Bank

Sinarmas is an Indonesian-based commercial bank that has carved out a niche in the market with its innovative financial services and extensive network of outlets. As a key member of the Sinar Mas Group, Bank Sinarmas aims to be Indonesia's leading payment and transaction bank, providing comprehensive solutions from traditional banking to digital services. The bank is customer-centric, combining modern technology and risk management to meet the diverse financial needs of individuals and businesses.

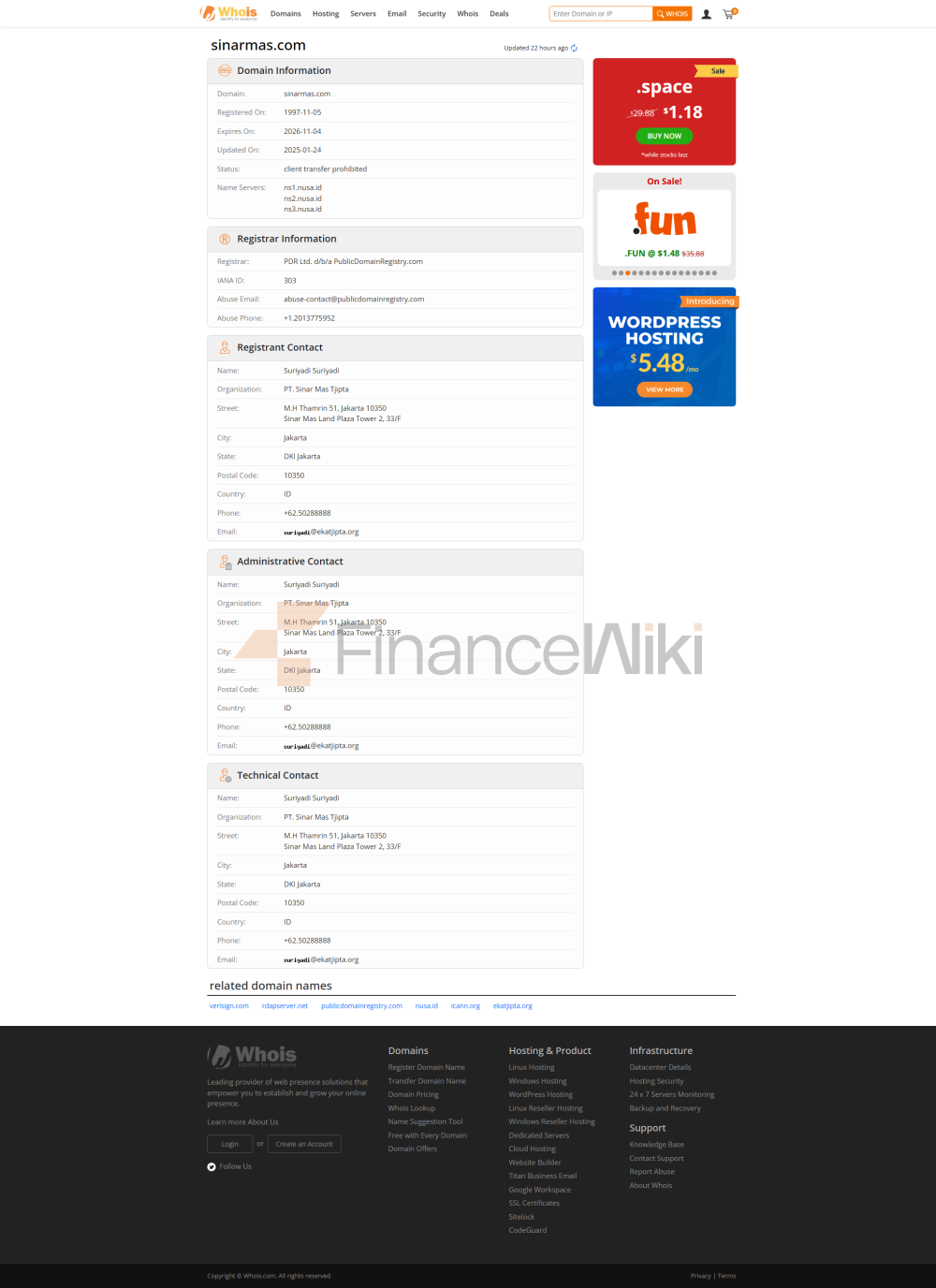

PT Bank Sinarmas Tbk was established on August 18, 1989 and is headquartered at Sinar Mas Land Plaza, Jakarta, Indonesia, located in the bustling commercial center of Jl. M.H Thamrin Kav. 51. The history of Bank Sinarmas began with PT Bank Shinta Indonesia, founded by the Shinta Group of the Hermijanto family. In 2005, Sinar Mas Group acquired a 21% stake through its financial services subsidiary, PT Sinar Mas Multiartha Tbk, which was renamed PT Bank Sinarmas Tbk in December 2006. In 2010, the bank was listed on the Indonesia Stock Exchange under the ticker symbol BSIM, and its major shareholders include PT Sinar Mas Multiartha Tbk (55.59%), PT Shinta Utama (3.25%) and the public (41.16%). The high percentage of public float reflects the market's confidence in banks.

