Banco Bilbao Vizcaya Argentaria (BBVA) is a leading global commercial bank known for its long history, extensive international footprint, and innovative financial services. Since its inception in 1857, BBVA has taken a prominent position in the global financial markets through its customer-first philosophy and digital transformation strategy. The following is a comprehensive introduction to BBVA, covering its basic information, deposit and loan products, digital services, technological innovations, unique services and market position.

Basic information of the bank

bank type: commercial bank, one of the largest financial institutions in Spain, not state-owned or joint venture.

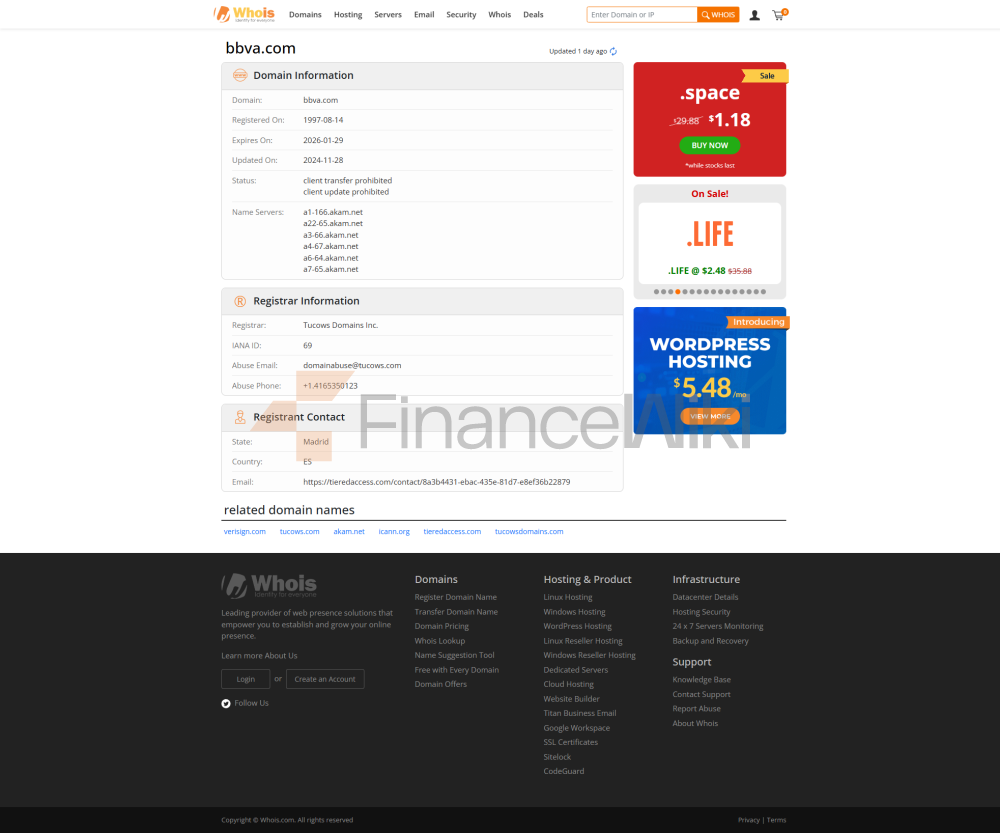

Full name: Banco Bilbao Vizcaya Argentaria, S.A

Founded: May 28, 1857.

Headquarters location: Bilbao, Spain, operational headquarters at the Ciudad BBVA complex in Madrid.

Shareholder Background: BBVA is a publicly traded company listed on the Madrid Stock Exchange (ticker symbol: BBVA), the New York Stock Exchange and the Mexican Stock Exchange, and is a constituent of the IBEX 35 and the Dow Jones EURO STOXX 50.

Regulation & Compliance: Regulated by the Spanish Banking Supervisory Authority (Banco de España) and the European Central Bank, it adheres to strict international financial standards to ensure operational transparency and the safety of client funds. BBVA's deposits in Spain are protected by the Spanish Deposit Guarantee Fund with a maximum guarantee amount of €100,000 per person.

Deposit & Loan Products

deposits BBVA offers a wide range of deposit products to meet the needs of both individual and corporate customers. For example, in 2018, the annual interest rate of HKD demand deposits was 0.0250% and that of US dollars was 0.0100% (the latest interest rate needs to be consulted with the bank). Fixed deposits are available in multiple currencies (e.g. HKD, USD, RMB), with tenors ranging from 1 day to 24 months, with minimum deposits starting from HKD 5,000 or USD 1,000. Featured products include high-yield savings accounts and large certificates of deposit (CDs), as well as inflation-linked savings products in the Turkish market to help clients combat the effects of inflation. Customers can check the latest interest rates and "Cloud Interest Rate" offers via BBVA's online banking or mobile app.

