Azania Bank Limited (Azania Bank) is Tanzania's first homegrown private commercial bank and is a key player in the market for its innovative financial solutions, focus on SMEs and commitment to financial inclusion. Since its establishment in 1995, the Bank has provided diversified financial services to individuals, SMEs and institutional customers through more than 20 branches and advanced digital platforms. Its brand mission is to "go beyond the average bank" to drive financial inclusion and economic development in Tanzania through flexible product design, exceptional customer experience and regional network.

Basic Bank Information

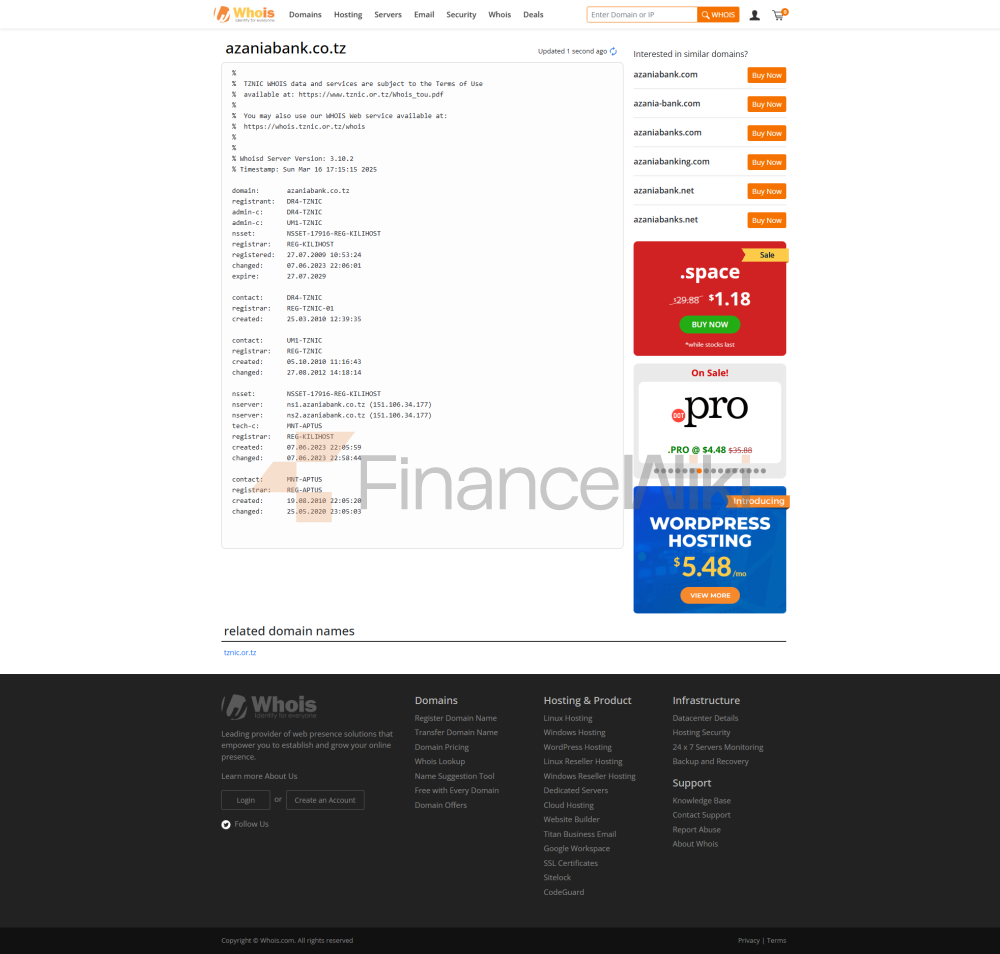

Azania Bank is a private commercial bank established in 1995 initially operating as First Adili Bancorp Limited and headquartered at Mawasiliano Towers, Plot No. 5/1/2, 2005, Block C Sinza, Sam Nujoma Road, Zip code 32089. The bank is held by Tanzania's local pension funds and individual investors, including institutions such as the East African Development Bank and the Swedish International Development Agency, and is not listed on the stock exchange, reflecting its private nature and focus on the local market. In January 2019, Bank of Azania further strengthened its market position by acquiring the assets and liabilities of Bank M, which had been taken over by the Central Bank of Tanzania due to liquidity issues.

Bank of Azania provides services throughout Tanzania and has more than 20 branches in Dar es Salaam (Masdo, Kariakoo, Mawasiliano Agency), Tegeta, etc. The bank provides convenient cash withdrawals through the 1Link ATM network, enhancing financial accessibility for customers in urban and remote areas. Bank of Azania is regulated by the Bank of Tanzania and is supervised by the Financial Sector Conduct Authority. The bank participates in the Tanzania Deposit Insurance Scheme, which protects customer deposits up to 100,000 Tanzanian shillings (approximately US$43). There have been no recent major compliance issues, indicating stable operations.

Financial health

Bank of Azania has a strong financial position, with total assets of approximately Tanzanian shillings (approximately US$582 million) and shareholders' equity of approximately Tanzanian shillings (approximately US$71.46 million) following the acquisition of Bank M in 2019. As of December 2019, total assets amounted to Tanzanian shillings of 114,871 million (approximately US$496.5 million) and shareholders' equity was Tanzanian shillings of 24,135.1 million (approximately US$104.3 million), indicating the growth of its assets and equity. As it is a private bank, specific financial indicators such as capital adequacy ratio, non-performing loan ratio and liquidity coverage ratio are not disclosed. According to the Central Bank of Tanzania, the capital adequacy ratio of Tanzania's banking sector averaged 19.0% in December 2022, higher than the regulatory minimum requirement of 14.5%, and the non-performing loan ratio was 8.3% in 2024, well above the regulatory requirement. As a Tier 1 bank, Bank of Azania expects its financial metrics to meet or outperform industry standards.

