name and background<

spanstyle="font-family: sans-serif; color: black" > full name: Azərbaycan Beynəlxalq Bankı (ABB) OJSC

Founded: January 10, 1992

Headquarters Location: 67 Nizami Street, Baku, AzerbaijanShareholder

Background: ABB Bank is a state-owned bank with shares held by the Azerbaijani government, and the management of the bank was transferred to the Azerbaijan Investment Holding Company (AIH) by Presidential Decree of November 5, 2020. Banks are not listed on the stock exchange, but as open-ended joint-stock companies, their operations have a certain market-oriented character, emphasizing public services and economic support functions.

scope of services

coverage area: ABB Bank mainly serves the whole of Azerbaijan, covering major cities such as Baku, Ganja, Sumgait and liberated areas (such as Shusha, Lachin, Khankendi). The Bank supports regional and global financial activities through its subsidiaries and representative offices in Russia, Georgia, Qatar, London, Frankfurt, Luxembourg, Dubai and New York.

Number of offline branches: As of 2023, the bank has 66 branches and 13 branch offices, covering all major regions of Azerbaijan, serving both individual and corporate customers.

ATM distribution: The bank operates more than 900 ATMs in cities and remote areas across the country, including the first ATM in the liberated areas (such as Shusha), which supports withdrawals, transfers and payment services. In addition, the bank manages more than 13,000 POS terminals, which are widely distributed at trade and service points.

services & products

ABB Bank for individuals, Offering a wide range of financial products and services to corporate and institutional clients, covering the following areas:

Corporate Banking: Investment loans, working capital loans, trade finance, bank guarantees, bridge loans, and cash management services for large corporations. The Birbank Biznes platform provides remote account management and trading support to corporate clients.

SME Services: Provide business loans, guarantees, overdrafts and factoring services of up to 100,000 AZN through SME Center to help SMEs grow.

Card processing services: Through the AzerCard subsidiary, which was established in 1996, it provides card processing services and supports international payment systems such as Visa, MasterCard, American Express, Union Pay, etc. It is the only bank in Azerbaijan that offers the American Express card.

Other services: Provision of insurance services through subsidiaries, participation in government social programs (such as pension and payroll card services), and support for e-commerce payments and POS terminal services.

> Personal Banking: Savings accounts, current accounts, fixed deposits (up to 11% p.a.), consumer loans, credit cards (e.g. Visa, MasterCard, American Express, Union Pay), debit cards, mortgages, and foreign exchange services. The Birbank mobile app allows you to manage your account online, transfer money and make payments.

The bank serves approximately 2.2 million individual customers and 18,000 legal entities, and 99% of its non-lending business can be completed through digital channels, demonstrating its strong customer service capabilities.

regulatory and compliance<

span style="font-family: sans-serif; color: black" > regulator: ABB Bank is regulated by the Central Bank of Azerbaijan (CBAR) and is subject to the Azerbaijan Banking Act and international financial standards (such as the Basel Accord). Its risk management system is in line with CBAR's Enterprise Risk Management Standards for Banks.

Deposit Insurance Program: The bank participates in the Azerbaijan Deposit Insurance Fund (ADIF), which protects deposits of up to 30,000 AZN (about $17,600) per customer.

Recent compliance record: ABB Bank has a strong compliance record and has no record of major violations. It strictly enforces Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) regulations and ensures compliance through three lines of defense (business unit, risk management department, and internal audit). The bank is regularly audited by international parties and has received Ba2 ratings from Moody's and BB- from Standard & Poor's, one of the highest ratings in the banking sector in Azerbaijan.

financial health

ABB's financial performance reflects its market leadership, The following key indicators (as of December 31, 2021

):non-performing loan ratio (NPL): 4.21%, a significant decrease from 7.72% in 2020, reflecting effective credit risk management and improved asset quality.

Liquidity Coverage Ratio (LCR): The immediate liquidity ratio is 54%, higher than the regulatory requirement of 30%, indicating robust liquidity management.

> Capital Adequacy Ratio (CAR): 39.40%, This is well above the CBAR requirement of 12%, indicating a strong capital buffer.

As of 2021, the bank has total assets of 7.681 billion AZN, total loans of 3.104 billion AZN, and net capital of 1.71 billion AZN, demonstrating its financial soundness and sustained profitability.

