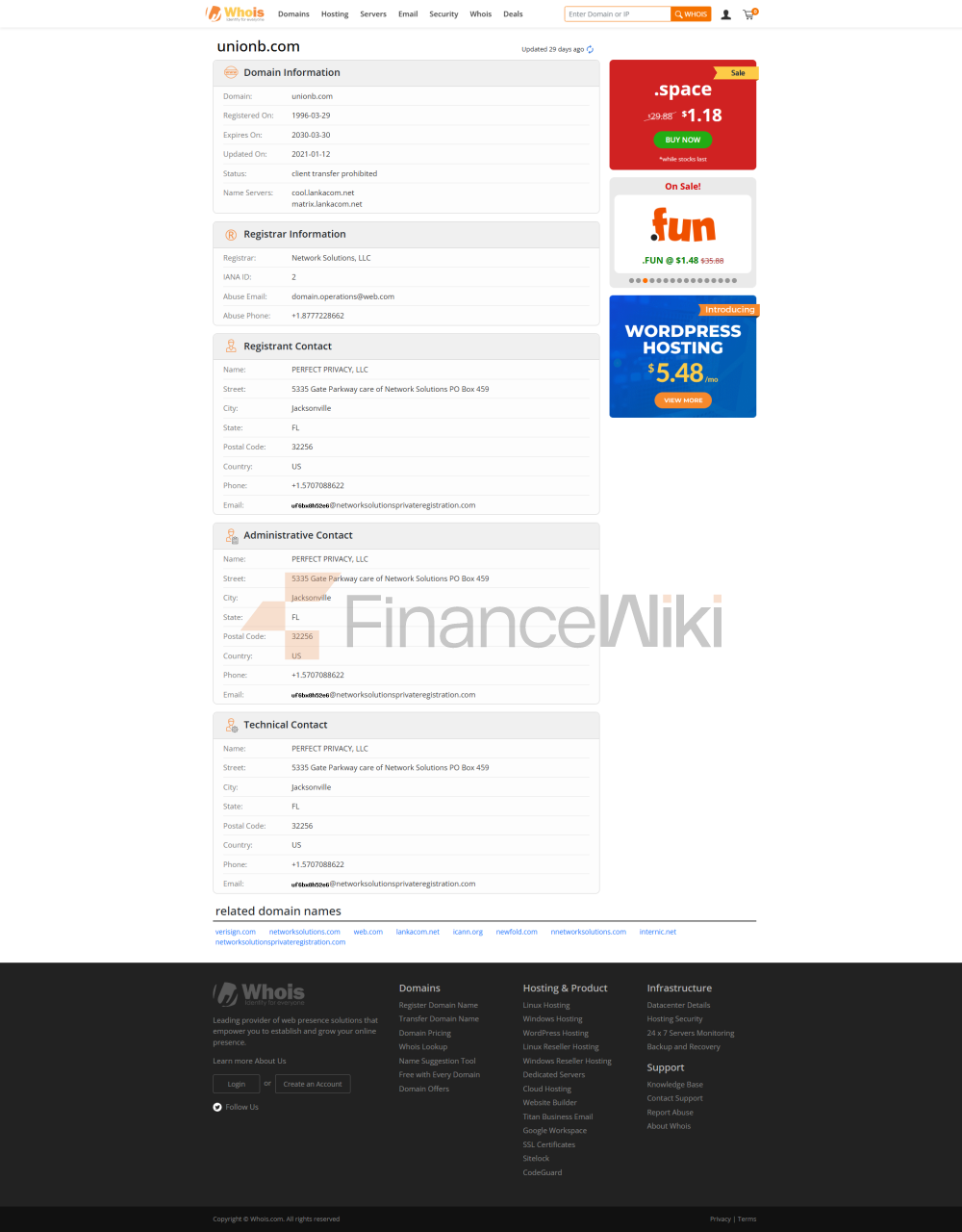

Bank is a private commercial bank established in 1995 and headquartered at 64 Galle Road, Colombo, Sri Lanka. As the eighth local commercial bank in Sri Lanka, it was co-founded by DFCC Bank and The Great Eastern Life Assurance Company Limited. In 2014, TPG Group became a major shareholder through its subsidiary Culture Financial Holdings, a 70% stake in the country's financial sector, marking one of the largest foreign direct investments in Sri Lanka's financial sector. In October 2023, CG Capital Partners Pte Ltd (an affiliate of CG Corp Global) indirectly acquired a majority stake, further enhancing the bank's international background. Union Bank was listed on the Colombo Stock Exchange in March 2016 with an IPO that was 350% oversubscribed, reflecting strong market confidence in its growth potential.

The Bank's services cover the whole of Sri Lanka, with about 63 branches as of 2024 in the cities of Colombo, Akuresa, Ambalangoda, Badulla, etc., and about 121 ATMs through the CO-OP network (2017 data, latest number to be confirmed). With a focus on retail, SME and corporate clients, Union Bank provides a comprehensive range of financial solutions including deposits, loans, trade finance, foreign exchange trading and investment services.

Union Bank is regulated by the Central Bank of Sri Lanka and is subject to the Banking Act (Banking Act No. 30 of 1988). Its deposits are protected through the Sri Lanka Deposit Insurance Scheme (SLDIS), which is compensated up to Rs 1.1 million per depositor. In 2024, the bank's CEO denied the allegations in the online media, emphasizing its transparent operations and good compliance record under the central bank's regulatory framework, indicating that it is robust in terms of compliance.

