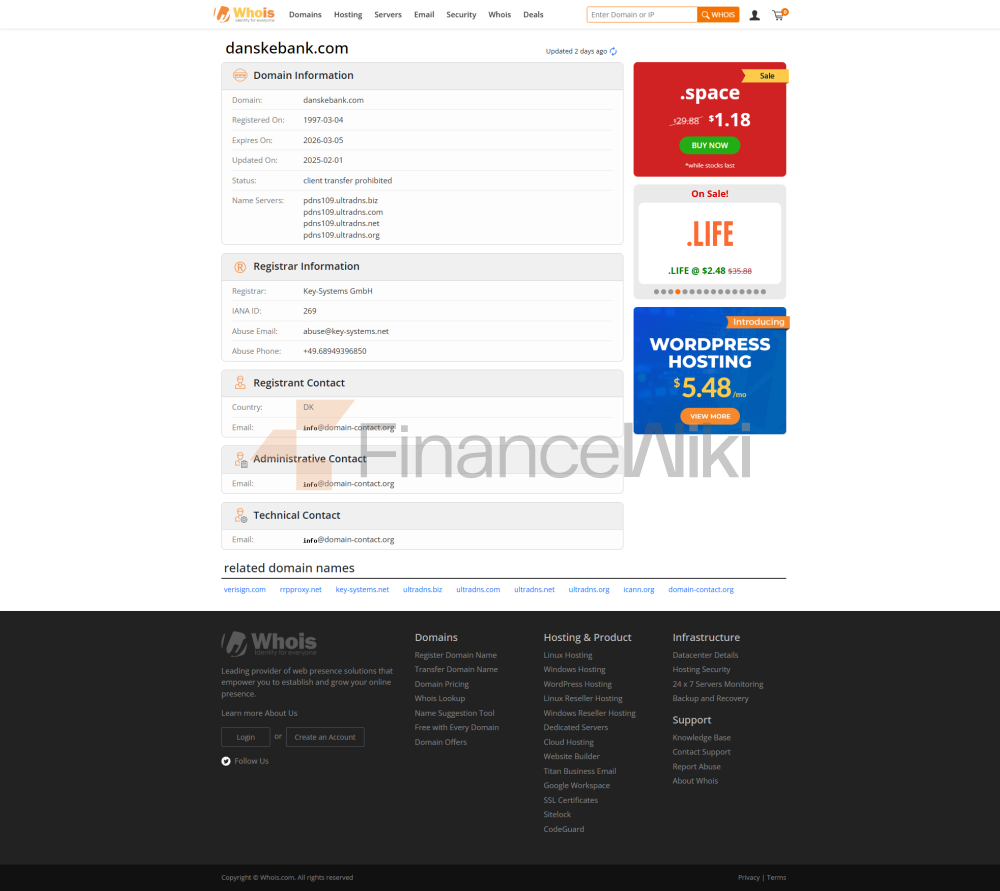

Basic Bank Information

Danske Bank is a multinational commercial bank, the full name of Danske Bank A/S, founded on October 5, 1871, headquartered in Bernstorffsgade, Copenhagen, Denmark (relocated here from Holmens Kanal in 2024). Originally known as Den Danske Landmandsbank, Hypothek- og Vexelbank i Kjøbenhavn ("Danish Farmers' Bank, Mortgage and Foreign Exchange Bank"), the bank mainly provided financial services to Danish farmers. In 1976, it was renamed Den Danske Bank, and in 2000 it adopted its current name Danske Bank. Through numerous mergers and acquisitions, the bank has grown to become a major financial services provider in the Nordic region.

Shareholder Background:D anske Bank is a publicly traded company whose shares are listed on the Copenhagen Stock Exchange (symbol: DANSKE). The largest shareholder is A.P. Moller Holding, with a 21% stake, which is controlled by the Maersk family. Other shareholders include Danish pension funds, insurance companies and institutional investors, with a stable shareholding structure that supports the bank's long-term strategy.

Scope of services:D anske Bank mainly serves the Nordic region (Denmark, Finland, Sweden, Norway) and Northern Ireland in the United Kingdom, with about 250 branches (as of earlier data, the number of branches in Northern Ireland will decrease to 24 in 2024). The distribution is as follows:

Denmark: As the largest bank, it has about 24% of the loan market share and 27% of the deposit market share.

Finland: The third largest bank serving about 1 million individual customers and 90,000 corporate customers, with about 50 branches.

Sweden: The fifth-largest bank with around 40 branches and 6 financial centers.

Norway: Focused on corporate and institutional clients, with 41 branches.

Northern Ireland: One of the major retail banks with 24 branches and 4 financial centres (as of June 2024).

The number of ATMs is not clearly disclosed, but they are widely distributed in the service area, making it convenient for customers to withdraw and make deposits. Banks also offer services through digital channels, such as mobile banking apps and online banking, to reach customers around the world.

Regulatory & Compliance:D anske Bank is regulated by the Danish Financial Supervisory Authority (Finanstilsynet) and complies with regulations in other countries and regions in which it operates, such as the Financial Conduct Authority (FCA) in the United Kingdom. The bank participates in the guarantee fund of the Danish Banking Association and the deposit insurance amount is up to DKK 100,000 (approx. EUR 13,400) per person per bank. In the UK, banks are protected by the Financial Services Compensation Scheme (FSCS) with a maximum compensation of £85,000 (approximately €100,000).

In terms of compliance records, Danske Bank has been the subject of controversy over a money laundering scandal involving 800 billion euros of suspicious transactions between 2007 and 2015 in Estonian branches. The bank has reached settlements with US and Danish authorities in 2022, paying hefty fines and strengthening anti-money laundering (AML) and customer due diligence (KYC) measures. No new significant compliance issues have been reported recently, indicating an improvement in its compliance system.