Bank Sinarmas' service network covers the whole of Indonesia, with 69 branches, 134 sub-branches, 140 cash offices, 28 Islamic branches and 12 Islamic cash offices as of the end of 2020, totaling about 383 service outlets. ATM networks are widely distributed in urban and remote areas, ensuring that customers can easily deposit and withdraw cash and transact. In terms of international services, Bank Sinarmas provides support mainly through foreign exchange transactions and cross-border remittances, but has fewer branches around the world and remains focused on the domestic market. The bank's services cover retail banking, corporate banking, Islamic banking, trade finance and wealth management, catering to a wide range of needs, from personal savings to corporate finance.

In terms of regulation and compliance, Bank Sinarmas is strictly regulated by the Indonesian Financial Services Authority (Otoritas Jasa Keuangan, OJK) and the Central Bank of Indonesia (Bank Indonesia, BI). The bank is a member of the Indonesian Deposit Insurance Corporation (Lembaga Penjamin Simpanan, LPS) and provides protection for customer deposits of up to IDR 2 billion. Bank Sinarmas follows regulations such as the Data Protection Act 2018 and ensures compliance through internal governance policies such as anti-money laundering and anti-fraud measures. No significant compliance issues were reported in 2024, demonstrating a solid performance in risk management and compliance.

Financial health

Bank Sinarmas is in a strong financial position, reflecting its competitiveness in the Indonesian banking sector. Based on 2023 data (which may be similar in 2024), its key financial indicators are as follows:

Capital Adequacy Ratio (CAR): about 15.5%, well above the minimum requirement for OJK (typically 8-12%), indicating that the bank has a strong capital buffer and is able to cope with market volatility and potential risks.

Non-performing loan ratio (NPL): Approximately 2.2%, which is lower than the industry average (2.26% in August 2024), indicating excellent asset quality and effective credit risk management.

Liquidity Coverage Ratio (LCR): Approximately 120%, exceeding the regulatory requirement of 100%, indicating that the bank has sufficient high-quality liquid assets to meet short-term funding needs.

In the first half of 2024, Bank Sinarmas' net profit increased by 41.96%, demonstrating its strong profitability and business growth momentum. The total assets of the bank are about IDR 2 trillion and the market capitalization is about IDR 1.02 trillion (as of May 2025). These figures show that Bank Sinarmas has performed well in terms of capital adequacy, asset quality and liquidity, and is able to remain stable in the face of economic volatility and provide reliable financial services to its customers.

Deposits & LoansBank

Sinarmas offers a wide range of deposit products to meet the needs of individuals, businesses and special groups

demand deposits: such as Simas Tara and Alfamart Savings, with an interest rate of about 0.5% per annum, suitable for day-to-day money management and providing high liquidity.

Fixed deposits: Such as Deposito Berjangka, with a minimum deposit amount of IDR 8 million and a 1-year interest rate of about 4.5% per annum, is suitable for customers who are looking for stable income. Fixed deposits can be automatically renewed (ARO), and the principal and interest can be automatically transferred to designated accounts.

Deposit in demand: For example, Sinar Mas Current Account, the interest rate is about 0.1% per annum, which is suitable for customers who need to trade frequently.

High-yield savings accounts, such as My Savings, offer tiered interest rates, the higher the deposit amount, the higher the interest rate, and the lower the minimum deposit requirement, which is suitable for regular savers.

Foreign Currency Deposits: Support multiple foreign currency deposits such as US dollars, Australian dollars, Japanese yen and RMB, which is suitable for customers with cross-border transaction needs.

LoansBank

Sinarmas' loan products cover both individual and corporate customers and are designed to meet different needs flexibly:

personal loansFor example, the interest rate is about 10% per annum, the loan amount is from IDR 5 million to IDR 500 million, and the term is 12 to 60 months, which is suitable for personal consumption needs.

Home Loans: Home Ownership Loans, with an interest rate of about 7% per annum and a loan term of up to 20 years, support the purchase of a property.

Business loans: including micro loans, SME loans and corporate loans, with an interest rate of about 8% per annum, for the working capital needs and business expansion of enterprises.

Micro Loans: Micro loans are provided through the MSME Loan Origination System, combined with training to support the growth of micro enterprises.

list of common

feesBank Sinarmas has a transparent fee structure, but customers need to be aware of potential hidden fees. The following is the main fee information (the exact amount may vary depending on the account type or policy changes):

account management fee: about IDR 5,000 (about USD 0.32) per month. Inactive accounts (no transactions for 6 consecutive months) will be charged IDR 5,000 per month from the 7th month.

Transfer fee: Free for transfers between Bank Sinarmas accounts; Transfers to other banks via SKN or RTGS are about IDR 6,500 per transaction. Cross-border money transfer fees vary depending on the type and amount of the transaction, but typically range from $10-$25.

Overdraft Fee: Please refer to the Bank Sinarmas website for specific fees.

ATM Interbank Withdrawal Fee: Interbank withdrawals through ATM Prima or ATM Bersama networks are approximately IDR 5,000 per transaction.

