overview

American Express National Bank (Amex) is the banking division of American Express, Inc., which focuses on online banking services. While known for its credit card business, it has expanded in recent years to position itself as a digital-first financial services provider by expanding its offerings such as savings, checking accounts, and personal loans. This report provides a detailed analysis of its background, services, financial health and characteristics, based on publicly available information as of May 30, 2025.

basic bank information

type: commercial bank

ownership: American Express Express Company) and its parent company is a publicly traded company (NYSE: AXP).

name and background<

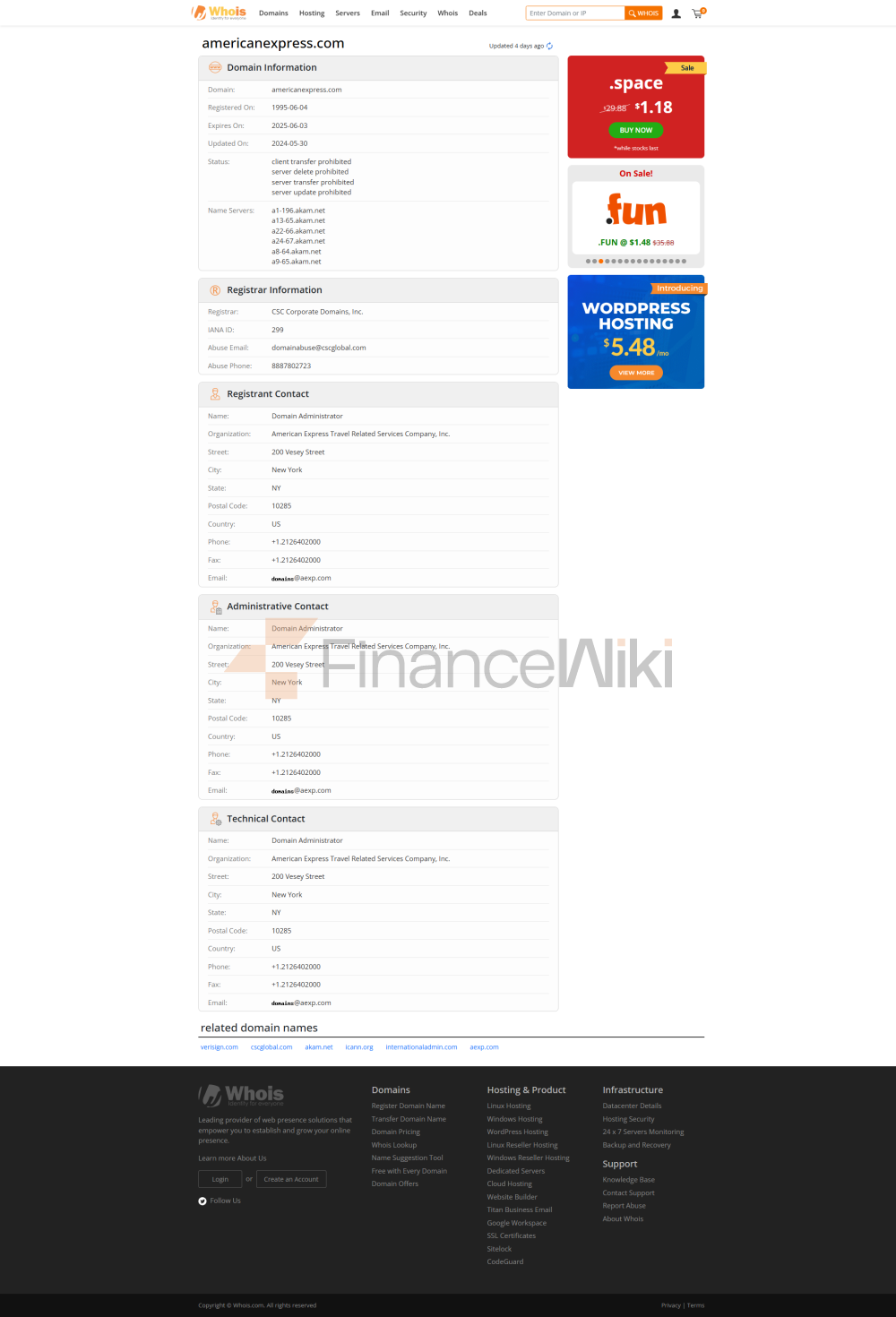

ul style="list-style-type: disc" type="disc">full name: American Express National Bank

Founded: 1850 (American Express), the banking division was officially established

in 1989 headquartered in Salt Lake City, Utah

USA Shareholder Background: The parent company, American Express, is a publicly traded company with the ticker symbol AXP, with a market capitalization of about $191.1 billion in 2023, ranking 77th on the Fortune 500. Shareholders include institutional investors and public shareholders, and there is no state-owned or joint venture background.

