Bank BasicsEcobank

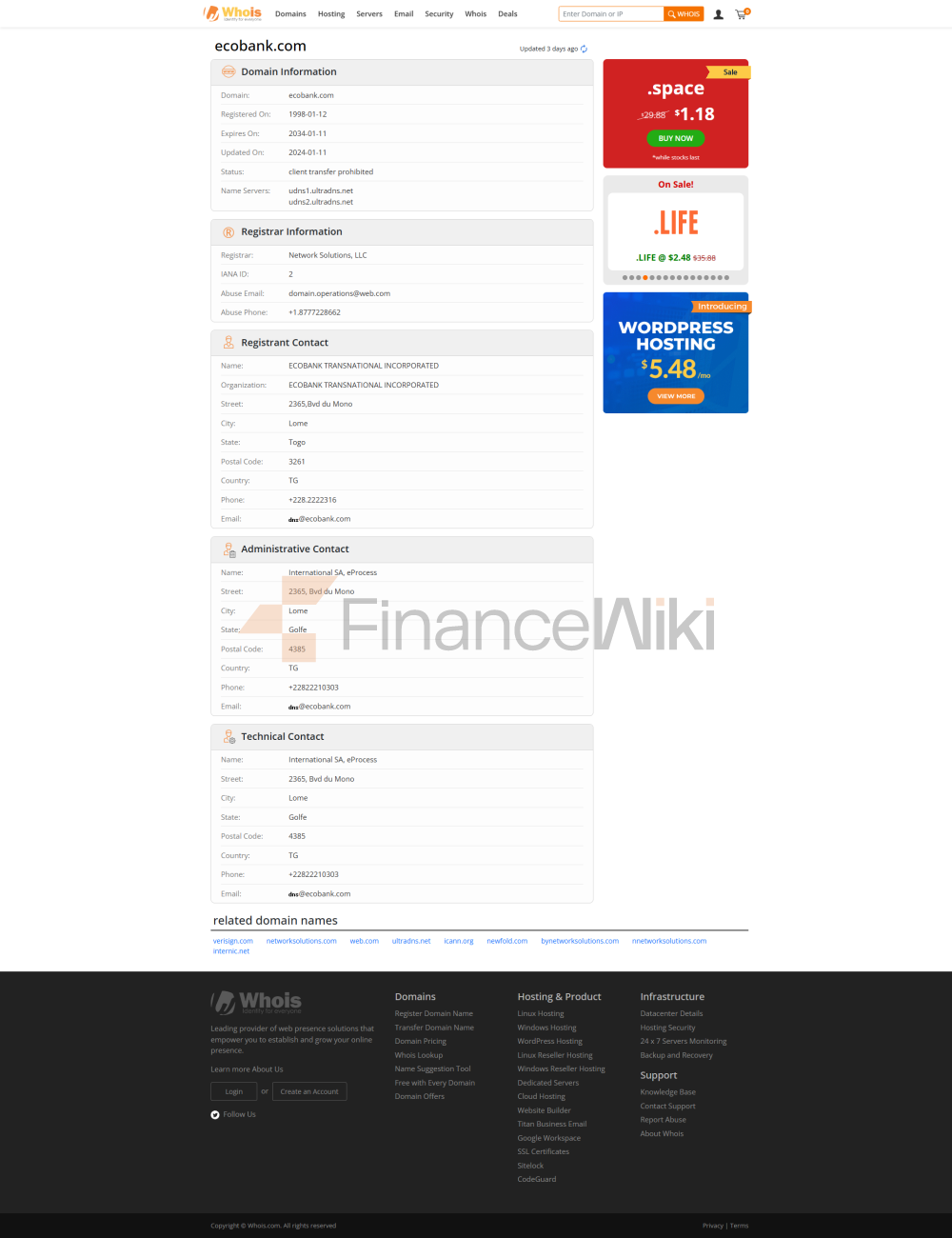

Nigeria Limited is a commercial bank that is part of Ecobank Transnational Incorporated (ETI), a pan-African banking group. It is not a state-owned bank or joint venture, but a regional commercial bank dominated by the private sector and designed to serve individual and corporate customers in West and Central Africa. ETI was launched in 1985 by the Federation of West African Chambers of Commerce to fill the gap in the lack of local private banks in West Africa at the time.

