🏦 Basic information

of the bank Nature of the bank: CIMB Niaga is a commercial bank that belongs to the second largest private bank in Indonesia.

Founded: September 26, 1955, originally known as Bank Niaga.

Headquarters location: Jl. Jend., South Jakarta, Indonesia Sudirman Kav. 58, Jakarta 12190, the name of the headquarters building is Graha CIMB Niaga.

Shareholder Background: CIMB Niaga is a subsidiary of CIMB Group Holdings Berhad, Malaysia, and the controlling shareholder is CIMB Group.

Listing: Listed on the Indonesia Stock Exchange (IDX) since November 29, 1989 under the ticker symbol BNGA.

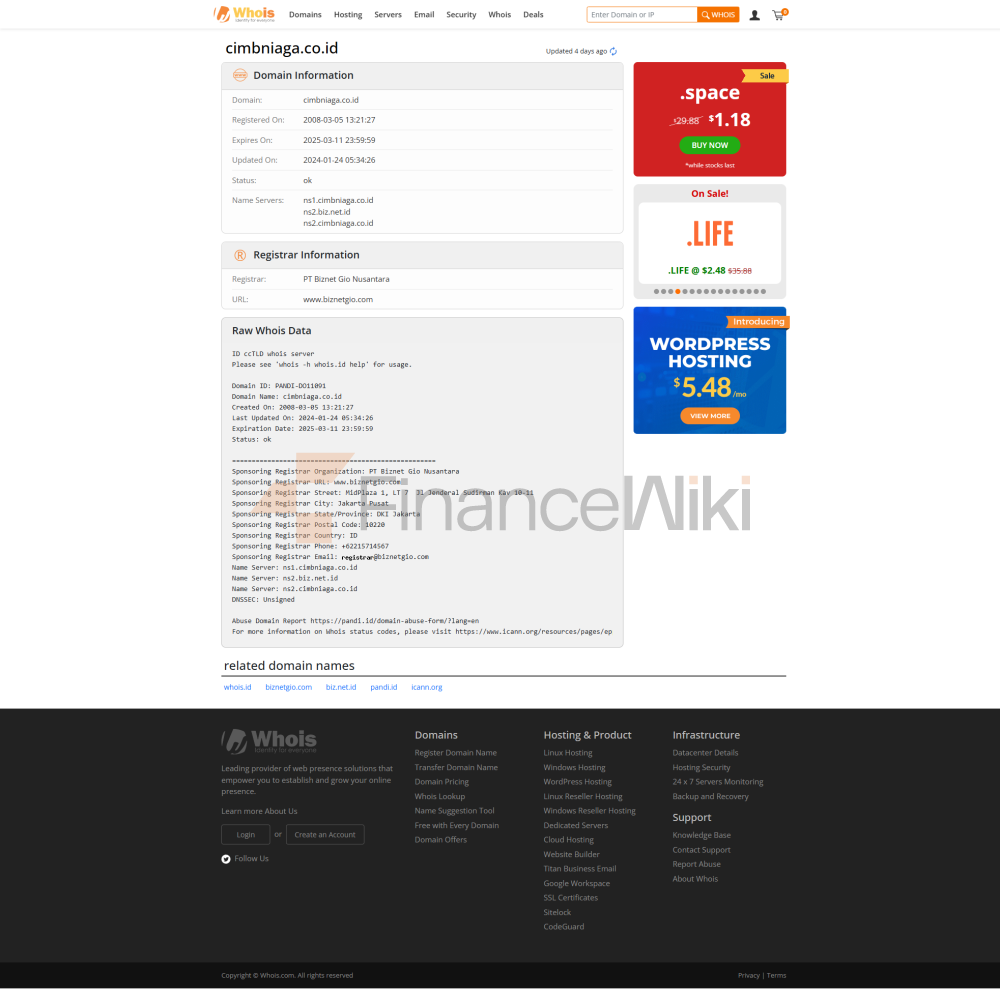

Official website: https://www.cimbniaga.co.id/

🌍 Service Scope and Network Layout

Coverage: Mainly serving the Indonesian market, but also providing services in Malaysia, Singapore, Thailand and Cambodia through the CIMB Group's regional network.

Number of offline outlets: CIMB Niaga has an extensive network of branches in Indonesia, the exact number of which can be found on its official website.

ATM distribution: Customers can withdraw money for free at CIMB Niaga's own ATMs, ATM Bersama, the Prima network, and CIMB Group's ATMs in Southeast Asia.

🛡️ Regulatory & Compliance

Regulatory Authority: Indonesian Financial Services Authority (OJK, Otoritas Jasa Keuangan).

