the name and background of the basic information of the bank

Julius Bär & Co. AG was founded in 1890 and is headquartered in Zurich, Switzerland. This bank is a private banking and wealth management institution with a long history of providing tailored financial services to high-net-worth clients. Founded by Swiss private capital, Baer has long been relatively independent, and although it has a broad global presence, it is not a state-owned or joint venture bank and is not listed on the public markets. Through acquisitions, expansions and mergers, MONEX Bank has strengthened its position in the international wealth management market and become one of the world's top private banks.

Scope of Services

: MONEX Bank operates globally, mainly covering Europe, Asia, the Americas and other regions, especially in the Middle East and Asian markets. With branches in a number of major financial centres, the bank's presence in wealth management and private banking far outstrips its presence in wealth management and private banking, despite its smaller number of offline outlets. MONEX Bank's ATM distribution is relatively limited, but through the interbank withdrawal service provided by partners, customers can easily access funds around the world.

Regulation &

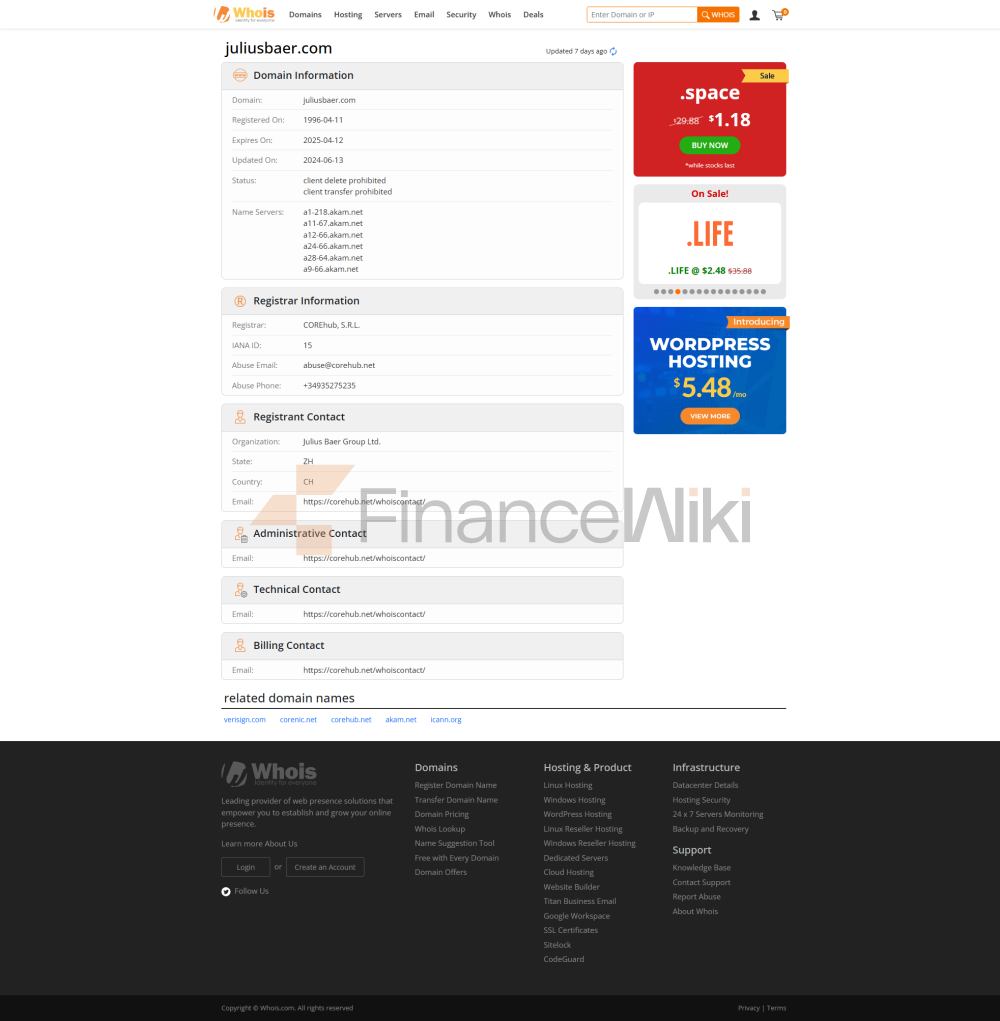

ComplianceBaer is regulated by the Swiss Financial Market Supervisory Authority (FINMA) and follows the country's strict financial regulations. Banks offer deposit insurance programs to their customers, which meet the Swiss government's financial stability standards. In recent years, MONEX Bank has excelled in compliance, actively strengthening anti-money laundering measures and customer identity verification to ensure that business operations comply with legal requirements.

