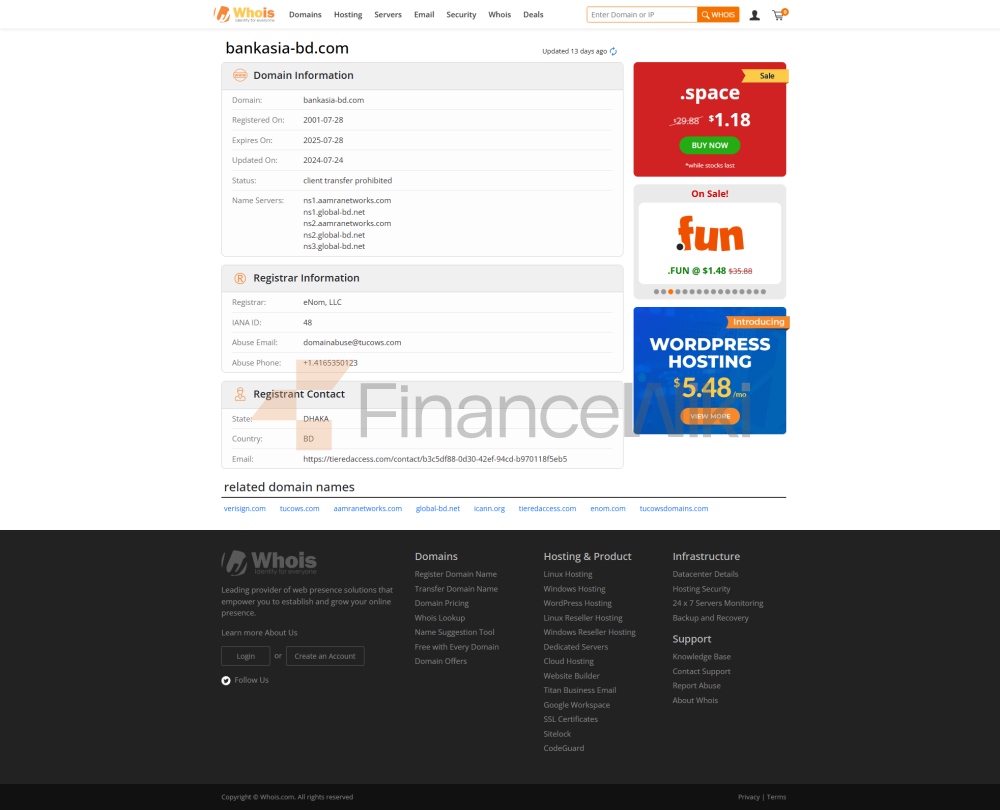

Name & BackgroundBank

Asia PLC (Bank of Asia) is a private commercial bank established in 1999 and headquartered in Dhaka, the capital of Bangladesh. The bank is held by a number of institutional and individual investors, and its shareholders are diverse, but mainly local private capital. Listed on the Bangladesh Stock Exchange, Bank of Asia's transparent shareholder structure and publicly listed status has brought greater market recognition to the bank. Since its inception, Bank of Asia has been committed to providing comprehensive financial services to individuals, corporations and government clients, with a particular focus on SME financing and consumer finance.

Scope of

ServicesBank Asia mainly serves the Bangladesh market, but has also established a number of strategic partnerships internationally, especially in South Asia. It has more than 150 branches in Bangladesh, covering major cities and some townships, providing a wide range of banking services. In addition, Bank of Asia has more than 200 ATMs throughout the country, ensuring that customers can easily withdraw money and other self-service services from anywhere. The bank relies on its strong network to maintain a stable presence in the domestic market.

Regulation & ComplianceAs

a bank in Bangladesh, Bank Asia is regulated by the Central Bank of Bangladesh (BB) and strictly adheres to the regulations of the Bangladesh Securities and Exchange Commission (SEC). In addition, the bank participates in Bangladesh's deposit insurance scheme, which protects customer deposits up to a certain limit. In recent years, the bank has maintained a good compliance record with no major breaches. Bank of Asia has earned regulatory recognition through ongoing internal reviews to enhance anti-money laundering, anti-fraud and financial transparency to ensure compliance with regulatory requirements.

