basic bank information

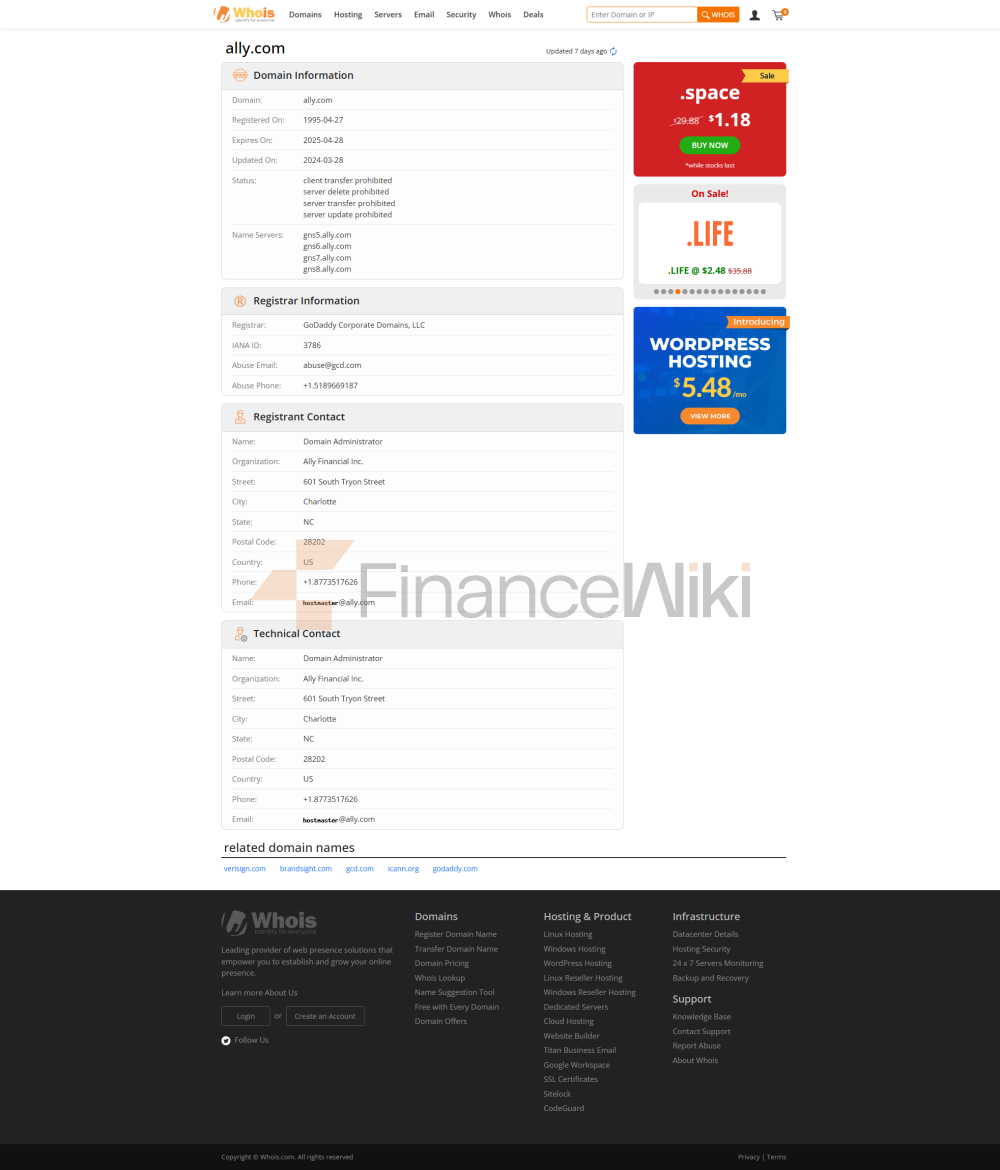

Ownership: Affiliated with Ally Financial Inc., a NYSE-listed company (ticker symbol: ALLY), with no national or joint venture background.

