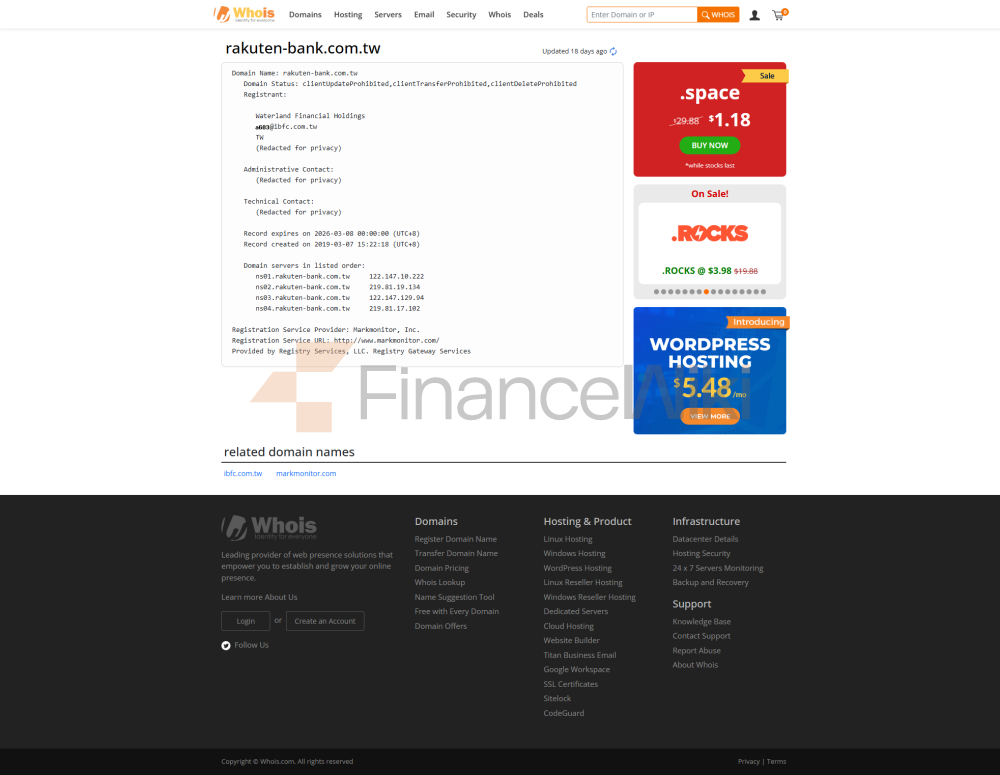

ProfileRakuten International Commercial Bank (Rakuten Bank) is the first online-only bank in Taiwan to open and is jointly owned by KGI Financial Holdings and Rakuten Group The Group holds 51% of the shares. Founded in 2006 and headquartered in Taiwan, the company has a registered capital of NT$4.9 billion. As a bank focused on digital financial services, Rakuten Bank is committed to providing convenient financial solutions to customers through innovative technology.

Regulatory

informationRakuten Bank holds an online-only banking license issued by the Financial Supervisory Commission (FSC) of Taiwan with license number B-FC-1001, which meets the requirements of relevant laws and regulations of Taiwan's financial market. Banks strictly adhere to the regulations of regulators in the course of their operations to ensure compliance and transparency in financial services.

trading productsAs

an online-only bank, Rakuten Bank mainly provides stock trading services. Clients can buy and sell shares through its online platform. In addition, the bank also cooperates with third-party fund platforms to provide fund account opening and trading services.

trading software

Rakuten Bank provides customers with a trading software based on AIoT (Artificial Intelligence Internet of Things) technology, which supports the operation of multiple devices such as mobile phones, tablets and computers. The functions of the trading software include real-time quotes, trading orders, account management, etc.

depositand withdrawal methodsRakuten Bank supports various forms of deposit and withdrawal operations, including e-wallets, third-party payment platforms, and bank transfers. Deposits and withdrawals can be done through its online platform, and clients do not need to visit a physical branch.

customer

supportRakuten Bank provides customers with online customer support and telephone customer support. Customers can contact the customer service team through their official website or mobile app for business consultation and problem resolution services.

core business and

servicesRakuten Bank's core business includes:

online stock trading: providing real-time stock quotes, Trade order placement and account management services.

Fund account services: Cooperate with third-party fund platforms to provide fund account opening and trading services.

