Basic information

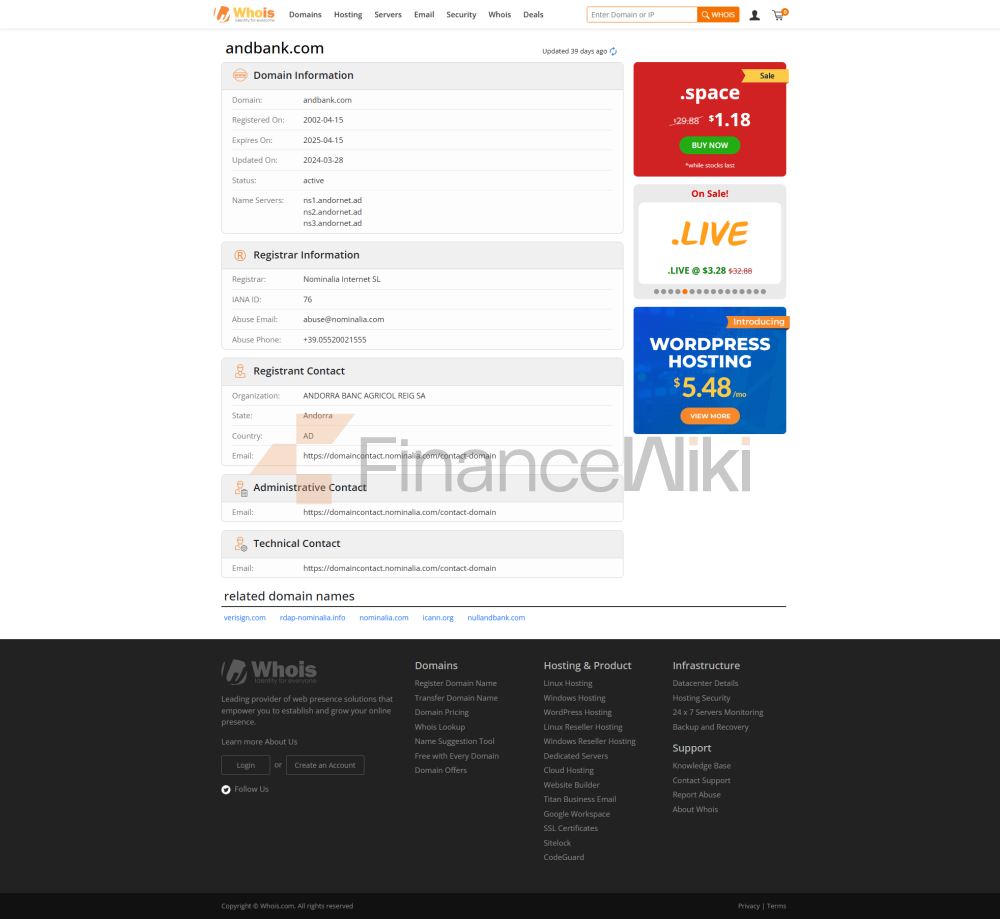

about the bank Andbank (full name: Andorra Banc Agrícol Reig, S.A.) is a private bank founded in August 2001 through the merger of two long-established banks in Andorra, Banc Agrícol i Comercial d'Andorra (founded in 1930) and Banca Reig (founded in 1956). Its headquarters are located in Escaldes-Engordany, Andorra, at C/Manuel Cerqueda i Escaler 6, AD700. Andbank is privately owned by the Cerqueda and Ribas families and is not listed on the stock exchange and is not a state-owned bank. Its Board of Directors is made up of independent professionals, including Manuel Cerqueda Diez, representing Cerqueda Donadeu, S.A., and Jorge Maortua, representing Reig Finances S.A.U., among others.

Andbank has a presence in 11 countries, including Spain, Brazil, Panama, Monaco, Luxembourg, Israel and Uruguay. In Andorra, Andbank has about 9 branches in the main towns of Andorra la Vella, Escaldes-Engordany, Canillo, Encamp, La Massana, Ordino and Sant Julià de Lòria. The network of ATMs is widely distributed in the dioceses of Andorra, providing customers with convenient cash deposits and withdrawals. Andbank's client base includes high-net-worth individuals, corporations and institutions, and its services range from retail banking, private banking and corporate banking.

