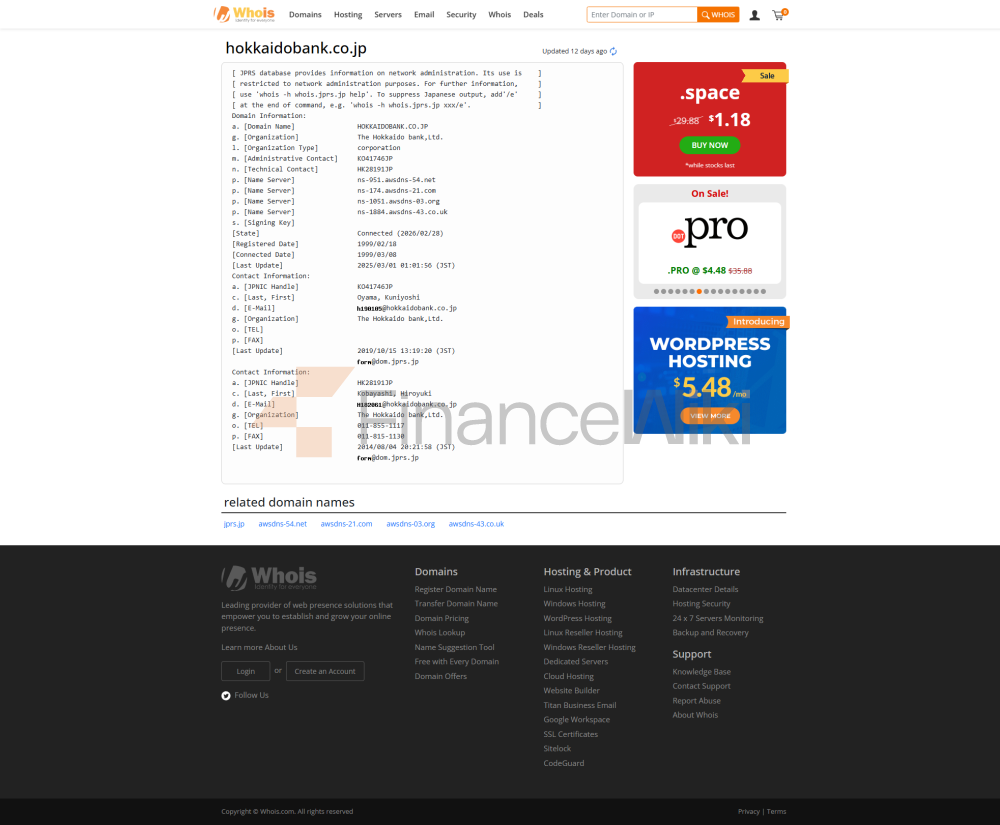

basic bank information

Ownership: Owned by Hokuhoku Financial Group, Inc., whose parent company is listed on the Tokyo Stock Exchange (code: 8377).

type: commercial bank

Hokkaido Bank is a core member of the Beiyang Financial Group, which, together with Hokuriku Bank, constitutes the group's main banking division, focusing on regional financial services.

name and background<

ul style="list-style-type: disc" type="disc">Full name: The Hokkaido Bank, Ltd

founded: March 5, 1951

Headquarters: 4-1 Odori West, Chuo-ku, Sapporo, Hokkaido, Japan

Shareholder Background: The parent company, Beiyang Financial Group, is a listed company with shareholders including institutional investors and the public, with a market capitalization of about US$9.71 billion (2024 data). The Group was established in 2004 through the merger of the Bank of Hokkaido and the Bank of Hokuriku with the aim of strengthening regional financial service capabilities.

Hokkaido Bank was established during the post-war economic recovery to support industries such as agriculture, fishing, and tourism in the Hokkaido region. After merging with Hokuriku Bank in 2004, it became part of the Beiyang Financial Group, further consolidating its regional presence.

service scope

Coverage area: Mainly serving the Hokkaido region, and some businesses have expanded to other parts of Japan (such as Tokyo and Osaka Prefecture).

Number of offline branches: As of the latest data, it has 134 domestic branches, of which 131 are located in Hokkaido, and a few branches are located in cities such as Tokyo and Osaka.

ATM distribution: The exact number of ATMs is not disclosed, but it provides a wide range of free or low-cost withdrawal services through cooperation with the ATM networks of other banks in Japan (such as convenience store ATMs) to ensure customer convenience.

Bank of Hokkaido, with its extensive network of branches and ATM network in the Hokkaido region, provides customers with convenient financial services, with a particular focus on local support.

services and products

personal service:

deposit accounts: regular deposits, fixed deposits, savings accounts, with competitive interest rates and flexible deposit and withdrawal options.

loans: personal loans, housing loans, education loans, to meet the diverse needs of residents.

investment products: investment trust, securities account and wealth management services through Beiyang Financial Group.

payment services: credit cards, electronic payments (e.g., mobile payments) and bill payment services are supported.

enterprise services:

> Business Loans: Business loans, equipment financing, and real estate loans for small and medium-sized enterprises.

