Basic banking

informationLandsbankinn hf. is a commercial bank positioned as a leading financial institution in Iceland, known for its comprehensive financial services and extensive network coverage.

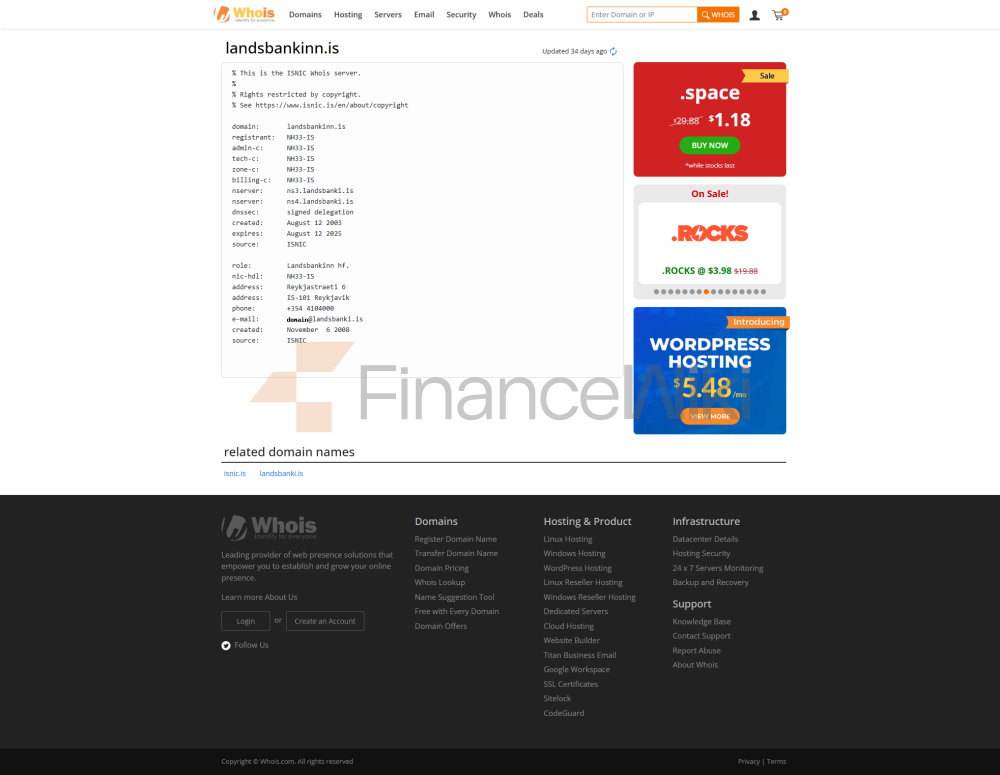

name and background: Landsbankinn hf., Chinese often translated as "National Bank of Iceland". With a history dating back to 1886, it was officially established on 7 October 2008 as the "New Landsbanki", which had collapsed due to the 2008-2011 Icelandic financial crisis. The headquarters is located in Reykjavík, Iceland (Reykjastræti 6, 101 Reykjavík). The bank is 98.2% owned by the National Ministry of Finance of Iceland through the Icelandic National Financial Investment Agency, and the remaining 1.8% is held by other shareholders.

Scope of services: Landsbankinn is the leader in the Icelandic financial services market with a market share of around 35.95% (2023 data). With 35 branches and outlets, it is the largest network of banking outlets in Iceland. ATMs are widely distributed and support contactless payments, encouraging customers to use mobile devices or smartwatches to make transactions (a single transaction is capped at ISK 5,000 for traditional card payments). The bank mainly serves the local market in Iceland and has less international business, and the historical overseas branches (e.g. London, Amsterdam, Luxembourg) have been adjusted to domestic business due to the financial crisis.

Regulation & Compliance: Landsbankinn is regulated by the Financial Supervisory Authority (FSA) of the Central Bank of Iceland and is subject to the EU Capital Requirements Regulation (CRR) and Liquidity Coverage Requirements (LCR). The bank participates in the Icelandic Deposit Insurance Scheme, which protects customer deposits up to €100,000. In terms of compliance records, there have been no recent major breaches, and banks have a solid track record of anti-money laundering (AML) and customer due diligence (KYC) with no records similar to recent AML fines in the Swedish financial sector.

Financial

healthLandsbankinn's strong financial performance demonstrates its strong competitiveness in the Icelandic market.

key metrics:

capital adequacy ratio: total capital ratio of 24.3% at the end of 2024, far exceeding the minimum requirement of 20.4% for the Icelandic Financial Supervisory Authority, Demonstrates a strong capital buffer.

Non-performing loan ratio: The default rate of corporate and household loans in 2021 was only 0.3%-0.4%, indicating high loan quality and low default risk.

Liquidity Coverage Ratio: At the end of the third quarter of 2024, the Liquidity Coverage Ratio (LCR) was 263%, a significant increase from 238% in the same period in 2023, well above regulatory requirements, demonstrating strong liquidity management capabilities.

These indicators demonstrate Landsbankinn's ability to remain robust in a high interest rate environment and potential economic volatility to provide reliable financial support to its customers.

Deposit & Loan

ProductsLandsbankinn offers a wide range of deposit and loan products to meet the needs of individual and business customers.

deposits:

demand deposits: Non-fixed-term savings accounts have lower interest rates, with an average net interest margin of 2.1% per household (2024 data).

Fixed Deposits: Corporate customers can enjoy an interest rate of up to 8.65% per annum (2024), which fluctuates depending on the tenor and amount of the deposit.

