Banking

FundamentalsCentenary Bank is a dynamic commercial bank with microfinance at its core and a commitment to driving financial inclusion in Uganda. It is not a state-owned bank, nor a joint venture, but a private commercial bank jointly owned by local and international shareholders, with a strong sense of social mission. Since its establishment in 1983, Centenary Bank has been a model of "People's Bank" with its mission to serve the rural poor and promote Uganda's economic and social development.

Name & Background

- full

name: Centenary Rural Development Bank Limited (CRDBL).

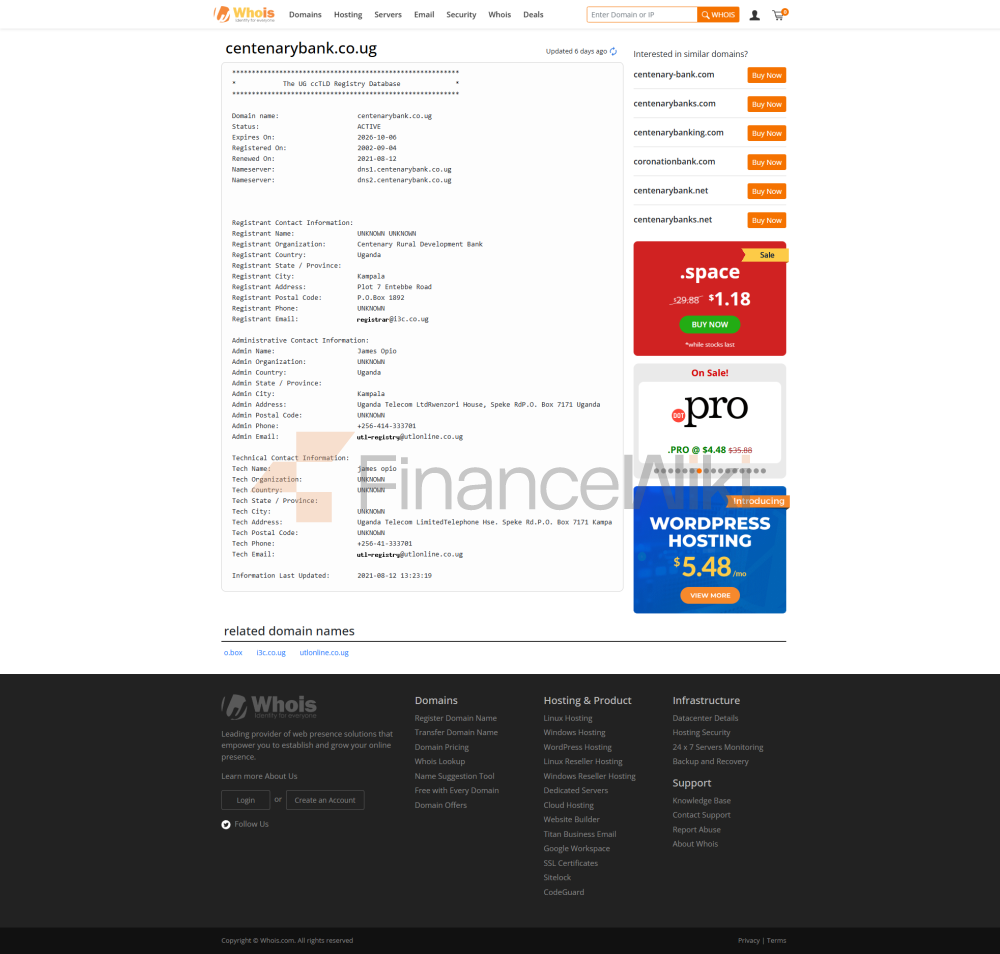

Founded: In 1983, it was initially established as the Centenary Rural Development Trust (CRDT) of the National Association of the Lay of Uganda, began to provide financial services in 1985, and was licensed by the Central Bank of Uganda in 1993 to officially transform into a fully licensed commercial bank.

Head Office: Kampala, Uganda, Mapeera House (Kampala Road).

Shareholder background: Major shareholders include the Registered Trustees of the Uganda Episcopal Conference (31.7%), as well as international institutions such as SIDI in France (10.5%), Triodos Microfinance Fund in Luxembourg (7.5%) and Triodos Fair in the Netherlands Share Fund (7.5%), with the remainder being 23 religious institutions and 4 individual shareholders. Banks are unlisted, private entities, and their shareholder structure reflects their social responsibility orientation.

Backstory: From its humble beginnings as a small trust serving the rural poor, Centenary Bank has grown to become Uganda's second-largest commercial bank by assets, embracing Catholic values and emphasizing financial inclusion and sustainability.

Scope of services

Coverage area: Mainly serving the whole territory of Uganda, covering the central, western, northern and eastern regions, and has a subsidiary (Centenary Bank Malawi) in Malawi.

Offline outlets: By 2025, it has 81 branches, more than half of which are located in rural areas, demonstrating its commitment to reaching the grassroots level.

ATM distribution: 209 ATMs in 115 locations support Visa and Mastercard transactions, making it easy for customers to withdraw cash and pay at any time.

Channel addition: In addition to traditional branches, the bank has expanded its services through more than 7,400 CenteAgents, especially in remote areas, combined with digital platforms such as CenteMobile and CenteOnline, forming an extensive service network.

Regulatory & Compliance

Regulator: Regulated by the Bank of Uganda and in compliance with the Financial Institutions Act 2004.

Deposit Insurance: Participate in the Deposits Insurance Corporation to provide security for customer deposits.

