Slovenská Sporiteľňa Bank Analysis Report Basic information

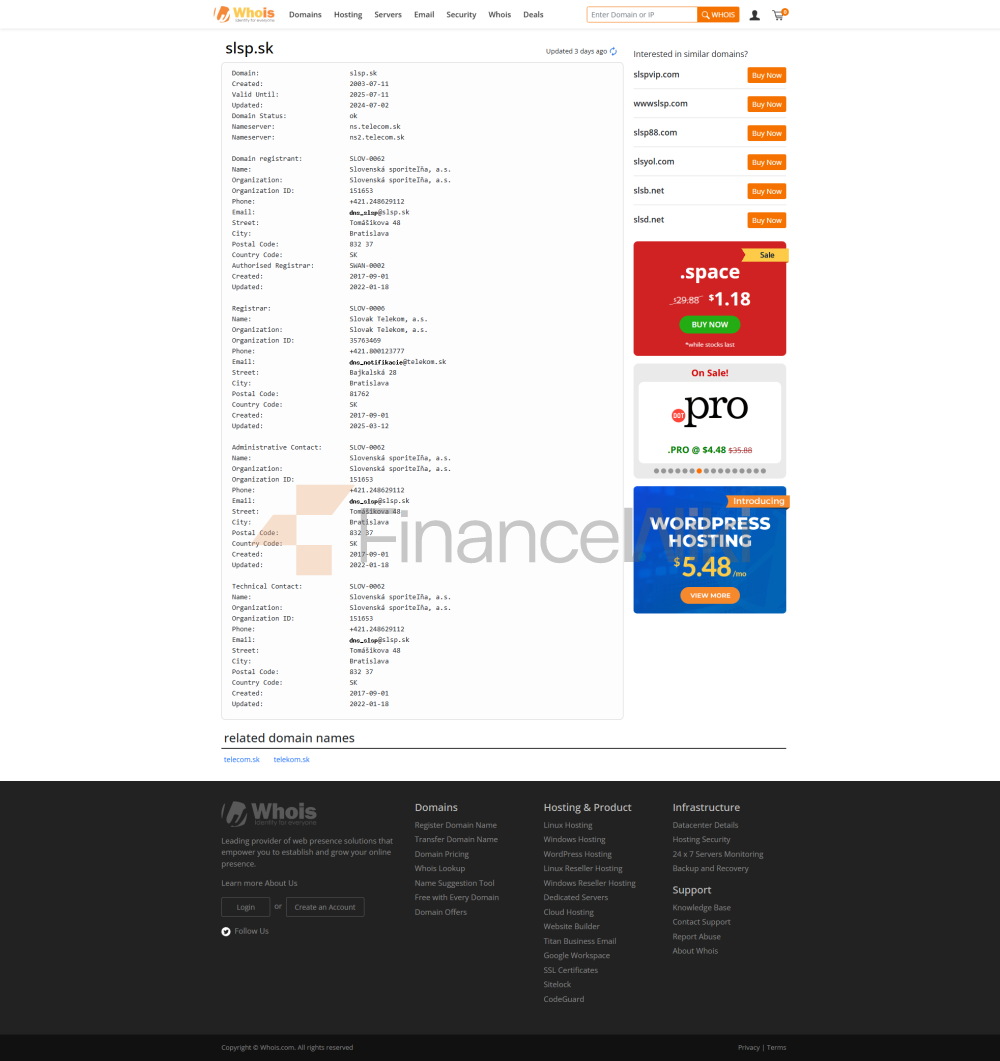

of the bankSlovenská Sporiteľňa (Slovak Savings Bank) was founded in 1825 and has its headquarters at Tomášikova Street 48 in Bratislava, and is the largest commercial bank in Slovakia. Originally part of the Austrian Erste banking group, the bank has been a wholly owned subsidiary of the Erste Group since 2001 (the Erste Group is headquartered in Austria) and is recognized as a systemically important bank in Slovakia (additional capital buffer of 2%). The type of bank is a joint-stock commercial bank (a.s.), which is not state-owned, but 100% owned by the Erste Group, so it is not separately listed. The bank has about 2.0–2.2 million customers and about 3,500 employees, and a nationwide branch network.

Slovakia is a member of the European Union and banks follow EU and Slovak regulatory laws and guidelines. The bank did not disclose other non-public investors or shares, and the main shareholder, the Erste Group, is listed in Vienna.

Slovenská Sporiteľňa's services are mainly in the Slovak region, and its business covers all parts of the country and does not have a global retail business. By the end of 2024, the bank will serve customers through nearly 160 retail outlets and 4 corporate centers, with more than 750 self-owned bank ATMs. Its service network ranks first in the country, with the largest number of branches and automated teller machines (ATMs). In addition, customers have access to the ATM network, which is part of the Erste Group. The services provided by the bank include a full range of financial services such as personal banking, corporate banking, investment and wealth management, and the business area is mainly in Slovakia. Its online branches (online banking and APP) can support customers to handle business remotely, without being limited to physical branches.

