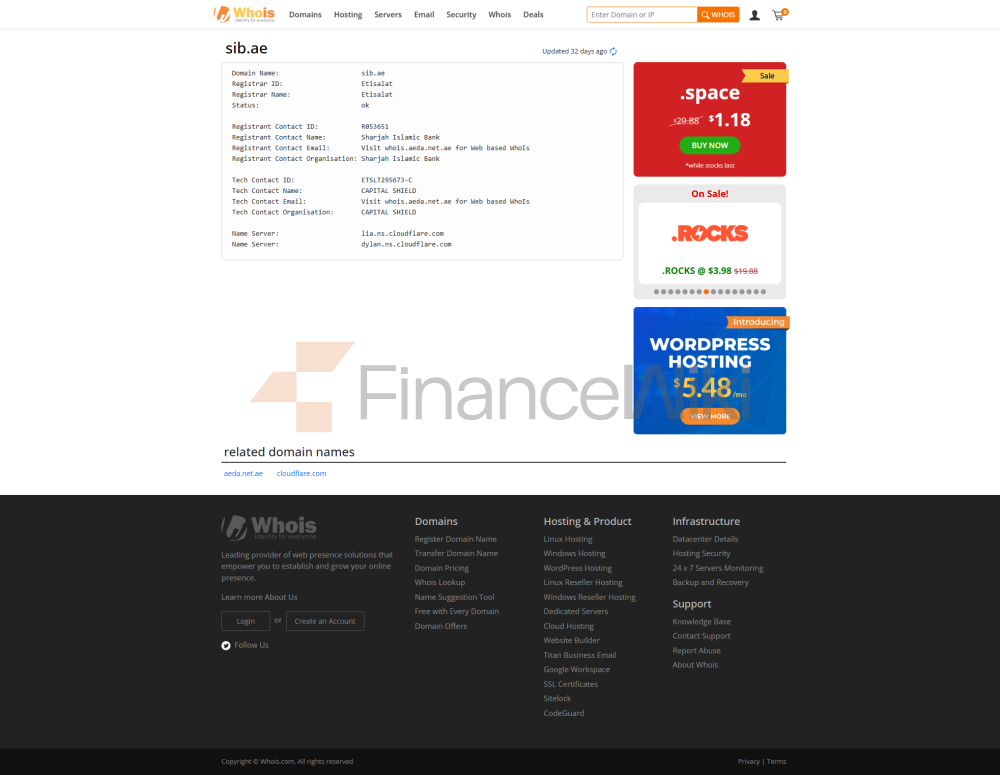

Bank BasicsSharjah

Islamic Bank (SIB) is a leading Islamic bank headquartered in Sharjah, UAE, which has been committed to providing Shariah-compliant financial services since its inception in 1975. As one of the first institutions in the UAE to fully transform into an Islamic bank, SIB completed this important transformation in 2004. The bank is listed on the Abu Dhabi Stock Exchange and its major shareholders include the Sharjah government and other institutional investors. SIB's service network covers all the emirates of the UAE, with multiple branches and an extensive ATM network. In addition, SIB actively participates in the international financial market, issuing a number of sukuk bonds, which have been recognized by international rating agencies.

Regulation &

ComplianceSIB is regulated by the Central Bank of the United Arab Emirates and follows the bank's capital adequacy and liquidity requirements. According to the December 2024 Pillar 3 Disclosure Report, SIB's capital adequacy ratio is 19.4%, which is above regulatory minimum. In addition, SIB has been certified to ISO 27001 for its information security management system, demonstrating its commitment to data security and the protection of customer information.

Financial HealthAs

of Q1 2025, SIB's non-performing loan ratio was 4.6%, an improvement from the previous quarter, indicating its solid asset quality. According to the Standard & Poor's report, SIB's risk-adjusted capital (RAC) ratio is 8.9% and is expected to approach the target level of 10% by the end of 2026. In addition, in March 2025, Fitch Ratings affirmed SIB's Long-Term Issuer Default Rating of "BBB+" with a stable outlook, reflecting its solid financial position.