Name & BackgroundFull

Name: Ecobank Nigeria Limited

Founded: 1989 Headquartered

in Lagos

, Nigeria

Shareholder Background: Ecobank Nigeria is a wholly owned subsidiary of ETI, a public company listed on the West African Stock Exchange, including the Nigerian Stock Exchange NSE. Major shareholders include the ECOWAS Bank for Investment and Development (EBID), the investment arm of the Economic Community of West African States (ECOWAS), as well as other individual and institutional investors in the West African region. ETI's listing status gives it a high degree of transparency, but it is not state-owned or fully private, but rather a regional, private-led hybrid model.

Backstory: Ecobank was born out of a vision discussed in Mali in 1972 to provide financial support to West African entrepreneurs. In 1985, ETI was incorporated in Togo with the status of an international organization and the special rights and interests of a non-resident financial institution. In 2011, Ecobank Nigeria significantly expanded to become one of the top five banks in Nigeria through the acquisition of Oceanic Bank.

Coverage area

: Ecobank Nigeria mainly serves the Nigerian market, and has branches or representative offices in 35 African countries (including West, Central, East and Southern Africa) and France, the United Kingdom, Dubai and China, relying on its parent company ETI.

Offline outlets: As of 2011, with the merger of Oceanic Bank, Ecobank Nigeria has over 600 branches, making it the second largest bank in Nigeria by the number of outlets.

ATM distribution: ETI Group has about 1,981 connected ATMs as a whole, the number of ATMs in Nigeria is not disclosed, but considering its extensive network layout, ATM coverage should be relatively dense in major cities and regions of Nigeria to facilitate customers' daily withdrawals and transactions.

Regulatory & Compliance

Regulator: Ecobank Nigeria is regulated by the Central Bank of Nigeria (CBN) and is subject to its strict banking regulations.

Deposit Insurance Scheme: As a licensed commercial bank in Nigeria, Ecobank Nigeria participates in the Nigerian Deposit Insurance Corporation (NDIC) Deposit Insurance Scheme to protect customers' deposits, usually covering small and medium-sized deposits (up to about 500,000 naira, depending on the policy).

Compliance record: Ecobank Nigeria has maintained its compliance profile by raising concerns in a 2015 debt dispute (a 3.5 billion naira loan dispute with Honeywell Group) that was eventually resolved by the Bankers Council. However, in December 2024, ETI and its subsidiaries, including Ecobank Nigeria, faced a $68 million lawsuit in Dubai involving allegations of defamation and misconduct by its subsidiaries and senior leadership.

Financial Health

Capital Adequacy Ratio: As of June 2024, ETI Group's capital adequacy ratio is 14.1%, higher than the usual requirement of 8% (which may be higher for regional banks). However, Ecobank Nigeria has faced the challenge of a capital adequacy ratio of less than 10% at the subsidiary level, which needs to be improved by issuing bonds or extending debt maturity.

Non-performing loan ratio: The exact data is not disclosed, but Ecobank Nigeria's non-compliant capital adequacy issues suggest that it may be under some asset quality pressure.

Liquidity Coverage Ratio: The Group's overall liquidity position is stable, but the Nigerian subsidiary is under pressure due to the recent repayment of US$50 million in bonds and US$25 million in bridge loans. The planned issuance of $600 million in bonds in 2024 to enhance liquidity indicates that it is actively managing its financial health.

Quick Verdict: Ecobank Nigeria's financial position is generally sound, but the capital and liquidity issues of the Nigerian subsidiary require continued attention. The Group supports providing some cushion, but needs to carefully assess its asset quality in the short term.

Deposits & LoansDeposits

:

demand deposits: basic current accounts are available, with a low interest rate (usually 0.5%-1%, depending on the market), suitable for daily money management.

Time deposits: A variety of tenor options (1 month to 5 years) are available, with an interest rate of about 3%-7% (depending on the amount and term), which is higher than that of current accounts.

High Yield Savings Account: Ecobank Nigeria offers a 'Premier' account for high-end customers with a slightly higher interest rate than a regular savings account (around 2%-4%).

Certificates of Deposit: Traditional certificates of deposit (CDs) are not explicitly available, but group-level investment products may include similar fixed-income instruments, which require consultation with specific outlets.