key indicators of financial health

, MONEX Bank's capital adequacy ratio has remained in the upper reaches of the industry and has a strong liquidity coverage ratio. With a focus on wealth management for high-net-worth clients, its non-performing loan ratio has remained extremely low, demonstrating a high level of financial soundness. Overall, Baer's financial health makes it one of the most reliable private banks in the world.

Deposits &

LoansDepositsMONEX Bank's

deposit products focus on providing customized financial solutions for high-net-worth individuals, and although the interest rates on demand deposits are conservative, the interest rates on specialty products such as time deposits and CDs are relatively high. Banks also offer high-yield savings accounts to meet the needs of different customers, especially for corporate and high-net-worth individuals.

LoansMONEX Bank's

loan products are mainly aimed at the affluent class, providing personalized housing loans, car loans and credit loan services. The interest rate is adjusted according to the customer's credit profile and wealth management plan. MONEX Bank is particularly adept at providing high-net-worth clients with flexible repayment options, such as deferred repayments, adjustable interest rates, etc., to help clients better manage their money.

List of common

feesMONEX Bank's account management fees are relatively high, but they are mainly aimed at high-net-worth clients, providing high-end private banking services, and the fees match the quality of services. The transfer fee varies according to the destination and amount of the transaction, and the cross-border transfer fee is more transparent. Overdraft fees and ATM interbank withdrawal fees also follow high-end market standards. It's important to note that MONEX Bank doesn't have a strict minimum balance requirement, but some of its services may come with higher hidden fees.

digital service experience

APP and online banking

MONEX Bank's mobile app and online banking platform have received high user ratings, especially among affluent customers. The core functions include face recognition, real-time transfer, bill management, etc., which greatly facilitates the daily banking affairs of high-end customers. In terms of technological innovation, MONEX Bank actively applies artificial intelligence (AI) customer service and robo-advisory services, and supports open banking APIs to facilitate customers to connect with the systems of other financial institutions, improving the flexibility and convenience of digital services.

customer service

quality service channel

MONEX Bank offers 24/7 phone support and has a dedicated live chat feature. Clients can get timely responses through social media in case of emergency, especially in wealth management and investment advisory, and their needs are handled efficiently. The bank has a robust complaint handling system, with a low customer complaint rate and most complaints being resolved within a short period of time. MONEX Bank's customer service team provides multilingual support, which is particularly suited to the needs of cross-border high-net-worth clients.

security

measuresFunds

securityMONEX Bank offers deposit insurance in Switzerland to ensure the safety of customer funds. In addition, banks employ advanced anti-fraud technologies, such as real-time transaction monitoring and risk assessment mechanisms, to prevent financial crimes. The bank also conducts regular security audits and bug fixes to ensure the absolute safety of customer funds.

Data

SecurityMONEX Bank adheres to the ISO 27001 certification standard in terms of data security, ensuring that all its customer information and transaction data are protected with the strictest possible protection. While banks have yet to experience a major data breach, they continue to invest in strengthening information protection and privacy policies.

Featured Services and Differentiated

SegmentsBaer

is uniquely positioned to provide private banking services for high-net-worth clients, while its green financial products are also favored in the field of sustainable investment. The bank also pays special attention to providing suitable wealth management products for elderly customers and young customers, such as low-risk wealth management products designed for the elderly and fee-free account services for students.

High-net-worth

servicesMONEX Bank's private banking services have a high threshold, but provide highly customized wealth management solutions, including international asset allocation, tax optimization, estate planning, etc., to meet the wealth management needs of customers on a global scale.

market position and accoladesIndustry

rankingMONEX

has a strong presence in the global private banking sector, and its AUM continues to rank among the top in the world. According to several rankings in the wealth management sector, MONEX Bank is considered one of the top 50 private banks in the world.

AwardsBaer has won several awards such as "Best Digital Bank" and "Most Innovative Bank", especially in wealth management and private banking, and has been highly recognized by the industry for its innovation and service quality.