Bank of Africa Kenya Limited (BOA Kenya) is one of the leading commercial banks in East Africa, with a strong presence in the Kenyan banking industry with its focus on SMEs and individual customers, as well as its innovative financial solutions. As a subsidiary of the BOA Group, BOA Kenya provides diversified financial services to individuals, SMEs and corporate clients through more than 30 branches and advanced digital platforms. Its brand mission is to "connect Africa, empower the future", and promote financial inclusion and economic development in Kenya through flexible product design and regional networks to meet the diverse needs of customers.

Basic Bank Information

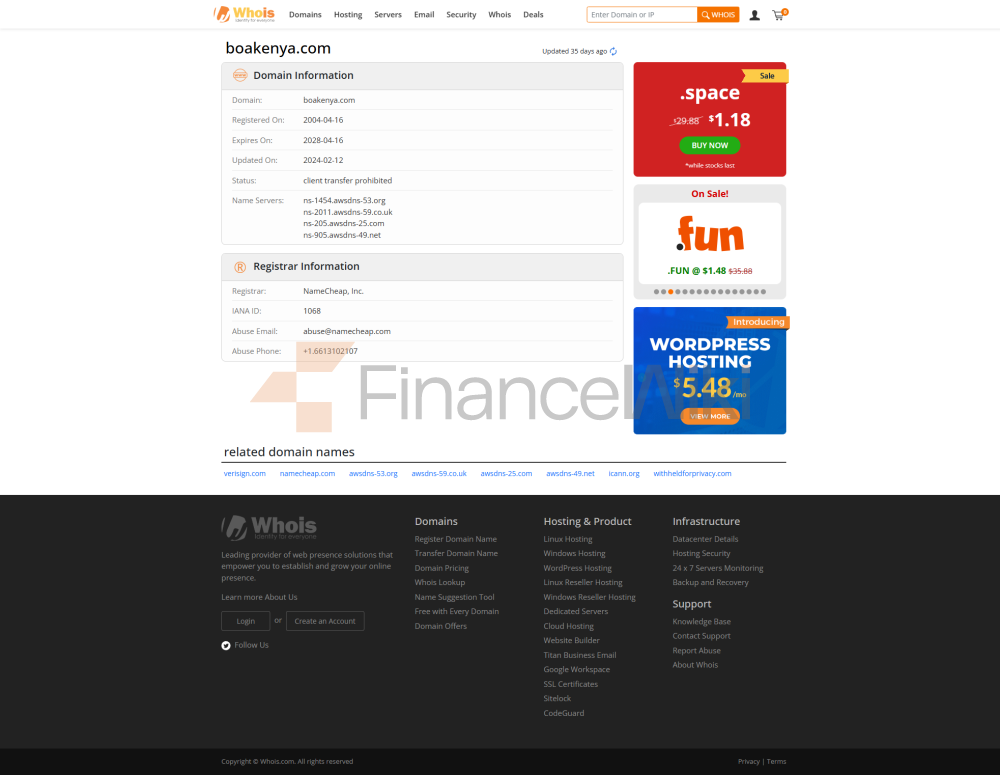

BOA Kenya is a private commercial bank established in 1981 and initially operated as Calyon Bank (formerly Credit Agricole Indosuez) before being acquired by the African Banking Group (BOA Group) and renamed BOA Kenya in April 2004. The head office is located at Bank of Africa House, Karuna Close, Westlands, Nairobi, Kenya 69562-00400. BOA Group holds 89.5% of the shares, with the remainder held by Western and multilateral development institutions and local individuals and entities, and the bank is not listed on the Nairobi Stock Exchange (NSE), reflecting its private nature and focus on regional markets.

BOA Kenya's services cover the whole of Kenya, with more than 30 branches in Nairobi, Mombasa, Eldoret, Kisumu, Nakuru and other places, with a customer base of more than 100,000 (March 2016 data). The bank provides convenient cash withdrawals through the 1Link ATM network, enhancing financial accessibility for customers in urban and remote areas. BOA Kenya is regulated by the Central Bank of Kenya (CBK) and the Financial Sector Conduct Authority (FSCA) oversees market conduct. The bank participates in the Kenya Deposit Insurance Corporation (KDIC) scheme, which protects customer deposits up to Ksh100,000 (approximately US$800). There have been no recent major compliance issues, indicating stable operations.

