🏢 Company Profile and Background

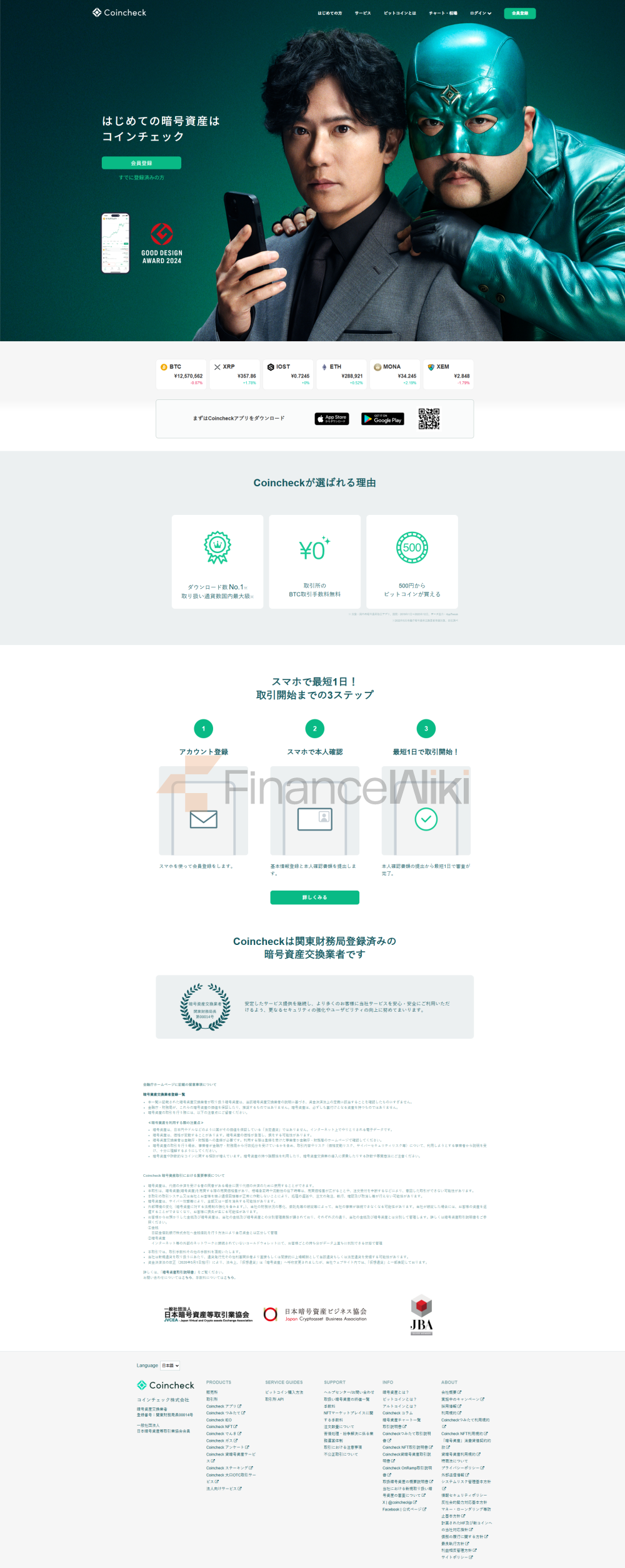

Coincheck is a fintech company focused on cryptocurrency trading, providing a multi-currency crypto asset trading platform and related digital asset services. Founded in 2012 and headquartered in Tokyo, Japan, the company is one of the leading platforms in the Japanese cryptocurrency trading market. Coincheck occupies a prominent position in the Japanese market with its user-friendly interface and diverse crypto asset services, including cryptocurrency trading, NFT marketplaces, and innovative payment solutions.

In 2018, Coincheck was acquired by Monex Group, Inc. for approximately 33.4 million USD as its wholly owned subsidiary. The acquisition strengthens Coincheck's capital strength and compliance capabilities, allowing it to further standardize its operations under the regulatory framework of the Financial Services Agency (FSA) of Japan. Despite a major security incident in 2018 (the theft of NEM tokens worth approximately 532 million USD), Coincheck fully compensated users with its own funds and strengthened security measures to restore trust in the market.

