PT

Bank Central Asia Tbk (BCA) is a leading commercial bank positioned as the largest private bank in Indonesia, known for its market-oriented operations and efficient services, not a state-owned or joint venture bank, but dominated by private capital. BCA occupies a central position in the Indonesian banking industry with its solid financial performance and extensive service network.

Name &

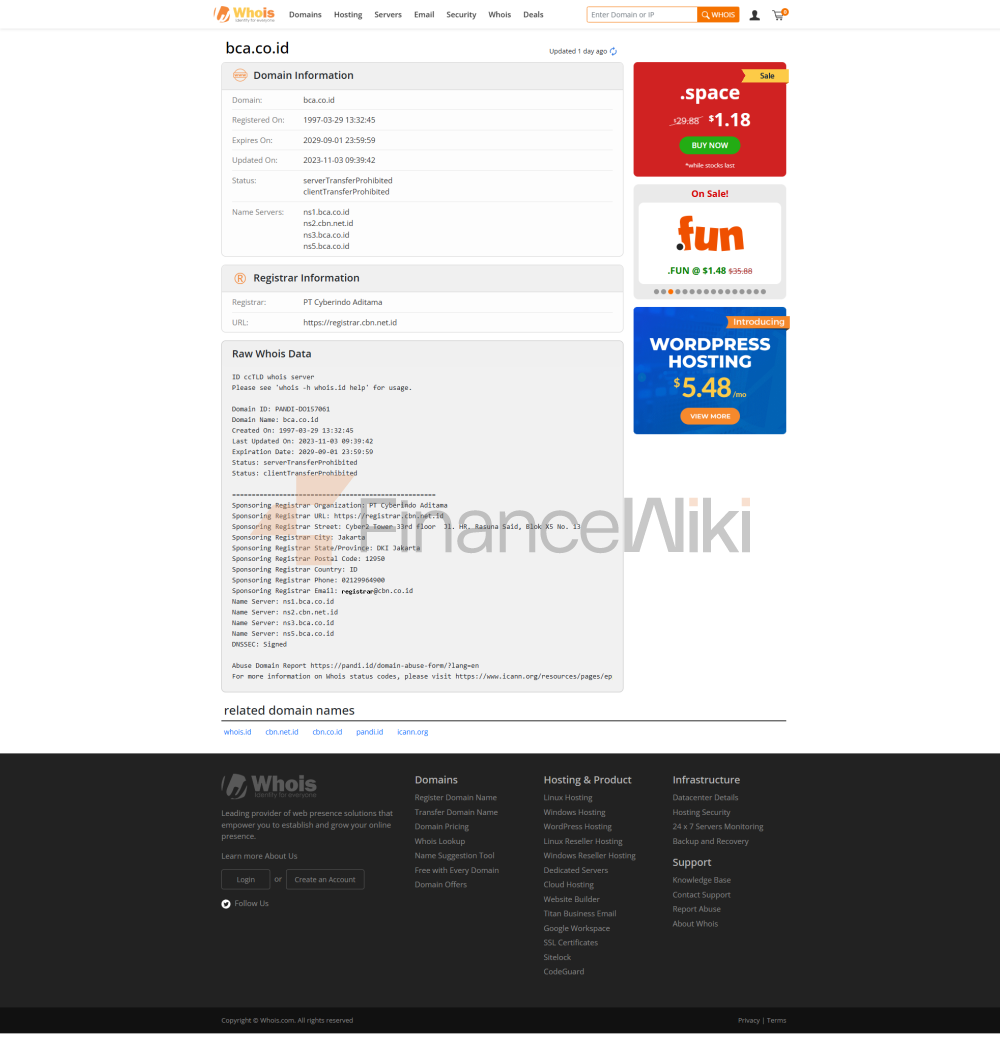

BackgroundFull Name: PT Bank Central Asia TbkFounded

in 1957

Headquartered in Jakarta, Indonesia

Shareholder background: BCA is one of the largest listed companies in Indonesia, and part of its equity is controlled by Djarum Group, an Indonesian giant consortium with businesses spanning tobacco, real estate and other fields. BCA is listed on the Indonesia Stock Exchange (IDX) under the ticker symbol BBCA, and has a high percentage of public float, indicating that it is more market-oriented. Non-state-owned banks, with a shareholder structure dominated by private capital, focusing on commercial returns and long-term sustainable development.

Coverage of services

: BCA mainly serves the Indonesian market, has a nationwide network, and supports some overseas customers through international remittances and cross-border services.

Number of offline outlets: As of 2020, BCA has more than 1,248 branches, including traditional outlets and more efficient BCA Express outlets, covering major cities and remote areas in Indonesia.

ATM distribution: BCA operates 17,623 ATMs and invests in cash recovery machines (CRMs) to reduce cash management costs. The ATM network, combined with partnerships such as MoneyPass, ensures that customers can withdraw money conveniently, especially in densely populated urban areas.

Regulatory & Compliance

Regulators: BCA is regulated by the Indonesian Financial Services Authority (OJK) and Bank Indonesia, and is subject to regulations such as the Banking Law.

Deposit Insurance Program: BCA participates in the deposit insurance program of the Indonesian Deposit Insurance Institution (LPS) to protect customers' deposits with a maximum payout amount of IDR 2 billion (approximately US$130,000).

