Banco Nacional Ultramarino, S.A. (BNU) is one of the oldest banks in Macau, with a strong track record in local and cross-border financial services based on its philosophy of "Passing on the Past and Connecting the Future". Founded in 1864 as a note-issuing bank for the Portuguese Overseas Territories, its headquarters is located in an iconic neoclassical building at the intersection of Avenida da Nam Van and Avenida de Ame de Lippiro, Macau. In 2001, BNU merged with the state-owned bank Caixa Geral de Depósitos (CGD) in Portugal, but continued to operate in Macau under an independent brand and issued patacas (MOP) as one of the legal tender banks in Macau. Serving both local and cross-border clients, BNU has become a key pillar of Macau's economic development through its outstanding role as a retail bank, corporate finance and financial bridge between China and Portuguese-speaking countries. The following is a comprehensive introduction to Banco Nacional Ultramarino, covering its basic information, deposit and loan products, digital services, technological innovations, unique services and market position.

Banking BasicsBanco

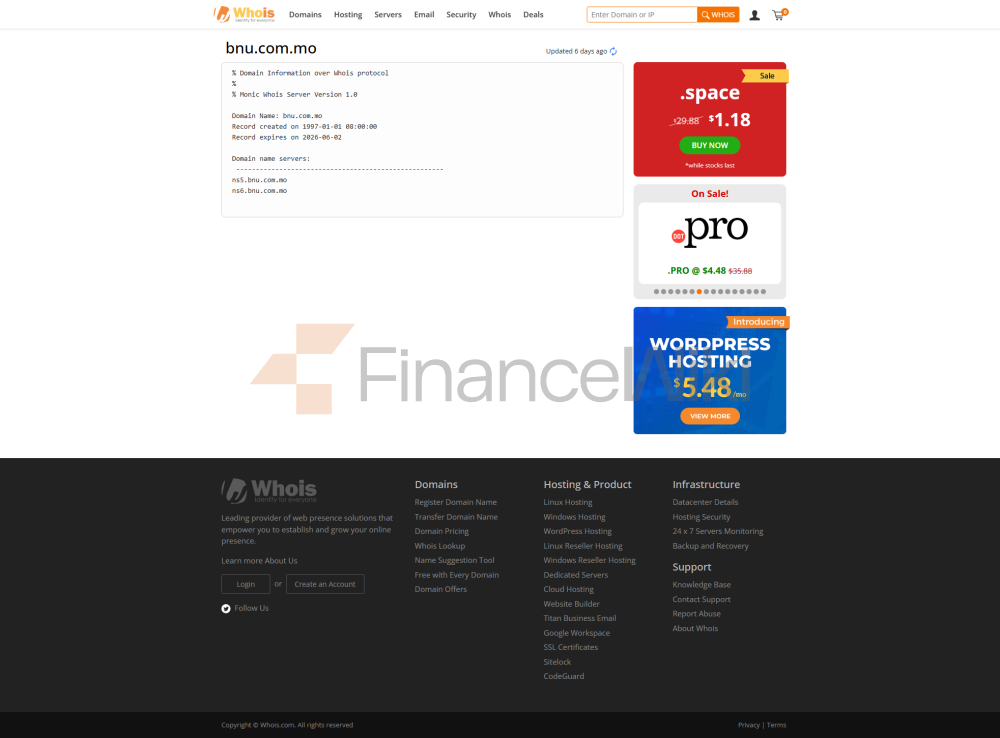

Ultramarino is a commercial bank, non-state-owned or joint venture, founded in 1864 and headquartered at 22 Avenida da Nam Van in Macau. The bank is wholly owned by Portuguese state-owned bank Caixa Geral de Depósitos (CGD), one of the largest financial groups in Portugal with operations in 23 countries in Europe, Asia, Africa and the Americas. BNU is strictly regulated by the Monetary Authority of Macao (AMCM) and is required to comply with international financial standards and local regulations to ensure operational transparency and the safety of client funds. Its deposits are protected by the Macau Deposit Protection Scheme, with a maximum protection amount of MOP1 million per depositor. BNU's SWIFT code is BNULMOMX and its Legal Entity Identifier (LEI) is 5493006ZSBXCR2G4QN03, reflecting its normative nature in the global financial system. As one of the legal note-issuing banks in Macao, BNU and Bank of China in Macau jointly issue pataca and assume important monetary functions.

