Family Bank Limited (FBL) is one of Kenya's leading private commercial banks, with a strong presence in the market for its customer-oriented services, innovative digital platform and commitment to financial inclusion. Since its establishment in 1984 as Family Finance Building Society Limited, FBL transformed into a fully licensed commercial bank in 2007, providing diversified financial solutions to individuals, SMEs and institutional clients through an extensive branch network and advanced digital services. Its brand mission is to be "With You, With You for Life", to drive economic development and financial inclusion in Kenya by empowering entrepreneurs and communities.

Basic Bank Information

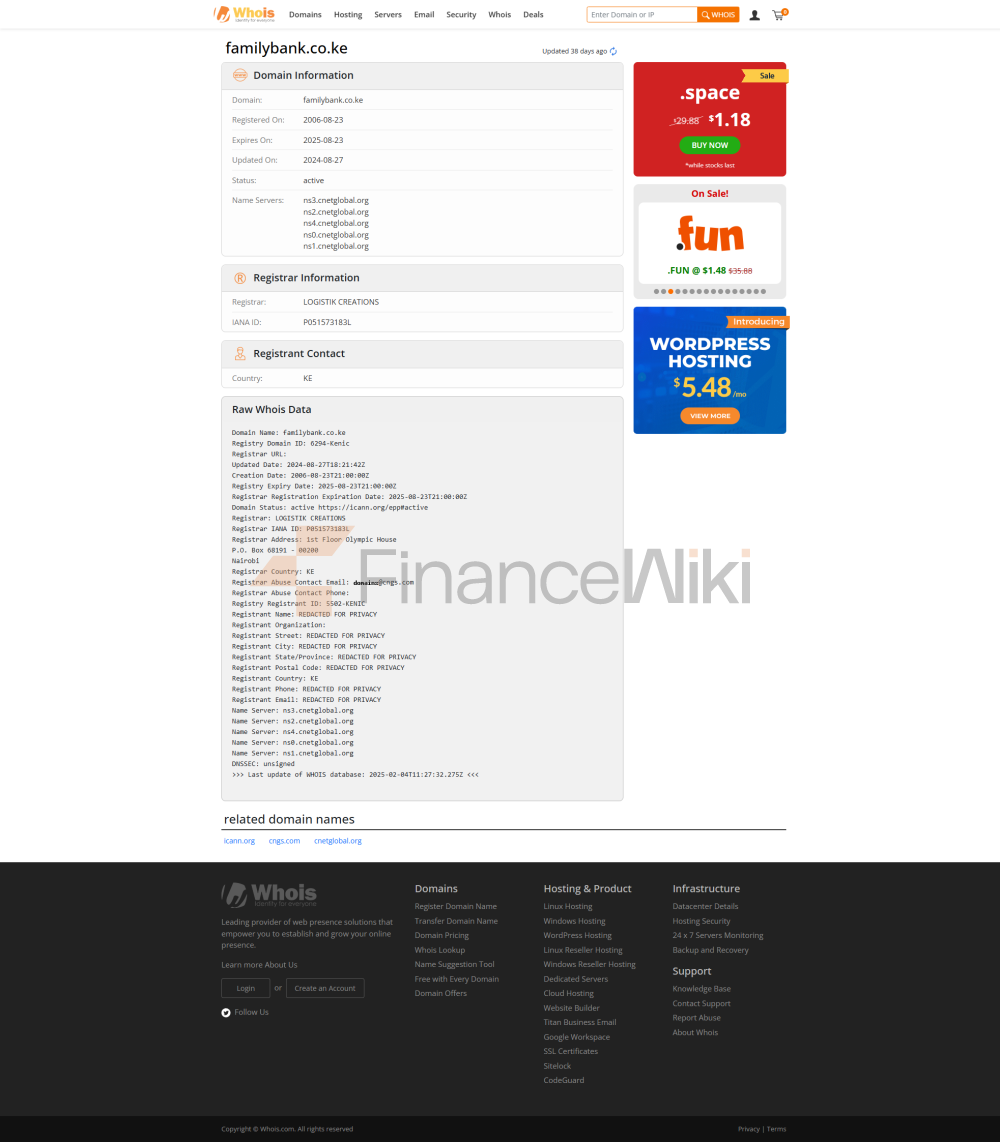

FBL is a private commercial bank established in 1984 and initially operated as Family Finance Building Society Limited, which was licensed as a commercial bank in May 2007 and is headquartered at Family Bank Towers, Muindi Mbingu Street, Nairobi, Kenya, Zip code 74145-00200. The bank is jointly owned by local and international investors, including Kenya Tea Development Agency and LAP Trust, and is not listed on the Nairobi Stock Exchange (NSE). FBL has expanded its financial product portfolio by providing insurance services through its wholly owned subsidiary, Family Bank Insurance Agency Limited.

FBL's services cover 95 branches in 32 counties in Kenya, with more than 1.7 million customers, and branches are located in Nairobi, Mombasa, Eldoret, Kisumu, Nakuru and other places. The bank provides convenient cash withdrawals through the 1Link ATM network, enhancing financial accessibility for customers in urban and remote areas. FBL is regulated by the Central Bank of Kenya (CBK) and is supervised by the Financial Sector Conduct Authority (FSCA). The bank participates in the Kenya Deposit Insurance Corporation (KDIC) scheme, which protects customer deposits up to Ksh100,000 (approximately US$800). There have been no recent major compliance issues, indicating stable operations.

