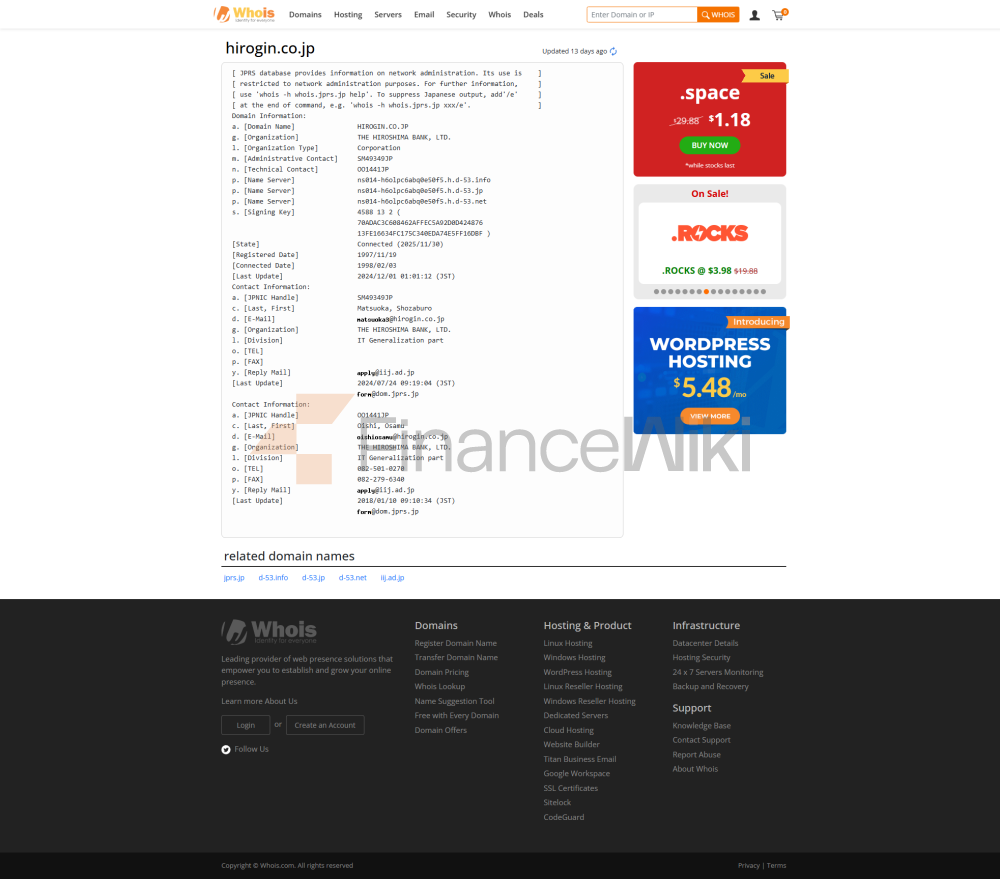

name and background<

spanstyle="font-family: sans-serif; color: black" > Hiroshima Bank, founded in 1878, is one of the oldest banks in Japan, headquartered at 1-3-8 Kaiyacho, Naka-ku, Hiroshima City, Japan. As a public company, its shares are listed on the Tokyo Stock Exchange under the ticker code 8379. The shareholder structure is diversified and includes mainly the Japanese government, local governments, and individual and institutional investors. This background of mixed ownership not only reflects its close connection with the local economy, but also reflects the characteristics of its market-oriented operation.

service scope

Hiroshima Bank's services are primarily focused on the western region of Japan, covering Hiroshima, Okayama, Yamaguchi and Ehime prefectures. As a regional bank, it is deeply involved in the local market and provides financial support close to the needs of residents and businesses. As of now, the bank has more than 175 offline branches and about 830 ATMs in Japan, and has built a wide range of traditional service networks. In addition, Hiroshima Bank has also taken steps towards internationalization, with representative offices in Shanghai, Bangkok and Singapore to provide cross-border financial services to customers, demonstrating the combination of its regional banking and global perspective.

services & products

Hiroshima Bank's service targets include both individual and corporate customers, and the product line is rich and targeted.

For individual customers, the bank offers a full range of services including savings accounts, personal loans, credit cards, investment products, insurance and pension plans. These products are designed to meet the diverse needs of customers, from day-to-day financial management to long-term wealth planning. For example, there are a wide variety of savings accounts, ranging from regular deposit accounts to high-yield fixed deposit options; Loan services cover housing loans, consumer loans, etc., to help customers achieve their life goals.