Coincheck is now expanding its global presence through its parent company, Coincheck Group N.V., which is listed on the NASDAQ (ticker symbol: CNCK). The company is committed to providing users with convenient digital asset services through blockchain technology and Web3 ecosystem, and occupies a unique growth potential in Japan's fourth-largest economy.

📋 Basic information

Full name and abbreviation:

Full name: Coincheck, Inc. (Japanese: コインチェック Co., Ltd.)

Abbreviation: Coincheck

English Head Office Address:

Shibuya Infoss Tower 12F, 20-1 Sakuragaoka-cho, Shibuya-ku, Tokyo 150-0031, Japan

Business Status:

Active

Company Type:

Private Limited Liability Company (Wholly Owned Subsidiary, Affiliated with Monex Group, Inc.)

Parent Company & Subsidiaries:

parent company: Coincheck Group N.V. (registered in the Netherlands, listed on NASDAQ, stock code: CNCK)

parent company: Monex Group, Inc. (Japanese online brokerage company).

Shareholding structure:

Coincheck, Inc. is wholly owned by Monex Group, Inc., which is 100% owned by Coincheck Group N.V. Coincheck Group N.V.'s shareholders include institutional investors, such as Wellington Management Co. LLP, whose shareholding percentage is not disclosed.

Key Executive Background:

Keisuke Wada (CEO): Co-founder of the company, with more than 10 years of experience in the fintech and blockchain industry, focusing on the technical development and market expansion of cryptocurrency trading platforms.

Yusuke Otsuka (COO): Co-founder, responsible for operations management and customer service strategy, with extensive experience in trading platform operations.

Toshihiko Katsuya (Representative): Joined Monex Group in 2018 after its acquisition, with a strong background in financial services with a focus on compliance and strategy development.

Oki Matsumoto (Executive Director): Monex Group executive in a strategic steering role at Coincheck with over 20 years of experience in the financial brokerage industry.

Advisory team:

Coincheck does not disclose detailed information about its advisory team, but its parent company, Monex Group, has partnered with the Japan Blockchain Association (JBA) and the Fintech Association to receive strategic consulting support from industry experts.

🏬

Companyclassification

Coincheck belongs to the fintech (FinTech) industry, which is specifically classified as a cryptocurrency exchange. Its business model is a centralized cryptocurrency exchange (CEX), which manages user funds, order matching, and asset storage through a centralized platform.

📊

Marketsegmentation

Coincheck primarily serves the Japanese cryptocurrency retail market, but also for some international users (US users are not available due to regulatory restrictions). Positioned as Asia's leading crypto asset trading platform, particularly in the Japanese market, Coincheck is known for its high trading volume, high liquidity, and user trust. According to CoinGecko data, Coincheck ranks highly among crypto exchanges in Asia, with a 24-hour trading volume of around 83.35 million USD (as of May 2025).

🛠️ service

Coincheck offers the following core services:

cryptocurrency trading: Spot trading of 19 major cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and more.

NFT Marketplace: The Coincheck NFT Marketplace allows users to trade non-fungible tokens (NFTs).

Lending service: Users can lend crypto assets to Coincheck and earn up to 5% annualized interest.

Payment Solution:

Coincheck Denki: Users can pay their electricity bills with Bitcoin and get cashback.

Coincheck Gas: Supports paying for gas with Bitcoin.

Over-the-counter (OTC) transactions: Customized services for large transactions.

Initial Exchange Offering (IEO): Provides a funding platform for emerging blockchain projects.

Coincheck Survey: Users earn cryptocurrency rewards for participating in surveys.

🛡️ Regulatory Information

Coincheck is regulated by Japan's Financial Services Agency (FSA) and holds a crypto asset exchange license.

Regulatory License No. Kanto Local Finance Bureau No. 00014

Regulator: Financial Services Agency (FSA)

of Japan Regulatory Effective Date: January

2019

Coincheck is a member of the Japan Blockchain Association (JBA) and the Japan Virtual Currency Business Association, and is regularly audited by the Japan Blockchain Association. The company strictly adheres to the Payment Services Act and the Financial Instruments and Exchange Act of Japan to ensure segregation management of user funds and anti-money laundering (AML) compliance.