digital service experience<

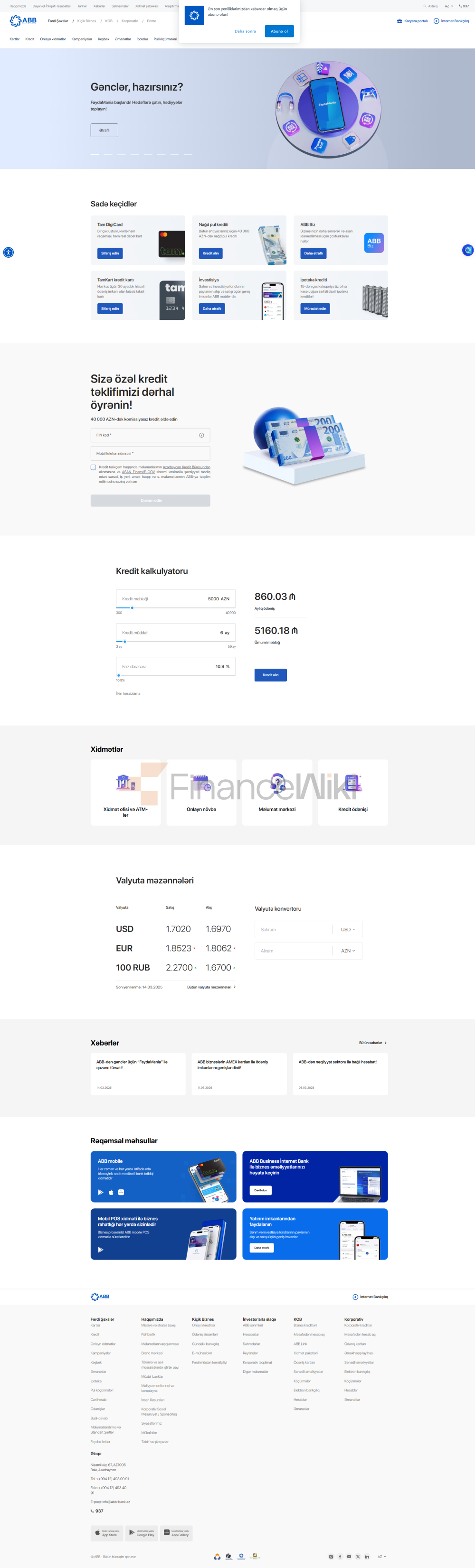

span style="font-family: sans-serif; color: black" > app and online banking: ABB Bank offers the Birbank mobile app and internet banking platform. Birbank is Azerbaijan's first fully digital banking platform, with a Google Play and App Store user rating of around 4.5 out of 5 stars, and is widely praised for its convenience, security, and rich features.

Core Features:

real-time transfers: support domestic and international transfers via BI-FAST and SWIFT systems.

Bill management: Payments on utilities, taxes, and loan repayments are supported.

investment tool integration: Provides deposit management, loan application, and trading of shares of securities and investment funds in the U.S. stock market.

technical innovation:AI customer service: Birbank integrates AI-based banking assistants to handle frequently asked questions and account inquiries.

Open Banking API: Facilitate the open banking ecosystem by enabling third-party developers to integrate payments and financial services through the Birbank platform.

Digital Deposits: Allows customers to open deposit accounts entirely online with an interest rate of up to 11% per annum.

> face recognition: supports account login and transaction verification.

The bank expects more than 60% of loans to be disbursed through digital channels by 2026, and its digital deposit portfolio has reached 1.1 billion AZN in 2024, highlighting its leading position in digital transformation.

customer service<

span style="font-family: sans-serif; color: black"> ABB provides multi-channel customer service, Meet the needs of individual and corporate customers:

Telephone: Customer Hotline *933 (domestic) or +994 12 493 00 91 (international), available 24/ 7 Support.

email: via the official website (". www.abb-bank.az) provides e-mail support, handles account and product inquiries.

Live chat: The Birbank app and internet banking platform offer a live chat feature to respond quickly to customer questions.

self-service area: Some outlets have 24/7 self-service areas, ATMs and payment terminals that support NFC card access.

security measures<

span style="font-family: sans-serif; color: black">ABB Bank uses multiple layers of security measures to protect customer assets and data:

Anti-Money Laundering & Anti-Fraud: Strict compliance with CBAR's AML/CFT requirements, monitoring of suspicious transactions, and regular risk assessments.

transaction security: Corporate clients reduce the risk of unauthorised transactions through Birbank Biznes' multi-level authorization mechanism.

Physical security: Branches and ATMs are equipped with surveillance systems and security personnel to prevent theft and fraud.

>Cybersecurity: Online transactions are secured using SSL encryption and multi-factor authentication, including facial recognition and SMS verification, and customer data is hashed and anonymized to ensure privacy.

featured services and differentiation

ABB Bank is unique among the Azerbaijani banking sector thanks to its state-owned background and extensive service network:

Largest service network: With 66 branches and more than 900 ATMs, it is the most extensive bank in Azerbaijan, serving 2.2 million individuals and 18,000 corporate customers.

Digital pioneer: Birbank, the first fully digital banking platform in Azerbaijan, won the "NETTY Mobile App of the Year" award, enabling 99% of non-loan transactions to be completed online.

SME support: Customized loans and financial advice to help SMEs grow through SME Center.

Social responsibility: Participate in government social projects, support the reconstruction of financial services in liberated areas (such as the establishment of ATMs in Shusha), and launch green banking products to promote sustainable development.

international payment network: As the only bank in Azerbaijan that offers American Express cards, it cooperates with international payment systems such as Visa, MasterCard, Union Pay, etc., to enhance the convenience of customer payment.

high ratings recognize: Moody's Ba2 and Standard & Poor's BB- ratings, reflecting its solid profitability and liquidity.

summary

ABB Bank, the largest commercial bank in Azerbaijan, is the backbone of the domestic financial market thanks to its state-owned background, extensive service network and leading digital capabilities. Banks meet the needs of individuals to large corporations through diversified products, solid financial performance, and customer-oriented innovation. Its contribution to SME support, digital transformation and financial reconstruction in the liberated areas further strengthened its market leadership. ABB Bank is a trusted partner for customers who want to carry out financial activities in Azerbaijan or who are looking for convenient banking services.