Basic Information

Types and

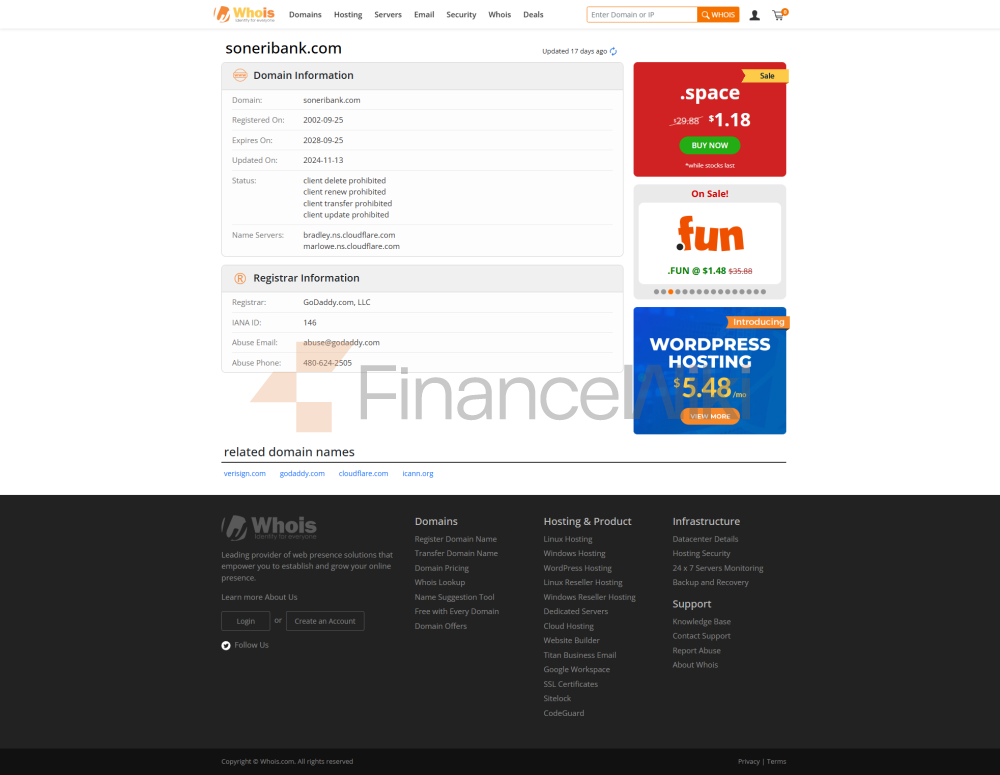

BackgroundSoneri Bank is a private commercial bank headquartered in Karachi, Pakistan, founded on September 28, 1991. Its major shareholders include the Feerasta family, with Amin A. Feesta as Chairman and Muhtashim Ahmad Ashai as Chief Executive Officer. The bank is not listed on the stock exchange.

Coverage &

OutletsSoneri Bank has a network of more than 500 branches and ATMs across Pakistan, including 68 Islamic bank branches, covering both urban and remote areas.

Regulation &

ComplianceThe Bank is regulated by the State Bank of Pakistan (SBP) and adheres to relevant banking regulations and compliance requirements. In addition, Soneri Bank has joined the deposit insurance program to protect customers' deposits.

Key Indicators of Financial Health

(as of end-2023)

Capital Adequacy Ratio (CAR): 18.4%, Above regulatory requirements, showing a strong capital base.

Non-performing loan ratio (NPL): 5.1%, slightly higher than the industry average, but measures have been taken to strengthen credit management.

Liquidity Coverage Ratio (LCR): Data is not publicly available, but banks maintain sufficient liquidity to meet short-term debt needs.

Credit Rating:

Soneri Bank has a long-term credit rating of "AA-" and a short-term credit rating of "A1+" according to PACRA, a Pakistani credit rating agency, reflecting its strong ability to meet its financial obligations.

Deposit & Loan

ProductsSoneri

Bank offers a variety of deposit products, including:

Fixed Deposits: The annual interest rate ranges from 8.60% to 10.00% depending on the tenor.

Featured accounts, such as "Soneri Roshan Savings Account" and "Soneri Sahara Account (for seniors)", with interest rates ranging from 9.50% to 9.60% per annum.

Current Savings Account: 9.50% p.a.

Loan products

personal loans: up to Rs 2 million for unsecured loans and up to Rs 5 million for secured loans, with a maximum repayment period of 4 years and partial early repayment support.

Car Loans: With a fixed interest rate of 14.50% and no prepayment penalty, flexible repayment options are available.

Home loans: A variety of home financing options are available, with specific interest rates and conditions to be determined according to the customer's situation.

list of common expenses

Account Maintenance Fee: Rs 50 per month will be charged if the average monthly balance is less than ₹5,000.

Transfer fees: Transfers made through digital channels are usually free of charge, depending on the type and amount of the transaction.

ATM interbank withdrawal fee: The specific fee is not disclosed, customers are advised to check with their bank before using it.

Other fees: Services such as account statements, cheque books, etc. may be charged, please refer to the bank charges for details.

Digital Service Experience

Mobile App & Online

BankingSoneri Bank's "Soneri Digital" mobile app has a rating of 4.7 out of 5 on the App Store and Google Play 4.5. Positive feedback from users.

Core Functions

account balance query and transaction details

, real-time transfer and bill payment

, investment tool integration

, face recognition, login and biometric authentication

The Innovation

Bank implemented the T-24 global core banking system, improving operational efficiency and customer service quality.

customer service

quality service

channelSoneri Bank offers 24/7 customer service, including phone support, live chat, and social media response, ensuring that customers can get help at all times.

Complaint HandlingAccording

to 2024 data, banks received a total of 44,261 complaints, with an average resolution time of 5.6 days, showing a high level of customer service efficiency.

Multilingual supportThe

bank provides multilingual services for customers with different language backgrounds.

security

measuresFunds securitySoneri Bank has joined the deposit insurance program to protect the safety of customer funds.

Data Safe

Bank is ISO 27001 certified for an information security management system and implements multiple layers of security measures, including real-time transaction monitoring and anti-fraud technology, to ensure the security of customer data.

featured services and differentiated

market segment services

student account: provides a fee-free student account, Supporting the financial needs of younger customers.

Senior-only banking: The "Soneri Sahara Account" offers preferential interest rates and exclusive services for senior customers.

Green financial products: Banks actively promote sustainable finance and support environmental protection projects and green investments.

High Net Worth

ClientsSoneri Bank provides private banking services to tailor financial solutions and portfolios for high net worth clients to meet their diverse financial needs.

Market Position &

HonorsIndustry

RankingSoneri Bank is in the middle and upper reaches of the banking industry in Pakistan, with a stable customer base and an extensive service network.

Awards & Accolades

- received the

"USD Clearing Elite Quality Recognition Award" from J.P. Morgan in 2024 for excellence in USD clearing services.

Winning awards in nine categories at the 2024 Global Diversity, Equity & Inclusion Benchmark (GDEIB) demonstrates its commitment to diversity and inclusion.