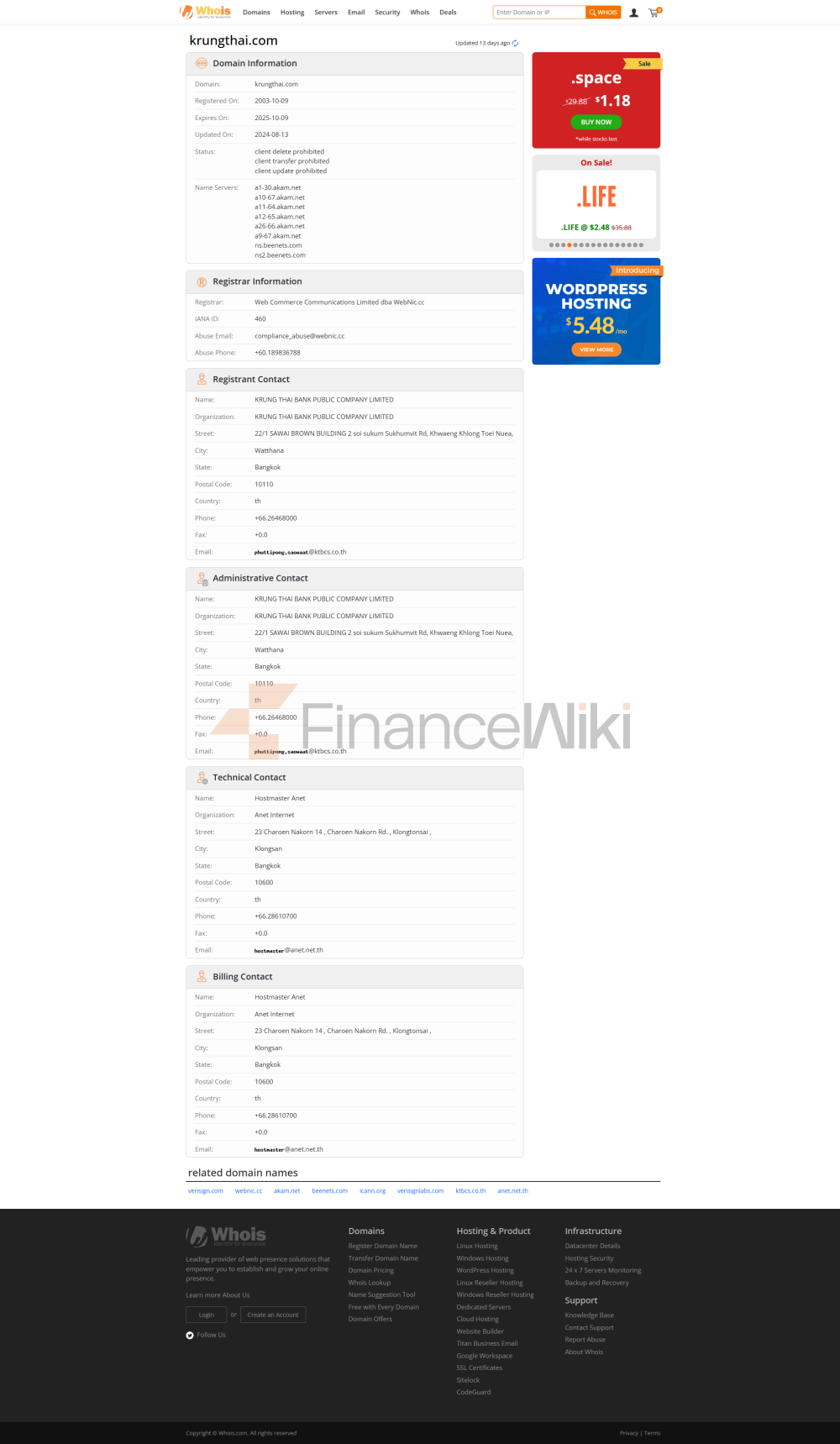

Bank Basic Information

Name and

BackgroundKrungthai Bank (Chinese: Thai Krungthai Bank) is one of the largest state-owned commercial banks in Thailand, established in 1966, and the bank is headquartered in Bangkok, Thailand. As a state-owned bank, Krungthai Bank's shareholder background is dominated by the Thai government, meaning that its operations are strictly regulated by the government. The bank is not publicly listed, and has maintained strong government support and influence.