Regulatory Effective Date: OJK was established in 2011 to succeed the previous financial regulator.

Regulatory Enquiry Method: Relevant regulatory information can be obtained through the OJK official website https://www.ojk.go.id/ search for "PT Bank CIMB Niaga Tbk".

Deposit Insurance Scheme: CIMB Niaga is a member bank of the Indonesia Deposit Insurance Corporation (LPS) and customer deposits are protected.

Recent Compliance Records: To date, no major compliance issues have been identified.

>

📊 financial health

Capital Adequacy Ratio (CAR): CIMB Niaga's capital adequacy ratio was 23.3% at the end of 2024, above regulatory requirements, demonstrating a solid capital position.

Non-Performing Loan Ratio (NPL): The NPL ratio will be 1.8% in 2024, an improvement from 2.0% in 2023, reflecting good asset quality.

Liquidity Coverage Ratio (LCR): The liquidity coverage ratio for December 2024 is 133%, well above the regulatory requirement of 100%, indicating sufficient liquidity.

💰 Deposit and loan products

Deposit products:

demand deposits: A variety of current accounts are available, some such as On Account offer up to 5% APR and no transfer and management fees.

Fixed Deposits: Fixed deposits opened through CIMB Clicks with a minimum deposit amount of IDR 8 million and an interest rate of up to 5.75% p.a.

Loans:

Mortgage (KPR): A variety of interest rate options are available, such as a fixed interest rate of 7.50% (1-5 years), followed by a variable interest rate of 13.00%.

Auto Loans: Newly financed through CIMB Niaga Auto Finance totaled IDR 9.96 trillion in 2024 with a non-executive financing ratio of 1.03 percent.

Personal Line of Credit: Offers flexible repayment options, with specific interest rates and conditions available on the official website.

💸 List of common fees

Account Management Fee:

- Current account: Some accounts are exempt from monthly fees, such as On Account;

Other accounts may be charged a monthly fee, which can be found on the official website.

Transfer fees:

Domestic transfers: Cross-border transfers are usually free for transfers made through CIMB Clicks and Go Mobile

: The fee depends on the destination and the amount, and the specific fee can be found on the official website.

ATM withdrawal fee:

Own ATM: Free.

Partner network ATMs: ATMs such as ATMs Bersama, Prima networks are usually free.

International ATMs: Fees may apply for the Cirrus/VisaPlus network, which can be found on the official website.

Other fees:

account closure fee: Fees may apply, the exact amount can be found on the official website.

Minimum Balance Limit: Some accounts have a minimum balance requirement that may be charged if it is not met.

📱 Digital Service Experience

Mobile App (OCTO Mobile):

User Rating: 4.9 on the App Store (over 130,000 reviews), on Google Play It has a rating of 4.1 (over 330,000 reviews).

Core functions: support face recognition login, real-time transfer, bill management, investment tool integration, etc.

Technological innovation: Provide AI customer service, robo-advisor, open banking API support, and other functions.

🤝 Quality of

Customer Service

Service Channels:

Telephone support: 24/7 customer service hotline available.

Live chat: Live chat support is available through the official website and mobile app.

Social Media: Customer support is available on multiple social media platforms with a fast response time.

Complaint Handling:

Processing time: Commitment to resolve customer complaints within 20 working days and provide a final response.

Customer satisfaction: Continuously improve customer service and enhance user satisfaction.

Multi-language support: Available in Bahasa Indonesia and English, it is convenient for cross-border users.

🔐 security measures

Security of Funds:

Deposit Insurance: As a member bank of the Indonesia Deposit Insurance Corporation (LPS), customer deposits are protected.

Anti-fraud technology: Adopt real-time transaction monitoring and multi-factor authentication technologies to ensure the safety of customer funds.

Data security:

certification standard: ISO 27001 and other international information security management system certifications.

Data protection: Strictly comply with data protection regulations to ensure the security of customer information.

🌟 Featured Services & Differentiation

Segment Services:

student accounts: Fee-free student accounts are available to support day-to-day banking needs.

Exclusive financial management for the elderly: Provide financial products and services suitable for elderly customers.

Green financial products: Launched ESG investment products to support sustainable development.

High-net-worth services:

Private banking: Provide customized financial solutions and exclusive services for high-net-worth clients.

🏆 Market Position & Accolades

Industry Rankings: CIMB Niaga is the second largest private bank in Indonesia with a leading position in terms of asset size and client base.

Awards and honors:

won a number of industry awards such as "Derivatives House of the Year, Indonesia", reflecting its outstanding performance in financial innovation and service quality.