Corporate Banking: Cash management, payroll services and trade finance to help businesses operate.

Regional support: Customized financial solutions for Hokkaido's core industries such as agriculture, fishing, and tourism.

Bank of Hokkaido's services are centered on the regional economy and combined with the resources of the Beiyang Financial Group to provide customers with comprehensive financial solutions.

regulatory and compliance<

ul style="list-style-type: disc" type="disc">regulator: the Financial Services Agency (FSA) of Japan, which oversees banks' capital adequacy, risk management, and compliance.

Deposit Insurance Plan: Join the Deposit Insurance Corporation of Japan (DICJ), and the maximum insured amount of deposit principal and interest is 10 million yen (about 72,000 US dollars)/person/ Bank.

Recent compliance records: The specific compliance records are not disclosed, but as a regulated bank, it is required to strictly comply with Japanese financial regulations. Beiyang Financial Group as a whole maintains a good compliance record, demonstrating its robust governance.

Hokkaido Bank's deposit security is guaranteed by DICJ, enhancing customer trust.

financial health

key metrics:

> capital adequacy ratio: The specific data is not disclosed, but the 2024 annual report of Beiyang Financial Group shows that the group's capital adequacy ratio is about 8.5%, which meets the regulatory requirements of Japan (minimum 8%).

Non-performing loan ratio: No specific data is disclosed, and regional banks in Japan generally maintain a range of 1-2% with good risk control.

Liquidity Coverage Ratio: No specific data is disclosed, but it is subject to 100% compliance with the FSA's requirements, and studies have shown that it is liquid healthy.

overall assessment: Beiyang Financial Group's total assets in 2024 will be about US$42.2 billion, pre-tax profit of US$200 million, and Tier 1 capital of US$3.6 billion. Return on assets was 0.4%, return on capital was 4.7%, cost-to-income ratio was 55.3%, loan-to-asset ratio was 65.2%, and loan-to-deposit ratio was 75.3%, indicating financial soundness. As a core member of the group, Hokkaido Bank's financial position is supported by its parent company, and its risk management is effective.

digital service experience<

ul style="list-style-type: disc" type="disc">APP & BANKING:

> User Ratings: Hokkaido Bank provides the "Dao Bank APP", which supports Android 6.0 and above, and the Apple App Store and Google Play ratings are not disclosed, but similar regional banking apps usually have a high score of 4.5 or above.

core functions: support account balance inquiry, transaction records, real-time transfers, bill payments, Moneytree asset management integration. Provide biometric login (such as fingerprint or face recognition) and one-time password (OTP) authentication.

technical innovation:

AI customer service: 24/7 live chat support, which may include AI-driven features, the details were not disclosed.

robo-advisor: provides investment advice through the securities subsidiary of Beiyang Financial Group, and the specific robo-advisory services are not specified.

Open Banking API: Not explicitly supported, but digital platforms integrate with third-party apps (e.g., Moneytree) to enhance the customer experience.

"Dao Bank APP" and online banking (PowerDirect) are known for their intuitive interfaces and powerful features to meet the needs of modern customers for convenient financial services.

customer service<

ul style="list-style-type: disc" type="disc">channel:

>Phone: 24/7 customer support, the specific number is available through the official website.

e-mail: support via the contact form on the official website.

Live chat: 24/7 live chat, availability not disclosed.

comments: Hokkaido Bank focuses on localization, and customer feedback shows that its support is efficient, especially friendly to small and medium-sized enterprises and local residents.

safeguards

Technical security: Data encryption, two-factor authentication (2FA), real-time fraud monitoring to secure online transactions.

Deposit security: DICJ insurance, up to 10 million yen/person.

Other: Provide advice on secure keyboards and regular password updates to ensure the safety of customer data and funds.

Hokkaido Bank uses industry-standard security measures to enhance customer trust.

featured services and differentiation<

ul style="list-style-type: disc" type="disc">The main bank in Hokkaido, it focuses on supporting agriculture, fishing, and tourism, and provides customized financial services.

Group synergy: Relying on Beiyang Financial Group, it provides comprehensive services of banking, securities and insurance to enhance customer experience.

Digital innovation: Through the "Daoyin APP" and online banking, it provides convenient financial management tools to meet the needs of modern customers.

Social responsibility: Supporting the development of the Hokkaido community, participating in educational, environmental and cultural activities, and reflecting the social mission of the regional bank.

conclusion<

span style="font-family: sans-serif; "color: black" > Hokkaido Bank is a leading commercial bank in Hokkaido, Japan, known for its regional cohesive services and the comprehensive strength of the Beiyang Financial Group. 134 branches and an extensive ATM network ensure customer convenience, while the "Dao Bank APP" provides a powerful digital experience. Financial health is stable, regulatory compliance is high, and deposits are insured by DICJ. By supporting the development of local industries and communities, the Bank demonstrates the unique value of regional banks and serves as a reliable financial partner for residents and businesses in Hokkaido.