Recent Compliance Record: BCA has a strong track record in anti-money laundering (AML) and financial crime compliance, and its internal control and compliance (ICC) system is considered a benchmark for the Indonesian banking industry. There were no major compliance breaches, demonstrating its robust operations under the regulatory framework.

Financial health

and capital adequacy ratio: BCA's capital adequacy ratio (CAR) was 28.9% at the end of 2022, well above the regulatory requirement of 8%, demonstrating its strong capital strength and ability to withstand economic volatility.

Non-Performing Loan Ratio: The non-performing loan ratio (NPL) is only 1.8%, well below the industry average, reflecting its high-quality loan portfolio and rigorous risk management.

Liquidity Coverage Ratio: BCA has a loan-to-deposit ratio (LDR) of 65%, a robust liquidity coverage ratio (LCR), and a high proportion of current and savings accounts (CASAs) from retail sources, providing it with a low-cost, stable source of funding.

Quick Verdict: BCA is financially healthy, well-capitalized, high-quality and liquid, making it suitable for clients looking for stable banking services.

Deposits & LoansDeposit

Class:

demand deposits: the annualized interest rate is about 0.1%-0.5%, which is suitable for daily fund management.

Fixed deposits: 1 month to 36 months, interest rate 0.5%-2.5%, depending on the deposit amount and term.

Featured Products: BCA offers high-yield savings accounts (such as Tahapan Xpresi, for young people, no minimum balance fee) and large certificates of deposit with negotiable interest rates for high-net-worth clients.

Loans:Mortgage: Fixed interest rate of about 5%-7%, floating interest rate adjusted by the market, loan term of up to 20 years, property mortgage and proof of income are required.

Car loan: the interest rate is about 4%-6%, the term is 1-5 years, new and used cars are supported, and the approval is fast.

Personal Line of Credit: The interest rate of unsecured loans is about 10%-15%, and the upper limit is based on credit score, and the approval threshold is low.

Flexible repayment: BCA offers installment and early repayment options, and some loans allow for adjustment of repayment plans to reduce customer stress.

List of Common Expenses

Account Management Fee: The monthly fee for an ordinary current account is about IDR 15,000 (about USD 1), which can be reduced by maintaining a minimum balance (e.g. IDR 500,000).

Transfer fee: Free of charge for domestic and intra-bank transfers, about IDR 6,500 for each inter-bank transfer; Cross-border transfers cost around $25-$50, depending on the amount and destination.

Overdraft fee: Overdraft accounts are charged on a daily basis at an interest rate of about 12%-18%/year.

ATM interbank withdrawal fee: approximately IDR 7,500 per transaction, free of charge within the MoneyPass network.

Hidden Fee Reminder: Be aware of the minimum balance requirement (monthly fee for some accounts below IDR 500,000) and foreign exchange conversion fees for cross-border transactions (around 1%-2%).

Digital Service Experience

App & Online Banking: BCA's mobile banking app (BCA Mobile) and online banking (KlikBCA) have been rated around 4.5/5 on Google Play and App Store, which is widely acclaimed. Core features include facial recognition login, real-time transfers, bill payments, investment product purchases, and credit card management.

Technological innovation: BCA introduces an AI-powered chatbot (VIRA) that provides 24/7 customer support; Support open banking API and integration with third-party fintech platforms; Robo-advisory services provide personalized investment advice to high-end clients.

User experience: The interface is intuitive and smooth, especially for younger users and digital natives, but some advanced features require additional registration.

Customer Service Quality

Service Channels: BCA offers 24/7 phone support (Halo BCA: 1500888), live chat (via APP), and social media quick response (Twitter, WhatsApp).

Complaint handling: The complaint rate is low, the average resolution time is 1-3 working days, and the user satisfaction is high (about 85% of customers say that the problem is properly resolved).

Multi-language support: Mainly provide services in Indonesian and English, and some outlets support Chinese and Malay, suitable for cross-border customers.

Security measures

: Funds are safeguarded: Deposits are protected by LPS insurance up to IDR 2 billion; BCA uses real-time transaction monitoring and two-factor authentication (2FA) to prevent fraud.

Data Security: BCA is ISO 27001 certified for information security and uses end-to-end encryption to protect customer data. No major data breaches were reported, demonstrating its commitment to cybersecurity.

Featured Services & Differentiated

Market Segments:

Student Account: Tahapan Xpresi No Annual Fee, Suitable for Young Adults, Low Balance Requirements, Comes with a Stylish ATM Card Design.

Exclusive wealth management for the elderly: Provide high-yield fixed deposits and health insurance bundled products to meet the needs of retirees.

Green Finance: BCA launched ESG investment products to support sustainable development and green energy projects.

High Net Worth Services: BCA Prioritas Private Banking Services, with a threshold of about IDR 500 million (about US$35,000), provides exclusive financial advisors, customized portfolios and global financial services.

Market Position and HonorsIndustry

Ranking: BCA is the largest bank in Indonesia by market capitalization, with a compound annual growth rate of over 44% in market capitalization in 2023, ranking first among Southeast Asian banks in terms of market capitalization. It ranks among the top 100 banks in the world in terms of assets.