💱 trading products

Coincheck supports trading on the following 19 cryptocurrencies (as of May 2025):

Bitcoin (BTC)

Ethereum (ETH

). Ripple (XRP)

Litecoin (LTC)

Ethereum Classic (ETC)

Lisk (LSK)

Factom (FCT)

Monero (XMR)

Augur (REP)

Zcash (ZEC)

NEM (XEM)

Dash (DASH)

Bitcoin Cash (BCH)

Stellar (XLM)

Enjin Coin (ENJ)

The Sandbox (SAND),

Polkadot (DOT),

Two Other Undisclosed but Supported Tokens

In addition, Coincheck offers NFT trading services, covering digital art, virtual real estate (such as Yuga Labs' Otherside project), and more.

📱 trading software

Coincheck offers the following trading platforms:

Coincheck Web: Browser-based trading interface with support for Tradeview Pro with real-time charting and order management capabilities.

Coincheck mobile app: Available for iOS and Android, it supports account management, trading, asset storage, and payment features. According to a 2017 App Ape study, the Coincheck app has a leading 50,000 users in Japan.

API interface: Provide trading and data query interfaces for developers and institutional users, and support automated trading strategies.

💳 Deposit and withdrawal methods

Deposit Methods:

fiat deposits:

Bank transfer (free for JPY, USD for a flat fee of 25 USD or 2500 JPY).

Convenience store payment/quick deposit: A fee of 756 JPY to 0.108% + 486 JPY will be charged depending on the deposit amount.

Cryptocurrency Deposits: All 19 listed cryptocurrencies are supported, and deposits are free.

Withdrawal method:

fiat withdrawal:

JPY withdrawal: 400 JPY.

USD withdrawal: 2500 JPY.

Cryptocurrency withdrawals: There is a fixed fee for each cryptocurrency, for example:

BTC: 0.0005 BTC

ETH: 0.01 ETH

XRP:0.15 XRP

LTC:0.001 LTC

All funds are handled through partner banks such as Resona Bank and SBI Sumishin Net Bank, and crypto assets are stored in cold or hot wallets.

📞 customer support

Coincheck offers multilingual customer support, including English, Japanese, Chinese, and Indonesian. Support channels include:

online inquiry form: Submit questions through the official website to handle personal privacy and account-related matters.

FAQ Center: Covers frequently asked questions about account registration, transactions, fees, and security.

Phone support: A specific phone number is not disclosed, but indirect support is provided through Monex Group's customer service network.

Users are required to complete two-factor authentication (2FA) to enhance account security. Coincheck's customer support is known for its responsiveness and intuitive user experience, especially in the Japanese market.

>

🔗 Core business and services

Coincheck's core business is to serve cryptocurrency exchanges, and it revolves around the following areas:

spot trading: provides low-cost trading of 19 cryptocurrencies, and BTC trading is free of fees.

NFT Ecosystem: Support digital asset innovation through the Coincheck NFT Marketplace.

Payment innovation: Integrate cryptocurrencies into everyday life payment scenarios through Coincheck Denki and Gas services.

Lending and appreciation: Provide users with crypto asset lending with up to 5% annualized return.

Web3 Expansion: Explore new applications of blockchain through IEOs and virtual real estate investments such as the Otherside project.

These services are centered around Japanese retail users, with an emphasis on ease of use and security.

🖥️ Technical infrastructure

Coincheck's technical infrastructure includes:

trading engine: a high-performance matching engine that supports high-frequency trading and low-latency order execution.

Wallet system:

cold wallet: More than 90% of user assets are stored in an offline environment to prevent network attacks.

Hot wallets: A small number of assets are used for daily transactions, and real-time data is traceable.

Security measures:

two-factor authentication (2FA).

Cooperate with global information security companies to conduct regular system security audits.

Mobile & Web Platform: Hybrid development based on HTML5 and native apps to ensure cross-device compatibility.

Blockchain technology: It supports multi-chain asset management and is compatible with mainstream blockchain networks such as Bitcoin and Ethereum.

⚖️ Compliance & Risk Control System

Compliance System:

Coincheck strictly complies with the regulatory requirements of the Financial Services Agency of Japan and implements the following measures:

KYC/AML: Users are required to complete identity verification (email, mobile phone number, government ID, and proof of address).

