Coöperatieve Rabobank U.A. (Rabobank) is a pioneer in global financial markets, with a vision of "growing together for a sustainable future" in retail banking, corporate finance and agricultural finance. Founded in 1972 by the merger of two Dutch farmers' cooperative banks, Raiffeisen-Bank and Boerenleenbank, its roots can be traced back to the cooperative banking movement founded by Friedrich Wilhelm Raiffeisen in 1898. Headquartered in Utrecht, the Netherlands, Rabobank is a cooperative bank that serves more than 10 million customers through a governance model of around 950,000 members (customer and community representatives), and is a leader in the Dutch and global financial markets thanks to its solid financial performance and innovative capabilities.

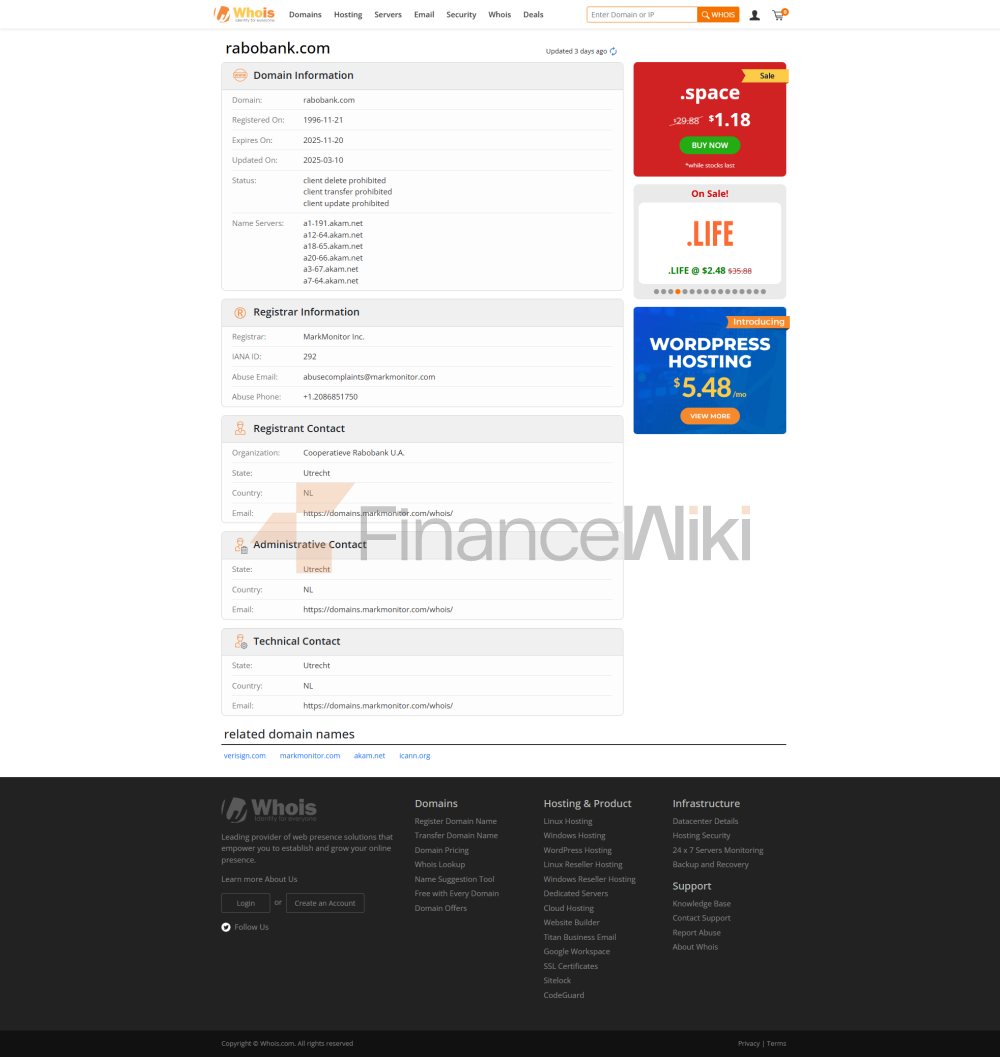

Rabobank is a commercial bank with a cooperative structure, non-state-owned or joint venture, founded in 1972 and headquartered in Croeselaan 18, Utrecht, the Netherlands. The bank consists of 89 local Rabobank cooperatives, including customer and community representatives, with no traditional shareholders, listed on the over-the-counter market (OTCMKTS: RABOY). In 2024, Italy's Unicredit will hold about 28% of the shares, the rest will be free float, and the German government once held 15% (which has now exited). Rabobank is strictly regulated by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Financial Market Authority (AFM) and is required to comply with the Dutch Banking Act and international financial standards to ensure operational transparency and the safety of client funds. Its deposits are protected by the Dutch Deposit Protection Scheme (DGS), with a maximum coverage of €100,000 per depositor. The SWIFT code for banks is RABONL2U and the Legal Entity Identifier (LEI) is DG3RU1DBUFHT4ZF9WN62. Rabobank has branches in more than 40 countries around the world, including Rabo AgriFinance (USA), RaboDirect (Australia, New Zealand) and mBank (Poland), with approximately 45,000 employees worldwide.

Deposit & Loan Products

DepositsRabobank

offers a wide range of deposit products to meet the savings needs of individual and corporate customers:

Demand Deposits: including checking accounts and savings accounts, such as "Rabo Girokonto", with a minimum opening amount of €100 and a base annualized rate of return (APY) of approximately 0.05%-0.3%, subject to confirmation of the latest interest rate through a branch or online banking. The account supports a no-monthly fee option (subject to minimum balance or trading conditions).

Fixed deposits: 12 currencies such as EUR, USD, CNY, etc., with deposit terms ranging from 1 month to 5 years, and the minimum deposit amount is 1,000 euros. In 2025, the interest rate on fixed deposits will be up to 2.5% (12 months, with a deposit amount of less than 1 million euros), which can be checked online or in a branch.

Featured products:

high-yield savings account: such as "RaboDirect Tagesgeldkonto", which offers an annualized interest rate of up to 1.5% and needs to maintain a balance of more than €10,000 with no monthly fee, The Australian market offers interest rates of up to 4.2%.

