Uchumi Commercial Bank Limited (UCB) is an important regional bank in the northern region of Tanzania and is known for its focus on small and micro enterprises and underbanked grassroots economic groups. Founded in 2005 and initiated by the Evangelical Lutheran Church of the Northern Diocese of Tanzania (ELCT-ND), UCB provides diversified financial services to individuals and SMEs through a single branch and digital platform. Its brand mission is to "empower communities, create the future", driving financial inclusion and economic development in Northern Tanzania through low-cost financial solutions and digital innovation.

Basic Information

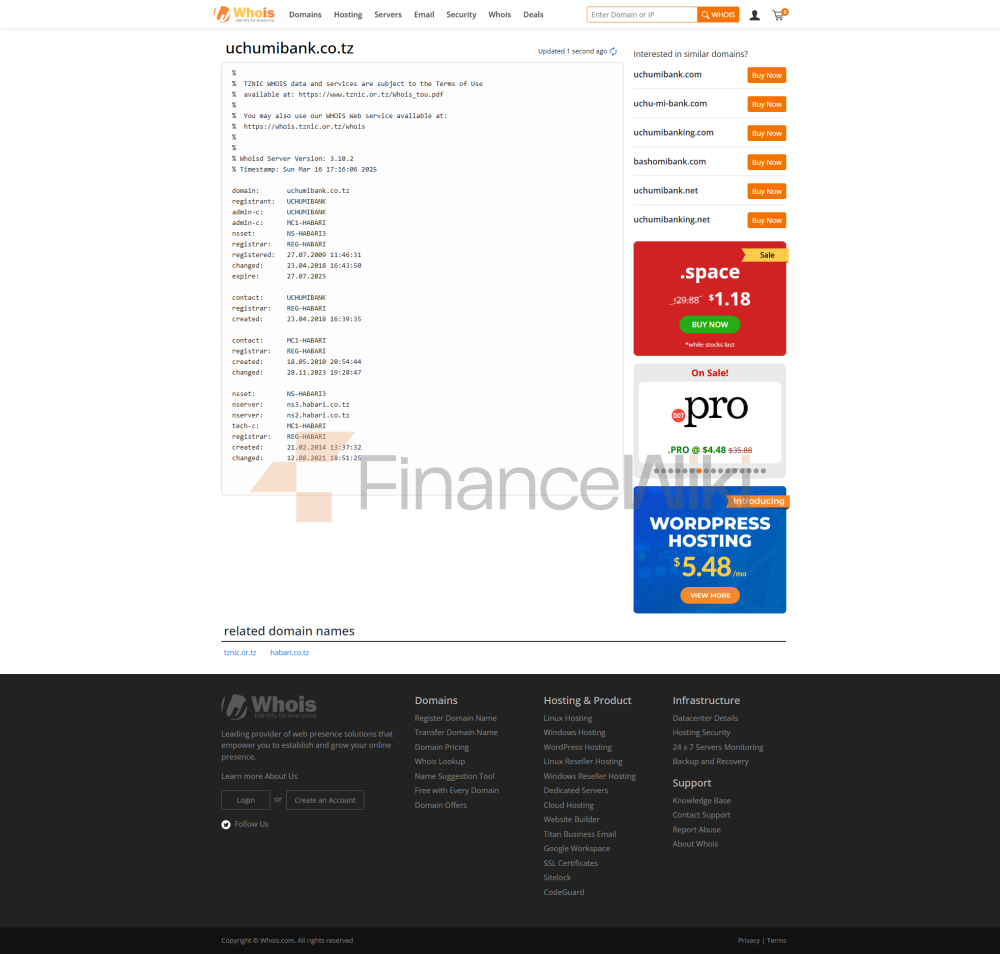

of the Bank UCB is a private commercial bank established on 16 September 2005 and licensed as a regional bank by the Central Bank of Tanzania (BOT) on 19 September 2005 and headquartered at ELCT-ND Building, Market Street Opposite Bus Terminal, P.O. Box 7811, Moshi, Tanzania. The bank is wholly owned by ELCT-ND and is not listed on any stock exchange, reflecting its private nature and focus on community finance.

