and Background

ofBasic Bank InformationJS

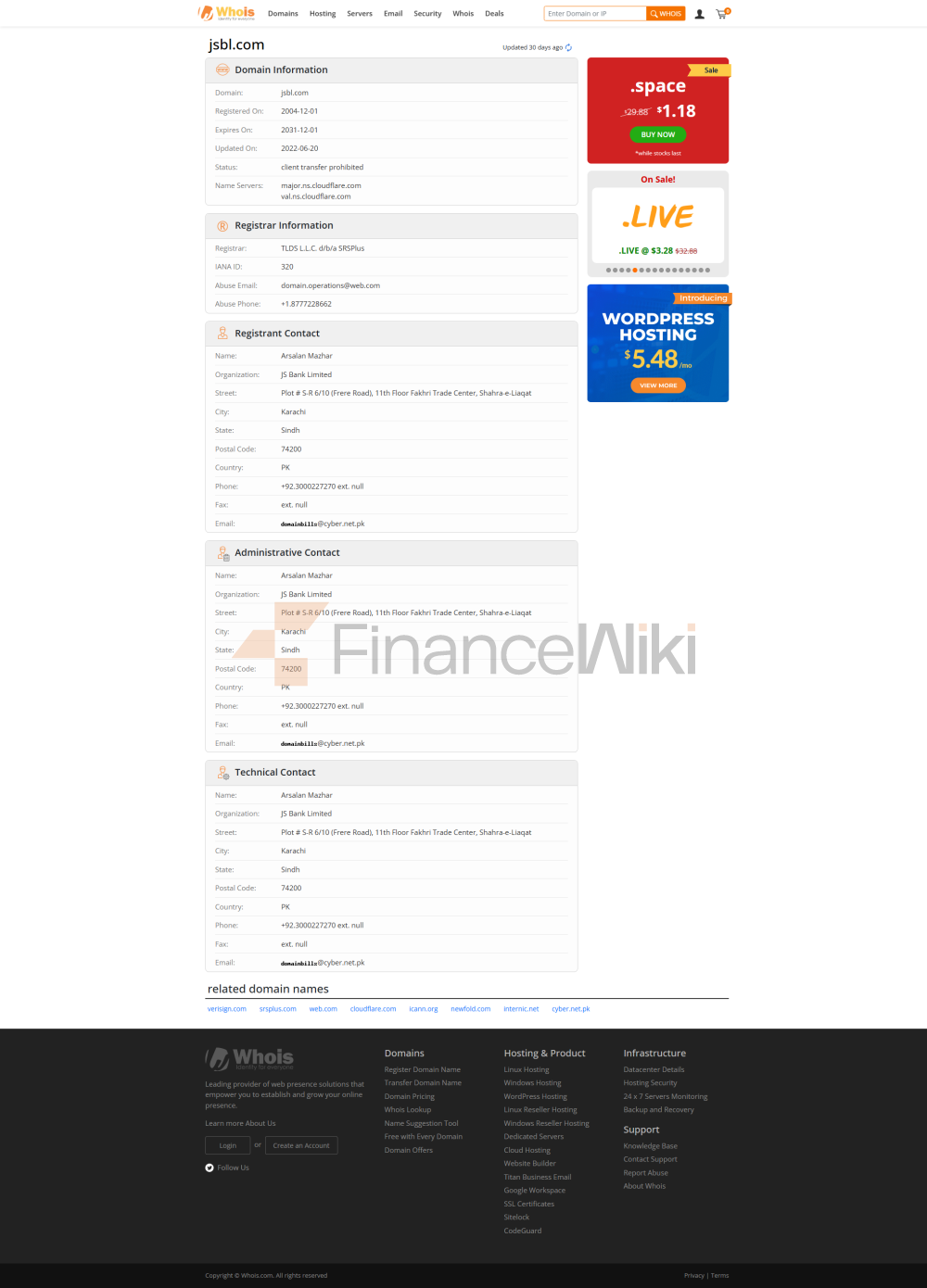

Bank is a Pakistani commercial bank established in 2007 and headquartered in Karachi. Its predecessor was Jahangir Siddiqui Investment Bank Limited (JSIBL), which was established by Jahangir Siddiqui & Co. Limited (JSCL) in 1999 following the acquisition of Citicorp Investment Bank Limited. In 2007, JSIBL merged with American Express Bank Limited (Pakistan operations) to form JS Bank. Currently, JS Bank is a subsidiary of JSCL and is listed on the Pakistan Stock Exchange (PSX).

Scope of

ServicesJS Bank has 293 branches in Pakistan and opened its first international branch in Manama, Bahrain in 2016. The Bank provides a wide range of financial services, including personal banking, corporate banking, investment banking, trade finance and SME services.

Regulation &

ComplianceJS Bank is regulated by the State Bank of Pakistan and participates in the National Deposit Insurance Scheme. In 2019, JS Bank was fined by the State Bank of Pakistan for inadequate customer due diligence and required to strengthen processes such as the identification of politically exposed persons, customer risk assessment, and transaction monitoring within a specific deadline.

Financial HealthAs

of September 2024, JS Bank's total deposits exceeded 500 billion Pakistani rupees (about $1.79 billion). According to the Pakistan Credit Rating Agency (PACRA), JS Bank has a long-term credit rating of "AA-" and a short-term credit rating of "A1+", reflecting its solid financial position and good solvency.

Deposits &

LoansJS

Bank offers a variety of deposit products, including current accounts, savings accounts, time deposits, credit cards and savings cards. In addition, the bank participates in the national Roshan Digital Account program to provide digital account services to Pakistanis abroad.

LoansIn

terms of loans, JS Bank offers a wide range of products such as personal loans, home loans, car loans, and credit loans. The bank has also launched the Zindigi app, which offers microloans, stock trading, and investment tools to meet the financial needs of the younger generation of users.

List of common

feesJS Bank's fee structure includes account management fees, transfer fees, overdraft fees, and ATM interbank withdrawal fees. The specific fees may vary depending on the account type and service content, and customers are advised to consult the relevant fee information in detail before opening an account.

JS Bank has launched a mobile app called Zindigi, designed for millennials and Gen Z users, offering features such as facial recognition, real-time transfers, bill management, and investment tools. The app is among the top five downloads in Pakistan, showing its popularity in digital services.

Technological

InnovationJS Bank actively promotes technological innovation, supports open banking APIs, and works with Mastercard to enhance the payment experience in Karachi's public transportation system. In addition, the bank is also using the Zindigi app to provide financial services to small businesses to facilitate their digital transformation.

Customer Service

QualityJS Bank offers 24/7 customer support services, including channels such as phone support, live chat, and social media response. In addition, the bank also offers multilingual services for cross-border users.

Security

MeasuresFunds SecurityJS

Bank participates in the National Deposit Insurance Program to ensure the safety of customers' deposits. The bank also employs advanced anti-fraud technologies, such as real-time transaction monitoring, to ensure the safety of customer funds.

Data

SecurityJS Bank is committed to protecting the security of customer data and employs a variety of security measures to prevent data leakage. So far, there have been no reports of major data breaches at the bank.

Featured Services & DifferentiationJS

Bank provides customized financial services for young users, such as microloans and investment tools, through the Zindigi app. In addition, the bank is actively involved in national financial inclusion projects, such as the Roshan Digital Account program, to serve Pakistanis abroad.

Market Position & AccoladesJS

Bank has an important position in the banking industry in Pakistan, especially in the digital transformation of the country. Its Zindigi app is hugely popular among younger users, showing its competitive edge in terms of innovation and customer experience.