Bank

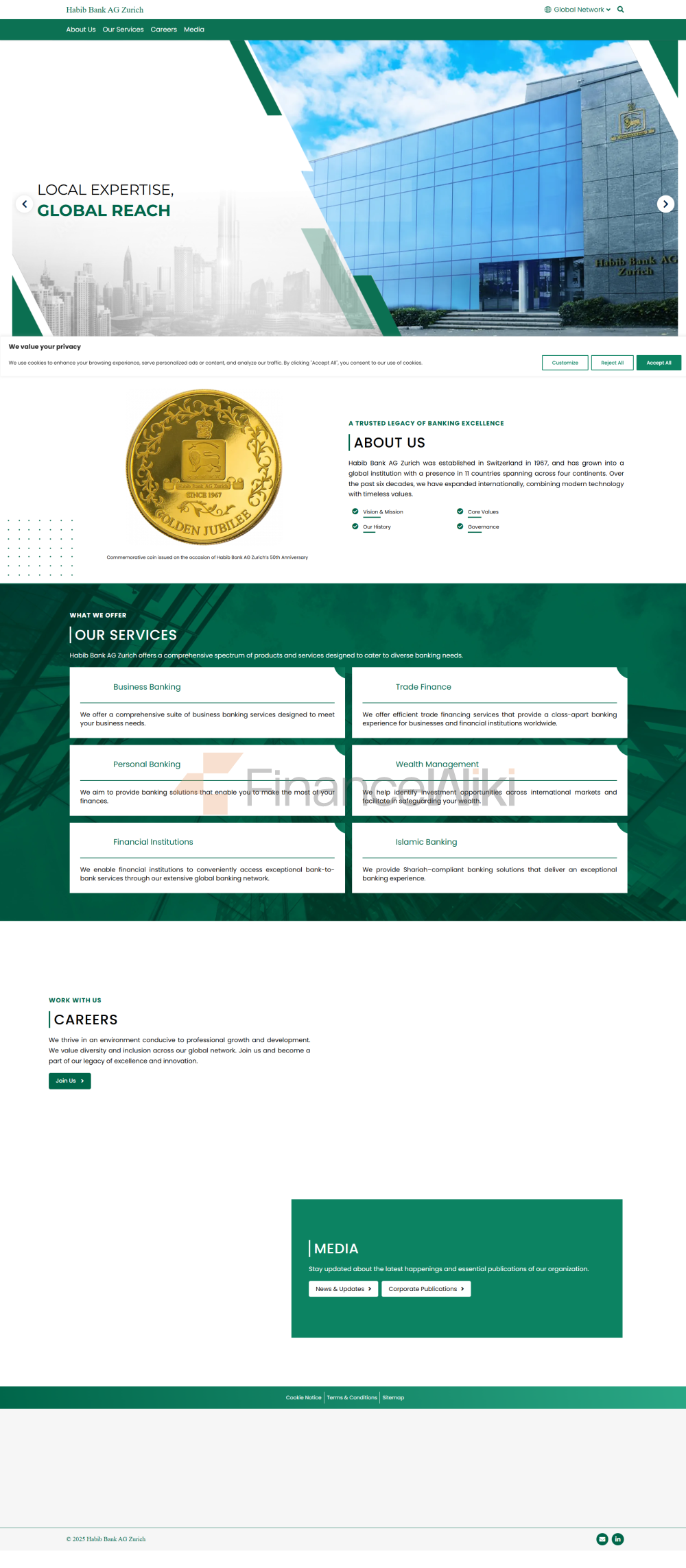

BasicsHabib Bank AG Zurich is a private commercial bank founded in 1967 and headquartered in Zurich, Switzerland. As an unlisted private bank, ownership is firmly in the hands of the Mahomedali Habib family, continuing a tradition that has been in place since the inception of the family banking business in 1941.

Theshareholders have a clear background, and family members such as Muhammad H. Habib (President) and Mohamedali R. Habib (Group CEO) are directly involved in the management, showing strong family governance characteristics. This non-state-owned, non-joint venture structure gives banks the flexibility to make decisions and focus on long-term strategies.

Scope of

ServicesHabib Bank AG Zurich has a global ambition in 11 countries on four continents. Core operations include headquarters in Switzerland, branches in Kenya and the United Arab Emirates, as well as subsidiaries in Canada, Hong Kong, Pakistan, South Africa and the United Kingdom, as well as representative offices in Bangladesh, China, Pakistan and Turkey. The number of offline outlets is undisclosed, but it shows deep regional coverage with its presence in markets such as the UAE (8 branches), the UK (8 branches) and Pakistan (500+ branches through Habib Metropolitan Bank).

ATMs are mainly located in the countries where subsidiaries and branches are located, especially in Pakistan, where the network of 510+ ATMs is particularly dense, providing convenient cash services to traditional customers.

Regulation & ComplianceAs

a Swiss-registered bank, Habib Bank AG Zurich is strictly regulated by the Swiss Financial Market Supervisory Authority (FINMA) to ensure its robust operations. In the UAE, it is subject to dual regulation by the Central Bank and the Securities and Commodities Authority; The UK subsidiary is regulated by the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA).