Financial

HealthUnion Bank is one of the top five banks in Sri Lanka for market capitalization, indicating its strong financial position. According to Q1 2024 data, the bank's total revenue was Rs.4569 crore, down 24 per cent YoY, and net profit was Rs.456 crore, up 5.12 per cent YoY. Despite fluctuations in profitability, banks have improved in terms of asset quality and liquidity ratios. In 2024, its market capitalisation is around Rs 108 crore and the share price is at Rs 9.90 (as of June 3, 2025). As the latest financial indicators (e.g., capital adequacy ratio, non-performing loan ratio, liquidity coverage ratio) for 2025 are not disclosed, customers should contact the bank directly for the latest data. Overall, Union Bank's long-term growth and market position indicate that it is financially healthy and able to weather economic challenges.

Deposits &

LoansDeposit Products

Union Bank offers a wide range of deposit products to meet the needs of different customer groups:

- Demand Deposits: including Ordinary Savings Accounts, Children's Savings Accounts and Senior Savings Accounts, with a minimum deposit of Rs.5,000 and competitive interest rates. The account comes with free ATM withdrawals, SMS alerts, and bill payment services.

- Fixed Deposits: Deposit tenors ranging from 1 to 60 months with a minimum deposit of Rs 100 lakh and a maximum of Rs 10 million with interest rates ranging from 6.00 per cent to 7.25 per cent.

- Featured products: These include savings accounts designed for low-income groups and investment plans for high-net-worth clients, some of which offer free personal accident insurance up to Rs 200,000.

Loan Products

Union Bank offers a wide range of flexible loan products to meet the needs of individuals and businesses:

- Mortgages: Buy, build or renovate a home with interest rates ranging from 12.0% to 14.5% (variable rate) and repayment terms of up to 25 years. Applicants must be Sri Lankan citizens aged between 18 and 55 years with a minimum monthly income of INR 30,000 and can apply jointly with their spouses.

- Personal Loans: Interest rates from 12.5 per cent to 15.0 per cent, up to Rs 3 lakh with repayment terms of up to 5 years, without the need for a personal guarantor, suitable for urgent financial needs.

- Flexible repayment options: Early repayment and partial early repayment are supported, allowing customers to adjust their repayment plans according to their financial situation and reduce interest expenses.

Digital Service

ExperienceUnion Bank provides modern financial services through the "UBgo" mobile app and online banking platform.

- App & Online Banking: The UBgo app is available for iOS and Android and offers features such as account management, real-time transfers, bill payments, and a loan calculator. User feedback is mixed, with some users reporting sign-in issues and app crashes (such as the "Check Network Connection" error), but the convenience is still somewhat recognized. The online banking platform is synchronized with the mobile app function and supports 24/7 access.

- Core features: including account balance inquiry, transaction history viewing, real-time transfers, bill payments, and investment tool integration.

- Technological innovation: The bank uses SSL encryption and multi-factor authentication (MFA) for security, with no explicit mention of AI customer service or open banking APIs, but its digital platform is a leader in Sri Lanka's banking industry. In 2024, Nisala Kodippili, Chief Information Officer, won the "Most Innovative CIO Award at the BFSI Technology Summit in South Asia", highlighting her technological innovation capabilities.

Customer Service QualityUnion

Bank offers a variety of customer service channels to ensure that customers receive timely support:

- Service channels: Telephone support includes general enquiries (011 237 4100) and 24-hour customer service (0117 818181). Email (info@unionb.com) can be used for non-urgent issues. Customers can also receive face-to-face service through 63 branches or interact through Platform X.

- Complaint handling: The bank has a standard complaint handling process, and customers can submit feedback through the official website, but the specific complaint rate, average resolution time, and satisfaction data are not disclosed.

- Multi-language support: Mainly available in English and Sinhala, Tamil may be supported, cross-border customers will need to inquire about other language support.

Safety and Security

MeasuresFunds Security

Deposits are protected through the Sri Lanka Deposit Insurance Scheme with a maximum compensation of Rs 11 lakh. Banks use anti-fraud technologies, such as real-time transaction monitoring, to prevent unauthorized transactions.

Data Security

The UBgo app and online banking platform use industry-standard encryption technology and MFA to ensure data security. The bank did not report any major data breaches in 2024, demonstrating that its data security measures are robust.

Market Position & Accolades

Union Bank is among the top five banks in Sri Lanka in terms of market capitalisation with total revenue of around Rs 25.9 million and market capitalization of around Rs 1,080 crore in 2024. It is particularly prominent in retail banking, accounting for a major portion of revenue. In 2014, TPG invested US$117 million, making it one of the largest foreign direct investments in Sri Lanka's financial sector. In 2023, CG Corp Global acquired a majority stake through its affiliates, further enhancing the bank's international background. In 2024, Nisala Kodippili, Chief Information Officer, won the "Most Innovative CIO Award" at the BFSI Technology Summit in South Asia, highlighting its leadership in technological innovation.

ConclusionUnion

Bank of Colombo PLC is a leader in the financial sector in Sri Lanka with its innovative financial products, extensive service network and solid financial performance. Whether it is a retail customer, an SME or a high-net-worth customer, banks offer a wide range of financial solutions to meet different needs. Despite technical issues with its mobile app, Union Bank continues to improve the customer experience through a strong customer service and digital platform. In the future, Union Bank is expected to further consolidate its market leadership position with its continued efforts in the field of technological innovation and sustainability.