HSBC Holdings Plc Is The Holding Company Of HSBC Group, Headquartered In London, UK. It Is The Largest European Bank. HSBC Holdings Was Officially Established In 1991, But Its Subsidiary The Hongkong And Shanghai Banking Corporation Limited Has A History Of More Than 150 Years. HSBC Is One Of The Largest Banking And Financial Services Institutions In The World, With A Market Value Of Up To 198 Billion US Dollars As Of May 20, 2018. HSBC Has A Deep Foundation In Business, And Its International Network Covers Six Regions Around The World. It Has About 4,000 Offices In 64 Countries And Regions In Europe, Hong Kong, Asia Pacific, The Middle East, North America And Latin America, And Its Financial Services Customers Exceed 50 Million.

Commercial Finance Business Department

Commercial Finance Business Department Provides Comprehensive Corporate Banking Services Such As Loans, Import And Export And Credit Cards For Business Or Corporate Customers Such As SMEs:

Daily Banking: Commercial Debit Cards, Business Integrated Accounts, Foreign Exchange, Deposit And Investment Services, Wealth Management Services, Etc.

Financing And Credit Cards: Export Services, Commercial Cards, Commercial Loans, Receivable Financing, Import Services, Etc.

Payment: Commercial Cards, International And Local Payments, Accounts Receivable Services, Payment Services, Etc.

Protection And Investment: Life Protection, Employee Benefits And Mandatory Provident Fund, Commercial Insurance, Unit Trust Trade-related Insurance, Etc.

Import And Export Billing Services: Export Services, Bookkeeping, Bank Guarantees, Etc.

Global Banking And Capital Markets Business Department

The Global Banking And Capital Markets Business Department Is HSBC's Investment Banking Business, Mainly Providing Financing, Securities Sales And Custody Solutions For Government Entities, Large Multinational Enterprises And Institutional Clients. The Business Is Further Divided Into Two Divisions: Global Banking And Global Markets And Securities Services.

Global Banking

Investment Banking: Mergers And Acquisitions Advising, Equity Markets, Corporate Restructuring, Leverage And Acquisition Financing

Corporate Banking: Corporate Finance, Project Finance

Global Liquidity And Cash Management: Provide Innovative Capital Management Solutions To Help Clients Improve Their Capital Management Efficiency

Global Markets And Securities Services

Global Markets: Sales And Trading Of Fixed Income Securities, Equities, Financial Derivatives

Securities Services: Securities Custody And Settlement, Fund Accounting And Administration, Securities Lending

Global Research: Provides Research Reports Covering Macroeconomics, Foreign Exchange, Equities, And Fixed Income Across Multiple Global Markets

Wealth And Personal Banking

HSBC Announced In 2020 That It Will Merge The Former Retail Banking And Wealth Management And Global Private Banking Into A New Global Business - Wealth And Personal Banking.

Retail Banking: Main Services Include Personal Banking And Deposits, Personal Loan Issuance And Management (home Loans, Etc.), Credit Card Issuance And Merchant Management, PayMe, Etc.

Wealth Management: Stocks, Trust Units, Bonds/certificates Of Deposit, Structured Investment Products, Warrants And CBBCs, ESG Investments, Etc.

Asset Management

Insurance: Life Protection, Medical Protection, Home Protection, Travel Protection And Employee Benefits (MPF/ORSO), Etc.