Banks participate in the Financial Services Compensation Scheme (FSCS) in the UK, which provides insurance coverage of up to £85,000 for eligible deposits, but participation in deposit insurance schemes in other countries such as Switzerland or the UAE is not explicitly disclosed. In terms of compliance records, the bank is known for its conservative risk management and strict legal compliance, with no recent major violations or fines, reflecting its robust operating culture.

Financial

HealthHabib Bank AG Zurich is known for its conservative financial strategy, emphasizing high liquidity and a robust capital structure. The public information does not provide specific capital adequacy ratio, non-performing loan ratio or liquidity coverage ratio data, but its subsidiary in the Pakistani market, Habib Metropolitan Bank, has maintained a good credit rating (e.g., AA+) for a long time, suggesting the overall financial health of the group. The World Bank Group (MIGA) provides further evidence of the capital stability of its Pakistan operations by providing a political risk guarantee. The bank is ranked in the top 1000 of the global banking rankings, showing some market resilience. For users looking for a low-risk bank, this bank's family governance and conservative strategy are a plus.

Deposit & Loan

ProductsDepository banks

offer demand and term deposit products, and eDeposit fixed deposit accounts in the UK market require a minimum of £5,000 and a maximum of £1,000,000, with a fixed interest rate to be paid at maturity, and the specific interest rate is not disclosed. Featured products include high-yield savings accounts and large certificates of deposit (such as Mahana Deposit and Izafa Certificate in the Pakistani market) to appeal to long-term savers.

Loan

products cover housing loans (e.g. income property loans in the UK), car loans and personal lines of credit, especially for small and medium-sized enterprises and owner-owned businesses. Loan thresholds vary from market to market, with the UK market focusing on credit history and proof of income, while the UAE market emphasizes flexible repayment options. Interest rate information is consulted directly with banks, but trade finance and Islamic finance products, such as the Sirat brand, are known for their market competitiveness.

List of common fees

Habib Bank AG Zurich's fee structure varies from country to country. UK eDeposit accounts are exempt from early withdrawal penalties, but the absence of online banking services may increase operational costs. Account management fees, such as monthly or annual fees, are not explicitly disclosed, but minimum balance requirements may trigger hidden fees. Cross-border transfer fees vary from market to market, and the UAE and Pakistan markets are relatively transparent, so users are advised to check the "Fees and Interest Rates" page on the official website. ATM interbank withdrawal fees and overdraft fees are not disclosed in detail, and customers should consult directly to avoid unexpected costs. Overall, there is still room for banks to improve their fee transparency.

Digital Service

ExperienceHabib Bank AG Zurich has taken a steady step in its digital transformation, launching mobile banking apps (e.g. HBZ+ UAE in the UAE) and online trading platforms (e.g. HBZtrade (for U.S. capital markets). The app supports facial recognition, real-time transfers, and bill management, and some markets, such as Pakistan, also integrate investment vehicles. The specific ratings on the App Store and Google Play are not disclosed, but the Kenya branch won the "Digital Banker of the Year at the Africa Fintech Forum" award in 2024, demonstrating its technical prowess. In terms of technological innovation, banks have launched the hPLUS system to optimize operational efficiency, but there is no clear application of AI customer service or open banking APIs, and digital services are more like the steady upgrade of traditional banks.

Customer Service Quality

Bank offers 24/7 phone support and live chat services, and social media is responsive, especially in the UAE and UK markets. Complaint handling data is not publicly available, but its FSCS compliance in the UK market and community activities in the Pakistani market, such as sponsoring educational programs, demonstrate the importance of customer satisfaction. Multi-language support is the highlight, covering English, Arabic, Urdu, etc., especially suitable for cross-border customers. Overall, customer service is centered around personalization, and the affinity of a family bank is its strength.

Security measuresIn

terms of fund security, deposits are backed by FSCS protection in the UK market, and the bank's anti-fraud technology includes real-time transaction monitoring and multi-factor authentication. In terms of data security, the bank follows FINMA's strict standards, emphasizing the confidentiality of customer information, but does not explicitly mention ISO 27001 certification. There have been no major data breaches recently, demonstrating its steady investment in cybersecurity. For clients who value money and privacy, the bank's Swiss background and conservative strategy provide a guarantee of trust.

Featured Services & DifferentiationHabib

Bank AG Zurich excels in the market segment with its Sirat Islamic Bank brand covering 5 countries and offering doctrinal financial products that are popular with customers in the Middle East and South Asia. Student accounts and senior wealth management products are not explicitly mentioned, but SME loans and trade finance are designed for owner-owned businesses and offer a high degree of flexibility. Private banking services are available to high-net-worth clients, especially at the Dubai International Financial Centre (DIFC) branches, where wealth preservation is at the heart of customised wealth solutions. In terms of green finance, banks do not have a prominent ESG investment product, but their social responsibility projects, such as school donations in South Africa, demonstrate sustainability awareness.

Market Position & AccoladesHabib

Bank AG Zurich is ranked in the top 1000 of global banks with modest assets but a regional presence in the SME and Islamic finance sectors. Its subsidiary, Habib Metropolitan Bank, has a leading position in the Pakistani market with 500+ branches. Recent awards include "Most Innovative Islamic Bank" in 2024 in the UK, "Digital Banker of the Year" in Kenya, and "Most Promising Private Bank" in DIFC in Dubai. These accolades underscore its competitiveness in innovation and customer service, especially in emerging markets.