Financial health

Danske Bank's financial health is key to assessing its stability and ability to grow over the long term. Here are the key financial indicators for 2024:

Capital adequacy ratio: Core Tier 1 capital adequacy ratio (CET1) was 17.8%, down slightly from 18.8% in 2023, but still above regulatory requirements, indicating that banks have sufficient capital to address potential risks.

Non-performing loan ratio: The exact data is not disclosed, but the loan loss allowance for 2024 is negative DKK 543 million (approx. EUR 73 million), reflecting good credit quality and a low non-performing loan ratio.

Liquidity Coverage Ratio: Not disclosed in public information, but banks claim to have a strong liquidity base to meet short-term debt needs.

In 2024, the bank achieved a net profit of DKK 2.36 billion (approximately EUR 317 million) and a net profit attributable to shareholders of DKK 2.13 billion (EUR 286 million). Total revenue decreased slightly due to lower market interest rates, but the cost-to-income ratio improved further from 48.5% in 2023 due to higher fee income and cost containment. In 2024, the bank launched a DKK 5 billion share buyback program, showing confidence in its capital strength.

Quick Judgment:D anske Bank is in a solid financial position with good capital adequacy and credit quality, but the liquidity coverage ratio needs to be further confirmed. The specter of money laundering scandals may affect investor confidence, but banks' profitability and cost management show high operational efficiency.

Deposit & Loan Products

Danske Bank offers a wide range of deposit and loan products to meet the financial needs of individual and corporate customers.

Deposits:

demand deposits: such as Danske Indlån, suitable for everyday trading, with low interest rates (depending on the account balance and whether it is a NemKonto account) and allowing customers to access funds at any time.

Fixed Deposits: Locks in funds for a period of time (e.g. 3 months, 6 months, 1 year), offers higher interest rates, and may be subject to penalties for early withdrawal.

High-yield savings accounts: Danske Toprente, such as Danske Toprente, offer higher interest rates than demand deposits, but may have minimum balances or withdrawal restrictions.

Large Certificate of Deposit (CD): A deposit product with a fixed term and interest rate, suitable for long-term savings.

Cash ISA (UK): Tax-Free Savings Account, suitable for UK residents, interest rates subject to market conditions.

Kids and teen accounts, such as Danske Piglet, encourage savings and offer interest rewards.

Loans:

Personal loans: For consumer needs (e.g. shopping, travel), the annualized interest rate (APR) is determined based on credit evaluation, and repayment is made from a Danske Bank account.

Car loan: used to buy a car, with a fixed or variable interest rate and a flexible repayment period (e.g. 3-5 years).

Mortgages: Offer the option of a fixed, variable or mixed rate with a fixed or variable interest rate option for the specific interest rate.

Graduate Loans: Designed for higher education costs, with preferential interest rates and flexible repayment options.

Green loans, such as energy efficiency loans, are designed for Danske mortgage customers to support sustainable projects.

Overdraft Facility: Provides flexible short-term funding support with low interest rates.

Technological innovation:

Artificial intelligence: Launched DanskeGPT, used by 74% of employees, optimizing internal tasks and customer service.

Open Banking API: Support third-party integrations to expand financial services.

Biometric login: Supports face recognition and fingerprint login to improve security and convenience.

Apple Pay/Google Pay: Provides fast and secure payment methods.

The bank has also developed the "Become a customer" app to streamline the onboarding process for new customers, and plans to launch a new version of the District platform for small businesses in 2025.

Quality of customer service

Danske Bank provides multi-channel customer service to ensure that customers receive support at all times:

24/7 telephone support: Danish customers can call +45 70 10 17 08, UK customers call 0345 600 2882, emergency (such as card loss) round-the-clock response.

Live chat: Secure messaging via eBanking and mobile apps.

Social Media Response: Respond quickly to customer inquiries via X (Danske Bank X).

Branch services: Approximately 250 branches provide face-to-face support.

Complaint Handling: The Bank handles complaints through an online form (feedback form) with a commitment to respond in a timely manner. In 2024, an independent survey in the UK showed high customer referrals to branches and digital services, but the specific complaint rate and resolution time were not disclosed.

Multi-language support: The service is mainly provided in Danish, English, and may support Swedish, Norwegian, and Finnish, which is suitable for cross-border customers, but the specific language coverage needs to be further confirmed.

Safety and security measures

Danske Bank has a number of measures in place to protect client funds and data:

security of funds: up to DKK 100,000 for deposit insurance in Denmark and up to £85,000 in the UK. Real-time transaction monitoring and Danske ID two-factor authentication prevent fraud.

Data breach records: No major data breaches were reported, and the bank conducted regular security audits.

Featured Services & Differentiation

Danske Bank addresses market segments with the following services:

student accounts: such as Danske 18-27, offer fee-free accounts and low-interest loans.

Exclusive financial management for the elderly: including retirement planning and pension management, specific products need to consult the bank.

Green financial products: Support renewable energy and energy-saving projects, such as green home loans.

Market Position & Accolades

Danske Bank is the largest bank in Denmark with a market share of 24% (loans) and 27% (deposits) in 2024. In the Nordic region, it is the third largest bank in Finland and the fifth largest in Sweden, ranking 454th in the world (2011). The bank has received several awards:

"Best Digital Bank in Denmark": in recognition of its digital transformation.

"Best Responsible Investment Bank": Recognition of its ESG investments.

"Best Mobile Banking App": Highlight its app functionality.