Digital account management: Provide customers with personalized account management services through AIoT technology.

scope of service

As a pure online banking, Rakuten Bank provides services throughout Taiwan, without physical branches or ATM networks, and provides financial services entirely through mobile applications and online banking platforms. The bank deeply integrates with the Rakuten ecosystem, including Rakuten Card, Rakuten Ichiba, Rakuten Kobo eBook, and Rakuten Peach Ape Baseball Team, allowing customers to manage accounts and transfer money quickly through the Rakuten app. As of the end of March 2024, Rakuten Bank has 219,000 deposit accounts, with total deposits of approximately NT$22.8 billion (about US$1.081 billion, calculated at an exchange rate of NT$1 to US$0.0474). Through collaboration with regional partners, the bank plans to expand into other Asian markets in the future, such as Thailand and Indonesia, serving both individual and corporate customers.

technology

infrastructureRakuten Bank adopts a trading system based on AIoT (Artificial Intelligence Internet of Things) technology, which provides customers with more intelligent and personalized financial services through artificial intelligence algorithms and IoT devices. The hardware and software of the technical infrastructure meet the highest industry standards to ensure the stability and security of customer transactions.

compliance and risk control

systemRakuten Bank has established a multi-level risk management system, including data monitoring, transaction monitoring and compliance monitoring. Through real-time data analysis and intelligent algorithms, banks are able to quickly identify and respond to potential risks. In terms of compliance management, the bank strictly abides by the relevant regulations of the Financial Supervisory Commission of Taiwan to ensure that all financial services meet the requirements of laws and regulations.

Market Positioning and Competitive

AdvantageRakuten Bank is positioned as a digital financial service provider, and its core competitive advantages are:

Convenience: The pure online banking model allows customers to complete transactions anytime and anywhere.

Partner ecosystem: Cooperate with third-party fund platforms and other institutions to provide customers with more diversified financial services.

Technological innovation: The trading system based on AIoT technology provides customers with intelligent financial services.

Customer Support &

EmpowermentRakuten Bank provides customers with a full range of support services through its online platform and customer service team. In addition, the bank also offers investor education courses to help customers improve their financial knowledge and investment skills.

Social Responsibility and ESG

Rakuten Bank focuses on financial inclusion in terms of social responsibility, lowers the threshold of financial services through digital services, and helps more people enjoy convenient financial services. In terms of ESG (Environmental, Social, Governance), banks actively participate in green finance projects to promote sustainable development.

strategic cooperation

ecosystemRakuten Bank has established strategic partnerships with a number of financial institutions and technology companies. For example, in June 2023, Rakuten Bank partnered with FundRich Securities to launch a one-click fund trading account opening service, becoming the first institution in Taiwan to realize cross-industry cooperation between the banking industry and fund platforms.

Technological

InnovationLotte Bank uses advanced digital technology to partner with Temenos to use a cloud-native core banking platform to ensure fast product launch and efficient scaling. Banks may support AI-driven customer service chatbots, robo-advisors, and open banking APIs to allow third-party fintech applications to interface and enhance service flexibility. Its digital transformation is in line with Taiwan's "Bank 3.0" trend and demonstrates the forward-looking nature of technological innovation.

Customer Service

QualityRakuten Bank provides a 24-hour customer service hotline (+886-2-7718-8866) in Chinese and English, and customers can get help through live chat, Rakuten app, or social media (such as X platform). The data on complaint handling efficiency and user satisfaction are not publicly available, but as a digital bank, it focuses on quick response and user experience. User feedback on the X platform shows that Rakuten Bank has received positive reviews for its ease of service and digital experience. For cross-border customers, the bank provides English support, and may expand more language services in the future.

Security

MeasuresRakuten Bank's deposits are protected by the Central Deposit Insurance Corporation of Taiwan (CDIC) with a maximum protection amount of NT$3 million, covering demand deposits and time deposits. Banks use instant transaction monitoring, multi-factor authentication (including facial recognition), and advanced encryption to prevent fraud. In terms of data security, in accordance with Taiwan's Personal Data Protection Act, no major data leakage incidents have been reported. Although ISO 27001 certification is not explicitly mentioned, as a digital bank, its security standards are in line with industry standards and customer trust is high.

Featured Services and DifferentiationRakuten

Bank has launched innovative services for young digital users, such as the integration of the Rakuten ecosystem and the provision of a spending point program where customers can accumulate points for Rakuten card purchases and use them on Rakuten Market or other services. Banks have also launched co-branded credit cards to offer double benefits to attract spenders. The information on green financial products is not clear, but the bank plans to support ESG investment, which is in line with the trend of sustainable finance. High-net-worth services have not yet been clarified, and customized financial solutions may be provided, and the entry threshold needs to be further confirmed. Rakuten Bank is also partnering with Rakuten Pay and Rakuten Market to expand financial services for life scenarios.

Market Position &

HonorRakuten Bank is one of the three pure online banks in Taiwan, with 219,000 deposit accounts and total deposits of about NT$22.8 billion as of March 2024, making it one of the leaders in Taiwan's digital banking market. Although it has not entered the ranking of global bank assets, it has a significant pioneer position as Taiwan's first pure online bank. Rakuten Bank's business strategy and convenient services have been highly praised by external organizations, but the specific awards have not been disclosed. Its integration with the Rakuten ecosystem and rapid market growth have made it popular among young users.