Deposits & LoansDeposit

Class

Flexi long-term deposit accounts: Offers up to 4.10% expected yield with a deposit term of 24 or 36 months and a minimum deposit amount of AED 200,000 or USD 50,000. Clients can choose to pay their profits monthly, quarterly, semi-annually, annually or at maturity. In addition, customers can get up to 70% of the financing amount based on the deposit amount.

MaxPlus Deposit Account: Offers up to 10.50% expected yield, deposit term of 36 months, minimum deposit amount of AED 10,000. Clients can withdraw their funds at any time without terminating their deposit and can get up to 90% of the financing limit.

Loan Type

Personal Financing: Loan amount of up to AED 2,500,000 for up to 48 months. Customers can enjoy low profit margins and the first instalment can be deferred up to 150 days later.

Property Financing: We offer a wide range of property financing options, covering both residential and non-residential properties, to support the financing of projects under construction. Customers can choose the right financing solution according to their own needs.

Auto Financing: Flexible auto financing options for new and used car purchases, with loan terms and margins determined by customer qualifications and vehicle type.

List of common fees

Account Management Fee: Depending on the account type and client qualifications, a monthly or annual fee may apply. Please refer to the bank's charging schedule for specific fees.

Transfer fees: Domestic transfers are usually free, and cross-border transfers are subject to fees based on the amount and destination.

ATM Interbank Withdrawal Fee: Withdrawals at non-SIB ATMs may incur a processing fee, depending on the amount withdrawn and the ATM operator.

Overdraft fee: A fee is charged based on the amount and duration of the overdraft.

Hidden Fee Alert: Some accounts may have a minimum balance requirement that may be charged if it is not met.

Digital Service

ExperienceSIB provides a comprehensive range of digital banking services, allowing customers to manage their accounts, transfer funds, pay bills, and more through the SIB Digital app. The app has a rating of 3.0 on the Google Play Store and 1.3 on the App Store, and user feedback is room for improvement. SIB Digital supports core features such as facial recognition, real-time transfers, and bill management, and is committed to improving the user experience.

Customer Service Quality

SIB provides 24/7 customer support, and customers can contact the bank through multiple channels such as phone, live chat, social media, etc. The Bank has an effective complaint management process in place and is committed to handling customer complaints in a timely and fair manner. In addition, SIB provides multi-language support, making it convenient for customers with different language backgrounds to use its services. SIB

Security Assurance

MeasuresSIB has obtained ISO 27001 Information Security Management System certification, demonstrating that it complies with international standards in information security management. The bank adopts advanced anti-fraud technology and real-time transaction monitoring system to ensure the safety of customer funds. In addition, SIB is committed to protecting customers' personal information and complying with relevant data protection laws and regulations.

Featured Services & DifferentiationSIBs

offer a variety of features to meet the needs of different customer groups:

Student Accounts: Provide fee-free account options to support the financial needs of student groups.

Exclusive wealth management for the elderly: Provide wealth management products for elderly customers to help them maintain and increase their wealth.

Green financial products: Launch investment products that meet environmental, social and governance (ESG) standards to support sustainable development.

High-net-worth services: Provide private banking services to provide customized financial solutions and exclusive services for high-net-worth customers.

Market Position & AccoladesSIB

has an important position in the field of Islamic banking, receiving several industry awards and recognitions:

Best Islamic Bank Contribution Award: Received this award in the Mediterranean region, In recognition of its excellence in the field of Islamic finance.

Best Customer Service Center in the Middle East: In recognition of excellence in customer service.

Sheikh Khalifa Excellence Award: In recognition of excellence in business operations and service quality.

Wells Fargo STP Excellence Awards: Recognising excellence in automated payment processing.

Deutsche Bank Quality Award: for its high quality performance in euro payment processing.

SIB's CEO, Mohamed Abdalla, also received the 'Best Islamic Bank CEO' award, demonstrating his exceptional ability in leadership and strategy execution.