Segregation of funds: Client funds are managed separately from the company's own funds and stored in designated bank accounts.

Regular audits: Audits by the FSA and the Japan Blockchain Association.

Risk Control System:

Security Incident Response: After the NEM theft incident in 2018, Coincheck upgraded its multisig wallet and intrusion detection system.

Transaction Monitoring: Monitor abnormal transactions in real-time to prevent market manipulation and money laundering.

User protection: Reduce asset risk with cold wallet storage and 2FA.

📈 Market Positioning & Competitive Advantage

Market Positioning:

Coincheck is positioned as a leading retail cryptocurrency exchange in Japan, targeting individual investors and small and medium-sized institutions. Its user-friendly interface and innovative services, such as NFTs and payment solutions, make it widely attractive in the Japanese market.

Competitive Advantage:

High liquidity: The BTC/JPY trading pair has a 24-hour trading volume of 76 million USD and leads the market depth.

No transaction fee policy: BTC transactions are free of handling fees, reducing user costs.

Regulatory compliance: FSA licenses and Monex Group endorsements enhance user trust.

Innovative services: The expansion of NFT marketplaces and payment scenarios is ahead of some of its competitors.

Technical advantages: Intuitive trading interface and stable mobile app enhance user experience.

Key competitors include bitFlyer, Binance Japan, Crypto Facilities, and others.

🤝 Customer support and enablement

Coincheck empowers customers by:

educational resources: tutorials that provide the basics of cryptocurrencies and blockchain.

Flexible account tiers: Supports deposits as low as 500 USD and withdrawal limits of 300 USD, making it suitable for beginners.

Innovation Incentive: Create additional revenue for users through Coincheck Survey and lending services.

Community Engagement: Enhance user engagement through social media and Monex Group's Web3 activities.

Customer support is centered on quick response and multilingual service, especially in the Japanese market.

🌱 Social Responsibility and ESG

Coincheck's social responsibility and ESG (Environmental, Social, Governance) practices include:

Environment: Promote low-carbon payment methods through Coincheck Denki and encourage the use of blockchain technology to reduce the carbon footprint of traditional finance.

Society: Support financial inclusion and make digital assets accessible to more Japanese users through low-barrier cryptocurrency services.

Governance: Strict compliance and transparency measures, including publicly available regulatory information and audit reports.

The specific ESG project data is not disclosed, but Coincheck indirectly participates in social welfare activities through Monex Group's CSR framework.

🌐 Strategic cooperation ecosystem

Coincheck's strategic partnerships include:

Monex Group: providing capital and strategic support to drive NASDAQ listing and global expansion.

Japan Blockchain Association (JBA): Participate in the development of industry standards and enhance regulatory collaboration.

Fintech Association: Partnering with FinTech businesses to explore blockchain payments and Web3 applications.

Electric & Gas Company: Partnered with major Japanese utilities to launch Coincheck Denki and Gas services.

Yuga Labs: Entering the virtual real estate and metaverse space through the Otherside project.

These collaborations have strengthened Coincheck's ecological position in the Japanese and global markets.

💰 financial health

According to PitchBook data (as of March 31, 2025):

revenue: 2.51 billion USD in the last 12 months.

Market Cap: Coincheck Group N.V. has a market cap of around 801 million USD and its stock price is 6.12 USD per share.

Earnings per share (EPS): -0.72 USD, reflecting some earnings pressure.

Stock Performance: A total of 131 million shares outstanding, with a stable performance since listing on the NASDAQ.

The specific balance sheet and cash flow data are not disclosed, but Monex Group's financial support provides it with stable capital backing.

🛤️ future roadmap

The future direction of Coincheck includes:

global expansion: Explore more international markets through the NASDAQ listing and Coincheck Group N.V.'s platform (the US market is not open due to regulatory restrictions).

Web3 innovation: Increase investment in NFTs, metaverse, and decentralized applications, such as the Monex Web3 ID project.

Diversification of services: Launched more retail-oriented financial products, such as staking services (Coincheck Staking has been launched).

Technology upgrades: Continuously optimize the trading engine and security system to improve user experience and asset protection.

Deepening compliance: Working with the FSA and other international regulators to ensure compliance for global operations.