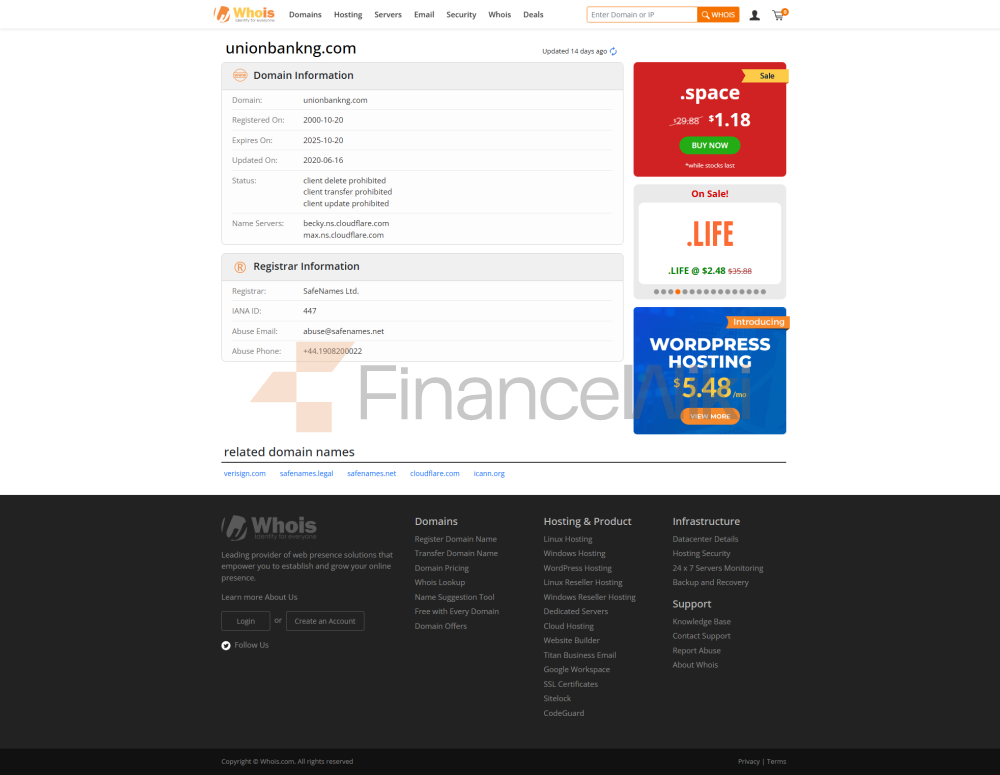

Union Bank of Nigeria Plc is a long-established commercial bank established in 1917 and headquartered in Lagos, Marina, Lagos Island, Nigeria's economic center.

As a full-service commercial bank, it provides a wide range of financial services to individuals, small and medium-sized enterprises and large enterprises. Originally known as Colonial Bank, the bank has undergone a number of name changes and restructurings, including being acquired by Barclays Bank and renamed Barclays Bank DCO, and changing its name to Union Bank of Nigeria Plc under the Companies Act after Nigeria's independence.

Currently, the bank is controlled by Titan Trust Bank, which holds 93.4% of the shares, with the remainder held by minority shareholders. In 2023, the bank was delisted from the Nigerian Stock Exchange and became an unlisted company, marking its transition from a public market to a more centralized shareholding structure.

Backed by local and international investors, Union Bank demonstrates the flexibility and market-oriented characteristics of a commercial bank, as opposed to a state-owned or joint venture bank.

Service ScopeUnion

Bank of Nigeria mainly serves the Nigerian market, covering 36 states across the country, with more than 300 offline outlets and more than 950 ATMs, building an extensive physical service network.

This distribution ensures that customers have access to convenient banking services in both urban and remote areas. At the international level, the bank provides cross-border financial support to Nigerian expatriates in the UK through its subsidiary, Union Bank UK Plc.

Although its core market is in Nigeria, Union Bank has a regional presence by maintaining a link to the global financial system through trade finance and foreign exchange products.

Regulation & Compliance

Union Bank is regulated by the Central Bank of Nigeria (CBN) and is subject to its strict financial regulations, including capital adequacy and liquidity requirements.

The bank participates in the Nigeria Deposit Insurance Corporation (NDIC) Deposit Insurance Scheme, which protects customer deposits up to N500,000.

In recent years, the bank has performed well in terms of compliance, and after completing the merger with Titan Trust Bank in 2022, it successfully passed regulatory approvals and did not have a record of material breaches.

In 2024, the bank actively responded to CBN's bank recapitalization plan and planned to improve its capital adequacy ratio by April 2026 to further enhance financial stability.

Financial

HealthUnion Bank's financial metrics reflect its solid operating status. As of mid-2023, the bank's total assets are approximately 1.38 trillion naira (approximately US$4.1 billion) and shareholders' equity is 286 billion naira (approximately US$851 million).