Deposit & Loan Products

DepositsBJB offers a wide range of deposit products to meet the savings needs of individual and corporate customers:

demand deposits: Including checking account and savings account, the minimum account opening amount is HKD 500 or equivalent currency, the base annualized rate of return (APY) is about 0.025%, the latest interest rate needs to be confirmed through branch or online banking.

Time deposit: Support 12 currencies such as HKD, USD, RMB, etc., with deposit tenors ranging from 7 days to 24 months, and the minimum deposit amount is HKD 10,000. The 2025 interest rate is subject to online banking or branch enquiry, and a preferential interest rate of up to 3% may be offered during the promotion period.

Featured products:

High yield savings account: such as "Accumulating Time Deposit", which provides high-end customers with higher returns and needs to maintain a higher balance (such as more than HK$100,000).

Large Certificate of Deposit (CD): Flexible tenor, suitable for customers with large amounts of funds, the interest rate needs to be queried through the branch or app.

Customers can enquire about the "Cloud Interest Rate" offer through the BNU Mobile app or online banking, and the deposit products can be opened and calculated instantly, and some of the products are integrated with CGD Group's services to enhance convenience.

loansBN offers a comprehensive range of loan products, including home loans, car loans, and personal lines of credit to meet diverse financing needs:

Car Loan: Support new and used car financing, with a loan amount of up to HK$3 million, a term of up to 60 months, an annualized interest rate (APR) as low as 1.88%, and a good credit history required.

Personal Line of Credit: includes personal instalment loan (APR as low as 1.88%, amount up to HK$3 million) and asset-backed overdraft (up to 95% of the collateral market value), the application threshold is a monthly salary of more than HK$20,000 or proof of assets.

Flexible repayment options: Mortgage and personal loans offer no penalty for early repayment, weekly or bi-weekly payment plans, and reborrowing of overdraft facilities, giving customers the flexibility to manage their debts.

All loans are subject to bank approval, the "Rule of 78" is used to calculate the interest and principal ratio, and the customer is required to provide credit history and financial documents, the specific terms of which are subject to the loan agreement. Banks' trade finance services, such as letters of credit and trade loans, provide additional support to cross-border businesses.

Mortgages: Fixed and variable rate mortgages are available for up to 70% of the value of the property and are repaid over a period of up to 30 years. In 2025, the floating rate is based on HIBOR (1-month HIBOR +1.5%) or Prime Rate (5.0%-2.5%), with cash rebates and insurance discounts, subject to bank consultation.

Digital Service

ExperienceBanco Nacional Ultramarino's mobile banking app "BNU Mobile" is at the heart of its digital services, available for download on iOS 14.0 and above and Android 9.0 and above, with an App Store rating of about 4.4 and a Google Play rating of about 4.2, with users praising its intuitive design and quick response. Core features include:

Face recognition: supports biometric authentication (such as Face ID and Touch ID), combined with strong encryption technology to ensure transaction security.

Real-time transfers: Instant transfers in HKD and RMB are supported through the Faster Payment System (FPS), with a daily limit of up to HK$500,000, and international remittances in more than 100 countries, integrated with CGD Group's global network.

Bill management: Support online bill payment, automatic deduction and e-statement, and classify transaction records in real time.

Investment Tool Integration: Support stocks, funds, bonds, and unit trust transactions, providing real-time market data and investment advisory services.

BNU Online Banking supports multiple browsers and provides similar features, allowing customers to open an account in less than 5 minutes through the app or website. The app supports accessibility features and is compatible with the needs of visually impaired and hearing-impaired customers. Some users reported that international remittance fees are high, but banks continue to optimize the application experience.