Financial health

FBL is in a strong financial position, with profit before tax amounting to Ksh 1.5 billion in the first quarter of 2025, up 15.4 per cent year-on-year, total assets up 19.2 per cent to Ksh 174 billion, and loan balances up 10.1 per cent to Ksh 96.2 billion. Net interest income increased by 32.6% to Ksh3.2 billion and non-interest income increased by 32.1%, indicating improved profitability and asset quality. Although specific financial indicators such as capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio are not disclosed, the capital adequacy ratio of the Kenyan banking sector averaged 19.0% in December 2022 (above the regulatory requirement of 14.5%), the non-performing loan ratio was 14.5% in 2023, and the liquidity ratio was 62.9% (well above the regulatory requirement of 20%). As a mid-sized bank, FBL expects its financial metrics to meet or outperform industry standards.

Deposit & Loan Products

Deposit

FBL offers a variety of deposit products to meet the needs of individual and corporate customers:

current account: Includes Mwananchi Account, Jenga Bizna Account, Salary Account and Personal Current Account, which supports daily transactions without interest.

Savings account: Competitive interest rate, the specific interest rate needs to be checked through the bank, suitable for long-term savings.

Fixed Deposits: Terminities from 1 month to 5 years, with interest rates depending on market conditions and the amount of the deposit.

Featured product:P esaPap Wallet, which supports mobile savings and instant loans to enhance financial convenience.

LoansFBL

offers a wide range of loan products covering personal and business financing needs:

Mortgages: support the purchase or construction of a home, with fixed or variable interest rates, specific interest rates need to consult the bank.

Car Loan: Support for the purchase of a new or used car, with flexible terms and a maximum financing amount based on credit assessment.

Personal Loans: Includes PesaPap mobile loan with a facility fee of 7.5% (subject to the CBK benchmark rate) for a term of 30 days up to 50% of the client's net salary.

SME Loans: Supporting business expansion and operations.

Flexible repayment options: Early repayment, deferred repayment or adjustment of repayment plan are supported, and customers can apply through the PesaPap platform.

App & Bank

mobile app:P esaPap mobile banking app is available for iOS and Android, and features include balance inquiry, fund transfer, bill payment (NHIF, water bills, tuition, TV subscriptions, etc.), insurance purchase, mobile loan application, card management, and ticket purchase. With more than 50,000 downloads on Google Play, user feedback mentions cumbersome logins and improved features, and undisclosed ratings.

Online Banking: Offered through Family Bank eBanking, it supports account management, bulk payments (salaries, dividends, M-Pesa transfers), statement viewing, and transaction inquiry.

Quality of customer service

24

/7 telephone support (+254 703 095 445, +254 703 095 000, 020 3252 445, 020 3252 000), email ( info@familybank.co.ke) and social media responses (e.g. Family Bank Facebook). The online form submission promises to respond to the initial contact within 15 minutes.

Multi-language support

supports both English and Kiswahili for both local and cross-border customers.

Security measures

Fundsare

secured by the Kenya Deposit Insurance Corporation (KDIC) up to a maximum of Ksh 100,000. Anti-fraud technologies such as real-time transaction monitoring and biometric authentication are used to ensure the safety of funds.

Featured Services & Differentiation

Segments

green financial products: MajiPlus program, partnered with water.org to provide water, sanitation and cleanliness (WASH) financing.

Women's Banking: The Queen Banking program, which provides financial support specifically for women entrepreneurs, won the 2024 "Best Bank for Access to Funds" award.

Other features

PesaPap Wallet: Supports mobile savings and instant loans for enhanced financial convenience.

Bancassurance Services: Insurance products are provided through Family Bank Insurance Agency Limited.

Custodian Services: Authorized by the Capital Markets Authority (CMA) to provide custody of bonds and treasury bills.

Market Position & Accolades

Industry RankingsFBL

is a significant player among Kenyan mid-sized banks, with total assets of approximately Ksh174 billion (approximately US$132 million) in the first quarter of 2025, ranking in the upper middle of 43 banks. Total assets in 2017 amounted to Ksh 69.12 billion (approximately US$696 million), showing continued growth.

Awards

- "

Banking on Women Awards" 2024 and

"Best Customer Experience Level 2 Bank" 2023 (KBA Awards

). ICX Service Excellence Awards 2023,

Most Influential Agricultural Loan Bank 2023 (Aceli Africa Convention),

2015 Think Business Banking Awards

Conclusion

Family Bank Limited (FBL) is a private, customer-centric commercial bank that occupies an important position in Kenya's banking industry with its flexible financial products, extensive branch network, and advanced digital services. Through the PesaPap mobile app and online banking platform, the bank provides seamless financial services to individuals, SMEs and high-net-worth customers, especially those looking for low-cost and convenient services. Its excellence in financial inclusion, customer service, and innovation, complemented by robust regulatory compliance and industry recognition, makes it a trusted financial partner in Kenya.