Regulation &

ComplianceSlovenská Sporiteľňa is regulated by the Slovak National Bank (NBS) and is also under the direct supervision of the European Central Bank (ECB) as a Systemically Important Institution. Banks comply with EU Banking Regulatory Directives and local laws, including regulations on Anti-Money Laundering (AML), Data Privacy (GDPR), and more. There have been no public reports of significant compliance violations at the bank. In accordance with Slovak law, Slovenská Sporiteľňa is a member of the National Bank Deposit Protection System and is a member of the State Deposit Protection Fund. The system guarantees deposits with natural and legal entities in the bank up to a maximum of €100,000 and is in line with the EU harmonized regulations. In terms of recent compliance records, the 2024 semi-annual report disclosed that the bank was not subject to major fines and penalties, and all compliance indicators were normal.

Financial

healthSlovenská Sporiteľňa is in strong financial health. According to authoritative analysis, as of the third quarter of 2024, the bank's total assets are about 26.2 billion euros, making it the largest commercial bank in Slovakia by assets. For the full year of 2023, the bank's capital adequacy ratio was as high as 20.02% (calculated according to the Basel III rules and internal rating methodology), well above the statutory minimum requirements. The capital adequacy ratio for the first half of 2024 is approximately 20.7%. These figures indicate that banks have ample capital buffers. Data for the first half of 2024 shows that the non-performing loan ratio is about 1.9%, a slight increase from previous years but still at a very low level, and the loan provision coverage ratio has decreased from 122.4% to 102.1%, indicating that non-performing loans have been fully provisioned. Banks are fully liquid, maintaining a liquidity coverage ratio (LCR) above EU regulatory requirements to meet short-term funding needs (the EU requires an LCR of at least 100%). Overall, the bank has good asset quality, enhanced profitability (net profit of more than 300 million euros in 2023), abundant capital, and a healthy and stable financial position.

Deposit & Loan

ProductsSlovenská Sporiteľňa offers a wide range of deposit and loan products. The interest rate on demand deposits is low (in the case of the euro, the current interest rate is below 0.5%), but through the promotion of Moja odmena, customers can enjoy no account management fees and relatively favorable service conditions. For example, according to public information, the current interest rate on euro time deposits is about 2.0% for half a year, 1.5% for one year, 2.0% for two years, and 2.0% for three years. Banks also offer preferential time deposit packages and savings products for specific customers (e.g. students, seniors, etc.).

In terms of loans, it mainly includes housing loans, car loans and personal consumption loans. Mortgage interest rates have been on a downward trend in recent years, with the base rate being around 3.7% or more (e.g. "Hypotéka od 3,69% ročne"), which may vary depending on the term of the loan and the proportion of the down payment. Through projects such as "green energy subsidies", interest rate discounts are provided when buying a house; In addition, loan handling fees are waived in developer-based cooperation projects. Car loans and personal consumption loans can also be applied for online, and the interest rate depends on the purpose of the loan and credit status, generally around 3-6% annualized. All types of loan applications usually require proof of income and credit information, but there is a more comprehensive assessment method for the type of income (including foreign income, self-employment income, etc.). Loan repayment is flexible, customers can make additional repayments free of charge: one overpayment per month (up to 3 times the monthly repayment amount) without handling fee; You can also adjust the repayment date at any time in the online banking or APP, without going to the bank. Such flexibility measures save borrowers fees and improve repayment convenience.

List of common

feesSlovenská Sporiteľňa's account management fees and transaction fees are generally deductible through rewards programs such as My Rewards, which allow for zero account fees. Under My Rewards, the monthly account fee and most service fees are waived as long as the account is kept active (e.g., if the monthly spend is met). If the conditions are not met, the monthly fee for an ordinary current account is around a few euros, depending on the bank's latest rate schedule.

In terms of transfer fees, ordinary bank transfers (including SEPA and instant payments) in the Eurozone will be charged around €0.22 per transaction if they are processed via online banking or apps (the rate will increase from €0.20 to €0.22 from 2024). Senior and student accounts are exempt from such fees under the incentive program. International money transfer and withdrawal fees vary by region: Eurozone and EEA are generally lower (same as €0.22 above), while non-EU remittances or foreign currency transactions are charged according to the card agreement (e.g. 2% for foreign currency settlements, up to 5 euros per transaction). In terms of inter-bank ATM withdrawals, intra-city ATM withdrawals are usually free of charge, and foreign withdrawals or non-Erste Group ATMs may charge a small fee (usually a few euros). In addition, the annual fee and currency conversion fee of the credit card are subject to the specific card type (e.g. no annual fee for Visa Classic, about 2% handling fee for foreign currency purchases). In general, the standard fees are transparent and open, and are detailed on the official website and the bulletin board of the outlets, and users will get the latest "Fee List" when opening an account, and can check the fee rules on the online banking at any time.