For corporate clients, Hiroshima Bank provides business lending, trade finance, cash management, investment banking services, and corporate advisory. These services are particularly focused on supporting small and medium-sized enterprises (SMEs) and helping them to meet the challenges of cash flow, business expansion and internationalization. The bank has also established long-term partnerships with local businesses through customized solutions, which have become an important pillar of regional economic development.

regulatory and compliance<

span style="font-family: sans-serif; color: black" > Hiroshima Bank is regulated by the Financial Services Agency (FSA) of Japan, ensuring that its operations meet the high standards of the Japanese financial system. As a responsible financial institution, Hiroshima Bank has joined the Japan Deposit Insurance System to provide additional security for customer deposits. In recent years, the bank has performed robustly in terms of compliance, with no major non-compliance incidents, demonstrating its maturity in risk management and internal control.

financial health

Hiroshima Bank's financial position is solid, and key indicators reflect its good operating ability and resilience to risks:

non-performing loan ratio: only 1.2%, which is lower than the industry average, indicating that the loan quality is high and the credit risk is properly controlled.

liquidity coverage ratio: 120% means that the bank has sufficient liquid assets to meet short-term funding needs, ensuring financial stability.

> capital adequacy ratio: 14.5%, well above the minimum requirement of 8% set by the Financial Services Agency of Japan, indicating that banks have sufficient capital buffers to deal with potential risks.

these figures show that Hiroshima Bank has not only performed well in terms of profitability, but has also been robust in the face of market volatility and provided reliable financial support to its customers.

digital service experience

With the advancement of technology, Hiroshima Bank actively embraces digital transformation to provide customers with a convenient and efficient service experience. The bank has launched a mobile banking app and online banking, and has improved user satisfaction through technological innovation.

its mobile banking app has an average rating of 4.5 stars on the App Store and Google Play, with generally positive user feedback. The app supports a variety of core functions, including:

real-time transfers make the flow of funds more flexible;

bill management to help users easily track and pay bills;

integrated investment tools to provide customers with one-stop financial services.

> face recognition login to improve account security and login convenience;

In addition, Hiroshima Bank has introduced AI customer service and robo-advisory services. AI customer service can quickly respond to customer inquiries, while robo-advisors provide personalized investment advice based on the customer's financial situation and risk appetite. These technological innovations not only improve service efficiency, but also bring customers a smarter financial experience.

customer service<

span style="font-family: sans-serif; color: black" > Hiroshima Bank values the customer experience and offers a variety of service channels to meet different needs. Customers can contact the bank by phone, email, online chat, and social media. The bank's customer service team is known for its professionalism and friendliness, and has earned high praise from customers for their responsiveness in answering account questions or dealing with complex needs. This multi-channel, round-the-clock service model ensures that customers can be supported anytime, anywhere.

security measures

In terms of information and fund security, Hiroshima Bank has invested a lot of resources to protect the interests of its customers. The bank's systems are certified by the ISO27001 Information Security Management System and are regularly scanned for security vulnerabilities and penetrated to ensure the robustness of the technical facilities. In addition, the bank provides customers with features such as two-factor authentication and SMS reminders to further enhance account security. Together, these measures provide a solid line of security for customers to use the bank's services with peace of mind.

featured services and differentiation<

span style="font-family: sans-serif; color: black" > Hiroshima Bank is unique in its deep local roots and deep understanding of customer needs. As a regional bank, it maintains close ties with communities and businesses in Hiroshima and the surrounding area, and is able to provide customized financial solutions tailored to the characteristics of the local economy. For example, banks have introduced flexible financing options for small and medium-sized enterprises to help them stand out from the competition.

At the same time, Hiroshima Bank actively fulfills its social responsibilities and participates in various public welfare activities, such as supporting education, environmental protection and post-disaster reconstruction projects. This approach of giving back to the community not only enhances the bank's social image, but also deepens the relationship of trust with customers. By combining financial services with local culture, Hiroshima Bank has established a distinct differentiator among regional banks.

summary

Hiroshima Bank is a regional commercial bank that combines historical heritage with modern vitality. With Hiroshima as the center and western Japan, it provides customers with traditional financial services through more than 175 outlets and 830 ATMs, while meeting the needs of the new era with the help of digital tools and an international layout. Whether it's solid financial performance, comprehensive product system, attentive customer service and advanced security, Hiroshima Bank has demonstrated its strength and responsibility as a pillar of local finance.