Global Private Banking

Operations

Share Status

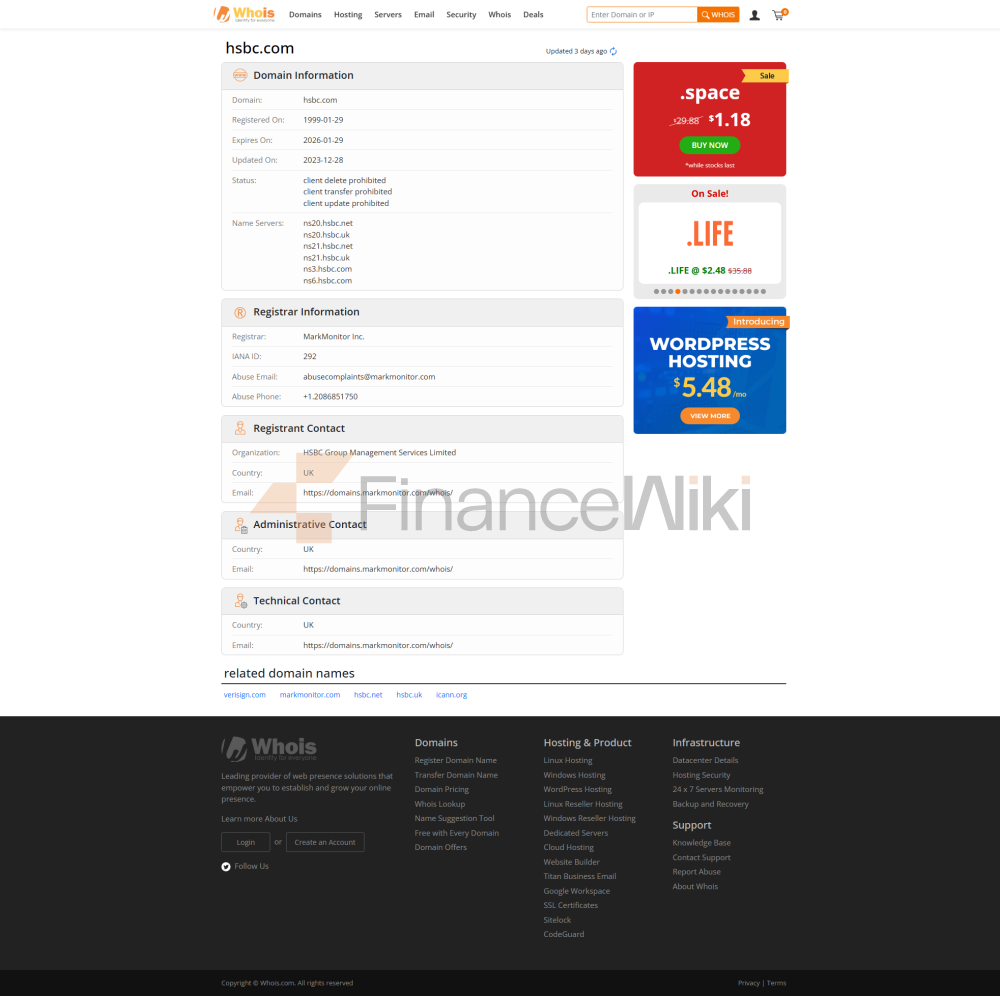

HSBC Holdings' Shares In London, Listed On The Hong Kong, New York And Bermuda Stock Exchanges, There Are Approximately 220,000 Shareholders From 120 Countries And Regions Around The World. HSBC Holdings Is Currently A Constituent Of The Hang Seng Index In Hong Kong And The FTSE 100 Index In The United Kingdom. On November 2, 2020, HSBC Holdings Announced Plans To Delist From Euronext In Paris Due To Considerations Of Trading Volume, Cost And Administrative Requirements.

Major Shareholder Shareholding Ratio

As Of January 16, 2022, Each Major Shareholder Held The Following Shares In HSBC Holdings:

Ping An Asset Management (a Subsidiary Of Ping An Insurance) 8%

BlackRock 7.32%

Vanguard 5.6%

Other Shareholders 79.08%

Total Assets

Europe: Total Assets $1.354483 Trillion, Customer Loans (Net) $397.09 Billion, Customer Deposits $667.769 Billion

Asia-Pacific: Total Assets $2617.07 Billion, Customer Loans (net) $492.525 Billion, Customer Deposits $792.098 Billion

Middle East And Africa (excluding Saudi Arabia): Total Assets $70.974 Billion, Customer Loans (net) $26.375 Billion, Customer Deposits $42.629 Billion

North America: Total Assets $362.45 Billion, Customer Loans (net) $108.717 Billion, Customer Deposits $178.565 Billion

Latin America: Total Assets $46.602 Billion, Customer Loans (net) $21.107 Billion, Customer Deposits $29.513 Billion

HSBC Internal Projects: Total Assets $137.977 Billion