History: Started as a courier company in 1850, launched the first charge card in 1958, issued the iconic gold card in 1966, established a banking division in 1989, and launched online banking services in 2009. Expansion of banking products through digital transformation in recent years.

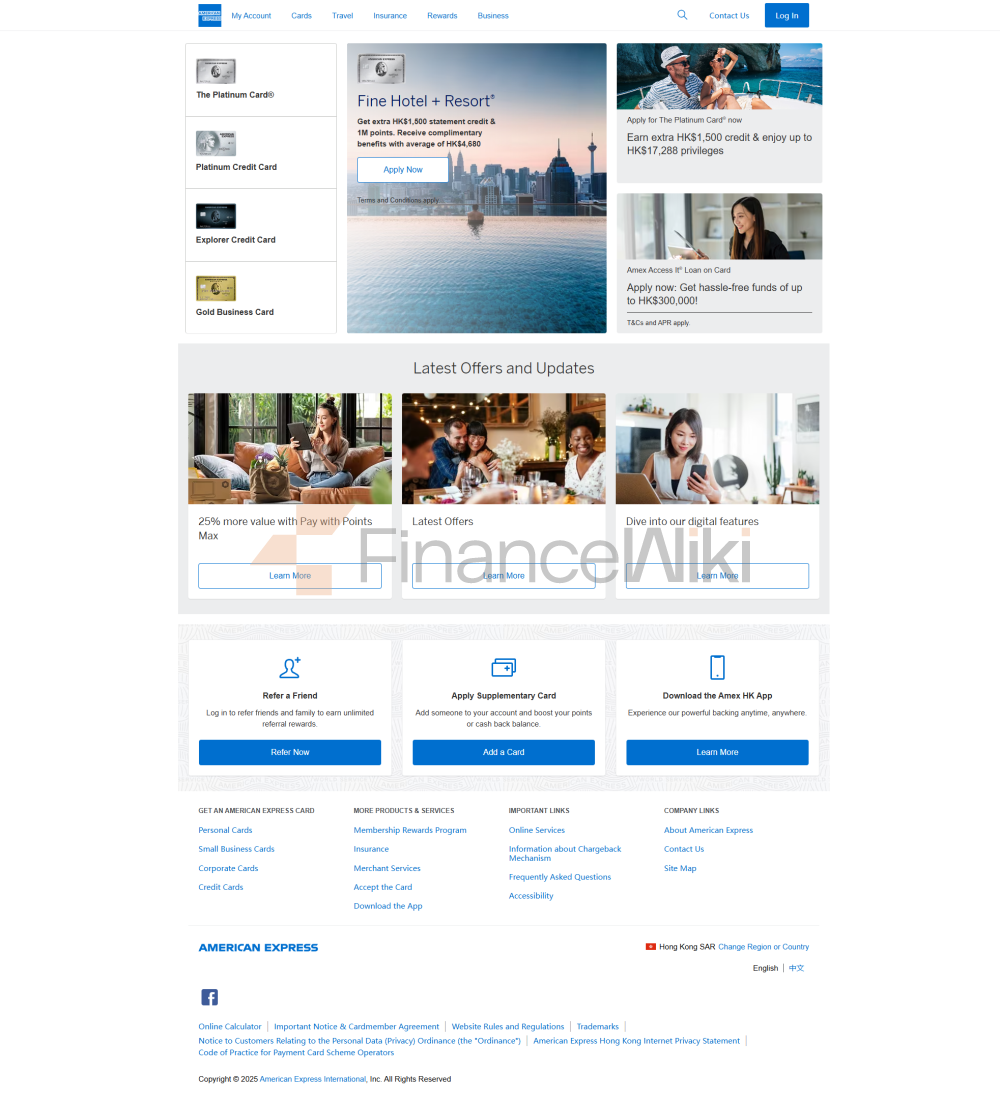

service scope

Coverage area: Mainly serving the U.S. market, credit card business covers more than 130 countries around the world.

Number of offline locations: There is only one headquarters office in Salt Lake City, Utah, and no physical branches for the general public.

ATM distribution: More than 95,000 free ATMs are available across the MoneyPass and Allpoint networks across the United States, with cash withdrawals but not cash deposits.

services and products

personal service:

High Yield Savings Account: Annualized rate of return (APY) of approximately 3.60%, no minimum deposit requirement, no monthly fee, interest calculated daily and paid monthly.

Rewards Chequing Account: Amex Credit Card held for at least 35 days to apply, 1.00% APY, no minimum deposit or monthly fee, and 1 bonus point for every $2 USD spent.

CDs: Tenors from 6 months to 60 months, APY from 3.60% to 4.25%, no minimum deposit required, early withdrawal penalty (90 to 540 days interest).