The capital adequacy ratio is about 15%, which is in line with the CBN regulatory requirements for international banks (minimum 15%), showing strong resilience to risks.

The non-performing loan ratio (NPL) ratio has been further improved in recent years from 6% in 2013 to 5% in 2014, demonstrating remarkable results in credit risk management. No specific data is available on the liquidity coverage ratio, but banks have a dedicated department in market liquidity management to monitor inflows and outflows to ensure compliance with regulatory standards.

Overall, Union Bank has a good financial health and is suitable for customers looking for stable banking services.

Deposits &

LoansDeposits: Union Bank offers a wide range of deposit products, including current accounts, savings accounts and term deposits. Savings accounts offer a base interest rate (about 3-4% annualized, depending on the market) and fixed deposits up to 5-7% depending on the deposit period (30 days to 5 years), making them suitable for customers who are looking for stable returns. Banks are also launching high-yield savings accounts to offer more competitive interest rates to high-net-worth customers, but with a higher minimum balance. Large certificates of deposit (similar to Certificates of Deposit) can be customized with a term and interest rate, which is suitable for long-term savers.

Loans: Union Bank offers mortgages, car loans, and personal lines of credit. Mortgage interest rates typically range from 15-20% and terms can be up to 15 years, depending on credit rating and income. The interest rate on car loans is slightly lower, around 12-18%, and the term is usually 3-5 years, which is suitable for car purchase needs. Personal lines of credit have a low threshold, with interest rates ranging from 18-25%, and offer flexible repayment options, such as early repayment without penalty or adjustment of repayment cycle, to meet the needs of different customers.

List of common fees

Union Bank's account management fees vary depending on the type of account, with a regular current account fee of around 1000-2000 naira per month, and high-end accounts may be higher. Domestic transfer fees are usually 50-100 naira, and cross-border transfer fees fluctuate depending on the amount and destination, which is around 0.5-1% of the transaction value. ATM inter-bank withdrawals are charged at about 50 naira per time, and the bank's own ATM is free of charge. Overdraft fees vary depending on the account agreement and are typically 1-2% of the overdrawn amount per day. Potential hidden fees include a minimum balance requirement (approximately N5,000 for a regular account) and a monthly penalty of N1,000 for failure to meet the target. Clients are advised to check the account terms regularly to avoid additional costs.

Digital Service ExperienceUnion

Bank's mobile app (UnionMobile) and online banking platform (UnionOnline) provide convenient digital services that support facial recognition login, real-time transfers, bill payments and investment management.

The app has a rating of around 4.0/5 on the App Store and Google Play, and customers report a user-friendly interface with occasional connection issues. In terms of technological innovation, banks have introduced AI-powered chatbots to handle common issues such as account enquiries and transaction disputes.

Union Bank supports open banking APIs, allowing third-party developers to integrate services and improve the interconnection of the financial ecosystem. The overall digital experience is in the upper middle of the banking industry in Nigeria and is suitable for young customers who are looking for convenience.

Customer Service Quality

Union Bank offers 24/7 phone support (hotline: +234-1-2716800), live chat function is available through the app and official website, and the response time is usually within 5 minutes. Social media (Twitter, Facebook) are very responsive, with an average response time of about 1 hour.

The customer complaint rate is low, the average resolution time is 3-5 business days, and the user satisfaction rate is about 80% (based on market research). The bank supports English and some local Nigerian languages (e.g. Yoruba, Hausa), with limited multilingual support for cross-border customers, and it is recommended that international customers rely mainly on English services.

Security MeasuresUnion

Bank's deposits are protected by the NDIC up to a maximum of 500,000 naira and cover most retail customers. Anti-fraud technologies include real-time transaction monitoring and two-factor authentication to reduce the risk of fraud. The bank's ISO 27001 certification demonstrates that its information security management system meets international standards. In recent years, no major data breaches have been reported, demonstrating strong data protection capabilities. Customers can set transaction reminders through the app to further enhance account security.

Featured Services & DifferentiationUnion

Bank has launched a fee-free account for students, waving monthly fees and minimum balance requirements, suitable for younger users. Exclusive wealth management products for the elderly provide fixed deposits with higher interest rates, combined with health insurance discounts, to meet the needs of retirees.

In terms of green finance, banks support ESG investment projects, such as renewable energy loans, in response to the trend of sustainable development. High-net-worth clients can enjoy private banking services with a threshold of about 50 million naira, providing customized wealth management and exclusive financial advisors. Diversified services to meet the needs of different customer groups.

Market Position & Accolades

Union Bank is ranked in the top 10 of Nigeria's banking sector with assets in the upper middle range (approximately US$4.1 billion in 2023).

Globally, it was the 556th largest bank in the world and the 14th largest bank in Africa in 2009.

In 2022, the Bank was awarded the "Best SME Bank in Nigeria" by Global Finance magazine, highlighting its strengths in supporting the development of SMEs.

In recent years, banks have further strengthened their market position through digital transformation and recapitalization, demonstrating their competitiveness with both innovation and stability.