Financial HealthBank

Asia's capital adequacy ratio has been steadily maintained at over 14%, meeting Bangladeshi regulators' capital requirements and demonstrating its strong capital resilience. The bank's non-performing loan ratio is kept at a low level (about 3%), indicating its prudent attitude in loan approval and risk control. The bank's liquidity coverage ratio is also good, ensuring that the bank can cope with sudden economic fluctuations and market risks, and effectively ensuring the liquidity and safety of customer funds.

Deposit & Loan

ProductsBank Asia offers a range of deposit products, including demand deposits, time deposits and specialty high-yield savings accounts. Demand deposits have moderate interest rates, while time deposits offer flexible maturities and different interest rate options. In particular, large certificates of deposit (CDs) provide competitive yields for large depositors. Banks have also launched high-yield savings accounts to meet the needs of customers who want to earn higher returns on their deposits.

In terms of loan products, Bank Asia offers a wide range of loan solutions, including home loans, car loans and personal lines of credit. Mortgages have relatively low interest rates and flexible repayment options, so customers can choose the right repayment method according to their financial situation. The approval of car loans and personal credit loans is also relatively convenient, the threshold is moderate, and the loan speed is relatively fast. The bank also provides a variety of consumer loans to support customers' financing needs in their daily consumption.

List of Common FeesBank

Asia's account management fees are relatively reasonable and vary for different account types. There is no monthly fee for a typical savings account, while an annual fee may be charged for a premium account. In terms of transfer fees, banks charge lower fees for domestic transfers, but higher fees for cross-border transfers, and the specific fees can be further understood through bank channels. In addition, overdraft fees and ATM withdrawal fees will also vary according to different services, so customers should pay attention to the relevant fee descriptions provided by the bank before using the service.

Digital Service ExperienceBank

Asia continues to innovate in digital transformation, with its mobile banking app and online banking platform both receiving high ratings from users (nearly 4.5 stars on Google Play and App Store). Core features include real-time transfers, bill payments, account management, and integration of investment tools, enabling customers to handle their day-to-day financial affairs quickly and conveniently. The bank is also actively introducing AI customer service technology to optimize the customer experience and provide round-the-clock online services. In addition, the bank also has robo-advisory services, which can provide personalized financial advice based on customers' investment preferences and risk tolerance.

Customer Service QualityBank

Asia offers 24/7 phone support, live chat, and social media responsiveness to ensure that customers can get help at any time. The customer service team is efficient and professional, complaints are handled quickly, and customer satisfaction is high. The bank also provides support services in multiple languages, especially in Bangladesh, a multilingual country, which is a great convenience for cross-border customers who do not understand Bengali.

Safety and Security MeasuresBank

Asia attaches great importance to the safety of funds, and all customer deposits are protected under Bangladesh's deposit insurance scheme. The bank has also adopted advanced anti-fraud technologies, including real-time transaction monitoring, intelligent risk control systems, etc., to protect customer funds from being compromised. In terms of data security, the bank is ISO 27001 certified to ensure that its information security management meets international standards. So far, the bank has not had a large-scale data breach, ensuring the security of customers' personal information.

Featured Services & DifferentiationBank

Asia excels in the innovation of financial products and services, especially in market segments. The bank offers fee-free student accounts for students to help young customers manage their finances conveniently. In addition, the bank has also launched a wealth management product specifically for elderly customers, providing personalized pension planning and financial advice. To meet the needs of environmental investors, Bank Asia has also launched green financial products to support investors' investment choices in environmental, social and governance (ESG) aspects.

Market Position & AccoladesBank

Asia is a leading player in the banking sector in Bangladesh with a high market share. The bank's assets have grown steadily and rank among the top domestic banks in Bangladesh. In recent years, Bank Asia has received industry recognition in several areas, including the "Best Retail Bank" and "Best Digital Bank". These awards reflect the bank's innovative achievements in digital transformation and customer service, further cementing its position in the industry.