Financial health

BOA Kenya has a strong financial position with total assets of approximately Ksh43,996 million (approximately US$403.27 million) and shareholders' equity of approximately Ksh4,280 million (approximately US$39.2 million) as at December 31, 2019. As it is a private bank, specific financial indicators such as capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio are not disclosed. According to the Central Bank of Kenya, the capital adequacy ratio of the Kenyan banking sector averaged 19.0% in December 2022, higher than the regulatory minimum requirement of 14.5%, indicating that the industry is generally robust. As a mid-sized bank, BOA Kenya expects its capital adequacy ratio to be close to or above this level. The non-performing loan ratio of Kenya's banking sector rose to 14.5% in 2023 from 13.6% in 2022, and BOA Kenya is likely to face a similar trend due to higher interest rates and public sector debt defaults. In terms of liquidity ratio, the Kenyan banking sector stood at 62.9% in December 2022, well above the regulatory requirement of 20%, and BOA Kenya's liquidity position should be similarly robust.

Deposit & Loan Products

Deposit

CategoryBOA Kenya offers a variety of deposit products to meet the needs of individual and corporate customers:

current accounts: such as Personal Current Account and Business Current Account, which support daily transactions with no interest.

Savings account: Competitive interest rate, the specific interest rate needs to be checked by the bank, suitable for long-term savings.

Fixed Deposits: Terminities from 1 month to 5 years, with interest rates depending on market conditions and the amount of the deposit.

The featured product:D iaspora Account, designed for the Kenyan diaspora and supports multi-currency transactions.

Deposit Products Details Current Account Support daily transactions, no interest, suitable for individuals and businesses Savings Account Competitive interest rate, please inquire for details Fixed Deposit Tenor from 1 month to 5 years, interest rate varies according to amount and term Featured Products Diaspora Account supports multi-currency transactions and is designed for expats

LoansBOA Kenya offers a wide range of loan products covering both personal and business financing needs:

Mortgage: Supports the purchase or construction of a home at a fixed or variable interest rate, subject to bank consultation.

Car Loan: Support the purchase of new or used cars, flexible terms, and the maximum financing amount is based on the customer's credit assessment.

Personal loans: include unsecured personal loans to meet short-term funding needs, with interest rates determined based on market conditions.

SME Loans: Support for enterprise expansion and operation, specific interest rates need to be inquired.

Flexible repayment options: Early repayment, deferred repayment or adjustment of repayment plan are supported, and customers can apply through the online banking platform.

App & Online Banking

mobile app: BOA Mobile supports iOS and Android, and features include balance inquiry, fund transfer, bill payment, and ATM/branch locator. It can be downloaded from [Google Play] ([invalid url, do not cite]) or [App Store].

Online Banking: Available through BOA Internet Banking, it supports account management, transfers, and loan applications.

Quality of customer service

Theservice channel

provides 24/7 telephone support (+254 703 058 120, +254 20 327 5000), email (information@boakenya.com) and social media responses (such as [BOA Kenya Facebook]

Multi-language support

supports English and Kiswahili for both local and cross-border customers.

industry rankingBOA

Kenya ranks 15th out of 42 commercial banks in Kenya (2019 data), with total assets of about Ksh 43.996 billion and a solid market share.

summary

Bank of Africa (Kenya) Limited (BOA Kenya) is a private commercial bank with a focus on small and medium-sized enterprises (SMEs) and individual customers, and occupies a key position in the Kenyan banking industry with its extensive branch network, advanced digital platform and diversified financial products. As a subsidiary of the African Banking Group, BOA Kenya provides seamless financial services to its customers through more than 30 branches and the BOA Mobile app. Its excellence in financial inclusion, customer service, and innovation, supported by robust regulatory compliance and a regional network, makes it a trusted financial partner in Kenya.