Technological InnovationBanco

Nacional Ultramarino actively explores in the field of fintech, relying on CGD Group's technical resources to promote digital transformation:

AI customer service: Introducing an AI-driven customer service system to analyze transaction behavior and detect fraud risks in real time, A virtual assistant is planned to be launched in 2025 to support 24/7 inquiries and financial advice.

Robo-advisor: Provide AI-based investment management services through BNU Invest, recommend diversified funds and stock portfolios according to customers' risk appetite, with a minimum investment of HK$1,000 and no subscription fees.

Open Banking API Support: Complying with the Open Banking Framework of the Monetary Authority of Macao, integrating with third-party service providers to provide account management and financial service interoperability, especially in the areas of trade finance and cross-border payments.

Other innovations: Launch of an online foreign currency exchange service, which allows customers to book foreign currency through online banking and collect it at designated branches; Support three-currency (MOP, HKD, RMB) credit cards, exempt from overseas transaction fees; Introduced the eTradeConnect platform to simplify trade finance applications. In 2024, banks will invest US$50 million to upgrade their digital platforms and strengthen cross-border payment and investment services.

Distinctive Services & DifferentiationBanco

Nacional Ultramarino is known for its unique role as a financial bridge between China and Portuguese-speaking countries and localized services:

Financial bridge between China and Portuguese-speaking countries, Supporting international remittance and trade finance (such as letters of credit and trade loans) in more than 100 countries, providing efficient solutions for importers and exporters and cross-border enterprises in Macao.

SME support: Provide customized corporate loans and cash management services, participate in the SME Financing Guarantee Program of the Monetary Authority of Macao, and approve loans in as fast as 10 seconds, with an amount of up to HK$3 million.

Green Finance: Launching green bonds and preferential interest rate loans to support environmentally friendly projects, such as microfinance schemes in countries along the Belt and Road, to promote sustainable economic development.

Wealth Management: Provide individual pension funds, unit trusts and insurance products, integrate with the global investment market, and provide high-net-worth customers with diversified choices.

Community Contribution: Partnered with the Rui Cunha Foundation to organize financial education activities, such as sharing the development opportunities of the Greater Bay Area with students of the University of Macau in 2023 to enhance the financial literacy of young people.

Market Position & Accolades

Banco Nacional Ultramarino is one of the major commercial banks in Macau, with a solid retail network and a net profit of MOP585.1 million (approximately US$73 million) in 2024, a slight decrease of 0.4% from 2023, ranking among the top 29 banks in Macau. Its parent company, CGD Group, is the largest financial group in Portugal, with operations in 23 countries, providing strong support to BNU. As the legal issuing bank of Macao, BNU shares the responsibility of currency issuance with the Bank of China, and has a unique market position. In 2023, the Bank won the "Best Commercial Bank in Macau Award" and in 2022, it was awarded the "Macau Fintech Innovation Award" in recognition of its outstanding performance in customer service and digital transformation. The Bank's asset quality remains at the best level and its risk management framework is internationally recognised.

SummaryBanco

Nacional Nacional Ultramarino Limited is a long-established commercial bank in Macau, renowned for its outstanding performance in its role as a financial bridge between China and Portuguese-speaking countries and the support of the local community. The bank offers a wide range of deposit and loan products, including high-yield savings accounts, fixed deposits, and flexible mortgages and personal loans, to meet the diverse needs of customers. In terms of digital services, the BNU Mobile app has been well received for its efficient real-time transfer and investment management features. Technological innovations, including AI-driven customer service, open banking APIs, and online foreign currency exchange services, demonstrate its commitment to digital transformation. With its cross-border financial capabilities, commitment to green finance and industry accolades in 2023, Banco Nacional Ultramarino continues to demonstrate strong competitiveness and influence in the financial markets of Macau and the Guangdong-Hong Kong-Macao Greater Bay Area.