Large Certificates of Deposit (CD): Support flexible tenors, suitable for large amount of money customers, interest rates need to be queried through branches or apps, early withdrawal penalty is 90 to 180 days of interest, Australian customers can get 0.1% loyalty bonus (automatic renewal).

Customers can check the "Cloud Interest Rate" offer through the "Rabo App" or online banking, and the deposit products support instant opening and interest rate calculation, and some accounts provide free transaction fee offers.

LoansRabobank

offers a comprehensive range of loan products to meet diversified financing needs:

Mortgages: Fixed-rate and variable-rate mortgages up to 90% of the value of the property (collateral required) with a repayment period of up to 30 years. In 2025, the fixed interest rate will be as low as 1.5% (3 years), and the floating rate will be based on Euribor (about 4.5%), offering cash rebates and green mortgage discounts (energy-efficient homes). To apply, you need a credit score of 700 or more and an annual income of more than 30,000 euros.

Car loans: New and used car financing is supported, with a loan amount of up to 50,000 euros, a term of up to 7 years, an annualized interest rate (APR) as low as 2.9%, and a credit score of 660 or more.

Personal Line of Credit: includes Rabo personal loans (APR as low as 5.9%, amount up to €200,000, term 1-7 years) and asset-backed overdraft (up to 95% of the collateral market value), with a monthly salary of more than €30,000 and a good credit history.

Flexible repayment options: Mortgages and personal loans offer no penalty for early repayment, weekly or bi-weekly payment plans, and a revolving line of credit for flexible debt management.

All loans are subject to bank approval, and customers are required to provide credit history, proof of income and asset information, subject to the terms of the loan agreement. The bank's agricultural loan services, such as Rabo AgriFinance, provide specialized financing support to farmers around the world.

Digital Service

ExperienceRabobank's mobile banking app "Rabo App" is the core of its digital service, which is available for download on iOS 14.0 and above and Android 9.0 and above devices, with an App Store rating of about 4.7 and a Google Play rating of about 4.5, and users praise its smooth experience and versatility (Rabo App).

Face recognition: Supports biometric authentication (such as Face ID and Touch ID), combined with multi-factor authentication and data encryption to ensure transaction security.

Real-time transfers: Support instant transfers in euros via SEPA and SWIFT, with a daily limit of up to €25,000, international remittances covering more than 100 countries, and support instant transfers in AUD (up to AUD 10,000) via PayID and OSKO in the Australian market.

Bill management: Support online bill payment, automatic deduction and e-statement, and classify transaction records in real time.