Deposit & Loan Products

DepositsAzania Bank offers a variety of deposit products to meet the needs of individual and corporate customers:

current accounts: such as Personal Current Account and Business Current Account, which support daily transactions with no interest.

Savings account: Competitive interest rate, the specific interest rate needs to be checked by the bank, suitable for long-term savings.

Fixed deposits: terms range from 1 month to 5 years, and the interest rate is usually between 4%-5%, depending on market conditions and the amount of deposit.

The featured product:D iaspora Account, designed for Tanzanian expats abroad, supports multi-currency transactions and makes it easier for international clients to manage their funds.

LoansAzania

Bank offers a wide range of loan products covering personal and business financing needs:

Mortgages: support for the purchase or construction of a dwelling, with an interest rate of about 4%-5% and a term of 8-25 years, with proof of income and credit assessment.

Car loans: support the purchase of new or used cars, with an interest rate of about 5%-6% and flexible terms.

Personal loans: including unsecured personal loans, with an interest rate of about 6%-8%, to meet short-term funding needs.

Corporate Loans: Supporting the expansion of small and medium-sized enterprises, interest rates are determined based on market conditions, and equipment loans and lease loans will grow significantly in 2024.

Flexible repayment options: Early repayment, deferred repayment or adjustment of repayment plan are available through the Azania Mobile Banking app.

App & Online Banking

mobile app: Azania Mobile Banking is available for iOS and Android and features include real-time transfers, bill payments (utility bills, government fees, etc.), phone bill top-up (Vodacom, Tigo, Airtel, etc.), loan calculator, and account management. Google Play has a rating of about 4.0 stars (2024 data), and user feedback mentions that the interface is user-friendly but the features need to be optimized. It can be downloaded through Google Play or App Store.

Online Banking: Available through the Bank of Azania online banking, it supports account management, transfers, and loan applications.

Core features

real-time transfers, bill payments, account management, phone bill top-up, loan calculator, ATM/branch locatoring.

Quality of customer service

ServiceChannels

:24/7 telephone support (+255 22 2412030, toll-free 0800 110 210), live chat, email ( information@azaniabank.co.tz) and social media responses (e.g., Azania Bank, LinkedIn).

Multi-language support

supports English, Swahili, and may include other local languages for both local and cross-border customers.

Safety and security measures

Funds are

secured by the Tanzania Deposit Insurance Scheme up to a maximum of Tanzanian Shillings 100,000. Real-time transaction monitoring, biometric authentication, and multi-layered security protocols are used to ensure the safety of funds.

Featured Services & Differentiation

Agricultural support: Supporting farmers' development through the agricultural sector's participation in agricultural loan programs.

Other features

Bancassurance services: provide insurance solutions that cover life and property.

trade finance: Provide letter of credit and import and export financing services to support the internationalization of small and medium-sized enterprises.

Community Involvement: Participate in national events, such as celebrating the 62nd anniversary of Tanzania's independence, to enhance the brand's influence.

Market Position & Accolades

Industry Rankings

Bank ofAzania ranks among the top 43 commercial banks in Tanzania, with total assets of approximately 133.9 billion Tanzanian shillings (approximately US$582 million) in 2019, ranking 81st among Arab banks.

The

branch network

, Bank of Azania, has its headquarters in Dar es Salaam. As of December 2021, the bank maintains a branch network at the following locations:

Masdo Branch - Samora Avenue,

Kariakoo Branch - Msimbazi Street, Dar es Salaam , Dar es Salaam

Kisutu Branch - Kisutu, Dar es Salaam

Tegeta Branch - Chief House, Tegeta, Dar es Salaam

Mwenge Branch - Mwenge Market, Dar es Salaam

Mawasiliano Agency - Sam Nujoma road, Dar es Salaam

Industrial Branch - Nyerere road, Lumumba Branch in Dar es Salaam

- Lumumba Street, Mwaloni Branch in Dar es Salaam

- Mwaloni Fish Market, Mwanza

Rockcity Branch - Makongoro Street, Mwanza

Rwagasore Agency - Rwagasore Street, Mwanza

Lamadi Agency - Ramadi, Simiyu

Shikahama Branch - Kahama Central Business District, New Yanglu District

Kagongwa Agency - Iponya Street, Kahama, Shinyanga

Arusha City Branch - WaKaloleni Street, Arusha

Mboda Branch - Mbauda Corner, Arusha-Dodoma Road, Arusha

Arusha Business Centre - Joel Maeda Street, Arusha

Moshi Branch - Opp. Moshi Municipal Offices, Moshi

Geita Branch -

Geita Mineral Centre - Kalangalala Street, Gaita

Gatoro Branch - Geita

Nyalugusu Service Center - Geita

Morogoro Branch - Old Dar es Salaam rd Street, Morogoro

Sokoine Branch - Kikuyu Avenue, Dodoma

Tunduma Branch - Sumbawanga Road, Tunduma

Mbeya Branch - Karume Avenue Road, Mbeya