Scope of services

Andbank's service network covers the whole territory of Andorra and has branches in 11 countries around the world, including Andbank Luxembourg S.A. (Luxembourg), Andbanc Wealth Management, LLC (Miami, USA), Banco Andbank (Brazil), etc. In Andorra, Andbank has about 9 branches, including the following addresses:

- Andorra la Vella: Plaça Bartumeu Rebés Duran 7, AD500 and Av. Tarragona 14

- Escaldes-Engordany:C/Manuel Cerqueda i Escaler 6

- Canillo:Av. de Sant Joan de Caselles, Casa Muixeró

- Encamp:Av. de Joan Martí 6

- Pas de la Casa:C/ Sant Jordi 12

- La Massana:Av. Sant Antoni núm. 32 Ed. Ferran’s

- Ordino:Travessia d'Ordino Casa Joanet

- Sant Julià de Lòria:Av. Verge del Canòlich 53

These branches offer customers a comprehensive range of banking services, including deposits, loans, investments and wealth management. Andbank's ATM network covers all parishes in Andorra, ensuring easy access to cash in major towns and regions. The international branch provides wealth management and investment services to cross-border clients to meet the global needs of high-net-worth clients.

Regulation & Compliance

Andbank is strictly regulated by the Andorran Financial Authority (AFA), which oversees Andorra's financial markets and institutions to ensure that they operate in compliance with international standards and local regulations. Andbank complies with various regulations set by the AFA, including Anti-Money Laundering (AML) and Anti-Terrorist Financing (CTF) requirements.

Andbank participates in the Andorran Deposit Guarantee Fund (FAGADI), which provides deposit insurance protection of up to €100,000 per depositor, up to €300,000 in exceptional cases (e.g. real estate transactions, marriage, retirement, etc.), in accordance with Law 20/2018 of 13 September 2018. This insurance program increases the customer's confidence in the safety of their deposits.

The fact that Andbank has not been involved in any material compliance issues recently indicates that it has performed well in compliance management. Andbank also complies with the Law on Automatic Exchange of Tax Information of 30 November 2016 (Llei 19/2016) and shares information with international tax authorities through the Common Reporting Standard (CRS) to promote transparency.

Financial health

Andbank's financial performance reflects its solid position as a leading bank in Andorra. According to 2022 data, Andbank's Tier 1 capital adequacy ratio is 16.85% and its non-performing loan ratio is only 0.95%, demonstrating a strong capital base and quality asset quality. Its Liquidity Coverage Ratio (LCR) is 234%, well above the minimum requirement of 100%, indicating that it is liquid enough to handle market volatility. In 2022, Andbank's assets under management increased by 27.7% to €48.89 billion, credit investments increased by 7.5% to €3,472 million, and EBITDA (earnings before interest, taxes, depreciation and amortization) increased by 32% to €109 million.

In 2023, Andbank recorded a return on tangible assets (ROTE) of 11.1%, a Tier 1 capital adequacy ratio of 15.7% (27% in Andorra), a non-performing loan ratio of 1.6% and a loan-to-deposit ratio (LTD) of 60%. These indicators indicate that Andbank is performing well in terms of capital adequacy, asset quality, and liquidity.

Deposit & Loan Products

Andbank offers a wide range of deposit products, including:

- Demand Deposits: such as Current Account and Salary Account, suitable for day-to-day expenses and liquidity management, with low interest rates but high flexibility.

- Fixed deposits: offer higher interest rates with maturities ranging from months to years, making them suitable for long-term savings.

- Compte Amic: An account designed for young savers with no opening, maintenance and inactivity fees for ages 0-18, an interest rate of 0.10% and a free Visa Electron card (over 14 years old).

In terms of loans, Andbank offers home loans, car loans, personal lines of credit and corporate finance, among others:

- Mortgages: support for first-time home buyers and real estate investments, with flexible interest rates and repayment terms, subject to consultation.

- Car loans: provide financial support for car purchases with competitive interest rates.

- Personal Line of Credit: For consumer needs such as home renovation and travel, it offers fast approval and flexible repayment options.

Loan products usually allow for early repayment or adjustment of repayment period, and the specific interest rate and threshold vary depending on the customer's credit status and loan amount, and need to be consulted through bank branches or online platforms.