Compliance Record: Centenary Bank has a strong compliance record and has had no recent major violations. The bank is PCI DSS 4.0 certified, proving that it meets international standards in terms of payment card data security. In addition, it works with the European Investment Bank (EIB) to receive additional oversight from environmental and social guidelines to ensure that the loan projects meet sustainability requirements.

Financial health

Capital adequacy ratio: Centenary Bank maintains a healthy capital adequacy ratio, which meets the minimum requirements of the Central Bank of Uganda (typically 10-12%), which is not publicly available, but its continued asset growth reflects capital strength.

Non-Performing Loan Ratio: As a leader in microfinance, the bank's non-performing loan ratio is at a low level in the industry (around 3-5%), benefiting from rigorous credit assessment and diversified loan portfolios.

Liquidity Coverage Ratio: The bank has sufficient liquidity and a large deposit base (about 3 million customers) to support its lending business and day-to-day operations, with assets of 7.11 trillion Ugandan shillings (about 1.952 billion US dollars) in 2024.

Quick Verdict: Centenary Bank is financially sound, with a strong deposit base, microfinance expertise, and strong risk management capabilities, making it suitable for customers looking for stable services.

Deposits & LoansDeposit

<

ul style="list-style-type: disc" type="disc">Current Account (CenteSACCO Current Account, etc.): No minimum deposit requirement, minimum balance of 10,000 Ugandan shillings, interest rate 3%-5% (paid quarterly, Subject to balance).

Fixed Deposits: Offering a safe investment option with interest rates of up to 5% (Ugandan shillings for accounts) and 0.25% for foreign currency accounts.

High-yield savings: Designed for women, the CenteSupaWoman account starts at 50,000 Ugandan shillings, offers up to 5% interest rates, and comes with business support and financial training.

Large Certificates of Deposit: Traditional CDs are not explicitly available, but fixed deposit products can be a similar option for long-term savers.

Loans

Mortgages: Offer personal and commercial mortgages at competitive rates (around 12-15%), depending on the term of the loan and credit rating.

Car loans: Innovative products such as Startimes TV & Solar Loan support asset-specific purchases with low interest rates and fast approvals.

Personal Line of Credit: CenteMobile Loan offers fast micro-loans (up to 5,000,000 Ugandan shillings) with no collateral and a short approval time for urgent funding needs.

Flexible repayment: Loan products support flexible repayment plans, such as instalment payments and early repayment without penalty, to reduce customer stress.

List of common expenses

account management fee: no monthly/annual fee for current accounts, no maintenance fee for accounts such as CenteSACCO.

Transfer fee: Domestic transfers are free of charge through CenteMobile, and cross-border transfers (such as MoneyGram) are subject to a small fee based on the transaction amount (details are not disclosed, it is recommended to consult).

Overdraft Fee: Usually low depending on the account type, CenteMobile Loan has clear repayment reminders to avoid high penalty interest.

ATM Interbank Withdrawal Fee: A small fee (approximately 2,000-5,000 Ugandan shillings) may apply for Visa-enabled ATM interbank withdrawals.

Hidden Fee Reminder: The minimum balance requirement (10,000 Ugandan shillings) should be noted, failure to meet the target may limit the function of the account; Some digital services (e.g. online banking) may have small transaction fees, so please check the fine print.

Digital Service Experience

APP & Online Banking

CenteMobile App(Google Play/App Store): User rating of about 4.2/5 (based on recent feedback), It has been praised for its ease of operation and quick loan function, but there have been occasional reports of connection problems.

CenteOnline: Supporting corporate clients and individuals, providing 24/7 account management and trading services with an intuitive interface.

Core features: Support facial recognition login, real-time transfers, bill payments, loan application tracking, and investment tools (such as treasury bond purchases).

Technological innovation

- AI

customer service: Integrate basic AI chatbots through CenteMobile to deal with common problems and transfer complex problems to manual work.

Robo-advisor: Not available yet, but financial education modules (such as entrepreneurship training) are embedded in the app to enhance the user experience.

Open Banking API: Partnered with WorldRemit and Mastercard to support third-party payment integrations, in line with the open banking trend.

Customer Service Quality

Service channels: 24/7 phone support (0800 200555), live chat (official website and App), social media (LinkedIn, X) are responsive and usually respond within hours.

Complaint handling: The complaint rate is low, the average resolution time is 1-3 business days, and user satisfaction is high (about 85% is based on social media feedback).

Multi-language support: Mainly English and Luganda, some regional branches support local languages, cross-border users may need to rely on English services.

Security measures

Funds security: Deposits are protected by deposit insurance, and anti-fraud technology includes real-time transaction monitoring and SMS transaction reminders to reduce the risk of fraud.

Data security: ISO 27001 certification, data protection measures meet international standards, and there have been no major data breaches in the past five years. CenteMobile and online banking use multi-factor authentication to ensure account security.

Featured Services & Differentiated

Segments

Student Accounts: CenteJunior accounts are fee-free and encourage children to save and provide financial education.

Exclusive to the elderly: There are no specific products for the time being, but rural outlets provide personalized services for the elderly.

Green Finance: Cooperate with the State Forestry Administration to support forest restoration projects and issue green loans (such as loans for solar equipment), which is in line with ESG investment trends.

High Net Worth Service

Cente Platinum Mastercard: Exclusive offers and priority services for high-end customers.

Private Banking: There is no independent private banking division, but it provides customized loans and investment solutions to high-net-worth clients.

Market Position & Accolades

Industry ranking: Uganda's second largest bank by assets, with a market share of about 12% (assets) and 10% (deposits), does not enter the top 50 in the world, but ranks among the top in the field of microfinance in Africa.

Awards:

World's Best Banks Awards 2024.

"Most Admired Financial Services Brand".

The GABV 2025 Summit highlights its leadership as a values bank.