UCB'S SERVICES MAINLY COVER THE NORTHERN PART OF TANZANIA, PARTICULARLY IN THE KILIMANJARO REGION, WITH A MAIN BRANCH IN MOSHI AND AN EXTENSION OF SERVICES THROUGH VILLAGE BANKS AND SAVINGS AND CREDIT COOPERATIVES (VICOBA AND SACCOS). The bank provides convenient cash withdrawals through the 1Link ATM network, enhancing financial accessibility for customers in urban and remote areas. UCB is regulated by the Central Bank of Tanzania (BOT) www.bot.go.tzRegulated, in line with the requirements of the Banking and Financial Institutions Act 2006 and regulated by the Tanzania Capital Market and Securities Authority (CMSA). The bank participates in the Tanzania Deposit Insurance Authority (TDIB) program, which protects customer deposits up to 10 million Tanzanian shillings (approximately US$4,000). There have been no recent major compliance issues, indicating stable operations.

Financial health

As UCB is a private bank, specific financial indicators such as capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio are not disclosed in detail in public information. According to the Central Bank of Tanzania, the capital adequacy ratio of Tanzania's banking sector averaged 19.0% in December 2022, higher than the regulatory minimum requirement of 14.5%, indicating that the industry is generally robust. As a regional bank, UCB expects its capital adequacy ratio to be at or above this level. In 2023, the non-performing loan ratio of Tanzania's banking sector is around 8.4%, and UCB is likely to face a similar trend. In terms of liquidity ratio, the Tanzanian banking sector stood at 62.9% in December 2022, well above the regulatory requirement of 20%, and UCB's liquidity position should be similarly robust.

Deposit & Loan Products

DepositsUCB offers a variety of deposit products to meet the needs of individual and SME customers:

current account: support daily transactions, business payment by check, no interest, Suitable for both personal and corporate customers.

Savings Accounts: Includes regular savings accounts and Mavuno accounts, offering up to 9% APR and no operating fees for Mavuno accounts.

Fixed Deposits: Fixed deposit accounts are available with tenors ranging from 1 month to 5 years and interest rates of up to 15% (subject to market conditions).

Featured products: Elimu Junior Education Savings Account, designed for children's education savings; Foreign currency account for international transactions.

LoansUCB offers a wide range of loan products, focusing on microfinance:

Payroll loans: for employees of government and private enterprises, with interest rates determined based on credit evaluation.

Capital loans: Short-term financing for customers who are waiting for the debtor to receive payment.

Insurance Loan (IPF): For asset protection, full collateral or cash guarantee is required.

Flexible repayment options: Early repayment or adjustment of repayment plan are supported, and customers can apply through online banking or UCB Wakala.

Service Experience

App & Online Banking

mobile appThe UCB Mobile App is available for iOS and Android, and features include real-time transfers, bill payments (utility bills, LUKU tokens, etc.), phone bill top-up, account management, and UCB Wakala cardless withdrawals. It can be downloaded through Google Play or App Store.

Online Banking: Available through UCB Online Banking, it supports account management, transfers, and mini statement viewing.

Technological innovations

enable the integration of TIPS (Tanzania Instant Payment System) with other mobile network operators (MNOs).

Quality of customer service

The service channels

provide telephone support (+255 272 750 492, +255 748 465 131), email (customerservice@uchumibank.co.tz) and social media responses (e.g. UCB Facebook). Opening hours are Monday to Friday 08:30-17:00, Saturday 08:30-13:00, Sunday 11:00-16:00.

Industry

RankingsUCB occupies a unique position in the microfinance sector in the northern region of Tanzania, with a focus on serving small and micro enterprises and underbanked groups. In 2016, the bank served 225,900 savings customers and 31,800 loan customers, with 29% of loan customers being women and 2% of rural customers.

Conclusion

Ushumi Commercial Bank (UCB) is an important regional bank in the northern region of Tanzania and is known for its focus on small and micro enterprises and underbanked grassroots economic groups. Through a single branch, UCB Mobile App and 1Link ATM network, UCB provides seamless financial services to its customers. With a strategic focus on cost optimization and digital transformation, it aims to become the preferred financial services provider in the Kilimanjaro region. Although some of the financial metrics and fee details are not disclosed, UCB's robust regulatory compliance, customer-oriented services, and commitment to community finance make it a trusted financial partner in Tanzania.