Credit card annual fee: about IDR 250,000/year.

Hidden Fee Alert: Customers should be aware of minimum balance requirements (e.g. some accounts may require a minimum balance) and inactive account fees to avoid additional costs. In addition, an administrative fee of IDR 1,500 per transaction may be charged for e-wallet top-up.

digital service experience

Bank Sinarmas excels in digital services, with its flagship mobile banking app, SimobiPlus, one of the most popular digital banking platforms in Indonesia. SimobiPlus was launched in 2016 with the aim of providing customers with convenient, smart and secure financial services. As of April 2024, SimobiPlus has seen a 15% increase in volume and 51% in transaction value, demonstrating its strong market appeal.

APP & BANKING: SimobiPlus has a rating of about 3.5 stars on Google Play (based on user feedback) and supports the following core features:

real-time transfers: Free transfers between Bank Sinarmas accounts and interbank transfers are supported.

Bill management: You can pay bills to hundreds of billers, and you can set up automatic payments.

Investment Vehicles: Stocks, funds, and bonds are available as investment options.

Biometric login: Support face recognition and fingerprint login.

Account management: Multiple sub-accounts can be created to facilitate budget management.

Technological innovation: Bank Sinarmas uses AI customer service to automatically respond to frequently asked questions, robo-advisors to provide personalized investment advice, and open banking APIs to support integration with third-party financial services. The bank partnered with Software AG to optimize data stream processing, improve transaction efficiency and customer experience.

Customer Service

QualityBank Sinarmas is committed to providing efficient customer service, supporting customer needs through multiple channels:

Service Channels: 24/7 phone support (hotline: 1500153, international call: +62 21 501 88888), live chat, email (care@banksinarmas.com) and social media responses (including Instagram, X, Facebook) are available. Customers can access the support page through the Bank Sinarmas website.

Complaint Handling: Bank Sinarmas handles complaints through an internal customer service center and OJK's consumer protection mechanism, promising to resolve simple complaints within 15 days and complex complaints within 35 days. User satisfaction data is limited, but SimobiPlus' success is indicative of the high quality of its services.

Multi-language support: Bank Sinarmas mainly provides support in Indonesian and English, other languages (such as Chinese) need to be further confirmed, and may be limited for cross-border users.

security measuresBank

Sinarmas attaches great importance to the security of funds and data, and takes multi-level measures to protect the interests of customers:

Data security: The SimobiPlus app is PCI-DSS certified, with data encryption and access controls. The bank conducts regular security audits and reported no major data breaches in 2024. The bank follows the Data Protection Act 2018 to ensure the security of customer information.

Security of funds: Deposits are insured by LPS up to IDR 2 billion per bank per customer. Banks use anti-fraud technologies such as real-time transaction monitoring, two-factor authentication (including biometrics and one-time passwords), and transaction limits to reduce risk.

Featured Services and DifferentiationBank

Sinarmas differentiates itself through customized services and innovative products for specific customer segments:

Market segments:

student accounts: such as Simas Tara, which has a low initial deposit requirement and no commissions for some transactions, appealing to younger clients.

Senior-only banking: Customised deposit and investment products combined with health services and financial planning through Simas Prioritas.

Green financial products: Supporting renewable energy and ESG investment projects in response to sustainable development trends.

High Net Worth Services: Simas Prioritas offers private banking services, including a dedicated relationship manager, customized portfolios, preferential interest rates and VIP treatment. In 2024, the bank hosted the Sinar Mas Wealth Concord Gala, inviting international star Jackie Chan to provide a unique experience for high-net-worth clients.

Islamic Banking: Offering Shariah-compliant financial products to meet specific customer needs through PT Bank Nano Syariah (spun off from Bank Sinarmas in 2024).

market position and

honors Bank Sinarmas occupies an important position in Indonesia's banking sector and ranks among the top 10 banks with a market capitalization of around IDR 1.02 trillion (as of May 2025). Its asset size is about IDR 2 trillion and its credit card business grew by 20 percent in the first quarter of 2024, demonstrating its competitiveness in the retail banking sector. The bank has further expanded the Islamic banking market through its subsidiary, PT Bank Nano Syariah.

Awards & Accolades:

Indonesia Technology Excellence Awards 2024: Winner of the "Best Mobile Banking" and "Best Financial Technology" awards for the innovation of the SimobiPlus mobile banking app and MSME loan origination system.

Best Digital Bank 2023: Recognition for its contribution to digital transformation and financial inclusion.

2022 Sustainability Advocates: Recognized for Green Finance and Community Empowerment Programs.

summary

As an important part of the Sinar Mas Group, Bank Sinarmas stands out in the Indonesian banking sector with its solid financial position, extensive service network, and innovative digital platform. From traditional retail banking to advanced SimobiPlus applications, Bank Sinarmas meets a wide range of needs, from individuals to businesses, with a diverse range of products and services. Its efforts in green finance, Islamic banking, and high-net-worth services have further strengthened its market position. Whether it's financial health, customer service, or technological innovation, Bank Sinarmas has demonstrated excellence in providing safe, convenient and efficient financial solutions to its clients.