type: commercial bank

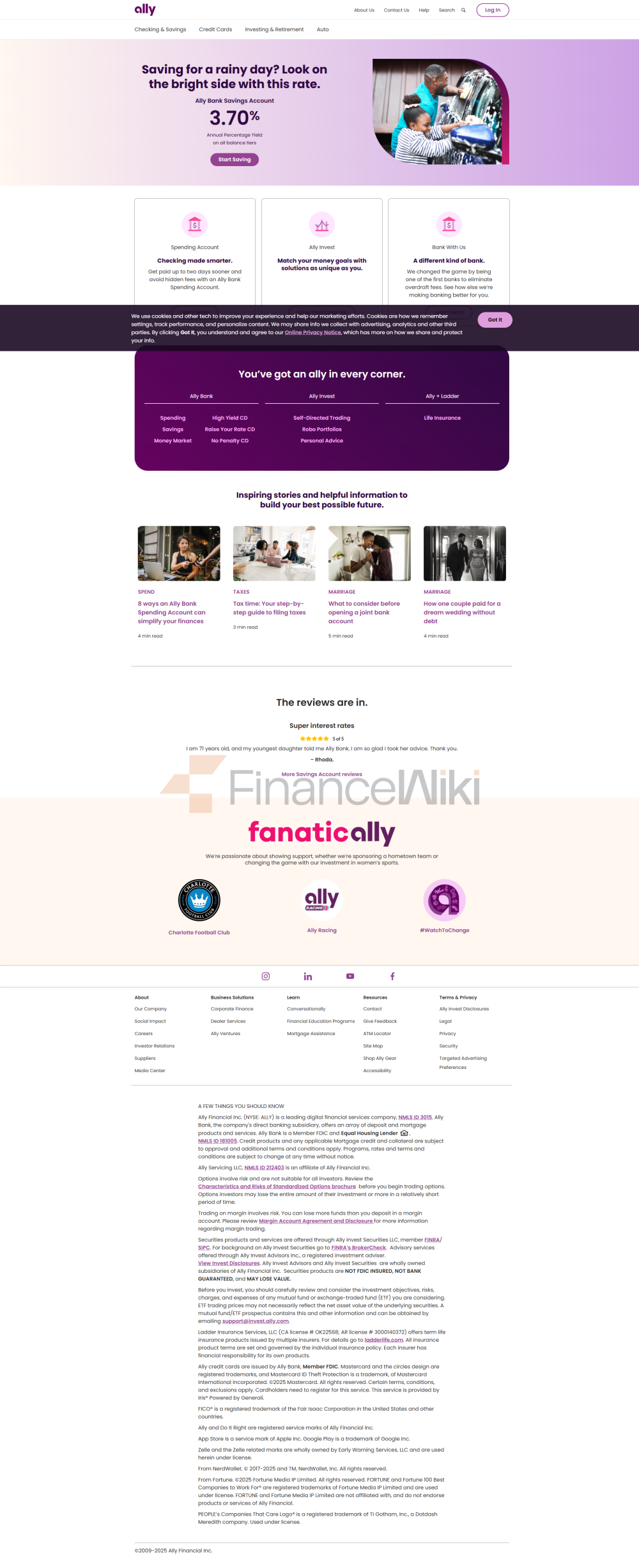

Ally Bank, the digital banking arm of Ally Financial, focuses on online financial services, covering areas such as savings, checking, loans, and investments, in contrast to traditional banks.

name and background<

ul style="list-style-type: disc" type="disc">Full name: Ally Bank

founded in 1919 (formerly known as General Motors Acceptance Corporation, GMAC) and renamed Ally Bank in 2009

Headquarters location: Sandy, Utah

Shareholder Background: The parent company, Ally Financial Inc., is a publicly traded company with a market capitalization of approximately $9.71 billion in 2024, ranking among the top 25 financial holding companies in the United States. Shareholders include institutional investors and the general public, and there is no state-owned component.

Ally Bank's predecessor, GMAC, was founded in 1919 by General Motors to finance car purchases. After the 2008 financial crisis, GMAC transformed into a bank holding company and launched the Ally Bank brand in 2009 with a focus on online banking services. In 2014, the company went public through an IPO, and in 2016, it acquired TradeKing (later renamed Ally Invest) to further expand its investment services. Headquartered in Sandy, Utah, and headquartered in Detroit, Michigan, the parent company reflects its auto finance roots.

service scope

Coverage area: Mainly serving the U.S. market, auto finance business covers some international markets.

Number of offline outlets: No physical branches, fully online operations.

ATM distribution: more than 75,000 free ATMs across the U.S. through the Allpoint and MoneyPass networks; Non-network ATMs can reimburse up to $10 per month in processing fees.

Ally Bank bridges the limitations of not having a physical branch through an extensive network of ATMs and online platforms, ensuring that customers can easily withdraw cash and manage their accounts.

services and products<

ul style="list-style-type: disc" type="disc">for individuals:

> High Yield Savings Account: Annualized rate of return (APY) of approximately 4.20%, no minimum deposit requirement, no monthly fee, daily interest, monthly payments.

Ally Spending Account: 0.10% APY (balance less than $15,000) or 0.25% (balance above $15,000), no monthly fee, savings bucket and automatic savings feature.

Term Deposits (CDs): Tenors from 6 months to 60 months, APY from 3.00% to 4.50%, no minimum deposit required, early withdrawal penalty of 60 to 150 days interest.

Money Market Account: APY 4.20%, check and debit card support, no monthly fee.