The

loan products of BBVA cover housing loans, car loans and personal credit loans. Mortgages include residential mortgage loans, sandwich class housing schemes and HOS loan schemes, with loan amounts of up to 70% of the value of the property and a repayment period of up to 30 years, with interest rates based on HIBOR or Prime rates, with cash rebates and insurance discounts. Personal lines of credit include "Fast Paperless Online Loans" with an amount ranging from €3,000 to €20,000 with a repayment period of 24 to 96 months and a minimum monthly income of €450. Car loans and green energy loans (e.g. loans for the installation of solar energy systems) are also in the spotlight, and specific interest rates and thresholds need to be consulted directly with banks. BBVA's loan products offer flexible repayment options, such as the Mortgage Plan, which allows customers to adjust their repayment arrangements according to their financial situation and reduce interest expenses. All loans are subject to bank approval and the terms are subject to the loan agreement.

Digital Service

ExperienceBBVA's mobile banking app is at the heart of its digital services, available on iOS and Android devices, with features including real-time transfers, bill payments, investment transactions (such as stocks and foreign exchange), e-statements and personalised product recommendations. With more than 8 million users in Spain, the app has a Google Play rating of 4.7 (the highest in the industry) and an Apple App Store rating of 4.6, with users praising its launch speed (opening in less than 2 seconds) and its clean, easy-to-use interface. Features include the "Money Bar", which helps users visualize their financial health and set savings goals. The online banking platform supports multiple browsers (e.g. Microsoft Edge, Google Chrome) and provides similar features to ensure that customers can manage their accounts anytime, anywhere. BBVA also supports modern payment methods such as Apple Pay and Bizum to make payments more convenient.

Technological

innovationBBVA leads the way in fintech:

AI customer service: In Turkey, BBVA has launched UGI, a virtual assistant that uses advanced voice recognition technology to process transactions, provide advice, and even tell jokes to simplify the user experience.

Robo-advisors: BBVA has developed algorithm-based and AI-based automated financial advisors to help clients achieve their investment goals, especially for small investors, lowering the threshold for wealth management.

Open Banking API: BBVA is a pioneer in open banking, allowing customers to access other bank account information through its mobile app and online banking, enabling inter-bank account management and instant transfers, in places like Turkey.

Global Data Platform (ADA): BBVA's ADA platform (Analytics + Data + AI), which integrates all of the group's data management and provides an efficient and scalable solution based on Amazon Web services, won the Global Finance Innovation Award.

Other innovations: BBVA has partnered with Xiaomi to pre-install its mobile banking app in the Spanish market and support online calculation tools, such as the deposit interest calculator, to enhance the customer experience.

Featured Services and DifferentiationBBVA

is committed to providing customers with personalized financial solutions based on the concept of "customer first, creating opportunities". Its featured services include:

Diversity & Inclusion: Through the global program "Yo soy talento feminino", BBVA increases the proportion of women in management (35.4% by 2024) and attracts tech talent in the fields of artificial intelligence, data management and cybersecurity.

Sustainability: BBVA supports green energy projects (such as solar loans) and corporate decarbonisation to help clients achieve their sustainability goals.

Cross-border financial services: BBVA has branches in 25 countries, with leading positions in Mexico (the largest financial institution), South America and Turkey (through Garanti BBVA), providing specialized cross-border financial services.

SME support: With BBVA Spark, banks provide customized financial solutions to high-growth businesses that foster entrepreneurship and innovation.

Market Position & AccoladesBBVA

is one of the largest financial institutions in the world, with total assets of approximately €772 billion, making it the second largest bank in Spain after Banco de San Andrés. It is the largest financial institution in Mexico and has leading positions in South America and Turkey, with a global network covering 25 countries. BBVA's financial performance is strong, with ROTE exceeding 20% and shareholder value increasing by 14% in the first quarter of 2025. Key accolades include:

being named "Best Digital Banking Experience in Europe" by Forrester for five consecutive years.

Received the SME Banking and Midsize Corporate Banking Customer Experience Awards from Greenwich Associates.

Recognized as a "Best Employer" in 2025 for excellence in talent management.

Global Finance recognizes its ADA data platform and AI Factory, an AI innovation lab.

SummaryBanco

Bilbao Vizcaya Argentaria (BBVA) is a long-established and global commercial bank that occupies an important position in the global financial markets with its innovation-driven strategy and customer-first philosophy. It offers a diverse range of deposit and loan products, including high-yield savings accounts, term deposits, mortgages, and fast online loans, to meet the needs of individuals and businesses. BBVA's mobile banking app is known as the best in the world, with real-time money transfers, investment tools, and AI-powered personalization. In terms of technological innovation, BBVA is a leader in the fields of AI customer service, robo-advisors and open banking APIs. With a focus on diversity, sustainability and cross-border financial services, it supports start-ups through programs such as BBVA Spark. With a solid market position and a number of industry awards, BBVA has demonstrated its excellence in the global financial sector.