Type of bank

Housing Finance Bank (HFB) is a commercial bank with housing finance as its core business, while providing a full range of retail, corporate and investment banking services. As a leader in Uganda's mortgage market, HFB has a significant advantage in the housing finance sector.

Name & Background

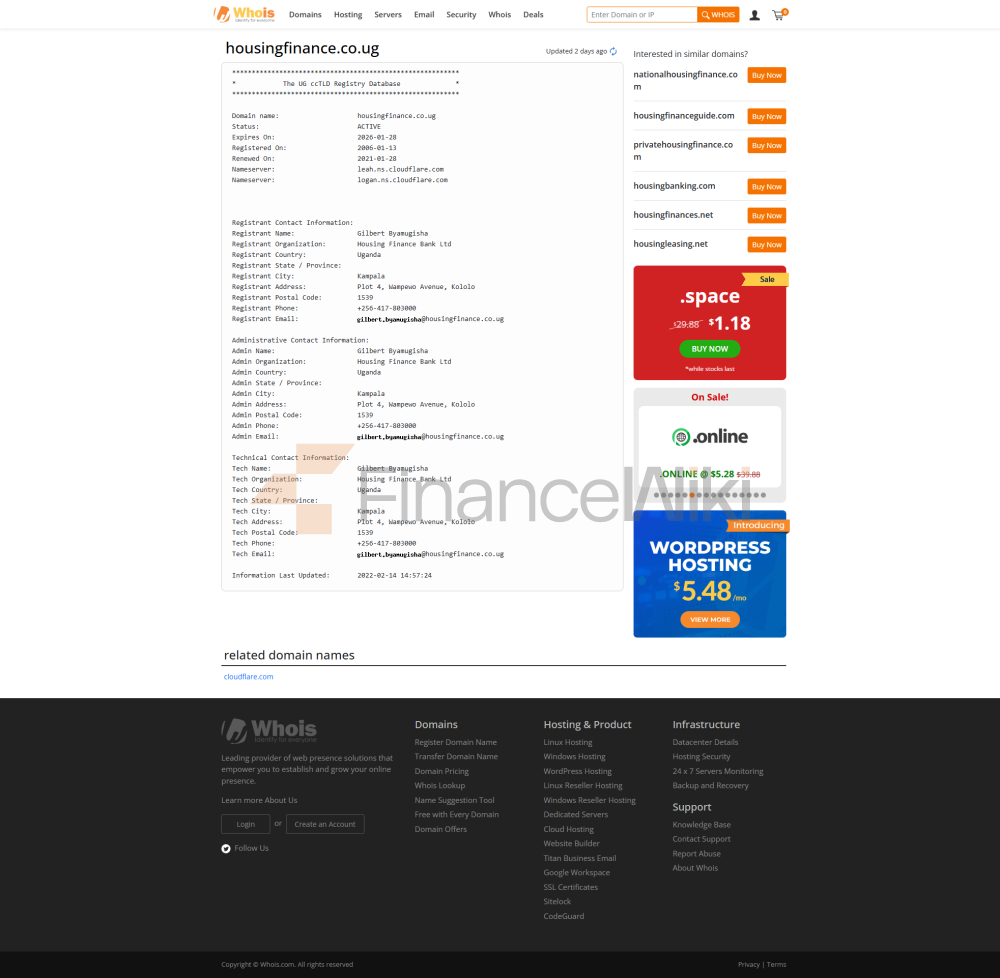

- Full Name: Housing Finance Bank Limited

- Date of Establishment: Originally established in 1967 as Housing Finance Company Uganda Limited, it focused on providing mortgages and accepting deposits from the public. In 2007, HFB obtained a commercial banking license from the Bank of Uganda and transformed into a fully licensed commercial bank.

- Headquarters location: Investment House, 4 Wampewo Avenue, Kololo District, Kampala, Uganda.

- Shareholder Background: HFB is a public limited company with major shareholders including:

- Uganda National Social Security Fund (NSSF): 50%

- Government of Uganda: 49.18%

- National Housing and Construction Corporation (NHCCL): 0.82%

Theauthorized and paid-up capital is 61 billion Ugandan shillings (approximately 61 billion UGX).

Scope of Services

- Regions Covered: HFB operates primarily throughout Uganda and its services include personal banking, corporate banking, mortgage and investment products.

