basic bank information

bank type: commercial bank, was one of the largest banks in Cyprus and mainly caters to international customers.

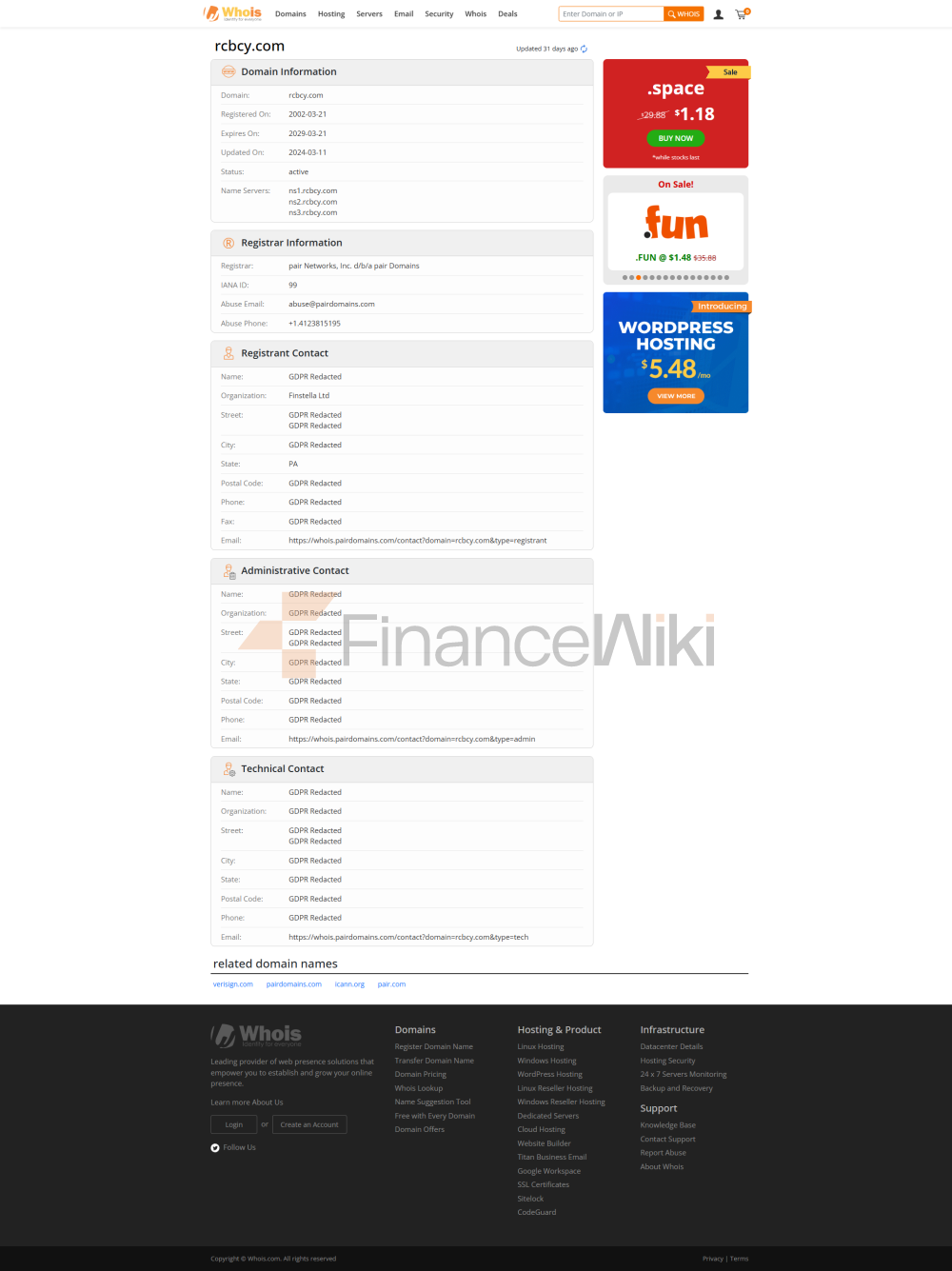

Name & Background: RCB Bank Ltd was established in 1995 and is headquartered in Limassol.

Shareholder background: It was once controlled by the Bank of Russia, and some of the top management had ties to the Kremlin. In 2022, the European Central Bank approved its phasing out of banking due to the impact of the Russia-Ukraine conflict.

services

Locations covered: mainly in Cyprus, with branches in Luxembourg, London and Moscow.

Number of offline outlets: Multiple branches in Cyprus.

ATM distribution: provides traditional banking services, and the specific ATM distribution information is not disclosed.

regulatory and compliance

regulator: Previously supervised by the European Central Bank and the Central Bank of Cyprus.

Deposit Insurance Scheme: Participated in the Deposit Insurance Scheme in Cyprus.

Compliance Record: No material compliance issues were observed prior to exiting the banking business.

financial health

capital adequacy ratio: Maintain a high capital adequacy ratio during operations.

Non-performing loan ratio: The specific data is not disclosed, but the asset quality is good before exiting the banking business.

Liquidity Coverage Ratio: Maintain good liquidity until exiting the banking business.

deposit and loan products

deposits: current and fixed deposit services are available, and the specific interest rate information is not disclosed.

Loans: Personal loans, corporate loans, etc., and the specific interest rate and threshold information are not disclosed.

list of common expenses

account management fee: The specific fee information is not disclosed.

Transfer fee: The specific fee information is not disclosed.

Overdraft fees and ATM inter-bank withdrawal fees: The specific fee information is not disclosed.

Hidden fee alert: The specific fee information is not disclosed.

digital service experience

APP and online banking: used to provide online banking services, but the specific function information was not disclosed.

Technological innovation: During the period of operation, no major technological innovations were observed.

customer service quality

service channels: telephone and online customer service are available.

Complaint handling: Specific complaint handling information is not disclosed.

Multi-language support: Multilingual services are available, mainly in English and Russian.

security measures

security of funds: During operation, the security of funds is guaranteed.

Data security: No major data security incidents have been observed.

Featured Services & Differentiation

market segments: Mainly serving international customers, especially enterprises and individuals in Russia and Eastern Europe.

High-net-worth services: Provision of private banking services, the details of which are not disclosed.