Personal Loan: $3,500 to $40,000 for credit card holders, debt consolidation, home improvement, etc.

Offering a variety of credit cards, including travel, cashback, reward points, and no annual fee cards.

Investment Management: Invests services through partnership with Vanguard with an annual advisory fee of 0.50%.

Retirement Account: Offers an IRA High Yield Savings Account and IRA Certificates of Deposit with no monthly fees.

enterprise services:

> Business Chequing Account: 1.10% APY (up to $500,000 balance), no monthly fee, and up to 20,000 bonus points.

Corporate credit card and expense management tools: Help businesses manage cash flow and expenses.

Other services: Travel-related services such as travel insurance, hotel and flight reservations, airport lounge access.

regulatory and compliance<

ul style="list-style-type: disc" type="disc">regulated by the Federal Reserve, OCC, and the Federal Deposit Insurance Corporation (FDIC).

Deposit Insurance Program: Accounts are insured by the FDIC up to $250,000 for single accounts and $500,000 for joint accounts.

Recent Compliance Record: In July 2023, American Express paid a $15 million settlement to settle a U.S. Treasury Department investigation into failure to oversee third-party agents and violations of small business customer retention rules. In addition, in 2021, it was investigated for misleading promotions, illegal late fees and other issues.

financial health<

ul style="list-style-type: disc" type="disc">key metrics:

> Capital Adequacy Ratio: American Express National Bank and its subsidiaries are required to maintain minimum capital requirements (CET1 6.5%, Tier 1 8.0%, Total Capital 10.0%, Leverage 5.0%) in accordance with Basel III standards. The specific data is not publicly available, but it is subject to federal regulatory requirements.

Non-performing loan ratio: No specific data disclosed, net income of $8.4 billion and net profit margin of 16.7% in 2023 indicate overall financial stability.

Liquidity Coverage Ratio: No specific data is disclosed, but as a member of the FDIC, it is subject to strict liquidity requirements.

with total assets of $270 billion in 2023, ranking 16th largest bank in the United States, with a strong financial position supported by the parent company.

digital service experience<

ul style="list-style-type: disc" type="disc">APP & BANKING:

> User Rating: 2025 J.D. In the Power study, the Amex mobile app and website ranked first in credit card satisfaction, with App Store and Google Play ratings not specifically disclosed, but users reported an intuitive and easy-to-use interface.

core features: support for real-time transfers, bill management, mobile check deposits, digital wallets (such as Apple Pay). Face recognition login is not supported, but two-factor authentication is provided.

technical innovation:

AI customer service: An AI-powered chatbot is not explicitly available, but it supports 24/7 live chat and phone service.

robo-advisor: provides investment advice through the INVEST service in partnership with Vanguard.

Open Banking API: There is no clear evidence to support an Open Banking API.

Other: Supports Zelle real-time transfers, real-time transaction alerts, and fraud monitoring.

customer service<

ul style="list-style-type: disc" type="disc">channels: 24/7 phone support (savings account: 800-446-6307, checking account: 877-221-2639), live chat (24/7 for some products), email support.

review: J.D. In Power's 2024 Direct Banking Satisfaction Study, customer satisfaction was below average, but its credit card-related services were highly rated.

security measures<

ul style="list-style-type: disc" type="disc">technical security: provide two-factor authentication, real-time transaction alerts, and a fraud monitoring center to ensure the security of online transactions.

Deposit security: FDIC covered deposit accounts up to $250,000 per person.

Zero Liability Fraud Protection: Waiver of liability for promptly reported unauthorized transactions (debit card).

Other: Protects user data with encryption and security protocols, and has a dedicated security center to deal with fraud.

featured services and differentiations<

ul style="list-style-type: disc" type="disc">Rewards points system: Loyalty points can be accumulated on chequing account debit card purchases, which can be redeemed for travel, gift cards or deposits, enhancing user stickiness.

high-end credit cards: such as platinum cards, which provide high-end services such as airport lounge access and travel insurance, suitable for high-end customers.

No minimum deposit requirement: There are no minimum deposits or monthly fees for savings, chequing, and certificate of deposit accounts, lowering the barrier to entry.

Global Brand Influence: The credit card network covers more than 130 countries, and is highly accepted by merchants, suitable for travel and international spending.

Social responsibility: Invest $500 million in 2022 to support vulnerable populations and commit to achieving net-zero emissions by 2035.

conclusion

American Express National Bank as an online bank that has a presence in the digital banking space with high-yield savings accounts, no minimum deposit requirements, and a robust credit card ecosystem. Its services are suitable for customers who prefer online banking and are looking for high yields and reward points. Despite the lack of brick-and-mortar branches and some traditional banking services, its digital experience and brand strength set it apart from the competition. Financial health is backed by the parent company and has strong regulatory compliance, but be aware of its limited product range and credit card holding requirements for checking accounts.