Featured product: "Smart Savings" account available, managed via the Landsbankinn app, with 39% increase in users in 2024 and around 59,000 customers enjoying the highest interest rates on non-indexed accounts. There is no explicit mention of Large Certificates of Deposit (CDs), but they do support flexible savings products, such as supplemental retirement savings, which can be used for the purchase of a first home or mortgage payments for up to 10 years, with tax exemptions.

Loans:

Mortgages: Non-indexed mortgages have lower interest rates (from 6% to 5.05% in 2019), with about 93% of new mortgages being non-indexed and nearly 40% being fixed-rate loans. Banks have streamlined the online loan application process to support first-time homebuyers by offering equal repayment mortgages to accelerate asset accumulation.

Car loans: Supporting the financing of new and used cars, personal car loans amounted to ISK 6.2 billion in 2019, accounting for one-third of vehicle and equipment financing.

Personal Line of Credit: "Aukaklán" loans, which can be applied for through the app, with funds available instantly and in installments of up to 5 years. It supports overdraft limit adjustment and installment repayment of credit card bills, which is more flexible.

Threshold and flexibility: Loan applications are subject to an online credit assessment, with additional documents required for amounts over ISK 2.2 million (for individuals) or ISK 4.4 million (for couples). Banks offer a variety of repayment options, such as contacting the bank in advance to adjust the repayment plan to cope with financial difficulties.

List of common fees:

Account Management Fee: The monthly/annual fee is not specified, but there are no additional fees for opening an account and obtaining a debit card through the app.

Transfer fee: Domestic transfer is completed in real time through the app, and there is no record of high fees; Cross-border transfer fees are not disclosed, and customers are advised to consult through customer service.

Overdraft Fees and ATM Fees: The overdraft limit can be flexibly adjusted through the app, and the specific fees are not specified. Interbank ATM withdrawal fees are not disclosed in detail, but contactless payments are encouraged to reduce transaction costs.

Hidden Fee Warning: Some short-term loans may have an annualized cost of up to 30-40%, including borrowing fees and payment fees, and customers should review the terms carefully. The minimum balance limit is not explicitly mentioned, but it is advisable to keep the account active to avoid potential fees.

Digital Service

ExperienceLandsbankinn is committed to digital transformation and offers convenient online and mobile banking services.

APP & Online Banking:

The Landsbankinn app is well-received and highly satisfied, with 33 updates released in 2024 and new features including facial recognition, real-time transfers, bill management, and fixed-rate loan applications. Specific ratings for the App Store and Google Play are not disclosed, but user surveys show high recognition for its intuitiveness and uniqueness, such as "Smart Savings" management.

Online banking supports account opening, debit card applications, loan applications, and credit assessments in a matter of minutes.

Technological innovation:

provides AI-powered web messenger (Web Messenger) with online response from 9:00-17:00 on weekdays.

Support for open banking APIs that allow customers to manage multiple financial services through applications.

Launched the Sustainable Financing Label for use in green financial products, such as the MSC-certified Sustainable Seafood Loan. Robo-advisors are not explicitly mentioned, but asset management services, such as the Landsbréf Fund, are growing rapidly, with AUM growing by almost 25% in 2021.

Customer Service

QualityLandsbankinn focuses on the customer experience, combining digital and personal service.

service channel: 24/7 customer service hotline (+354 410 4000), answered before 16:00 on weekdays; Online chat (Web Messenger) 9:00-17:00 on weekdays, quick response; E-mail (landsbankinn@landsbankinn.is) supports non-urgent consultations. The social media response speed is not clear, but the bank is active on platforms such as LinkedIn.

Complaint handling: Landsbankinn ranks first in customer satisfaction in the Icelandic Performance Satisfaction Index 2023, with complaint rates and resolution times undisclosed, but satisfaction with the "360° Financial Review" service (free personalised financial advice) is as high as 4.7/5 (2019 data).

Multi-language support: Mainly serving local customers in Iceland, English support is more complete, suitable for cross-border users; Other non-local language support is not explicitly mentioned and may need to be confirmed by customer support.

Security

MeasuresLandsbankinn attaches great importance to the security of funds and data, in line with modern banking standards.

security of funds: Deposits are protected by the Icelandic Deposit Insurance Scheme up to €100,000. Anti-fraud measures include requiring e-commerce transactions to use electronic identity verification, real-time transaction monitoring, and support for contactless payments (e.g., mobile devices and smartwatches).

Data security: Raise customer awareness and emphasize privacy through ongoing cybersecurity workshops, such as in partnership with associations for older adults. There is no explicit mention of ISO 27001 certification, but no major data breaches have been recorded. In 2020, it was certified as a CarbonNeutral® company, demonstrating its efforts in operational transparency.

Featured Services & DifferentiationLandsbankinn

offers customized services for different customer groups to strengthen its competitiveness in the market.

segment:

student account: No fee waiver account is specified, but the app supports quick account opening, which is suitable for younger users.

Exclusive financial management for the elderly: Provide personalized consultation through the "360° financial review", combined with pension savings products, to meet the needs of the elderly.

Green financial products: issuance of sustainable coverage bonds (EUR 300 million, 2024) to support green and social loans; Launched a sustainable financing framework with Sustainalytics ratings for environmental projects such as energy-efficient vehicle loans (up 55% in 2021).

High-net-worth services: Private banking thresholds are not specified, but asset management services (such as the Landsbréf Fund) provide customized investment solutions for high-net-worth clients, with a 35% increase in fund subscriptions in 2021.