Loans:

Mortgages: Mortgage loans are available, usually at 15%-20% (due to the high interest rate environment in Nigeria), with a high credit score and proof of stable income.

Car loans: New and used car loans are supported, with an interest rate of about 12%-18%, and the term is usually 3-5 years.

Personal Line of Credit: Unsecured loans are available at higher interest rates (20%-25%), and approvals are based on credit history and income.

Flexible repayment options: Some loan products allow for early repayment or adjustment of payment schedule, but additional negotiation may be required, and terms vary by product.

List of common expenses

Account management fee: about 100-500 naira per month for ordinary accounts, and monthly fees may be waived for premium accounts (such as Premier), but a minimum balance (about 100,000 naira) needs to be maintained.

Transfer fee: 5-50 naira for domestic transfers, higher for cross-border transfers (about 0.5%-1% of the transaction amount).

Overdraft fee: Depending on the account type, overdrafts may be subject to daily interest or a flat fee (approximately 500-1000 naira).

ATM interbank withdrawal fee: approximately 50-100 naira per transaction, depending on the network protocol.

Hidden Fee Reminder: Pay attention to the minimum balance requirement (100-300 naira per month may be deducted if you do not meet the standard) and undisclosed cross-border transaction fees, and it is recommended to check the statement regularly.

Digital Service Experience

App & Online Banking: Ecobank Nigeria's mobile app (Ecobank Mobile App) and online banking platform support a wide range of features. The app has a rating of around 4.0/5 on Google Play and the App Store (based on user feedback), with users praising its convenience, but some users report occasional technical glitches.

Core features:

face recognition: Some high-end accounts support biometric login.

Real-time transfers: Support real-time domestic transfers and some cross-border payments (e.g. through Ecobank Single Market Trade Hub).

Bill management: It can pay utility bills, mobile phone recharge, etc., with a friendly interface.

Investment Instrument Integration: Underlying investment product inquiries are available, but advanced investment tools are subject to consultation through a branch or Ecobank Development Corporation (EDC).

Technological innovation:AI customer service: Ecobank introduced a basic AI chatbot for FAQs, but complex issues still require human support.

Robo-advisors: Not widely promoted yet, but are being explored at the group level.

Open Banking APIs: Ecobank Group, through its partnership with Afreximbank and XTransfer, supports open banking APIs to facilitate cross-border trade for SMEs.

Customer service quality

channels: 24/7 telephone support (hotline: +234 700 500 0000), live chat via app and website, social media (LinkedIn, X) with fast response times (usually within hours).

Complaint handling: Complaint rate data is not publicly available, but customer feedback shows that simple issues (e.g., failed transfers) are usually resolved within 1-3 days, while complex issues (e.g., loan disputes) can take 1-2 weeks. User satisfaction is average, and some customers are dissatisfied with the response time.

Multi-language support: Mainly support English, some regional outlets provide local languages (such as Yoruba, Hausa), but cross-border users may need to rely on English services.

Safety and security measures

: Participate in the NDIC deposit insurance scheme to protect small and medium-sized deposits. Anti-fraud technologies include real-time transaction monitoring and anomalous activity alerts to reduce the risk of fraud.

Data security: The Ecobank Group centralizes its IT operations through eProcess International, which claims to comply with international security standards, but does not explicitly mention ISO 27001 certification. There is no record of recent major data breaches, but it is necessary to pay attention to the progress of its IT infrastructure upgrade.

Featured Services & Differentiated

Segments:

Student Accounts: Fee-free youth accounts are available for students with a low minimum balance (about 5,000 naira).

Senior-only banking: Not explicitly promoted, but high-end customers can get customized financial advice through the Premier account.

Green financial products: The Ecobank Group supports sustainable finance (e.g. the Equator Principles), but the Nigerian subsidiary does not widely promote ESG investment products.

High Net Worth Services: Private banking services for high net worth clients (threshold of approximately N50 million), including wealth management and fixed income investment solutions.

Market Position & Accolades

Industry Rankings: In 2011, Ecobank Nigeria ranked among the top five banks in Nigeria with assets of US$8.1 billion (1.32 trillion naira). Operating in 35 countries in Africa, ETI Group is one of the largest banking networks in Africa (1500+ outlets).

Awards: 'Best SME Bank in Nigeria' by Global Finance in 2024 for its financial support to SMEs.