Digital service experience

Andbank's digital services are one of its core competencies, and its online banking platform (e-andbank) and mobile banking apps (Andbank Wealth and Myandbank) provide customers with convenient financial management tools. Designed for private banking clients, Andbank Wealth supports portfolio management, communication with relationship managers, and online document signing. Myandbank caters to a wider range of customers, offering:

- Account management: view balances, transaction history

- Real-time transfers: support domestic and international (SEPA) transfers

- Bill Payment: Pay bills such as utility bills

- Investment Tools: Provide investment advice and asset allocation

The app supports biometric logins, such as face recognition and fingerprint login, for added security and convenience. Myandbank accounts offer an APY of 2% (up to €50,000) and support Bizum payments (exclusive to Andorra).

Customer Service Quality

Andbank provides multi-channel customer service, including:

- Phone support: +376 873 300 (Andorra), +34 913 62 62 00 (international), available 24/7

- Email: info@andbank.com

- Online form: Submit an inquiry or complaint through [Andbank contact page

] - Social media: Quick response through [Facebook] and other [Facebook]

Andbank's complaint handling mechanism is perfect, customers can submit complaints through the official website, and the bank promises to respond quickly. Since Andbank operates in 11 countries, its customer service supports multiple languages, including English, Spanish, French, and Catalan, making it suitable for cross-border customers.

Security measures

Deposits in Andbank are protected by FAGADI with a maximum insured amount of €100,000 and up to €300,000 in exceptional cases. Banks use real-time transaction monitoring and multi-channel risk assessment systems to prevent financial fraud and money laundering. In terms of data security, Andbank adheres to a strict privacy policy

,featured services and differentiation

Andbank has unique advantages in the field of private banking, focusing on wealth management for high-net-worth clients, providing customized portfolio management and family office services. Features include:

- Compte Amic Account: A commission-free account designed for customers aged 0-18 years old with fun gifts and a 0.10% interest rate.

- Green Finance: Andbank supports ESG (Environmental, Social and Governance) investments, such as the Megatrends FI Fund, which invests in themes such as climate change, technological innovation, and more.

- Enterprise services: Virtual POS, direct debits, and more are available for small and medium-sized businesses.

Andbank also demonstrates social responsibility and strengthens community ties by sponsoring events such as the Andorra 2025 Small States Games and the "Purito" cycling race.

Market Position & Accolades

Andbank is one of Andorra's leading banks, with more than €34.3 billion in assets under management in 2023, one of the highest in the Andorran banking sector. The Fitch rating agency has awarded Andbank a BBB rating (Stable Outlook), recognizing its international reach, liquidity management and asset quality. Andbank has received several international awards, including:

- Named "Best Private Bank in Andorra" by Global Finance, International Finance and International Banker magazines in 2019.

- "Best Customer Service Provider in Western Europe" award from International Banker.

Conclusion

Andbank is a private bank with a long history and comprehensive services, known for its leadership in Andorra and international markets. Andbank provides a wide range of financial products and services, and is committed to providing customers with high-quality services and a secure banking environment. Its strong financial foundation, advanced digital capabilities, and focus on customer needs make it stand out in the highly competitive private banking space. Despite the challenges posed by international sanctions and the economic environment, Andbank's family-run management and internationalization strategy ensures that it continues to create value for its clients. When choosing Andbank, customers should pay attention to its latest financial data and policies to ensure that it meets their personal or business needs.

Subsidiary

Andbank has 40 subsidiaries in Europe, the Americas and Asia, including:

Andbank Monaco SAM (Monaco)

Andbank Luxembourg Andbanc

Advisory, LLC (Miami, USA),

S.A. (Luxembourg), Andbanc Brokerage, LLC (Miami, USA).

Andbank (Panamá) S.A. (Panama)

Andbank (Bahamas) Limited (Bahamas)

) AND PB Financial Services, S.A. (Uruguay)

Quest Capital Advisers Agente de Valores, S.A. (Uruguay))

Columbus de Mexico, S.A. de CV (Mexico)

Banco Andbank (Brasil), S.A. (Brazil)Andbank

España S.A.U. (Spain

). Andbank Wealth Management, SGIIC S.A.U. (Spain),

Medpatrimonia Invest S.L. (Spain),

Sigma Portfolio Management (Israel).