Scope of

ServicesKrungthai Bank has a large service network in Thailand, covering major cities and remote areas across the country. Its offline outlets are all over Thailand, including hundreds of branches and ATM points, and the service system is complete, especially in the traditional banking business. Although the global presence of banks is relatively small, there is a certain amount of business expansion in the region, such as Southeast Asian markets, especially in the areas of cross-border remittance and corporate finance.

Regulation &

ComplianceKrungthai Bank is regulated by the Bank of Thailand and follows the laws and regulations of Thai financial services. The bank has joined Thailand's deposit insurance program, which provides depositors with a certain amount of deposit protection. Recently, Krungthai Bank has a good compliance record, with no major breaches, and has maintained a high level of compliance.

Krungthai Bank's capital adequacy ratio, a key indicator of financial health, remains at a high level in the industry, indicating that it has a strong capital buffer. Its non-performing loan ratio remained in a low range, reflecting its good risk control capabilities. The liquidity coverage ratio is also in a good state, which can cope with market liquidity risks and maintain stable operations.

Deposits &

LoansDepositsKrungthai Bank offers a wide range of deposit products, including demand and time deposits. The interest rate on fixed deposits is competitive and suitable for different customer groups. The bank has also launched high-yield savings accounts, which have attracted a large number of depositing customers. In addition, Large Certificates of Deposit (CDs) are also one of the bank's featured products, offering higher interest returns to meet the needs of large depositors.

LoansIn

terms of loan products, Krungthai Bank provides a variety of options for individual customers, including home loans, car loans and personal lines of credit. Loan interest rates vary depending on the customer's credit profile, and there are often flexible repayment options that can be arranged according to the customer's financial situation. Especially in the field of home loans and car loans, Krungthai Bank offers low thresholds and competitive interest rates.

List of Common

FeesKrungthai Bank's account management fees vary depending on the account type, and some accounts are subject to annual or monthly fees. In terms of transfer fees, domestic transfers are relatively low, while cross-border transfers are subject to a certain fee. Overdraft fees and ATM inter-bank withdrawal fees are also within reasonable ranges, and banks have transparently disclosed hidden fees to avoid unnecessary additional fees for customers due to minimum balance restrictions and other reasons.

digital service experience

app and

Krungthai Bank's official app and online banking system have high ratings, and the user experience is good. Core features include facial recognition login, real-time money transfers, bill management, and integration with multiple investment tools. The bank has also made positive technological innovations in digitalization, such as the introduction of AI customer service and robo-advisory functions to improve customer service efficiency and optimize financial advice. Open banking API support also gives Krungthai Bank a competitive edge in third-party collaboration and technology development.

Technological innovationThe

bank has outstanding performance in technological innovation, especially in the application of AI intelligent customer service and robo-advisory, which has further improved the digital service experience. Banks also have high capabilities in supporting open banking APIs, which promotes cross-platform financial service cooperation.

Service Quality

Service

ChannelKrungthai Bank offers 24/7 phone support, live chat, and social media platform services to ensure that customers can get help at any time. It is fast to respond and can effectively solve customer problems, especially when dealing with urgent matters.

Complaint

HandlingKrungthai Bank is more efficient in handling complaints, with a lower complaint rate, a shorter average resolution time, and a higher level of customer satisfaction. The process for solving problems is clear, and customers are able to get feedback and solutions within a reasonable time.

Multi-language supportTo

better serve cross-border users, Krungthai Bank provides multi-language support, including English and other commonly used languages in Southeast Asia, to ensure that international customers can bank smoothly.

Security

MeasuresFunds SafetyKrungthai Bank attaches great importance to the safety of funds and provides deposit insurance to ensure the safety of depositors. At the same time, the bank employs advanced anti-fraud technologies, including real-time transaction monitoring and an automated alert system for high-risk transactions, to ensure the safety of customer funds.

The Data Security

Bank is ISO 27001 certified in terms of data security, ensuring that its information management system complies with international standards. To date, there have been no major data breaches at Krungthai Bank, and its information protection measures have a good reputation in the industry.

Featured Services & Differentiated

Market

SegmentsKrungthai Bank provides differentiated services for specific groups of people, such as free handling fees for student accounts, etc., to attract younger groups. In addition, the bank has also launched exclusive wealth management services for the elderly, paying attention to the special needs of elderly customers.

High Net Worth ServicesFor

high-net-worth clients, Krungthai Bank provides private banking services with a high entry barrier and customized financial solutions to meet the diverse needs of customers for asset management and value-added.

Market Position &

HonorsIndustry

RankingsKrungthai Bank ranks high in the world and is one of the top 5 banks in Thailand. It also has a presence in Southeast Asia's banking sector based on its asset size and market influence.