Digital Service

ExperienceSlovenská Sporiteľňa actively promotes digital transformation with its own e-banking system "George", which offers a full range of online banking and mobile app services. The George App supports a variety of modern features: QR code payment, automatic currency conversion, fingerprint/face login, real-time Push notifications, and more. In terms of user reviews, the George App has been well received (with a Google Play rating of about 4.6 stars and more than 1 million downloads), with reviews pointing out that the interface is friendly and the features are perfect. The bank has also built an Open Banking platform that provides payment origination and account information services to licensed third parties through standardized APIs in accordance with the PSD2 directive, taking into account both security and innovation. In 2022, the bank launched the world's first holographic virtual customer service "Vesna" at its Bratislava branch, which uses 3D holographic projection, speech recognition and text synthesis to automatically answer customer questions in more than 150 scenarios such as accounts and investments. In addition, Slovenská Sporiteľňa is piloting an AI customer service project, where a PoC test showed that a large language model (GPT)-based chatbot can answer bank product inquiries with 76% accuracy. It can be seen that the bank's digital experience and innovative functions are in a leading position in the industry.

Quality of Customer

ServiceSlovenská Sporiteľňa provides multi-channel customer service, including nationwide outlets, telephone customer service, online customer service, and social media. Its customer service hotline provides 24/7 support for domestic users such as 0850 111 888, and an international hotline +421 915 111 888 for overseas users. In terms of multilingual support, the official information is mainly in Slovak and English, and there is an "International Desk" for foreign customers in English. Banks are also more formal in terms of complaint handling and customer satisfaction surveys, and overall user ratings are high. The bank's senior management emphasises the importance of listening to customer feedback and continuously improving its services (e.g., winning multiple "Bank of the Year" awards in 2023 reflects the recognition of its services by customers and the industry). In general, customers can obtain support through various channels such as in-person visits, phone calls, emails, online banking messages or in-app messages, and the complaint handling mechanism is standardized, and the timeliness is generally guaranteed.

Security

MeasuresSlovenská Sporiteľňa invests significant resources in terms of funding and data security. Encrypted transmission and multi-factor authentication are used in digital channels, such as fingerprint/face login for mobile apps and dynamic passwords for online banking. The banking system complies with EU regulatory requirements and complies with GDPR user privacy protection regulations. Its security management system adheres to international standards (e.g. ISO 14001 environmental management certification, and information security policies are continuously evaluated and updated). For payment security, all transactions require two-factor authentication or SMS verification code; For account funds, deposits up to €100,000 are protected by state deposit insurance. So far, there have been no major data breaches of Slovenská Sporiteľňa's own in public reports, and only a few isolated bank card information has been stolen by criminals (such information leaks are often related to the risk of physical use of the card, and the bank has not disclosed systemic security failures). Overall, the bank is at the highest level in the industry in terms of IT security, cyber protection and anti-fraud, and no public security incidents have been identified.

Unique services and differentiationSlovenská

Sporiteľňa has launched special financial services for different customer groups. For example, students and young people can open a "SPACE Student Account" without charging a monthly fee and enjoy free dual card services and free inter-bank withdrawals. Senior customers (over 62 years old) can also apply for a SPACE account, which is free for the first two years and has a long-term monthly fee waiver with My Rewards. The bank also offers products such as child savings accounts for families with children to help with the different needs of customers throughout their life cycle. In terms of green finance, the bank has implemented an environmental management system since 2015 and took the lead in obtaining ISO 14001 certification and obtaining the "Green Bank" certificate. In addition, Slovenská Sporiteľňa offers high-end private banking services, partnering with Erste Private Bank to tailor asset management and legacy solutions for wealthy clients. Featured technology services include innovative tools such as George Bývanie, which centrally manages housing-related spending, views the mortgage value of a property, and reads property financial advice, reflecting the bank's focus on market segments and diverse needs.

Market Position & AccoladesAs

the largest commercial bank in Slovakia, Slovenská Sporiteľňa has a leading market share in the local banking sector. According to Nord/LB research, as of the third quarter of 2024, its share of the loan and deposit market is about 23.5% and 22.9%, respectively, ranking first in the country. The bank's assets are around 26.2 billion euros. Over the years, the bank has won many accolades for its solid performance: it has won the Best Bank Award by Euromoney, the Bank Bank of the Year Award and the Bank of the Year by the Slovak financial magazine TREND. In 2024, it also won the "Smart Bank" award. These achievements reflect its industry leadership in product innovation, market performance, and customer service.

Conclusion: Slovenská Sporiteľňa provides comprehensive financial services based on the background of the Erste Group and the characteristics of the local market. Its extensive network, solid finances, rich product line, and continuous digital innovation have made it a leading player in the Slovak banking industry. In the future, Slovenská Sporiteľňa is expected to continue to strengthen its market position as the regulatory and digitalization wave advances in Europe, providing a safe and efficient service that meets regulatory requirements and meets the needs of diverse customers.