The Kenya Cooperative Bank is a commercial bank in Kenya, the largest economy in the East African Community. It is licensed by the Central Bank of Kenya, the Central Bank, and the National Banking Regulator. The bank has introduced a correspondent banking model and has a deep customer base in Kenya, with more than 7.5 million accounts as of December 2018. In 2010, the bank was awarded the "Best Bank in Kenya" award by the Financial Times of London for its outstanding growth.

An overview

of the banking needs of the bank to meet the banking needs of individuals, small businesses, and large corporations, with a focus on the needs of Kenyan cooperatives. Co-operative Bank is a large financial services institution. Its total assets are valued at Ksh 404.15 billion (about $4 billion). As at 31 December 2013, the value of its shareholders' equity was approximately 36.8 billion shillings As of May 2012, the bank controlled about 8.2 per cent of all bank assets in Kenya.

History

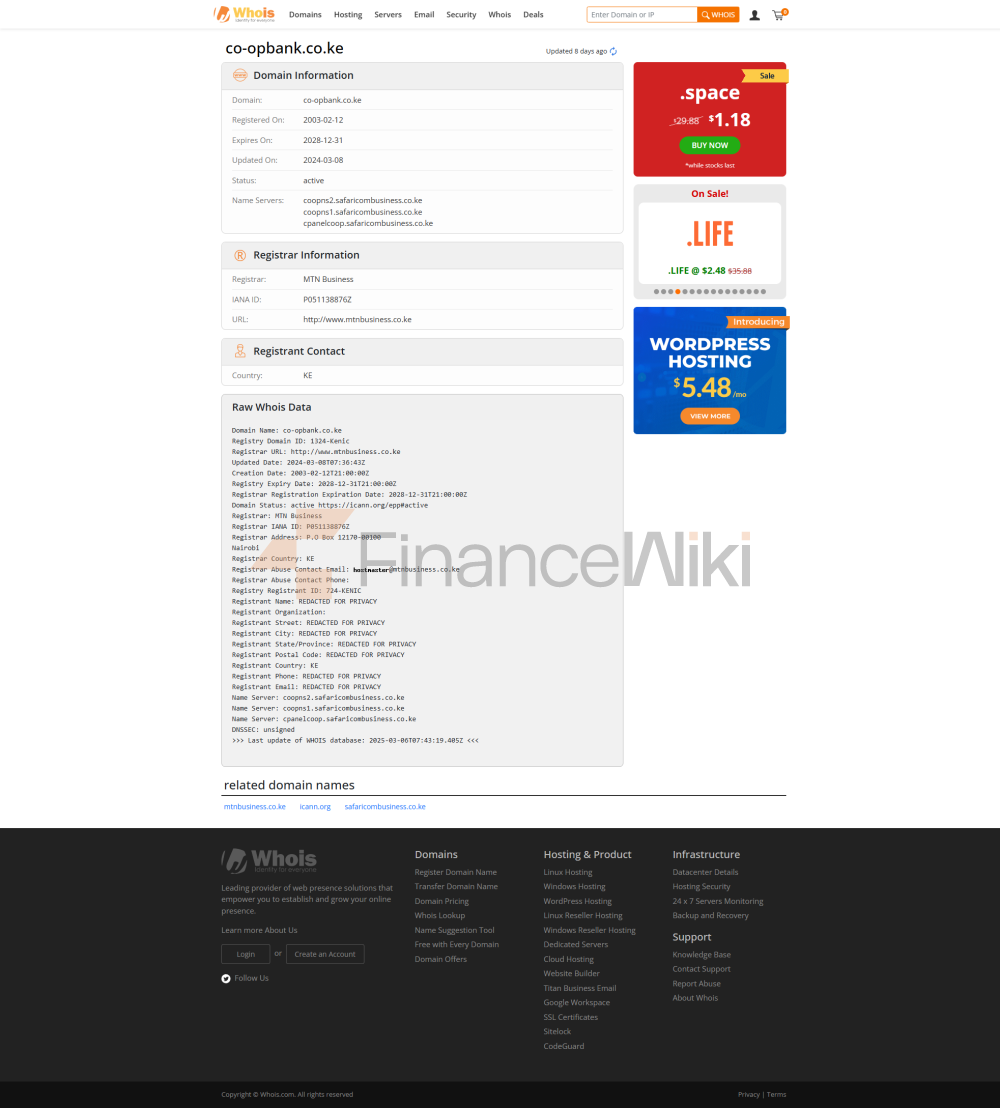

The bank was founded in 1966 as a cooperative. The banking license was issued in 1968. The Government of Kenya instructed all cooperatives in the country to transfer their deposits to the Kenya Cooperative Bank and required all cooperatives to buy shares in the bank. In 1977, the bank opened its first subsidiary: Cooperative Finance Limited. In 1989, the bank transformed into a full-fledged commercial bank and increased its product menu. In 1998, the bank's headquarters was destroyed by the bombing of the nearby embassy of the United States of America and subsequently relocated. In the same year, the bank became an agent for the money transfer service company MoneyGram. In 2002, the bank's headquarters were renovated and returned to the cooperative bank building. In 2008, the bank was listed on the Nairobi Stock Exchange under the ticker symbol COOP.

In March 2020, the bank announced plans to acquire Jamii Bora Bank. Cooperative Bank acquires Jamii Bora Bank and changes its name to Kingdom Bank Limited.

The companies whose member companies

make up Cooperative Bank Limited include, but are not limited to, the following:

- Kingdom Securities Limited – Nairobi, Kenya – 60% ShareholdingCo-opTrust

- Investment Services Limited – Nairobi, Kenya – 100% Equity

- Co-operative Consultancy Services Kenya Limited – 100% Equity

- , CIC Insurance Group Limited – 35.71% Holdings,

- South Sudan Cooperative Bank, South Sudan Juba

- Cooperative Bank Foundation – Nairobi, Kenya ,

- Ethiopian Cooperative Bank – Addis Ababa, Ethiopia – Under development

- Uganda Cooperative Bank – Kampala, Uganda – is under development.

- Kingdom Bank Limited (Kenya) (formerly Jamii Bora Bank) – Nairobi, Kenya (90% equity)

Ownership

The Bank's shares are owned by the following corporate entities and individuals:

CoopHoldings Cooperative Society Limited is a holding company owned by cooperatives in Kenya who collectively own a majority stake and represent 65% of all shares in the company. The remainder is held by individual and institutional investors through the Nairobi Stock Exchange.