- Number of offline outlets: As of December 2022, HFB has a number of branches in Uganda, including Kololo Headquarters, Kampala Main Branch, Mbarara Branch, Mbale Branch, Arua Branch and Nansana Service Centre.

- ATM distribution: HFB has an extensive network of ATMs across the country, which is convenient for customers to make cash deposits and withdrawals. In addition, HFB has expanded its service coverage through Agency Banking, which allows customers to conduct basic banking transactions through agent points.

Regulation & Compliance

- Who is regulated: HFB is regulated by the Bank of Uganda and complies with the Financial Institutions Act No. 2 of 2004.

- Deposit Insurance Scheme: HFB's client deposits are protected by the Deposit Protection Fund of Uganda up to a maximum of 10 million Ugandan shillings (approximately 10 million UGX).

- Recent Compliance Record: As a highly regulated commercial bank, HFB is subject to the compliance requirements of the Central Bank of Uganda. No recent public records involving significant violations were found, indicating good compliance.

Financial Performance

- Total Assets: As of December 31, 2023, HFB's total assets amounted to 2.14 trillion Ugandan shillings (approximately US$569.6 million).

- Profitability: In 2023, HFB achieved an after-tax profit of 65.1 billion Ugandan shillings (approximately US$16.37 million), an increase of 11.3% year-on-year, thanks to digital transformation and revenue diversification strategies.

- Deposit growth: HFB ranked first in Uganda's banking sector in terms of deposit growth in 2023, demonstrating its strong market appeal and customer trust.

- Capital injections: In 2017, the NSSF and the Government of Uganda each injected $8.2 million (for a total of $16.4 million) to enhance HFB's lending capacity and liquidity.

Deposits &

LoansDeposits

HFB offers a variety of deposit products to meet the needs of different customer groups:

- Demand deposits: Includes "Easy Savings Account" (for low- and middle-income customers), "U – Savers Account" (for students and young adults), "Salary Current Account" (for salaried customers) and "Pearl Current Account" (for high-end customers).

- Fixed Deposits: HFB offers fixed deposit products with tenors ranging from 3 months to 10 years, and customers can choose to receive interest on a monthly, quarterly or semi-annual basis.

- High-Yield Savings Account:

- Toto's Treasure Account: A savings account designed for children, operated by a parent or guardian to encourage a habit of saving.

- Easy Savings Account: A low-cost trading account for low- and middle-income clients.

- U – Savers Account: A low-cost savings account for students and young adults.

- Large Certificates of Deposit (CDs): HFB's fixed deposit products offer higher interest rates than regular savings accounts and offer flexible tenors for long-term investments.

Loans

HFB is the largest mortgage provider in Uganda and offers a wide range of personal and business loan products:

- Mortgages: HFB offers a wide range of home loan products, including loans to purchase or complete a home. The loan amount can be up to 80% of the value of the property, with a repayment period of up to 20 years.

- Car Loan: No specific information found, but HFB may offer a personal car loan, which needs to be further confirmed by consulting the bank.

- Personal Line of Credit: These include Swift Loan, Personal Secured Loan and HFB Woman Pearl Overdraft.

- Flexible repayment options: HFB's loan products typically offer flexible repayment terms and methods, with specific terms depending on the type of loan and the customer's circumstances.

Digital Service Experience

App & Online Banking

HFB offers a mobile banking app (HFB Mobile Banking), which can be downloaded from Google Play and App Store for iOS and Android devices.

- User Ratings: On the Google Play Store, users have mixed reviews of the HFB mobile app. Some users praised the convenience and fast transaction features, but others reported stability issues, such as delayed transactions or uncredited funds.

- Core features:

- Real-time transfers: Instant transfers between accounts are supported.

- Bill Management: Allows customers to pay utility bills, school fees, and more.

- Investment Instrument Integration: Support for the purchase of Treasury bills and bonds.

Customer Service Quality

Service Channels

- 24/7 Telephone Support: HFB provides a round-the-clock customer service hotline that customers can contact via the "Contact" page of its website.

- Live chat: HFB supports the live chat function, which is convenient for customers to consult quickly.

- Social Media Responsiveness: HFB engages with customers through social media platforms such as X and Facebook and is more responsive.

Complaint Handling

- HFB has a dedicated complaint handling procedure and customers can submit complaints through its website. The bank undertakes to respond within two weeks of receipt of the complaint.

- In 2024, HFB received the "Best Customer Service Bank Uganda 2024" award, demonstrating its excellence in customer service.