Auto Loans: Provides car purchase and lease financing to individuals and businesses, serving 4.1 million customers, and disbursing 1.2 million auto loans in 2023.

investment services: self-service investment and wealth management through Ally Invest, with an annual advisory fee of 0.50%.

for business:

commercial loans: SME loans, commercial real estate loans.

Dealer Services: Wholesale loans, inventory financing, and insurance services for auto dealers.

Corporate Finance: Secured loans and asset-backed loans for medium-sized enterprises, suitable for mergers and acquisitions, debt restructuring, etc.

Ally Bank's personal services are centered around high-yield savings and flexible checking accounts, complemented by auto loans and investment products. Corporate services focus on the financing needs of auto dealers and medium-sized enterprises, reflecting their expertise in the field of auto finance.

regulatory and compliance<

ul style="list-style-type: disc" type="disc">regulators: Federal Reserve System (FRB), Federal Deposit Insurance Corporation (FDIC).

Deposit Insurance Program: FDIC-insured up to $250,000 for single accounts and $500,000 for joint accounts.

recent compliance record:

settled with the Consumer Financial Protection Bureau (CFPB) and the Department of Justice in December 2023 to pay $98 million ($80 million in consumer compensation, $18 million in fines) for discriminatory pricing on auto loans.

settled with the Department of Justice in 2016 for a $52 million payment over subprime mortgage-backed securities.

Ally Bank is regulated by multiple layers, and deposits are safe and secure under the FDIC. Despite past compliance issues, the settlement demonstrates that it is responsive to regulatory challenges.

financial health

Capital Adequacy Ratio: Total capital ratio of 13.2% as of December 31, 2024 (12.4% in December 2023), above regulatory requirements (minimum 10%).

non-performing loan ratio: total non-performing loans amounted to US$1.48 billion, accounting for approximately 1.1% of the loan portfolio, up 6.6% year-over-year.

Liquidity Coverage Ratio: No specific data is disclosed, but the 2023 annual report shows $19.2 billion in liquid assets, including cash and highly liquid securities, which meet regulatory requirements.

2023 with total assets of $186.1 billion, ranking the 21st largest bank in the United States, with a net income of $1.7 billion, showing financial soundness. Non-performing loans (NPLs) increased slightly, but the overall risk was manageable.

digital service experience<

ul style="list-style-type: disc" type="disc">APP & BANKING:

> user ratings: Ally mobile app has a rating of 4.7 (based on 90,600 reviews) on the Apple App Store and a rating of 4.5 on Google Play (based on 32,400 reviews).

core features: support for real-time transfers (Zelle), bill management, mobile check deposits, piggy bucket (allocate savings by goal), automatic savings (Surprise Savings). Face recognition login is not supported, but two-factor authentication is provided.

technical innovation:

AI customer service: provides 24/7 live chat, which may include AI-driven features, details are not disclosed.

Robo-advisor: Automated investment advice through Ally Invest.

Open Banking API: Not explicitly supported, but digital platforms support seamless connection with external accounts.

Ally Bank's mobile app and online banking are known for their intuitive interface and high functionality, and their savings buckets and automated savings tools have been widely acclaimed for helping users manage their finances effectively.

customer service

channels: 24/7 phone support (877-247-2559), live chat, secure email.

Rating: Customer service is responsive and professional, with a slightly below-average rating in J.D. Power's 2024 Straight Bank Satisfaction Study, but a positive rating in user reviews.

Ally Bank provides round-the-clock support through multiple channels, ensuring that customers are always available for assistance, especially for those who are used to operating online.

safeguards

technical security: data encryption, two-factor authentication, real-time fraud monitoring.

Deposit security: FDIC insurance, up to $250,000 for single accounts.

Other: Zero-liability fraud protection (against unauthorized debit card transactions) and a dedicated security center to deal with fraud.

Ally Bank uses industry-standard security measures to ensure the safety of customer data and funds, and enhance user trust.

featured services and differentiation<

ul style="list-style-type: disc" type="disc">No overdraft fees: Ally Bank was one of the first banks to eliminate overdraft fees, reducing costs for customers.

High Yield Savings: Savings Account APY is 4.20%, much higher than traditional banks, attracting savings-oriented customers.

Auto Finance Leadership: One of the largest auto finance companies in the U.S., serving 4.1 million customers and issuing 1.2 million auto loans in 2023.

Savings Tools: Savings Bucket and Surprise Savings help users save automatically and manage their money by goal.

Social Responsibility: Provide free financial education through Ally Wallet Wise, support community charity, and match employee donations.

Ally Bank differentiates itself from traditional banks with low fees, high yields and innovative savings vehicles, and further strengthens its competitiveness with its auto finance business and digital experience.