Bank Basic

InformationName and BackgroundBank

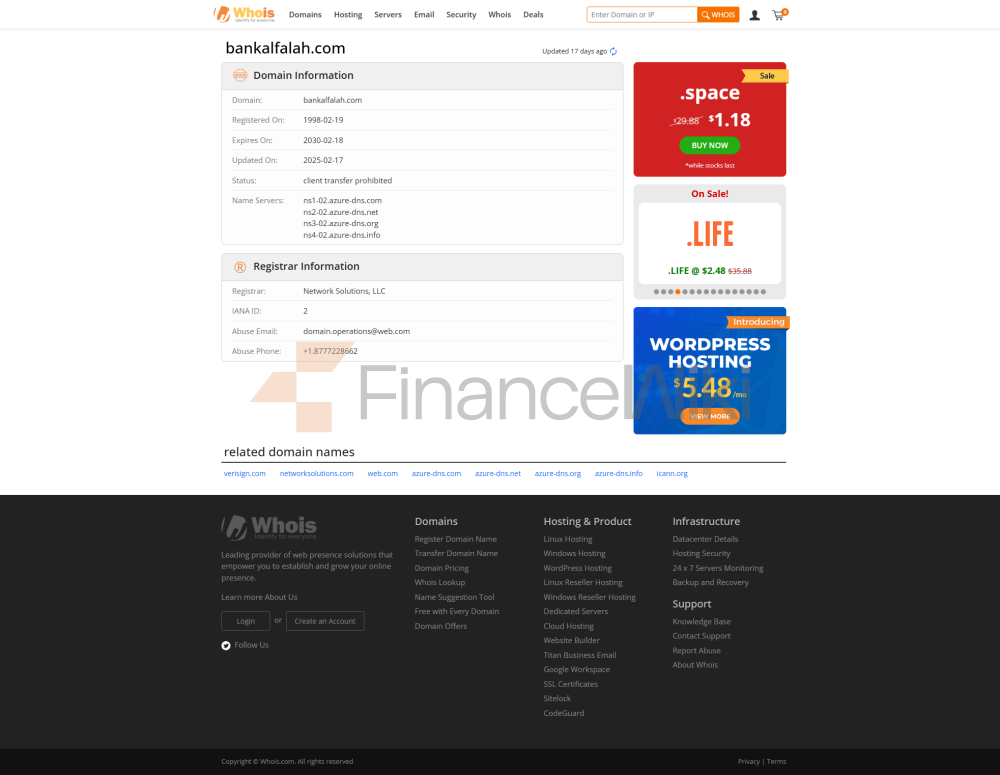

Alfalah Limited (Pakistan Alfalah Bank) was established in 1992 and is headquartered in Karachi, Pakistan. The bank is one of the largest private banks in Pakistan and its main shareholder is the Abu Dhabi Group, reflecting its international shareholder background. Bank Alfalah is listed on the Pakistan Stock Exchange, demonstrating its transparent corporate governance structure.

Scope of

ServicesBank Alfalah has an extensive network of branches in Pakistan, covering major cities and regions across the country. In addition, the bank has branches in countries such as the United Arab Emirates, Bangladesh, Afghanistan, and Bahrain to provide cross-border banking services.

Regulation & ComplianceBank

Alfalah is regulated by the State Bank of Pakistan and complies with the country's banking regulations and regulatory requirements. The bank is a member of the Deposit Protection Corporation of Pakistan and customer deposits are protected.

Financial HealthAs

of June 2017, Bank Alfalah had a capital adequacy ratio of 13.27%, a non-performing loan ratio of 4.81%, a risk coverage ratio of 90.14%, and a liquidity ratio of 11.50%. These indicators show that the bank is performing well in terms of capital adequacy and asset quality.

Deposits &

LoansBank Alfalah offers a wide range of deposit products, including demand deposits, time deposits and high-yield savings accounts. According to 2016 data, the interest rate on one-year fixed deposits in US dollars is about 4.1%.

LoansThe

Bank offers a wide range of loan products, including home loans, car loans, and personal loans. The interest rate and conditions of the loan are based on the customer's credit profile and the type of loan, and specific information can be obtained through the bank's official website or branches.

List of Common Fees

Bank Alfalah charges reasonable fees for its banking services, including account management fees, transfer fees, overdraft fees, and ATM interbank withdrawal fees. The specific fee schedule may vary depending on the account type and service, and customers are advised to learn more about the relevant fee information before opening an account.

Thedigital service experience

app and online banking

Bank Alfalah's mobile banking app "Alfa" has a rating of 4.7 out of 5 on the Google Play Store and has been downloaded more than 5 million times. The app supports facial recognition login, real-time transfers, bill payments, and investment management to provide a convenient digital banking experience.

Technological

InnovationBank Alfalah actively adopts artificial intelligence technology to provide intelligent customer service and improve customer experience. In addition, the bank supports open banking APIs to provide customers and partners with flexible financial service interfaces.

Customer Service Quality

Service ChannelBank

Alfalah offers 24/7 customer support, and customers can get help through multiple channels such as phone, live chat, and social media.

Complaint HandlingThe

Bank attaches great importance to customer feedback and has a dedicated complaint handling mechanism in place to resolve customer problems within a reasonable time and improve customer satisfaction.

Multi-language

supportBank Alfalah provides multi-language services to meet the needs of customers with different language backgrounds, especially for cross-border users.

Security

MeasuresFunds

SecurityCustomers' deposits are guaranteed by the Pakistan Deposit Insurance Corporation to ensure the safety of funds. In addition, Bank Alfalah employs advanced anti-fraud technologies, such as real-time transaction monitoring, to prevent unauthorized transactions.

Data SecurityThe

Bank is committed to protecting the security of customer data and complying with international information security standards to ensure the confidentiality and integrity of customer information.

Featured Services & Differentiated

Market SegmentsBank

Alfalah provides special services for specific customer groups, such as student accounts, exclusive wealth management products for the elderly and green financial products, to meet the diverse needs of different customers.

High Net Worth ServicesThe

Bank has a private banking division that provides customized wealth management solutions to high net worth clients, including investment advisory, asset allocation and family trust services.

Market Position & AccoladesIndustry

RankingsBank

Alfalah is one of the leading private banks in Pakistan with significant advantages in terms of asset size and customer base.

AwardsThe

bank has received several industry awards, such as "Best Digital Bank" and "Most Innovative Bank", for its excellence in digital services and innovation.