Multi-language support

- HFB's primary language of service is English, which meets Uganda's official language requirements.

Niche

– Student Account: HFB offers "U – Savers Account", which is designed for students and young adults and is low cost and easy to operate.

- Exclusive wealth management for the elderly: No specific wealth management products for the elderly have been found, but HFB's diversified accounts may meet the needs of elderly customers.

- Green financial products: HFB won the "Most Sustainable Financial Service Provider 2024" award in 2024, indicating that it may offer environmental, social and governance (ESG)-related financial products, such as green loans or sustainable investments.

- Women's Empowerment: HFB supports female clients with products such as the "HFB Woman Pearl Overdraft" and won the "Empower Her Awards" in 2024 for gender equality initiatives.

High Net Worth Services

- Pearl Current Account: An exclusive service account designed for high-end clients, providing personalized banking solutions.

Market Position & Accolades

Industry Rankings

- HFB is the leader in Uganda's mortgage market with a market share of approximately 60% (as of 2023).

- Total assets of 2.14 trillion Ugandan shillings, making it an important player in Uganda's banking sector.

Awards

- Empower Her Awards 2024: Receive the "Empower Her Award" and "Woman of the Future" awards for her contributions to gender equality and women's empowerment.

- Global Brand Awards 2024: Winner of "Most Sustainable Financial Service Provider 2024" and "Best Banking CEO in Uganda 2024".

- World Economic Magazine Awards 2024: Winner of "Best Mortgage Loan Bank Uganda 2024" and "Best Customer Service Bank Uganda 2024".

SummaryHousing

Finance Bank is one of the pillars of Uganda's banking sector and is known for its expertise and market leadership in the field of housing finance. Since its inception in 1967, HFB has grown from a housing finance company to a full-fledged commercial bank serving individuals, corporations and high-net-worth clients. Its solid financial performance, extensive service network and commitment to sustainable development have made it an important player in Uganda's financial markets. HFB's digital transformation and the quality of its customer service further enhance its competitiveness, especially in the context of several international awards in 2024. Whether it's a family looking for a home loan or a business in need of flexible financial solutions, HFB is committed to meeting customer needs through innovation and service excellence.

The branch network

HFB has its corporate headquarters and main branches in the new headquarters building on Wampewo Avenue in Kololo Hill. HFB's former head office is located on Kampala Road.

Another branch in Kampala's CBD is located in Naccasero, across Naccasero Road from the Nigerian High Commission. There are two other branches in Kampala, located on the outskirts of Namuwongo and Ntinda.

In February 2009, HFB opened a branch in Mbalala, western Uganda. In March 2009, HFB opened a branch in an area called Kikuubo in Kampala. In June 2009, HFB opened a branch in Mbale and at the opening ceremony promised to launch online banking and rural mobile banking later in 2009. In July 2009, HFB opened a branch in Arua, its eighth in the country.

As of December 2022, HFB has branches in the following locations:

Kololo Head Office, Investment Company: 4 Wampewo Avenue, Kololo, Kampala Main BranchKampala

Road Branch: 25 Kampala Road, Kampala

Namuwongo Branch: 38 Kisugu Road, Namuwongo, Kampala

Ntinda Branch: Ntinda Mall, 1 Kimera Road, Ntinda

Nakasero Branch: 34A Nakasero Road, Nakasero, Kampala

Kikuubo Branch: Muzinge Dry Cleaners Building, 15 Nakivubo Road, Kampala

Garden City Branch: Garden City Mall, 64-68, Yusuf Lule Road, Kampala

Ndeeba Branch: 94-96 Masaka Road, Ndeeba, Kampala

Lira Branch: 4 Bazaar Road, Lira

Guru Branch: 26 Labwor Road, Gulu

Jinja Branch: Beamteks Plaza, 68 Main Street, Jinja

Mbarala Branch: Classic Hotel Building, 57 High Street, Mbarara

Mbara Branch: Bugisu Cooperative Union House, 2 Court Road, Mbale

Arua Branch: OB Plaza, 9-11 Adumi Road, Arua

Tororo Branch: 11 Mbale Road, Tororo

Mukono Branch: 51 Kampala Road, Mukono

Fort Portal Branch: 4 Kyebambe Road, Fort Portal

Nansana Service Center: Njovu Estate, Headquarters Building, 1158 Hoima Road, Nansana.