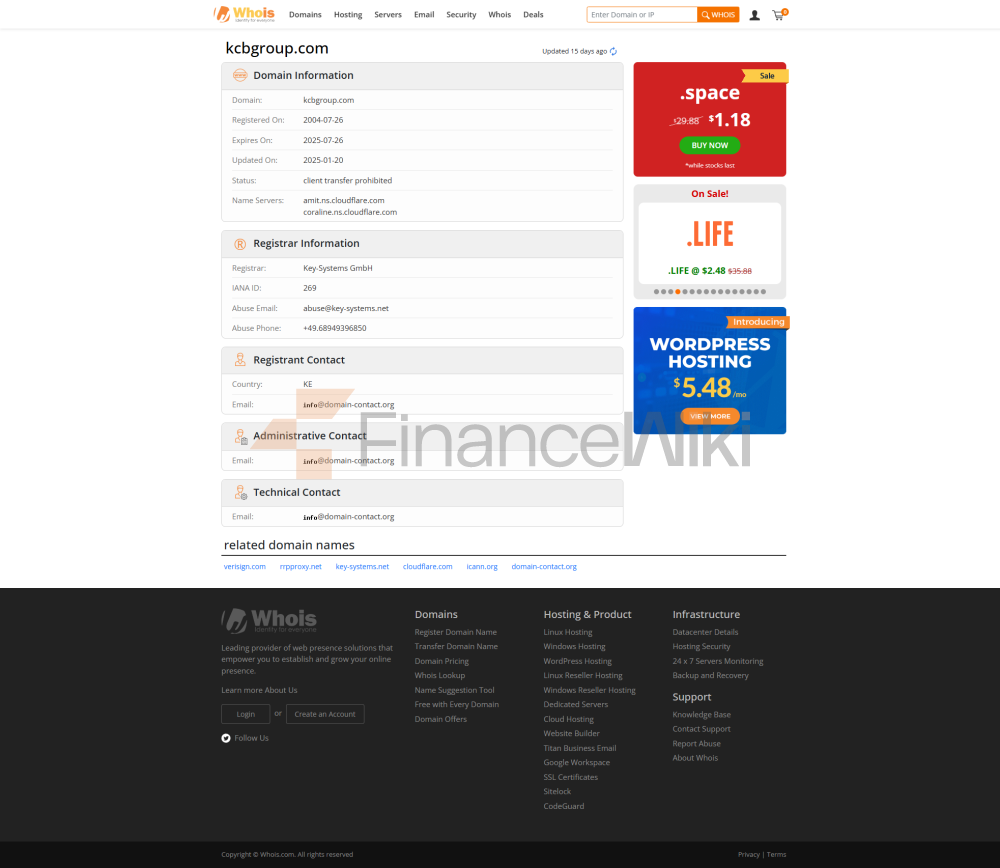

IntroductionKCB Bank Kenya Limited is one of the leading commercial banks in Kenya, part of KCB Group Plc, the largest financial group in East Africa. Originating from the State Bank of India's branch in Mombasa in 1896, KCB Bank Kenya has grown into a bank with a deep history and extensive influence.

Here's a closer look at KCB Bank Kenya:

basic information

type and background: KCB Bank Kenya is a wholly owned subsidiary of KCB Group Plc. KCB Group Plc is a holding company listed on the Nairobi Stock Exchange, and its shares are also cross-listed on the stock exchanges of Uganda, Rwanda and Tanzania. As of December 2023, the Ministry of Finance of Kenya holds approximately 19.76% of the shares of KCB Group, the National Social Security Fund holds approximately 9.73% of the shares, and the rest is held by the public.

Scope of Services

Coverage area: KCB Bank Kenya's services mainly cover the whole country of Kenya.

Offline outlets and ATMs: As of August 2021, KCB Bank Kenya has 201 branches, 397 ATMs, and provides banking services through 15,273 agent and merchant outlets.

Regulatory & Compliance

regulator: KCB Bank Kenya is regulated by the Central Bank of Kenya.

Deposit Insurance: The bank participates in Kenya's deposit insurance scheme to protect customers' deposits.

Compliance Record: KCB Bank Kenya complies with all regulatory requirements and regularly discloses financial and operational information to demonstrate its strong compliance status.

Financial health

capital adequacy ratio: As of June 2023, KCB Group's capital adequacy ratio was 19.1%, higher than regulatory requirements.

Non-performing loan ratio: In the first quarter of 2024, KCB Group's non-performing loan ratio was approximately 14.3%, and the bank has taken steps to control risks.

Liquidity Coverage Ratio (LCR): KCB Bank Kenya's liquidity coverage ratio remains at a stable level to meet regulatory requirements.

Deposit & Loan Products

Deposit products: KCB Bank Kenya offers a variety of deposit products, including demand deposits, term deposits, and high-yield savings accounts.

Loan products: Banks offer a variety of loan products such as home loans, car loans, personal lines of credit, etc., with interest rates and loan terms depending on the customer's credit profile and loan type.

List of common fees

Account management fees: KCB Bank Kenya's account management fees vary according to the type of account, and the specific fees can be found on the bank's official website.

Transfer fees: Banks provide low-cost domestic transfer services, and cross-border transfer fees vary depending on the transaction.

ATM withdrawal fees: Withdrawals at your own ATM are usually free, and there may be a fee for using other banks' ATMs.

Other fees: The bank's fee structure is transparent, and customers can view detailed fee information through the official website or mobile app.

Digital Service Experience

Mobile App & Online Banking: KCB Bank Kenya provides a feature-rich mobile banking app and online banking platform that supports account management, transfer and payment, Features such as bill payment.

Technological innovation: Banks have introduced technologies such as AI customer service, robo-advisors, and open banking APIs to improve customer experience.

User Ratings: KCB Bank Kenya's mobile app has received high ratings on both the App Store and Google Play, reflecting good user satisfaction.

Customer Service Quality

Service Channel: KCB Bank Kenya offers 24/7 phone support, live chat, and social media responsiveness to ensure that customers can get help at all times.

Complaint Handling: The Bank is committed to quickly resolving customer complaints and improving user satisfaction.

Multi-language support: KCB Bank Kenya offers services in multiple languages, making it convenient for customers with different language backgrounds.

Security Measures

security of funds: Customers' deposits are protected by the Kenya Deposit Insurance Scheme, and the bank also uses advanced anti-fraud technologies such as real-time transaction monitoring to ensure the safety of funds.

Data Security: KCB Bank Kenya takes the security of customer data seriously and has taken several measures to prevent data breaches.

Featured Services and Differentiation

market segment services: Banks provide customized services for different customer groups, such as student accounts, exclusive wealth management products for the elderly, and green financial products.

High Net Worth Services: KCB Bank Kenya provides private banking services to provide customized financial solutions to high net worth clients.

Market Position & Accolades

Industry ranking: KCB Bank Kenya is one of the largest commercial banks in Kenya with over 30 million customers.

Awards and honors: The bank has won a number of international honors, such as the "Best Bank of the Year 2023 Award" and the "World's 6th Strongest Bank Brand", demonstrating its outstanding performance in the field of financial services.