Investment Tool Integration: Support stocks, ETFs, mutual funds, and bond trading with Rabo Wealth Management, providing real-time market data and investment advisory services.

The online banking platform "Rabo Online Banking" supports multiple browsers and provides similar functions, allowing customers to open an account in less than 5 minutes through the app or official website. The app supports accessibility features such as dynamic font adjustment and VoiceOver compatibility for visually impaired and hearing-impaired customers. In 2023, banks report that 70% of customers complete transactions through the Rabo App, significantly improving the user experience.

Technological

InnovationRabobank excels in the fintech sector, driving technological advancements through its Digital Innovation Center:

AI customer service: Introduce an AI-driven customer service system to analyze transaction behavior, detect fraud risks in real time, automate 90% of customer inquiries by 2023, and plan to launch a virtual assistant in 2025 to support 24/7 inquiries and personalized financial advice.

Robo-advisor: Provide AI-based investment management services through Rabo Wealth Management, recommend diversified portfolios based on customer risk appetite, with a minimum investment of €1,000 and no subscription fees.

Open Banking API Support: Compliant with the European Open Banking Standard (PSD2) and integrated with third-party service providers to provide account management and financial services interoperability, particularly in the areas of trade finance and cross-border payments. The Australian market supports 35 deposit and loan services through an open banking framework.

Other innovations: support for mobile payments such as Apple Pay and Google Pay, mobile check deposits, and cooperation with Temenos core banking system for rapid product launches; The Fraud Protection tool leverages AI to reduce fraud losses by 30%. In 2024, the bank will invest 1 billion euros to upgrade its cloud technology and AI platform to improve operational efficiency.

Featured Services & DifferentiationRabobank

is known for its agricultural finance and sustainability:

- Agricultural

finance: As a global leader in agricultural finance, serving 85%-90% of Dutch agricultural customers, Provides agricultural lending, insurance, and risk management services to support farmers and agribusinesses in the U.S., Australia, New Zealand, and Latin American markets.

Green Finance: Launched green bonds and preferential rate loans to support renewable energy and energy efficiency projects, and signed a green power contract with a subsidiary of Santi Renewable Energy in 2023 in response to the United Nations Principles for Responsible Banking.

Community support: Through a cooperative model, members participate in the governance of the bank to ensure that services are close to the needs of the community; In 2023, we will donate 10 million euros for community development, hold financial literacy lectures, and improve the financial literacy ability of young people.

SME support: Customized loan and cash management services, participation in the SME Financing Guarantee Program in the Netherlands and Australia, loan approval in as fast as 10 seconds, up to €3 million.

International presence: With branches in more than 40 countries, including Rabo AgriFinance (USA), RaboDirect (Australia, New Zealand) and mBank (Poland), it supports the global food and agriculture supply chain.

Market Position & Accolades

Rabobank is the second largest bank in the Netherlands, with total assets of approximately €628 billion and net profit of €2.7 billion in 2024, ranking among the top in the global financial market. With more than 1,000 branches (including 89 local cooperatives) serving 10 million customers, the bank has a 30% share of the Dutch retail banking market, a 40% share of the SME market, and a dominant position in the agricultural finance sector. Its international presence covers Europe, Asia, North America and Latin America, and it will rank high on the Forbes Global 2000 list in 2023. Key accolades include:

The Banker's 2023 Best Sustainable Bank in the World

Greenwich Associates SME Customer Experience Award 2022

The 2023 "Best Employer" certification recognizes performance in employee development and community support

2023 European Green Finance Pioneer Award

Rabobank's solid financial performance and innovative ability have made it a leader in the global financial markets.

SummaryRabobank S.A. has become a pioneer in the Dutch and global financial markets with its 100-year cooperative tradition, global business layout and innovative financial services. It offers a wide range of deposit and loan products, including high-yield savings accounts, term deposits, and flexible mortgages and personal loans, to meet the diverse needs of its customers. In terms of digital services, the "Rabo App" has been widely praised for its efficient real-time transfer and investment management functions. Technological innovations, including AI customer service, robo-advisors, and open banking API support, demonstrate its forward-looking digital transformation. With its agricultural finance, green finance, community support, and multiple industry accolades in 2023, Rabobank continues to demonstrate strong competitiveness and influence in the global financial market.

Note<

ul style="list-style-type: disc" type="disc">specific interest rates and product details may vary due to market changes, please contact Rabobank official website or contact the bank directly for the latest information.